In recent developments, Avadel Pharmaceuticals (AVDL, Financial) has been the focus of attention following an important announcement from HC Wainwright & Co. On July 18, 2025, the analyst firm, represented by Raghuram Selvaraju, initiated coverage on the stock. A "Buy" rating was announced, signaling confidence in the company's future performance.

The analyst firm set a price target of $22.00 USD for Avadel Pharmaceuticals (AVDL, Financial), suggesting potential growth in the stock's value. This new price target reflects the firm's positive outlook on AVDL's market prospects.

It's noteworthy that this is an initial price target for AVDL from HC Wainwright & Co., as no previous price target was disclosed. This announcement could influence investor sentiment and bring additional attention to Avadel Pharmaceuticals (AVDL, Financial) on the NASDAQ exchange.

Investors and market participants may want to keep a close watch on AVDL following this news. With the "Buy" rating and the $22.00 USD price target, HC Wainwright & Co. has set a foundation for potential investment opportunities in the stock, aligning their outlook with Avadel Pharmaceuticals' projected performance.

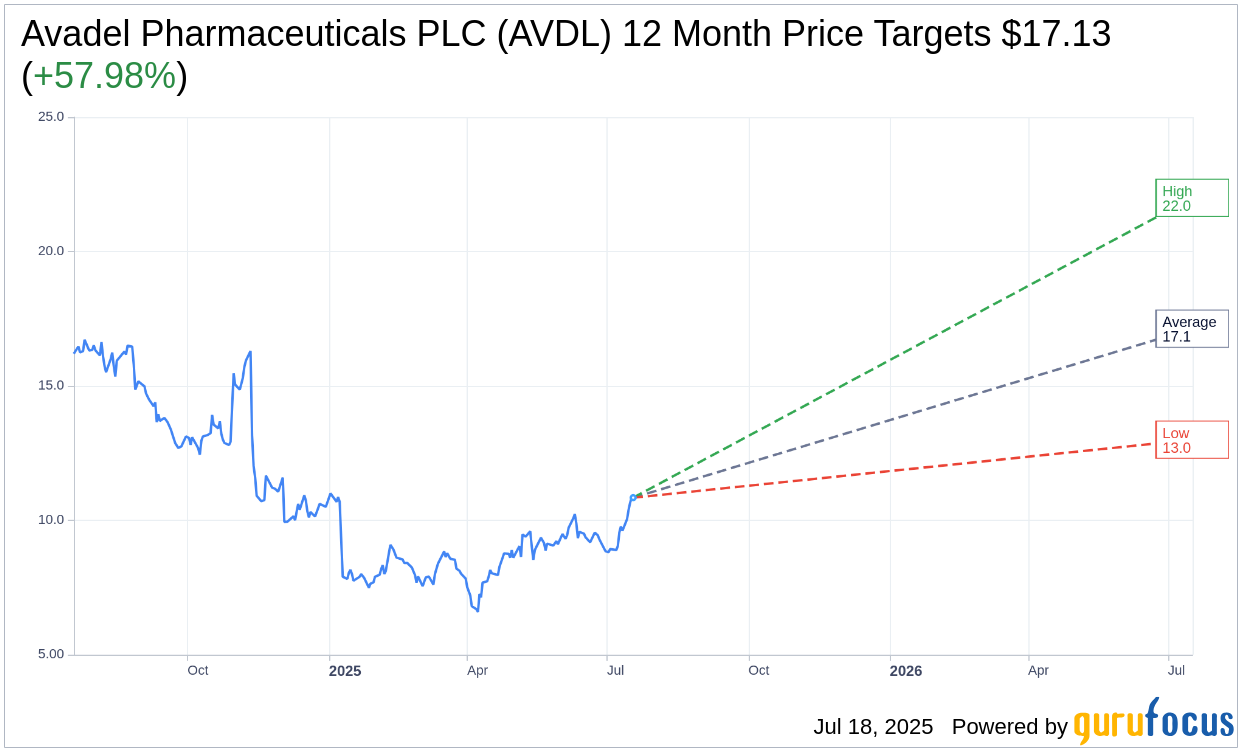

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Avadel Pharmaceuticals PLC (AVDL, Financial) is $17.13 with a high estimate of $22.00 and a low estimate of $13.00. The average target implies an upside of 57.98% from the current price of $10.84. More detailed estimate data can be found on the Avadel Pharmaceuticals PLC (AVDL) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Avadel Pharmaceuticals PLC's (AVDL, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.