Build-a-Bear Workshop (BBW, Financial) is an Amazon-resistant interactive retailer offering "make your own stuffed animal" and related products. The company is managed into three segments, direct-to-consumer, international franchising and commercial. It operates 371 stores globally and 94 franchise locations. Also, products sold on the company, third-party and franchisee e-commerce sites including retail locations under wholesale agreements.

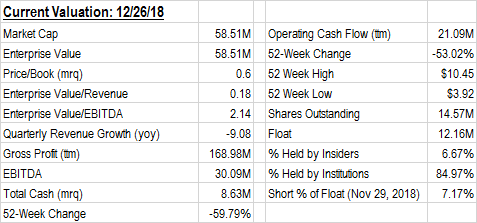

The current stock price is $3.92 or an enterprise value $57.249 million and market capitalization of $58.63 million.

Insider transactions

Major ownership: Note that 20% of the outstanding shares are owned by Steven Cohen. Cohen is a known shorter-term trader and likely sold over the past two weeks after the weak third-quarter performance.

Worse-than-expected financial performance for the quarter ending November 2018 helped create this investable opportunity. Three factors impacted the weak quarter-three performance: redirected event promotion, continued poor U.K. sales and lack of new kid-friendly films.

A strategic decision to limit planned marketing for September 2018 has been redirected to a new event for January. The move was motivated by unexpected overwhelming consumer response to July's "Pay Your Age" promotion, which created long waiting lines and increased media attention.

But management believes there are long-term benefits from the 3 billion media impressions from the Pay Your Age initiative.The proximity and historical lines of prior National Teddy Bear Day promotion forced management to move September's event to manage potential negative consumer and brand-damaging event coverage. The changes made to National Teddy Bear Day resulted in lower third-quarter sales. Now the goal is to recoup lost business with a similar event on National Hug Day before this year's 2018 fiscal year-end in January.

A deceleration in European revenues included double-digit decline in year-over-year sales in the U.K. The overall U.K. market continues to be a burden with a challenging retail environment, driven by weak consumer confidence and Brexit, which has led to pound sterling volatility.

The third factor is fewer high-impact kid-friendly films that translate into higher product demand. Further, management believes the weak mall traffic contributed. Although anticipated, the negative impact was greater than forecast.

Positives going into the last quarter of 2018

Launched intellectual products include top-selling Beary Fairy Friends and Rainbow Friends. New tourist locations include FAO Schwarz NYC, four Great Wolf lodges, Gaylord Resorts' Ice! event and more future launches. Holiday pop-up locations doubled. Sites expanded next to Santa’s Workshop, Bass Pro Shops and Cabela’s. These initiatives are tracking above expectations. Six full-service Build-a-Bear Workshop stores opened inside select market researched Walmart locations.

Additional positives for 2019 include a promising kid-friendly movie line-up: How to Train Your Dragon, Aladdin, Lion King and the second installment of Frozen. New films drive family traffic to theaters located at the mall. Consumers attracted by Pay Your Age day are leveraged for the future. It launched “Count Your Candles" birthday.

E-commerce sales have been growing by double digits for the last four consecutive quarters. This channel was targeted for the fourth quarter and is up to 50% of our annual digital sales. A new digital radio station introduced Build-a-Bear Radio with Dash Radio. An increase in commercial and international franchise revenue is estimated to reach 5% of total revenues in the quarter. It is scheduled to open the first store in India later this fiscal year and has development plans in China. Expect a franchise footprint of 120 locations in 12 countries by year-end.

Opportunities

The company trades at its historical lowest valuation for sales, book value and gross profit with no long-term debt and a forecasted year-end cash balance of $26 million. Insider buying during 2018 is twice the current market value. Aggressive share buybacks reduced shares outstanding by 14% from December 2014. And, it has a trailing 12-month gross profit of $152.20 million versus an enterprise value of $57.25 million.

International franchising expansion was realized with the recent addition of an India franchisee. Shanghai and Beijing are areas management noted for development as the concept was embraced. The concourse model shops are available for franchising.

It has commercial, wholesaling, e-commerce and outbound licensing revenue opportunities to diversify its business model and growth potential within Walmart stores after six successful pilot locations.

The ongoing promotion of Count Your Candle gained full public recognition after the Pay Your Age event in July. A database of over 6 million exists that can be leveraged to drive additional business over 12 months of the year.

Real estate diversification with more tourist locations and rent concessions exist as a good portion of leases go up for renewal. Finally, Toys 'R' Us' $6 billion in liquidations negatively impacted sales during first half of 2018.

Disclosure: Author is long Build-a-Bear.