Apple has overtaken Microsoft to claim the number two spot in the ranking of American companies as measured by market capitalization. At $222 billion, Apple only trails Exxon Mobil which has a $279 billion market cap. Microsoft’s market capitalization fell today to $219 billion. What does this mean and are there any lessons that investors can learn from Apple’s amazing rise over the past decade?

Apple’s Business Success Drove Result

There can be no doubt that Apple’s business success has driven investor enthusiasm and led the market to value the company at a very high level. When one looks back at Apple’s condition in the late 1990s, few investors at the time would have bet much on the company even existing in 2010 let alone being the second most valuable company by market cap. The leadership of Steve Jobs in general and the introduction of the iPod and iPhone not only drove Apple’s bottom line results but radically disrupted the hardware, software, music, and telecommunications industries.

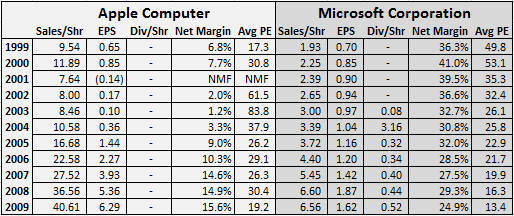

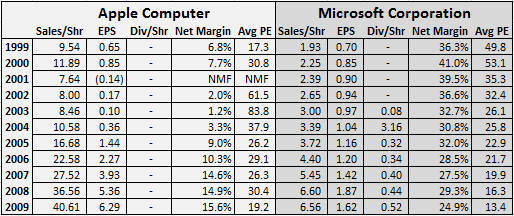

Apple’s earnings growth, as we will see in a table later in the article, has been extremely rapid particularly over the past few years as the iPhone gained momentum. Sales have increased at a rapid clip while net profit margins have expanded. It is no surprise that investors are excited about future prospects and willing to pay over twenty times 2010 earnings estimates to own the shares (Value Line estimates 2010 earnings at $11.55/share).

Whether a buyer of Apple stock today will be successful in the long run is beyond the scope of this article, and indeed far beyond the abilities of this author to analyze. Obviously, based on projecting the past five years of results into the future, nearly any price can be justified today. However, at some point (which we cannot pretend to know with any certainty), Apple’s growth will slow and investors will suddenly refuse to pay rich multiples of earnings.

Microsoft: Solid Business Results, Dismal Stock Performance

Microsoft’s story over the past ten years under CEO Steve Ballmer has been one of solid progress in business results and absolutely dismal performance from a stock price perspective. This can be traced to the fact that investors in the late 1990s and early 2000s were willing to pay very rich multiples of earnings based on Microsoft’s track record up to that point. Microsoft often traded at multiples of 50 or more during the height of investor euphoria.

Looking at Microsoft’s Value Line data (available free of charge as a Dow 30 member), we can see the rapid earnings growth in the mid to late 1990s that fueled investor enthusiasm and we can also see solid, but slowing growth over the past ten years. Indeed, the company failed to increase year over year earnings only twice over the past decade. In addition, a dividend was introduced. Profit margins declined over the past decade as the company’s business matured and pricing came under pressure (operating system sales for net books are a good example of the pricing headwinds faced in recent years). Still, at a 24.9 percent net profit margin in 2009, Microsoft clearly remains a great business.

The stock price decline over the past decade is attributed to the fact that investors were willing to pay far less for each dollar of earnings than in the past. At an average PE ratio of 13.4 in 2009, investors were treating Microsoft as an average company, at best, and possibly as a company that may be in decline going forward.

A table showing key data (all from Value Line) for Apple and Microsoft appears below.

What can we learn from the history of Apple and Microsoft over the past decade?

First, while Apple’s success story is indisputable, it is very difficult to see how a value investor could have justified a purchase of the company’s common stock in the early part of the last decade while insisting on any margin of safety. The wonderful success Apple has experienced was courtesy of products that hardly anyone could foresee at the time. Would it have made sense to purchase shares in 2005 or 2006 after the iPod was firmly established and when speculation raged over the iPhone? Possibly for an investor who firmly believed that the industry was within his circle of competence, but most value investors probably still would have passed.

Second, we can see from Microsoft’s history the dangers of paying a fancy price for a wonderful company based upon expectations that past trends can continue indefinitely. Despite turning in solid performance over the past ten years from a business perspective, any buyer of Microsoft stock from that era is sitting on losses of fifty percent or more. It is clear that a value investor would not have purchased Microsoft stock in 1999 or 2000 simply based upon the valuation at the time. There was no margin of safety.

While this article is not intended to make any statement regarding Apple’s valuation, it would seem prudent for any prospective Apple shareholder to consider Microsoft’s experience over the past ten years and the importance of a margin of safety when making long term investment commitments.

Disclosures: No position in Apple or Microsoft.

Ravi Nagarajan

http://www.rationalwalk.com

Apple’s Business Success Drove Result

There can be no doubt that Apple’s business success has driven investor enthusiasm and led the market to value the company at a very high level. When one looks back at Apple’s condition in the late 1990s, few investors at the time would have bet much on the company even existing in 2010 let alone being the second most valuable company by market cap. The leadership of Steve Jobs in general and the introduction of the iPod and iPhone not only drove Apple’s bottom line results but radically disrupted the hardware, software, music, and telecommunications industries.

Apple’s earnings growth, as we will see in a table later in the article, has been extremely rapid particularly over the past few years as the iPhone gained momentum. Sales have increased at a rapid clip while net profit margins have expanded. It is no surprise that investors are excited about future prospects and willing to pay over twenty times 2010 earnings estimates to own the shares (Value Line estimates 2010 earnings at $11.55/share).

Whether a buyer of Apple stock today will be successful in the long run is beyond the scope of this article, and indeed far beyond the abilities of this author to analyze. Obviously, based on projecting the past five years of results into the future, nearly any price can be justified today. However, at some point (which we cannot pretend to know with any certainty), Apple’s growth will slow and investors will suddenly refuse to pay rich multiples of earnings.

Microsoft: Solid Business Results, Dismal Stock Performance

Microsoft’s story over the past ten years under CEO Steve Ballmer has been one of solid progress in business results and absolutely dismal performance from a stock price perspective. This can be traced to the fact that investors in the late 1990s and early 2000s were willing to pay very rich multiples of earnings based on Microsoft’s track record up to that point. Microsoft often traded at multiples of 50 or more during the height of investor euphoria.

Looking at Microsoft’s Value Line data (available free of charge as a Dow 30 member), we can see the rapid earnings growth in the mid to late 1990s that fueled investor enthusiasm and we can also see solid, but slowing growth over the past ten years. Indeed, the company failed to increase year over year earnings only twice over the past decade. In addition, a dividend was introduced. Profit margins declined over the past decade as the company’s business matured and pricing came under pressure (operating system sales for net books are a good example of the pricing headwinds faced in recent years). Still, at a 24.9 percent net profit margin in 2009, Microsoft clearly remains a great business.

The stock price decline over the past decade is attributed to the fact that investors were willing to pay far less for each dollar of earnings than in the past. At an average PE ratio of 13.4 in 2009, investors were treating Microsoft as an average company, at best, and possibly as a company that may be in decline going forward.

A table showing key data (all from Value Line) for Apple and Microsoft appears below.

What can we learn from the history of Apple and Microsoft over the past decade?

First, while Apple’s success story is indisputable, it is very difficult to see how a value investor could have justified a purchase of the company’s common stock in the early part of the last decade while insisting on any margin of safety. The wonderful success Apple has experienced was courtesy of products that hardly anyone could foresee at the time. Would it have made sense to purchase shares in 2005 or 2006 after the iPod was firmly established and when speculation raged over the iPhone? Possibly for an investor who firmly believed that the industry was within his circle of competence, but most value investors probably still would have passed.

Second, we can see from Microsoft’s history the dangers of paying a fancy price for a wonderful company based upon expectations that past trends can continue indefinitely. Despite turning in solid performance over the past ten years from a business perspective, any buyer of Microsoft stock from that era is sitting on losses of fifty percent or more. It is clear that a value investor would not have purchased Microsoft stock in 1999 or 2000 simply based upon the valuation at the time. There was no margin of safety.

While this article is not intended to make any statement regarding Apple’s valuation, it would seem prudent for any prospective Apple shareholder to consider Microsoft’s experience over the past ten years and the importance of a margin of safety when making long term investment commitments.

Disclosures: No position in Apple or Microsoft.

Ravi Nagarajan

http://www.rationalwalk.com