- Meta Platforms (META, Financial) chooses not to support the European Commission's new AI regulation framework.

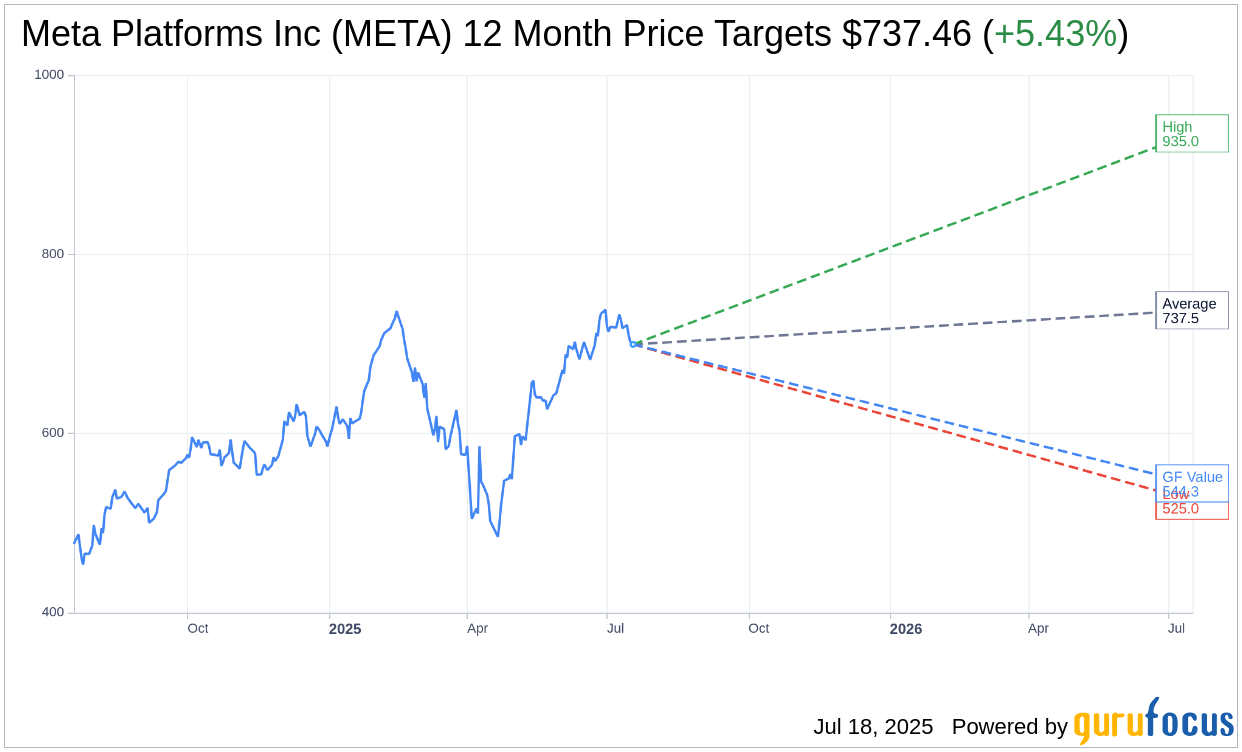

- Analysts project a moderate upside potential for META stock over the next year.

- The stock's estimated GF Value suggests potential overvaluation at current levels.

Meta Platforms' Stance on AI Regulations

Meta Platforms (META) has opted out of endorsing the European Commission's newly proposed Code of Practice concerning AI regulations. The company's hesitation stems from the potential legal ambiguities and extensive requirements that seem to exceed the initial scope of the AI Act. This framework is designed to align with upcoming AI rules, though some stakeholders worry it might stifle innovation in Europe's AI sector.

Analyst Price Targets and Forecast

A survey of 61 analysts offers a diverse perspective on Meta Platforms Inc (META, Financial), with an average one-year price target of $737.46. This includes projections ranging from a high of $935.00 to a low of $525.00. The average target price indicates a potential upside of 5.43% relative to the current trading price of $699.46. For a deeper dive into the estimates, visit the Meta Platforms Inc (META) Forecast page.

Brokerage Recommendations and GF Value

The consensus from 71 brokerage firms places Meta Platforms Inc (META, Financial) at an average brokerage recommendation of 1.8, which aligns with an "Outperform" rating. The rating scale spans from 1 to 5, where a score of 1 indicates a Strong Buy, and a 5 signifies a Sell.

According to GuruFocus estimates, the projected GF Value for Meta Platforms Inc (META, Financial) over the next year is $544.27. This suggests a potential downside of 22.19% from the current share price of $699.46. The GF Value is a calculated fair value based on historical trading multiples, past business growth, and anticipated future performance. For further insights, explore the Meta Platforms Inc (META) Summary page.