The AAOI portfolio has decided to add a position in Neutral Tandem (TNDM, Financial).

The investment analysis below is the third write-up in our ongoing series of guest posts, and is brought to you by friend of the blog Cale Smith. Cale is the portfolio manager of the Tarpon Folio, a spoke fund. He is also the founder and managing partner of Islamorada Investment Management, an independent value investing firm based in the Florida Keys.

Cale also happens to run one of our favorite blogs on the net, you can check it out yourself at www.caleinthekeys.com (we highly recommend it). With consistently amusing high-quality investment analysis, commentary, and slogans like “One geek in the Keys is worth two suits in the city,” its hard not to grow fond of Cale’s “Warren Buffett meets Jimmy Buffett” attitude/approach. We think you will agree.

Anyhow, below is Cale’s recent “high conviction idea” interview with Seeking Alpha, which in our opinion provides an outstanding overview of what we believe offers yet another low-risk, high-return opportunity for the bargain hunting investor.

Seeking Alpha Interview:

We recently had the opportunity to ask Smith about his single highest conviction holding.

What is the highest conviction stock position in your fund?

Our highest conviction position is Neutral Tandem (TNDM). While we own some great businesses, few have earnings power as underappreciated as TNDM right now. It’s the dominant player in a previously obscure telecommunications niche, and it’s stunningly cheap. I am unequivocally bullish and believe the laws of economics are squarely on the long side. More importantly, though, is that at current price levels, even if I’m wrong our losses should be disproportionately small.

I have tried repeatedly to kill this business on paper. Very few scenarios, however, are of the magnitude or urgency that would rationally explain the gap between this business’s real value and what the market currently believes it’s worth. I think the company is worth at least twice where it now trades.

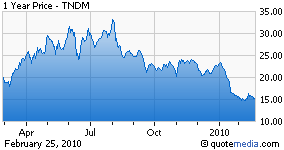

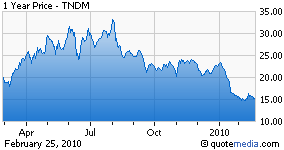

The vast majority of shares appear to be held by growth funds, and selling that began last fall apparently attracted the attention of momentum shorts. The price decline originally began when fears arose about the impact of a T-Mobile and Sprint (S) merger on Neutral Tandem’s revenues, as both are big customers. Such a merger was improbable for several reasons, but the slide in shares has nonetheless continued relatively unabated.

The vast majority of shares appear to be held by growth funds, and selling that began last fall apparently attracted the attention of momentum shorts. The price decline originally began when fears arose about the impact of a T-Mobile and Sprint (S) merger on Neutral Tandem’s revenues, as both are big customers. Such a merger was improbable for several reasons, but the slide in shares has nonetheless continued relatively unabated.

There simply aren’t too many companies in the world with strong earnings power, high returns on invested capital, no debt, solid management, improving margins and a simple business that is hard for competitors to replicate. To be able to buy in when trading near multi-year lows is even more rare. Neutral Tandem is a wonderful business, priced as if it had been caught secretly securitizing subprime mortgages. It has just four years of operational history, but the moat the company is building around its business is becoming wide enough that I’m willing to tolerate that.

Tell us a bit about TNDM’s business, and that moat you described.

When describing the company, I’m going to presume that “providing tandem interconnections services to competitive carriers” may not mean much to most readers, so I’ll try to keep it simple. Neutral Tandem allows wireless, cable, broadband and traditional phone companies to connect and exchange traffic. It has solved two very big problems. The first is that TNDM allows companies to swap traffic without having to connect to each other directly. Doing that is expensive and ridiculously inefficient. The second problem Neutral Tandem has addressed is one of competition.

As its name implies, TNDM is a neutral player, meaning that it does not provide any of the same services as its customers. Avoiding scenarios in which you compete with your own major customers might sound like a pretty obvious rule of thumb, but telecom is often Bizarro World. Even the most vicious competitors partner up on certain things simply because there are no other options. TNDM is now one of those options, but it’s an alternative that is lower cost, higher quality, and comes with more bells and whistles.

Prior to Neutral Tandem, customers had to depend on their biggest, more fearsome competitors to help them deliver service. As you might expect, carriers would prefer to do business with someone that isn’t going to attempt to steal any of their customers. As a result, TNDM’s early growth has been impressive.

For a general sense of how much economic value can ultimately accrue to a well-managed neutral party in the telecom service sector, investors might look at colocation provider Equinix (EQIX). It’s in a completely different business, and Neutral Tandem’s facilities don’t have cool “man-traps” at the front door, but the strategic positioning is similar.

Another key differentiator is that TNDM also has its own network. This is important for several reasons, one of which is that it helps keep costs low while ensuring scalability. It also allows the company to use better technology in more markets to differentiate its services in important ways.

Sounds like a strong story. So what is the downside risk in TNDM?

There are risks in Neutral Tandem, but the majority are low-probability and persistent across the sector. One commonly-cited concern does bear specific mention, however. Neutral Tandem is a big fish in a small pond. Its switching network already reaches almost every key market in the country, and the size of the entire tandem switching industry appears to be in the billion dollar annual revenue range. Though TNDM will continue to grow strongly over the next few years, it is not yet obvious how the company will maintain high growth after that period.

My first response to that concern is, “We should be so lucky.” To dominate a billion dollar market will still create immense value for today’s investors. Even if growth stopped immediately, however, the company would still produce cash at such a rate that by doing nothing more than servicing its existing client base, in four years TNDM would have accumulated an amount of cash per share equivalent to today’s stock price. Alternatively, even if the company’s expansion rate fell off a cliff and TNDM grows only slightly faster than the economy over the next five years – and then implodes like Tiger Woods – shares are still worth about $14. So shares today are priced as if the apocalypse has already happened, but the reality is the business has never been stronger.

To presume that management is completely blind to that concern about long-term growth either underestimates the IQ of management or overestimates the perceptiveness of the investor. Cash flow gives management plenty of options, and while I have no more real insight into what they might be planning than anyone else, I am confident this particular issue will be satisfactorily addressed. A recently announced Ethernet exchange service is certainly a step in the right direction. International service is another opportunity. In the meantime, I’m happy to watch the cash pile up.

To what extent is this a telecom industry pick as opposed to a pure bottom-up pick?

If I have a curse, it’s that I’m a value investor whose circle of competence includes telecommunications – an industry that is forever destined to attract irrational people. Using a top-down approach to investing in telecom often leads to trouble. But ideas don’t come much more bottom-up than Neutral Tandem.

A decade ago, I was a project manager at the world’s first commercial internet service provider. My team’s job was to provision circuits – to create and test connections that would provide smooth internet traffic flow between the networks of different companies. That this job required an MBA and two teams of network engineers probably speaks the most to how challenging it was to work with the old Ma Bell companies.

Those ILECs, or incumbent local exchange carriers, were none too pleased to have to open their telco cages and patch panels to the telco upstarts of the world. Nonetheless, they were required to do just that by the Telecommunications Act of 1996. They weren’t too happy about it, and their informal policy was “strategic non-cooperation.”

Ten years later, Neutral Tandem has basically solved that problem – first for carriers of voice traffic, and soon for data carriers, too, as per recently announced plans to offer Ethernet interconnection services. TNDM is simply the faster, better, cheaper alternative to connecting traffic through the ILECs’ networks. As a project manager, it would have been hard to describe how valuable the service is that Neutral Tandem provides. As a portfolio manager, however, it’s relatively easy.

How would you describe Neutral Tandem’s competitive environment?

The market seems to think the company’s future earnings are somehow in doubt. I believe that the race to be the monopoly provider of tandem switching services is already over, and that Neutral Tandem has won.

On paper, current competitors include HyperCube, Peerless Networks and Level 3 (LVLT), but the reality is that none have the scale, capital or model to seriously challenge TNDM. Lawsuits have flown around the group, but TNDM has been on the winning side of each one that’s been adjudicated to date. The lawsuits are not about intellectual property per se as much as they are about pestering the competition.

TNDM is far and away the leader in the independent tandem switching market. Neither HyperCube nor Peerless own a network, which among other things means that neither has the reach to complete calls themselves nor the quality of service that might otherwise be expected. It also means that TNDM is the lowest cost provider in a commodity industry, another considerable advantage. Level 3 has its own network, but its balance sheet is horrific and, more to the point, it’s not neutral.

TNDM also recently announced it would be launching Ethernet exchange services (think businesses with offices all over the country), an arguably brilliant strategic move despite the rush of other competitors entering the fray. It’s another hugely inefficient niche with considerable pent-up demand caused by odd competitive dynamics. The same advantages TNDM has in tandem switching translate over very well to the Ethernet business. Neutral Tandem’s solution is once again non-threatening as well as capitally efficient and leverages its existing interconnections and expertise. TNDM will also almost certainly be the low cost provider in this market as well.

In that Ethernet exchange market, Neutral Tandem will competes with Equinix, though it has a much smaller footprint and lacks a backbone network of its own. TNDM also competes with start-up CENX, which, interestingly, has several key ex-Neutral Tandem officers on its management team. Whether CENX represents a legitimate threat or is really an off-balance sheet R&D department for TNDM remains to be seen. What is clear, however, is that CENX doesn’t have a deep existing roster of clients to upsell into nor a network of its own. It also has a presence in only three markets, compared to TNDM’s current presence in 137.

One of the most critical parts of understanding Neutral Tandem, however, is this: TNDM’s competitive advantage is similar to that of eBay, American Express, CME Group, and Western Union. Specifically, the “network effects” in Neutral Tandem’s business are extremely powerful insulation from competition and should ensure above average earnings power for years.

By network effects I mean that the value of TNDM’s service increases the more customers use it. The economic value of that physical network is increasing at a faster rate than its absolute size. It’s fairly amazing to see how fast the number of switch connections grows as more customers come onboard.

Network effects are also virtuously powerful because the larger the physical TNDM network becomes, the more traffic TNDM can handle, and the more profitable each switch the company is connected to becomes. You can see this relationship pretty clearly by dividing the company’s annual operating income by the number of carrier switches it was connected to at the end of each year.

There is a relatively simple way to test for a moat, and another way to test for network effects. Over the last three years, Neutral Tandem has averaged annual returns on invested capital after adjusting for excess cash of 54%. That’s a pretty strong indicator of a durable competitive advantage.

Over that same three year period, TNDM has increased the amount of capital it has reinvested in its operations by about 40% each year, in order to expand the number of carrier switches on its network by 50% each year, which in turn has increased the number of connections between each switch by almost 140% each year. The company’s operating income increased by 800% over that same period.

The network effect drives those economics, which just don’t get much more attractive in a business.

What are your thoughts on Neutral Tandem’s valuation – and why the big sell-off since mid-2009?

Neutral Tandem is cheap in the absolute sense of the word. Take the company’s earnings. TNDM has a market capitalization of $530 million with ’09 earnings of $41 million, giving shares a trailing P/E of 13. That’s a bargain in just about any book.

However, TNDM also has no debt and holds $161 million in cash, or about $4.75 in cash per share. That means two things. The first is that the company, which the market now believes to be worth $530 million, could be bought outright today for a cash outlay of only $369 million, a point which may resonate most strongly in the private equity community. The second takeaway should hold broader appeal, though; TNDM’s cash-adjusted P/E is 9. An adjusted earnings yield of 11% is simply way too cheap.

Just about any other metric or any kind of valuation based on cash flows will point you to a similar conclusion: Neutral Tandem is a wonderful business selling at a terrific price.

When it comes to valuation, the market also appears to be overly concerned about the company’s decision to lower prices in response to competition. It’s important to understand, though, that most telecommunications services are a commodity. The long-term trend for all prices is down, and the lowest cost operators will ultimately win. To invest in Neutral Tandem and worry about a near-term decline in average fees billed per minute is a one-way trip to the sanitarium. The company will, and from the strategic sense, should, continue to intelligently lower prices in the near future. But to conclude it will never be able to raise prices again is mistaken, and to focus on average revenue per user (ARPU) instead of average margin per user (AMPU) is a common mistake when evaluating many telecom companies.

Over time the ARPU of most telecom companies will decline, and Neutral Tandem is certainly no exception. Only by focusing on AMPU, however, can you gauge the efficiency of operations in the face of lower prices. A reasonable proxy for the company’s AMPU is adjusted EBITDA margin, and despite recently decreased per-minute prices, TNDM increased its adjusted EBITDA margin in Q4 ’09 to 50.0%, an increase of 200 basis points over the year ago period. That continued increase indicates that costs per user are falling faster than prices, which is likely due to three things: (1) the benefits of scale, (2) network efficiency and optimization, and (3) good management.

I believe what we are seeing in Neutral Tandem is the creation of a natural monopoly in one market and a strong early position in a nascent but much bigger second market. In the end, the most valuable network will be the one that attracts the most users. Competitors need to replicate that network, or come relatively close, before users will see more value and switch. I believe it’s already too late.

What near-term catalysts do you see?

Several, including a recently announced $25 million share buyback, but the biggest by far is the company’s recently announced roll out of Ethernet exchange services. Management believes the Ethernet market will be worth $40 billion in four years, meaning that business line could eventually dwarf TNDM’s existing business. It will likely be higher margin, as well.

The degree of success TNDM will have in that market is too difficult to predict, but buyers of shares today are getting those earnings for free in any case.

Thank you very much, Cale.

My pleasure.

Disclosure: Funds managed by Cale Smith are long TNDM

Above Average Odds

http://aboveaverageodds.wordpress.com/

The investment analysis below is the third write-up in our ongoing series of guest posts, and is brought to you by friend of the blog Cale Smith. Cale is the portfolio manager of the Tarpon Folio, a spoke fund. He is also the founder and managing partner of Islamorada Investment Management, an independent value investing firm based in the Florida Keys.

Cale also happens to run one of our favorite blogs on the net, you can check it out yourself at www.caleinthekeys.com (we highly recommend it). With consistently amusing high-quality investment analysis, commentary, and slogans like “One geek in the Keys is worth two suits in the city,” its hard not to grow fond of Cale’s “Warren Buffett meets Jimmy Buffett” attitude/approach. We think you will agree.

Anyhow, below is Cale’s recent “high conviction idea” interview with Seeking Alpha, which in our opinion provides an outstanding overview of what we believe offers yet another low-risk, high-return opportunity for the bargain hunting investor.

Seeking Alpha Interview:

We recently had the opportunity to ask Smith about his single highest conviction holding.

What is the highest conviction stock position in your fund?

Our highest conviction position is Neutral Tandem (TNDM). While we own some great businesses, few have earnings power as underappreciated as TNDM right now. It’s the dominant player in a previously obscure telecommunications niche, and it’s stunningly cheap. I am unequivocally bullish and believe the laws of economics are squarely on the long side. More importantly, though, is that at current price levels, even if I’m wrong our losses should be disproportionately small.

I have tried repeatedly to kill this business on paper. Very few scenarios, however, are of the magnitude or urgency that would rationally explain the gap between this business’s real value and what the market currently believes it’s worth. I think the company is worth at least twice where it now trades.

The vast majority of shares appear to be held by growth funds, and selling that began last fall apparently attracted the attention of momentum shorts. The price decline originally began when fears arose about the impact of a T-Mobile and Sprint (S) merger on Neutral Tandem’s revenues, as both are big customers. Such a merger was improbable for several reasons, but the slide in shares has nonetheless continued relatively unabated.

The vast majority of shares appear to be held by growth funds, and selling that began last fall apparently attracted the attention of momentum shorts. The price decline originally began when fears arose about the impact of a T-Mobile and Sprint (S) merger on Neutral Tandem’s revenues, as both are big customers. Such a merger was improbable for several reasons, but the slide in shares has nonetheless continued relatively unabated.There simply aren’t too many companies in the world with strong earnings power, high returns on invested capital, no debt, solid management, improving margins and a simple business that is hard for competitors to replicate. To be able to buy in when trading near multi-year lows is even more rare. Neutral Tandem is a wonderful business, priced as if it had been caught secretly securitizing subprime mortgages. It has just four years of operational history, but the moat the company is building around its business is becoming wide enough that I’m willing to tolerate that.

Tell us a bit about TNDM’s business, and that moat you described.

When describing the company, I’m going to presume that “providing tandem interconnections services to competitive carriers” may not mean much to most readers, so I’ll try to keep it simple. Neutral Tandem allows wireless, cable, broadband and traditional phone companies to connect and exchange traffic. It has solved two very big problems. The first is that TNDM allows companies to swap traffic without having to connect to each other directly. Doing that is expensive and ridiculously inefficient. The second problem Neutral Tandem has addressed is one of competition.

As its name implies, TNDM is a neutral player, meaning that it does not provide any of the same services as its customers. Avoiding scenarios in which you compete with your own major customers might sound like a pretty obvious rule of thumb, but telecom is often Bizarro World. Even the most vicious competitors partner up on certain things simply because there are no other options. TNDM is now one of those options, but it’s an alternative that is lower cost, higher quality, and comes with more bells and whistles.

Prior to Neutral Tandem, customers had to depend on their biggest, more fearsome competitors to help them deliver service. As you might expect, carriers would prefer to do business with someone that isn’t going to attempt to steal any of their customers. As a result, TNDM’s early growth has been impressive.

For a general sense of how much economic value can ultimately accrue to a well-managed neutral party in the telecom service sector, investors might look at colocation provider Equinix (EQIX). It’s in a completely different business, and Neutral Tandem’s facilities don’t have cool “man-traps” at the front door, but the strategic positioning is similar.

Another key differentiator is that TNDM also has its own network. This is important for several reasons, one of which is that it helps keep costs low while ensuring scalability. It also allows the company to use better technology in more markets to differentiate its services in important ways.

Sounds like a strong story. So what is the downside risk in TNDM?

There are risks in Neutral Tandem, but the majority are low-probability and persistent across the sector. One commonly-cited concern does bear specific mention, however. Neutral Tandem is a big fish in a small pond. Its switching network already reaches almost every key market in the country, and the size of the entire tandem switching industry appears to be in the billion dollar annual revenue range. Though TNDM will continue to grow strongly over the next few years, it is not yet obvious how the company will maintain high growth after that period.

My first response to that concern is, “We should be so lucky.” To dominate a billion dollar market will still create immense value for today’s investors. Even if growth stopped immediately, however, the company would still produce cash at such a rate that by doing nothing more than servicing its existing client base, in four years TNDM would have accumulated an amount of cash per share equivalent to today’s stock price. Alternatively, even if the company’s expansion rate fell off a cliff and TNDM grows only slightly faster than the economy over the next five years – and then implodes like Tiger Woods – shares are still worth about $14. So shares today are priced as if the apocalypse has already happened, but the reality is the business has never been stronger.

To presume that management is completely blind to that concern about long-term growth either underestimates the IQ of management or overestimates the perceptiveness of the investor. Cash flow gives management plenty of options, and while I have no more real insight into what they might be planning than anyone else, I am confident this particular issue will be satisfactorily addressed. A recently announced Ethernet exchange service is certainly a step in the right direction. International service is another opportunity. In the meantime, I’m happy to watch the cash pile up.

To what extent is this a telecom industry pick as opposed to a pure bottom-up pick?

If I have a curse, it’s that I’m a value investor whose circle of competence includes telecommunications – an industry that is forever destined to attract irrational people. Using a top-down approach to investing in telecom often leads to trouble. But ideas don’t come much more bottom-up than Neutral Tandem.

A decade ago, I was a project manager at the world’s first commercial internet service provider. My team’s job was to provision circuits – to create and test connections that would provide smooth internet traffic flow between the networks of different companies. That this job required an MBA and two teams of network engineers probably speaks the most to how challenging it was to work with the old Ma Bell companies.

Those ILECs, or incumbent local exchange carriers, were none too pleased to have to open their telco cages and patch panels to the telco upstarts of the world. Nonetheless, they were required to do just that by the Telecommunications Act of 1996. They weren’t too happy about it, and their informal policy was “strategic non-cooperation.”

Ten years later, Neutral Tandem has basically solved that problem – first for carriers of voice traffic, and soon for data carriers, too, as per recently announced plans to offer Ethernet interconnection services. TNDM is simply the faster, better, cheaper alternative to connecting traffic through the ILECs’ networks. As a project manager, it would have been hard to describe how valuable the service is that Neutral Tandem provides. As a portfolio manager, however, it’s relatively easy.

How would you describe Neutral Tandem’s competitive environment?

The market seems to think the company’s future earnings are somehow in doubt. I believe that the race to be the monopoly provider of tandem switching services is already over, and that Neutral Tandem has won.

On paper, current competitors include HyperCube, Peerless Networks and Level 3 (LVLT), but the reality is that none have the scale, capital or model to seriously challenge TNDM. Lawsuits have flown around the group, but TNDM has been on the winning side of each one that’s been adjudicated to date. The lawsuits are not about intellectual property per se as much as they are about pestering the competition.

TNDM is far and away the leader in the independent tandem switching market. Neither HyperCube nor Peerless own a network, which among other things means that neither has the reach to complete calls themselves nor the quality of service that might otherwise be expected. It also means that TNDM is the lowest cost provider in a commodity industry, another considerable advantage. Level 3 has its own network, but its balance sheet is horrific and, more to the point, it’s not neutral.

TNDM also recently announced it would be launching Ethernet exchange services (think businesses with offices all over the country), an arguably brilliant strategic move despite the rush of other competitors entering the fray. It’s another hugely inefficient niche with considerable pent-up demand caused by odd competitive dynamics. The same advantages TNDM has in tandem switching translate over very well to the Ethernet business. Neutral Tandem’s solution is once again non-threatening as well as capitally efficient and leverages its existing interconnections and expertise. TNDM will also almost certainly be the low cost provider in this market as well.

In that Ethernet exchange market, Neutral Tandem will competes with Equinix, though it has a much smaller footprint and lacks a backbone network of its own. TNDM also competes with start-up CENX, which, interestingly, has several key ex-Neutral Tandem officers on its management team. Whether CENX represents a legitimate threat or is really an off-balance sheet R&D department for TNDM remains to be seen. What is clear, however, is that CENX doesn’t have a deep existing roster of clients to upsell into nor a network of its own. It also has a presence in only three markets, compared to TNDM’s current presence in 137.

One of the most critical parts of understanding Neutral Tandem, however, is this: TNDM’s competitive advantage is similar to that of eBay, American Express, CME Group, and Western Union. Specifically, the “network effects” in Neutral Tandem’s business are extremely powerful insulation from competition and should ensure above average earnings power for years.

By network effects I mean that the value of TNDM’s service increases the more customers use it. The economic value of that physical network is increasing at a faster rate than its absolute size. It’s fairly amazing to see how fast the number of switch connections grows as more customers come onboard.

Network effects are also virtuously powerful because the larger the physical TNDM network becomes, the more traffic TNDM can handle, and the more profitable each switch the company is connected to becomes. You can see this relationship pretty clearly by dividing the company’s annual operating income by the number of carrier switches it was connected to at the end of each year.

There is a relatively simple way to test for a moat, and another way to test for network effects. Over the last three years, Neutral Tandem has averaged annual returns on invested capital after adjusting for excess cash of 54%. That’s a pretty strong indicator of a durable competitive advantage.

Over that same three year period, TNDM has increased the amount of capital it has reinvested in its operations by about 40% each year, in order to expand the number of carrier switches on its network by 50% each year, which in turn has increased the number of connections between each switch by almost 140% each year. The company’s operating income increased by 800% over that same period.

The network effect drives those economics, which just don’t get much more attractive in a business.

What are your thoughts on Neutral Tandem’s valuation – and why the big sell-off since mid-2009?

Neutral Tandem is cheap in the absolute sense of the word. Take the company’s earnings. TNDM has a market capitalization of $530 million with ’09 earnings of $41 million, giving shares a trailing P/E of 13. That’s a bargain in just about any book.

However, TNDM also has no debt and holds $161 million in cash, or about $4.75 in cash per share. That means two things. The first is that the company, which the market now believes to be worth $530 million, could be bought outright today for a cash outlay of only $369 million, a point which may resonate most strongly in the private equity community. The second takeaway should hold broader appeal, though; TNDM’s cash-adjusted P/E is 9. An adjusted earnings yield of 11% is simply way too cheap.

Just about any other metric or any kind of valuation based on cash flows will point you to a similar conclusion: Neutral Tandem is a wonderful business selling at a terrific price.

When it comes to valuation, the market also appears to be overly concerned about the company’s decision to lower prices in response to competition. It’s important to understand, though, that most telecommunications services are a commodity. The long-term trend for all prices is down, and the lowest cost operators will ultimately win. To invest in Neutral Tandem and worry about a near-term decline in average fees billed per minute is a one-way trip to the sanitarium. The company will, and from the strategic sense, should, continue to intelligently lower prices in the near future. But to conclude it will never be able to raise prices again is mistaken, and to focus on average revenue per user (ARPU) instead of average margin per user (AMPU) is a common mistake when evaluating many telecom companies.

Over time the ARPU of most telecom companies will decline, and Neutral Tandem is certainly no exception. Only by focusing on AMPU, however, can you gauge the efficiency of operations in the face of lower prices. A reasonable proxy for the company’s AMPU is adjusted EBITDA margin, and despite recently decreased per-minute prices, TNDM increased its adjusted EBITDA margin in Q4 ’09 to 50.0%, an increase of 200 basis points over the year ago period. That continued increase indicates that costs per user are falling faster than prices, which is likely due to three things: (1) the benefits of scale, (2) network efficiency and optimization, and (3) good management.

I believe what we are seeing in Neutral Tandem is the creation of a natural monopoly in one market and a strong early position in a nascent but much bigger second market. In the end, the most valuable network will be the one that attracts the most users. Competitors need to replicate that network, or come relatively close, before users will see more value and switch. I believe it’s already too late.

What near-term catalysts do you see?

Several, including a recently announced $25 million share buyback, but the biggest by far is the company’s recently announced roll out of Ethernet exchange services. Management believes the Ethernet market will be worth $40 billion in four years, meaning that business line could eventually dwarf TNDM’s existing business. It will likely be higher margin, as well.

The degree of success TNDM will have in that market is too difficult to predict, but buyers of shares today are getting those earnings for free in any case.

Thank you very much, Cale.

My pleasure.

Disclosure: Funds managed by Cale Smith are long TNDM

Above Average Odds

http://aboveaverageodds.wordpress.com/