Bank First (BFC, Financial) is poised to gain from recent developments toward yield curve normalization, following a prolonged period of inversion. Chairman and CEO Mike Molepske expressed that although the bank remains interest rate neutral, which helps stabilize its earnings against interest rate fluctuations, a normalized yield curve is advantageous for the banking sector as a whole. If this trend persists, Bank First is likely to experience an enhanced net interest margin in the coming months and years.

Wall Street Analysts Forecast

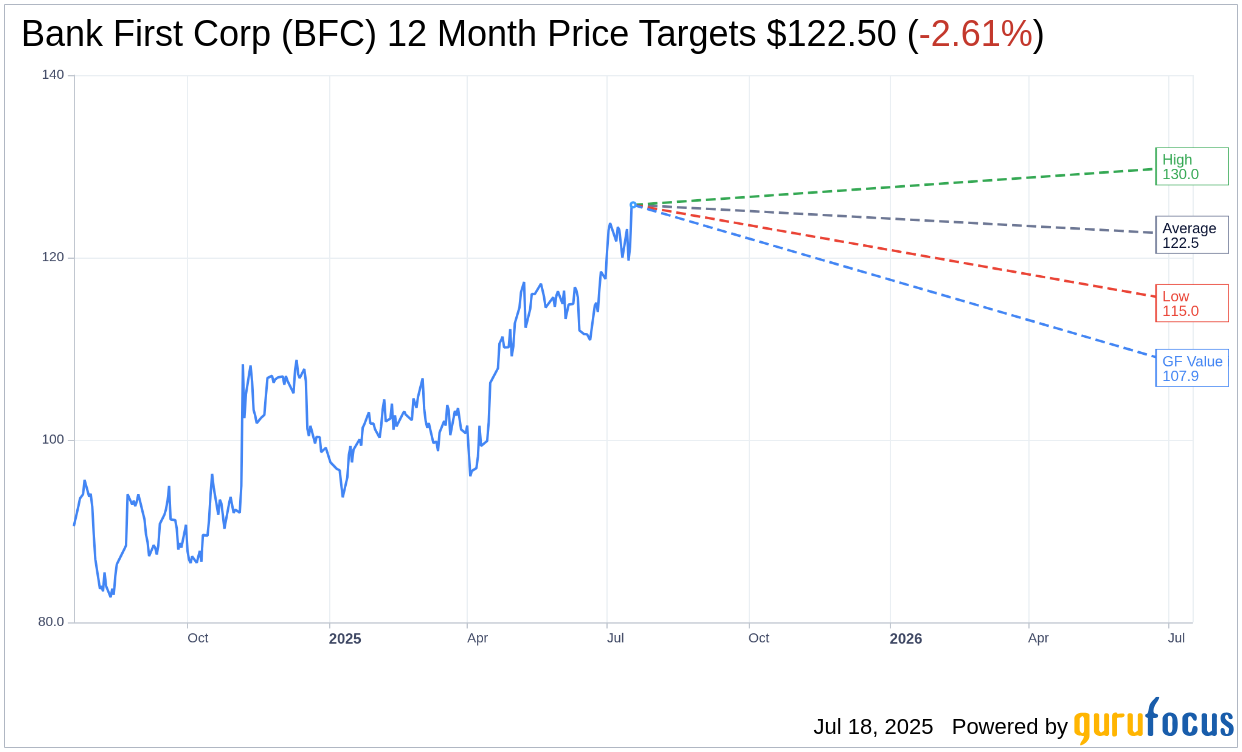

Based on the one-year price targets offered by 2 analysts, the average target price for Bank First Corp (BFC, Financial) is $122.50 with a high estimate of $130.00 and a low estimate of $115.00. The average target implies an downside of 2.61% from the current price of $125.78. More detailed estimate data can be found on the Bank First Corp (BFC) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Bank First Corp's (BFC, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bank First Corp (BFC, Financial) in one year is $107.91, suggesting a downside of 14.21% from the current price of $125.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bank First Corp (BFC) Summary page.