- BP is divesting its U.S. onshore wind assets as part of a major strategic shift towards low carbon energy.

- Analyst forecasts suggest a moderate potential upside for BP's stock price over the next year.

- GuruFocus's GF Value estimate indicates a slight premium to the current stock price.

BP (BP, Financial) has announced the sale of its U.S. onshore wind assets to LS Power, highlighting a significant step in the company's ongoing transition towards low carbon energy. This strategic divestment is part of BP's ambitious $20 billion simplification strategy aimed at streamlining operations and reallocating resources to sustainable energy projects. The transaction will see 10 wind farms, boasting a combined generating capacity of 1.7 GW, transferred to LS Power's Clearlight Energy by the end of the year, subject to regulatory approvals.

Wall Street Analysts' Forecasts

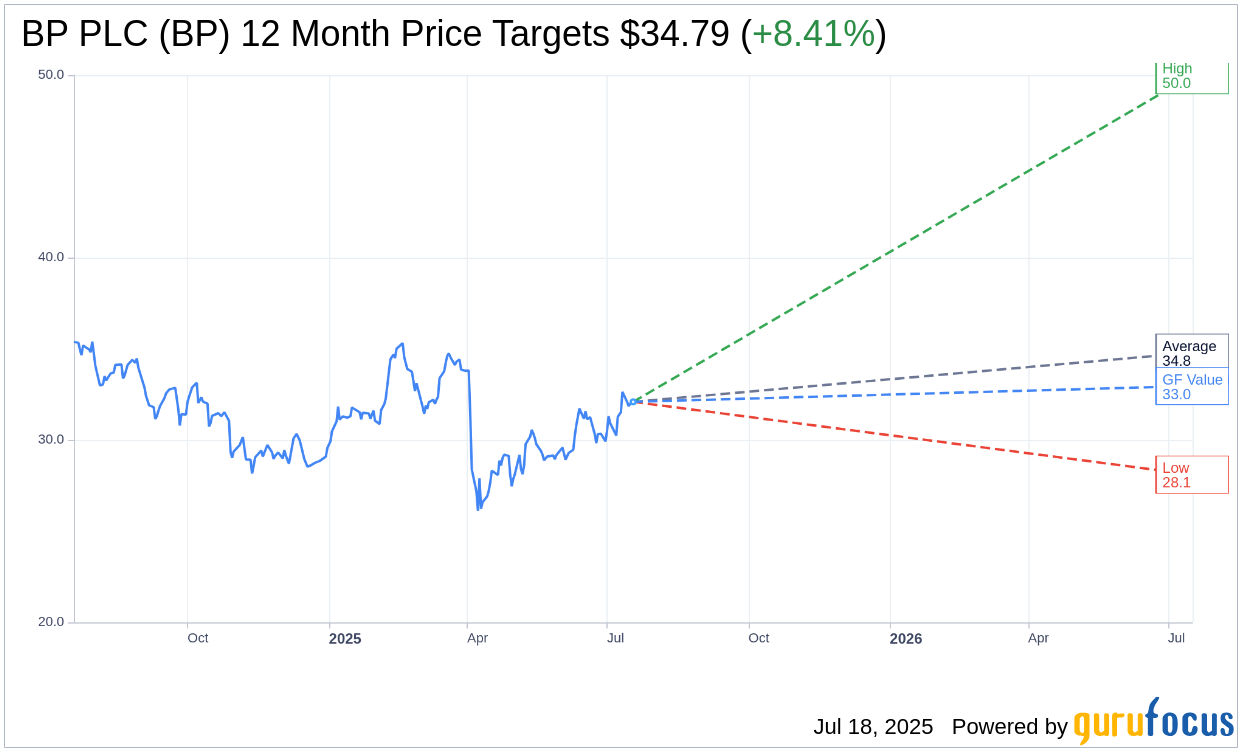

In terms of market outlook, 16 analysts have provided one-year price targets for BP PLC (BP, Financial), placing the average target price at $34.79. This represents a potential upside of 8.41% from BP's current trading price of $32.09, with price estimates ranging from a high of $50.00 to a low of $28.10. Investors can explore more detailed estimates on the BP PLC (BP) Forecast page.

The average brokerage recommendation, derived from 19 firms, positions BP PLC (BP, Financial) with a "Hold" status, reflected by an average score of 2.7 on a scale where 1 indicates a Strong Buy and 5 indicates a Sell.

GuruFocus GF Value Estimate

Additionally, the GF Value for BP PLC (BP, Financial) in the upcoming year is projected at $32.96. This suggests a modest upside of 2.71% from the current stock price of $32.09. The GF Value is GuruFocus's calculation of the fair market value of the stock, derived from historical trading multiples and anticipated future business performance. More comprehensive data can be accessed on the BP PLC (BP) Summary page.