Vanda Pharmaceuticals Inc. (VNDA, Financial) has reported its results for the first quarter ended March 31, 2009.

We’ve been following VNDA (see our post archive here) because it’s trading below its net cash value and Tang Capital Partners (TCP) has called for the company to “cease operations immediately, liquidate [VNDA]’s assets and distribute all remaining capital to the Stockholders.” TCP has now filed a preliminary proxy statement for the 2009 Annual Meeting urging stockholders to support TCP’s slate of two director nominees, Kevin C. Tang and Andrew D. Levin, M.D., Ph.D. The stock is up 29.5% since we initiated the position to close yesterday at $1.01, giving the company a market capitalization of $24.3M. We initially estimated the net cash value to be around $42.6M or $1.60 per share. We’ve now reduced our estimate of the net cash value to $38.6M or $1.45 per share. The company continues to hemorrhage cash, so the investment turns on TCP’s ability to get control of the board at the Annual Meeting and staunch the bleeding. If TCP cannot get onto the board quickly, the company will continue to burn cash and the investment will be a dud. VNDA has a staggered board, which makes TCP’s task difficult.

The value proposition updated

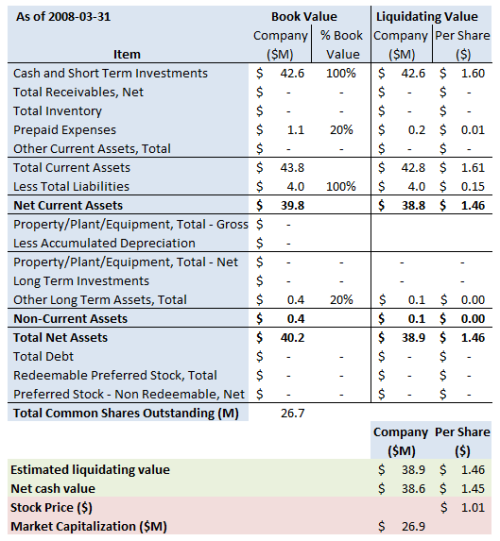

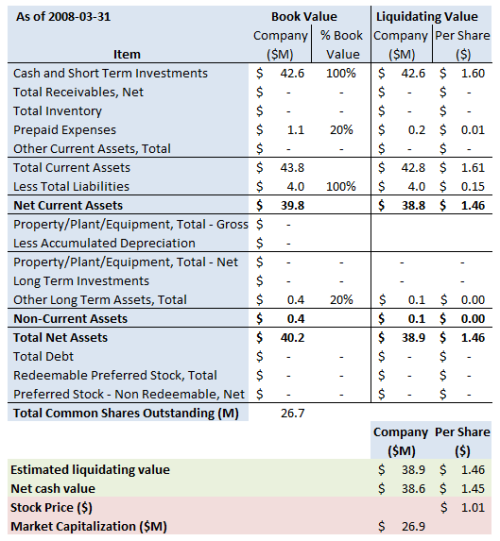

In the first quarter of 2009 VNDA burned through $3.8M in cash, which reduces our estimate of the net cash value from $42.6M to $38.6M or $1.45 per share (the remaining difference is due to the slight increase in shares on issue). Set out below is our summary balance sheet (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

Conclusion

VNDA continues to be an interesting play. While the stock is up nearly 30% since we initiated the position, it is still trading at a 45% discount to our estimate of its $1.45 per share net cash value. That value is of course deteriorating rapidly, and the challenge for investors is to determine which of two outcomes is more likely: If TCP can get on the board quickly, stop the cash burn and liquidate the company, we’re likely to see a good return. If TCP cannot get onto the board quickly or at all, the company will continue to burn cash and the investment will be a dud. VNDA has a staggered board, so this will make TCP’s task difficult. We’re inclined to maintain our position and see how this plays out.

Full Disclosure:Â We have a long position in VNDA. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.

Greenbackd

www.greenbackd.com

We’ve been following VNDA (see our post archive here) because it’s trading below its net cash value and Tang Capital Partners (TCP) has called for the company to “cease operations immediately, liquidate [VNDA]’s assets and distribute all remaining capital to the Stockholders.” TCP has now filed a preliminary proxy statement for the 2009 Annual Meeting urging stockholders to support TCP’s slate of two director nominees, Kevin C. Tang and Andrew D. Levin, M.D., Ph.D. The stock is up 29.5% since we initiated the position to close yesterday at $1.01, giving the company a market capitalization of $24.3M. We initially estimated the net cash value to be around $42.6M or $1.60 per share. We’ve now reduced our estimate of the net cash value to $38.6M or $1.45 per share. The company continues to hemorrhage cash, so the investment turns on TCP’s ability to get control of the board at the Annual Meeting and staunch the bleeding. If TCP cannot get onto the board quickly, the company will continue to burn cash and the investment will be a dud. VNDA has a staggered board, which makes TCP’s task difficult.

The value proposition updated

In the first quarter of 2009 VNDA burned through $3.8M in cash, which reduces our estimate of the net cash value from $42.6M to $38.6M or $1.45 per share (the remaining difference is due to the slight increase in shares on issue). Set out below is our summary balance sheet (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

Conclusion

VNDA continues to be an interesting play. While the stock is up nearly 30% since we initiated the position, it is still trading at a 45% discount to our estimate of its $1.45 per share net cash value. That value is of course deteriorating rapidly, and the challenge for investors is to determine which of two outcomes is more likely: If TCP can get on the board quickly, stop the cash burn and liquidate the company, we’re likely to see a good return. If TCP cannot get onto the board quickly or at all, the company will continue to burn cash and the investment will be a dud. VNDA has a staggered board, so this will make TCP’s task difficult. We’re inclined to maintain our position and see how this plays out.

Full Disclosure:Â We have a long position in VNDA. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.

Greenbackd

www.greenbackd.com