Intevac Inc. (IVAC) supports the electronic components industry with two business units, thin-film equipment and photonics.

The thin film equipment division designs, makes and services capital equipment that deposit surface thin films to produce magnetic disks. These magnetic disks are for hard drives and centralized cloud computing storage units.

Additionally, other applications are key to material near-term growth. These are touch panels such as mobile phones, notebooks, smartwatch, tablets and automotive monitors. The solar power industry uses the thin film equipment division by maximizing solar cell efficiency/lower cost per watt.

The photonics division offers digital night-vision products and services to the defense industry. Specific products include night vision cameras, soldier night vision and integrated night vision.

Management presented the below slide forecasts at the 19th Annual B. Riley FBR Investor Conference on May 24.

Quarter one reported on May 1 was within expectations, with revenues of $18 million and a loss of 23 cents per share. The short-term outlook is disappointing. But, medium-term and longer the future is positive with new products supported by patents and a growing pipeline. The second half of the fiscal year management expects positive operating results.

Buying IVAC shares at today's valuation offers a sound opportunity. I will add shares if the stock continues to weaken.

Two new Board Members are Kevin Barber and Mark Popovich. They both have deep experience in the cell phone and advanced packaging markets. Their key role will advise on the current pipeline and expected growth for mobile phones, touch panels, notebooks, smartwatch, tablets and automotive monitors.

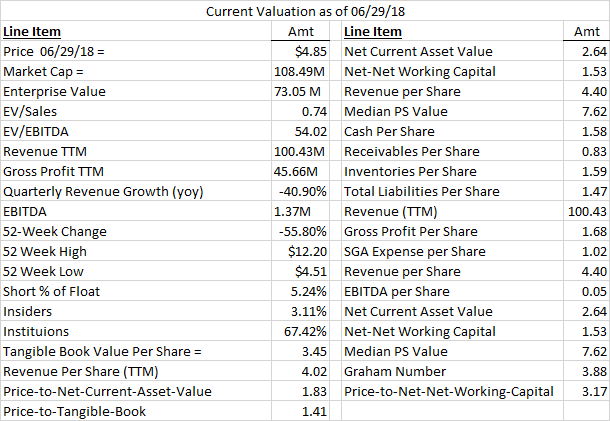

Current valuation for IVAC:

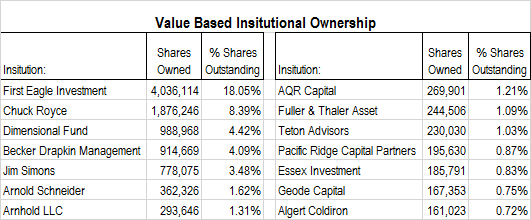

Value-Based low portfolio turnover institutions investing and invested in IVAC

Insider buying year to date 2018 for IVAC

Relative Peer Valuation: The 14 peer companies taken from the May 16 proxy were used to evaluate compensation were also used for my relative valuation.

These 14 companies are in the Scientific/Technical Instruments, Electronic Components and Semiconductor Equipment/Materials industries.

After an analysis of the 14 peer companies, I separated the financial metrics for both IVAC and Amtech Systems (ASYS, Financial). I purchased IVAC along with ASYS as both are value outliers.

Opportunities

There are mean reverting attributes such as -56.50% 12-month stock return for IVAC and -27.20% Amtech Systems. IVAC enterprise value declined -45.65% from fiscal year-end 2016 to July 2, 2018. Amtech Systems increased 6.30% over the same period. Amtech Systems added 9.1 million in debt during fiscal year 2016.

Amtech Systems' median P/S is $12.10 versus the current price of $6.11. IVAC's median P/S is $7.62 versus a price of $4.85. EV/Sales and P/TB trade near historical lows. IVAC P/TB improved from 2016 ratio of 2.52 to its current value of 1.39, equating to a 44.84% improved valuation. Amtech Systems' P/TB was 1.26 for fiscal year 2016. This improved to 1.06 or 15.87%. IVAC's EV/Sales improved from 2016 balance of 1.68 to .73 or a 56.54% improved valuation. Amtech Systems' EV/sales 1.26 for fiscal year-end 2016 improved to 1.06 or 47.36 %.

Year to date, IVAC had material insider buying (with no sales) of $6,472,838 or 1,080,264 shares purchased at the average price of $5.99.

There is value-based institutional buying or holding of IVAC shares by investors such as activist Becker Drapkin Management, Royce Funds, First Eagle, Jim Simons, Tenton and others.

The company has a strong balance sheet with a P/NCAV = 1.83 for IVAC, P/Networking capital of 1.53, gross profit per share of $1.68, cash per share of $1.58 and no long-term debt. It is trading near a 52-week low.

There are strong growth opportunities with the current pipeline in new markets for display covers, smartphones, tablets, solar and night vision technology.

Risks

The main risk is that the medium- and long-term projection for display markets and night vision are not fully realized.