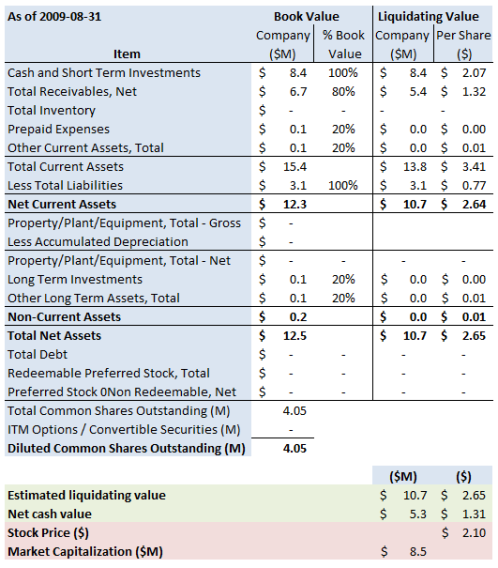

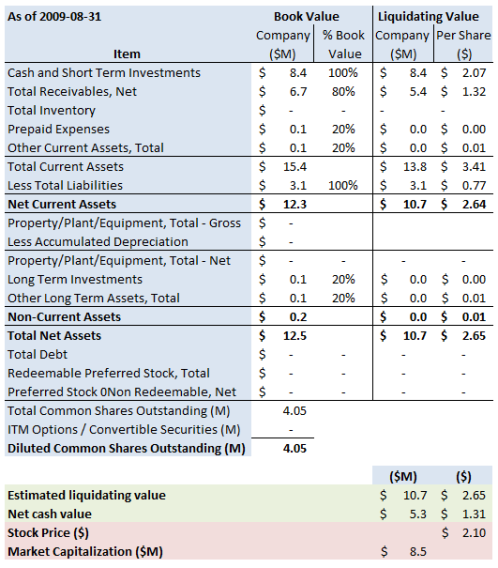

TSR Inc (NASDAQ:TSRI) is an interesting play at a discount to liquidation value and an ongoing cash flow positive business. At its $2.10 close yesterday, the stock has a market capitalization of $8.5M. I estimate the liquidation value to be around 26% higher at $2.65. 26% is not a huge upside, but in this instance I would not regard liquidation value as the upside. Rather, here it is the worst case scenario. TSRI has generated positive cashflow from operating activities over the last four years, growing it from around $1m per annum in 2006 to around $1.6M in 2009. The growth in its operating cash flow is encouraging, though I’ve got no particular view on TSRI’s business – contract computer programming – or the prospects for that business. It’s a consulting-type business, which means that in tough times its fixed overhead should be quite low, and it can trim its sails for the business conditions. In better times, it should be able to readily expand, although I suspect its competition will seek to do the same, pushing up salaries by competing for consultants and thereby keeping margins static. In summary, TSRI seems to have a good, ongoing, cash-generative operating business that should survive the current general malaise. It might even do a little better in the good times. If I’m wrong, as Walter Schloss would say:

We can always liquidate it and get our money back.

About TSRI

According to the 10K:

A primer on Contract Computer Programming Services

Also from the 10K:

The value proposition

TSRI’s annual cash from operating activities has grown from $0.96M in 2006 to $1.63M in 2009. That growth is encouraging, but I’ve got no idea how sustainable it is. TSRI’s balance sheet is very liquid and it holds no debt (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

The catalyst

There are no obvious catalysts in the stock other than a general turnaround in business conditions, which might lead to the company restarting its stock buy-back or its dividend. The company has previously repurchased stock, but the buy-back was suspended earlier in the year. It was also previously paying a dividend, but that was suspended in the second quarter and is yet to be restarted. Restarting the dividend would be an obvious positive catalyst for this stock.

Conclusion

As I mention above, I’ve got no special insight into TSRI’s business or its prospects. I believe it to be a reasonably low risk bet that the company can muddle through the downturn and do better in a few years’ time. At its $2.10 close yesterday, it’s trading at around 80% of $2.65 per share liquidating value, most of which is in cash and equivalents and other liquid current assets. Add to that the positive cash flow from operating activities in the amount of $1.63M for the last year, which has grown from just under $1M in 2006, and TSRI looks like a reasonable prospect. If it can continue to grow the cash from operations, it should do well over the next few years. If it doesn’t, the discount to liquidation value provides some downside protection. I’m going to add it to the Greenbackd Portfolio.

TSRI closed yesterday at $2.10.

The S&P500 Index closed yesterday at 1,098.51.

[Full Disclosure: I hold TSRI. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.]

Greenbackd

http://greenbackd.com/

About TSRI

According to the 10K:

TSR, Inc. (the “Company”) is primarily engaged in the business of providing contract computer programming services to its clients. The Company provides its clients with technical computer personnel to supplement their in-house information technology (“IT”) capabilities. The Company’s clients for its contract computer programming services consist primarily of Fortune 1000 companies with significant technology budgets. In the year ended May 31, 2009, the Company provided IT staffing services to approximately 80 clients.

The Company was incorporated in Delaware in 1969.

…

OPERATIONS

The Company provides contract computer programming services in the New York metropolitan area, New England, and the Mid-Atlantic region. The Company provides its services principally through offices located in New York, New York, Edison, New Jersey and Long Island, New York. The Company does not currently intend to open additional offices. Due to the continuing impact of the current economic environment, the Company has reversed its plan of hiring additional account executives and technical recruiters in its existing offices to address increased competition and to promote revenue growth. As of May 31, 2009, the Company employed 9 persons who are responsible for recruiting technical personnel and 10 persons who are account executives. As of May 31, 2008 the Company had employed 14 technical personnel recruiters and 16 account executives.

A primer on Contract Computer Programming Services

Also from the 10K:

STAFFING SERVICES

The Company’s contract computer programming services involve the provision of technical staff to clients to meet the specialized requirements of their IT operations. The technical personnel provided by the Company generally supplement the in-house capabilities of the Company’s clients. The Company’s approach is to make available to its clients a broad range of technical personnel to meet their requirements rather than focusing on specific specialized areas. The Company has staffing capabilities in the areas of mainframe and mid-range computer operations, personal computers and client-server support, internet and e-commerce operations, voice and data communications (including local and wide area networks) and help desk support. The Company’s services provide clients with flexibility in staffing their day-to-day operations, as well as special projects, on a short-term or long-term basis.

The Company provides technical employees for projects, which usually range from three months to one year. Generally, clients may terminate projects at any time. Staffing services are provided at the client’s facility and are billed primarily on an hourly basis based on the actual hours worked by technical personnel provided by the Company and with reimbursement for out-of-pocket expenses. The Company pays its technical personnel on a semi-monthly basis and invoices its clients, not less frequently than monthly.

The Company’s success is dependent upon, among other things, its ability to attract and retain qualified professional computer personnel. The Company believes that there is significant competition for software professionals with the skills and experience necessary to perform the services offered by the Company. Although the Company generally has been successful in attracting employees with the skills needed to fulfill customer engagements, demand for qualified professionals conversant with certain technologies may outstrip supply as new and additional skills are required to keep pace with evolving computer technology or as competition for technical personnel increase. Increasing demand for qualified personnel could also result in increased expenses to hire and retain qualified technical personnel and could adversely affect the Company’s profit margins.

In the past few years, an increasing number of companies are using or are considering using low cost offshore outsourcing centers, particularly in India, to perform technology related work and projects. This trend has contributed to the decline in domestic IT staffing revenue. There can be no assurance that this trend will not continue to adversely impact the Company’s IT staffing revenue.

The value proposition

TSRI’s annual cash from operating activities has grown from $0.96M in 2006 to $1.63M in 2009. That growth is encouraging, but I’ve got no idea how sustainable it is. TSRI’s balance sheet is very liquid and it holds no debt (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

The catalyst

There are no obvious catalysts in the stock other than a general turnaround in business conditions, which might lead to the company restarting its stock buy-back or its dividend. The company has previously repurchased stock, but the buy-back was suspended earlier in the year. It was also previously paying a dividend, but that was suspended in the second quarter and is yet to be restarted. Restarting the dividend would be an obvious positive catalyst for this stock.

Conclusion

As I mention above, I’ve got no special insight into TSRI’s business or its prospects. I believe it to be a reasonably low risk bet that the company can muddle through the downturn and do better in a few years’ time. At its $2.10 close yesterday, it’s trading at around 80% of $2.65 per share liquidating value, most of which is in cash and equivalents and other liquid current assets. Add to that the positive cash flow from operating activities in the amount of $1.63M for the last year, which has grown from just under $1M in 2006, and TSRI looks like a reasonable prospect. If it can continue to grow the cash from operations, it should do well over the next few years. If it doesn’t, the discount to liquidation value provides some downside protection. I’m going to add it to the Greenbackd Portfolio.

TSRI closed yesterday at $2.10.

The S&P500 Index closed yesterday at 1,098.51.

[Full Disclosure: I hold TSRI. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.]

Greenbackd

http://greenbackd.com/