Polar Asset Management Partners Inc. - Net Worth and Insider Trading

Polar Asset Management Partners Inc. Net Worth

The estimated net worth of Polar Asset Management Partners Inc. is at least $362 Million dollars as of 2024-05-15. Polar Asset Management Partners Inc. is the 10% Owner of Tortoise Acquisition Corp and owns about 1,298,253 shares of Tortoise Acquisition Corp (SHLL) stock worth over $58 Million. Polar Asset Management Partners Inc. is the 10% Owner of Trinity Merger Corp and owns about 3,447,876 shares of Trinity Merger Corp (TMCX) stock worth over $38 Million. Polar Asset Management Partners Inc. is also the 10% Owner of Tuscan Holdings Corp and owns about 3,547,287 shares of Tuscan Holdings Corp (THCB) stock worth over $35 Million. Besides these, Polar Asset Management Partners Inc. also holds Silver Spike Acquisition Corp (SSPK) , Industrea Acquisition Corp (INDUU) , SC Health Corp (SCPE) , Garnero Group Acquisition Co (GGAC) , Industrea Acquisition Corp (INDU) , Repay Holdings Corp (RPAY) , Big Rock Partners Acquisition Corp (BRPA) , Hurco Companies Inc (HURC) , E-compass Acquisition Corp (ECACU) , KBL Merger Corp IV (KBLM) , Pacific Special Acquisition Corp (PAACU) , Barington/Hilco Acquisition Corp (BHAC) , Roth CH Acquisition V Co (ROCL) , Ace Global Business Acquisition Ltd (ACBA) , Chain Bridge I (CBRG) , GEN Restaurant Group Inc (GENK) , First Light Acquisition Group Inc (FLAG) , PHP Ventures Acquisition Corp (PPHP) , GigCapital5 Inc (GIA) , Orisun Acquisition Corp (ORSN) , Yatra Online Inc (YTRA) , ARMOUR Residential REIT Inc (ARR) , Sirius International Insurance Group Ltd (SG) , Digital Media Solutions Inc (DMSL) , Tottenham Acquisition I Ltd (CLNN) , Kaixin Holdings (KXIN) , iSun Inc (ISUN) , Simplicity Esports and Gaming Co (WINR) , Corner Growth Acquisition Corp 2 (TRON) . Details can be seen in Polar Asset Management Partners Inc.'s Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the assumption that Polar Asset Management Partners Inc. has not made any transactions after 2023-12-05 and currently still holds the listed stock(s).

Transaction Summary of Polar Asset Management Partners Inc.

Polar Asset Management Partners Inc. Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Polar Asset Management Partners Inc. owns 95 companies in total, including Orisun Acquisition Corp (ORSNU) , Tottenham Acquisition I Ltd (TOTAU) , and Tortoise Acquisition Corp (SHLL.U) among others .

Insider Ownership Summary of Polar Asset Management Partners Inc.

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| ORSNU | Orisun Acquisition Corp | 2020-10-14 | 10 percent owner |

| TOTAU | Tottenham Acquisition I Ltd | 2020-09-22 | 10 percent owner |

| SHLL.U | Tortoise Acquisition Corp | 2020-06-19 | 10 percent owner |

| 2020-05-13 | 10 percent owner | ||

| 2020-05-07 | 10 percent owner | ||

| 2020-03-23 | 10 percent owner | ||

| 2020-04-21 | 10 percent owner | ||

| 2020-03-13 | 10 percent owner | ||

| 2019-11-19 | 10 percent owner | ||

| 2019-11-07 | 10 percent owner | ||

| 2018-09-28 | 10 percent owner | ||

| 2019-06-19 | 10 percent owner | ||

| 2018-01-23 | 10 percent owner | ||

| 2019-04-17 | 10 percent owner | ||

| 2019-04-09 | 10 percent owner | ||

| 2019-03-21 | 10 percent owner | ||

| 2019-03-12 | 10 percent owner | ||

| 2019-03-06 | 10 percent owner | ||

| 2019-01-03 | 10 percent owner | ||

| 2018-12-20 | 10 percent owner | ||

| 2018-12-04 | 10 percent owner | ||

| 2018-11-06 | 10 percent owner | ||

| 2018-11-02 | 10 percent owner | ||

| 2018-08-24 | 10 percent owner | ||

| 2018-06-07 | 10 percent owner | ||

| 2018-05-23 | 10 percent owner | ||

| 2018-02-22 | 10 percent owner | ||

| 2016-05-24 | 10 percent owner | ||

| 2017-08-09 | 10 percent owner | ||

| 2015-03-24 | 10 percent owner | ||

| 2017-02-10 | 10 percent owner | ||

| 2017-01-26 | 10 percent owner | ||

| 2015-10-15 | 10 percent owner | ||

| 2016-01-12 | 10 percent owner | ||

| 2016-07-20 | 10 percent owner | ||

| 2016-06-23 | 10 percent owner | ||

| 2016-05-17 | 10 percent owner | ||

| 2014-10-01 | 10 percent owner | ||

| 2016-03-08 | 10 percent owner | ||

| 2015-11-23 | 10 percent owner | ||

| 2009-11-06 | 10 percent owner | ||

| 2021-02-23 | 10 percent owner | ||

| 2018-01-03 | 10 percent owner | ||

| 2017-08-09 | 10 percent owner | ||

| 2018-01-05 | 10 percent owner | ||

| 2017-06-07 | 10 percent owner | ||

| 2017-07-27 | 10 percent owner | ||

| 2019-04-17 | 10 percent owner | ||

| 2019-01-03 | 10 percent owner | ||

| 2020-02-27 | 10 percent owner | ||

| 2019-03-13 | 10 percent owner | ||

| 2019-04-09 | 10 percent owner | ||

| 2020-03-26 | 10 percent owner | ||

| 2020-04-29 | 10 percent owner | ||

| 2020-03-25 | 10 percent owner | ||

| 2022-02-09 | 10 percent owner | ||

| 2022-12-01 | 10 percent owner | ||

| 2022-07-07 | 10 percent owner | ||

| 2022-07-19 | 10 percent owner | ||

| 2022-07-07 | 10 percent owner | ||

| 2022-09-09 | 10 percent owner | ||

| 2023-03-24 | 10 percent owner | ||

| 2022-10-19 | 10 percent owner | ||

| 2022-09-09 | 10 percent owner | ||

| 2023-04-27 | 10 percent owner | ||

| 2022-10-24 | 10 percent owner | ||

| 2022-11-15 | 10 percent owner | ||

| 2022-11-28 | 10 percent owner | ||

| 2022-11-09 | 10 percent owner | ||

| 2022-11-10 | 10 percent owner | ||

| 2022-12-15 | 10 percent owner | ||

| 2022-12-15 | 10 percent owner | ||

| 2022-12-21 | 10 percent owner | ||

| 2022-09-09 | 10 percent owner | ||

| 2022-12-15 | 10 percent owner | ||

| 2023-01-09 | 10 percent owner | ||

| 2023-01-06 | 10 percent owner | ||

| 2023-08-10 | 10 percent owner | ||

| 2023-01-13 | 10 percent owner | ||

| 2023-02-13 | 10 percent owner | ||

| 2023-01-06 | 10 percent owner | ||

| 2023-02-15 | 10 percent owner | ||

| 2022-07-07 | 10 percent owner | ||

| 2023-03-06 | 10 percent owner | ||

| 2023-04-17 | 10 percent owner | ||

| 2023-06-02 | 10 percent owner | ||

| 2023-05-10 | 10 percent owner | ||

| 2023-06-14 | 10 percent owner | ||

| 2023-07-20 | 10 percent owner | ||

| 2023-08-07 | 10 percent owner | ||

| 2023-11-15 | 10 percent owner | ||

| 2022-11-28 | 10 percent owner | ||

| 2023-04-17 | 10 percent owner | ||

| 2023-04-27 | 10 percent owner | ||

| 2022-12-21 | 10 percent owner |

Polar Asset Management Partners Inc. Latest Holdings Summary

Polar Asset Management Partners Inc. currently owns a total of 32 stocks. Among these stocks, Polar Asset Management Partners Inc. owns 1,298,253 shares of Tortoise Acquisition Corp (SHLL) as of June 19, 2020, with a value of $58 Million and a weighting of 16.1%. Polar Asset Management Partners Inc. owns 3,447,876 shares of Trinity Merger Corp (TMCX) as of June 19, 2019, with a value of $38 Million and a weighting of 10.47%. Polar Asset Management Partners Inc. also owns 3,547,287 shares of Tuscan Holdings Corp (THCB) as of May 7, 2020, with a value of $35 Million and a weighting of 9.79%. The other 29 stocks Silver Spike Acquisition Corp (SSPK) , Industrea Acquisition Corp (INDUU) , SC Health Corp (SCPE) , Garnero Group Acquisition Co (GGAC) , Industrea Acquisition Corp (INDU) , Repay Holdings Corp (RPAY) , Big Rock Partners Acquisition Corp (BRPA) , Hurco Companies Inc (HURC) , E-compass Acquisition Corp (ECACU) , KBL Merger Corp IV (KBLM) , Pacific Special Acquisition Corp (PAACU) , Barington/Hilco Acquisition Corp (BHAC) , Roth CH Acquisition V Co (ROCL) , Ace Global Business Acquisition Ltd (ACBA) , Chain Bridge I (CBRG) , GEN Restaurant Group Inc (GENK) , First Light Acquisition Group Inc (FLAG) , PHP Ventures Acquisition Corp (PPHP) , GigCapital5 Inc (GIA) , Orisun Acquisition Corp (ORSN) , Yatra Online Inc (YTRA) , ARMOUR Residential REIT Inc (ARR) , Sirius International Insurance Group Ltd (SG) , Digital Media Solutions Inc (DMSL) , Tottenham Acquisition I Ltd (CLNN) , Kaixin Holdings (KXIN) , iSun Inc (ISUN) , Simplicity Esports and Gaming Co (WINR) , Corner Growth Acquisition Corp 2 (TRON) have a combined weighting of 63.64% among all his current holdings.

Latest Holdings of Polar Asset Management Partners Inc.

| Ticker | Comapny | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| SHLL | Tortoise Acquisition Corp | 2020-06-19 | 1,298,253 | 44.91 | 58,304,542 |

| TMCX | Trinity Merger Corp | 2019-06-19 | 3,447,876 | 11.00 | 37,926,636 |

| THCB | Tuscan Holdings Corp | 2020-05-07 | 3,547,287 | 10.00 | 35,472,870 |

| SSPK | Silver Spike Acquisition Corp | 2020-12-10 | 1,754,420 | 18.84 | 33,053,273 |

| INDUU | Industrea Acquisition Corp | 2017-08-24 | 2,999,900 | 10.80 | 32,398,920 |

| SCPE | SC Health Corp | 2020-05-06 | 1,500,000 | 15.84 | 23,760,000 |

| GGAC | Garnero Group Acquisition Co | 2014-10-31 | 2,273,841 | 10.05 | 22,852,102 |

| INDU | Industrea Acquisition Corp | 2018-10-22 | 1,974,900 | 9.36 | 18,485,064 |

| RPAY | Repay Holdings Corp | 2019-03-13 | 1,709,979 | 10.49 | 17,937,680 |

| BRPA | Big Rock Partners Acquisition Corp | 2020-03-13 | 488,036 | 24.25 | 11,834,873 |

| HURC | Hurco Companies Inc | 2021-02-23 | 659,968 | 17.72 | 11,694,633 |

| ECACU | E-compass Acquisition Corp | 2015-09-09 | 783,820 | 10.80 | 8,466,040 |

| KBLM | KBL Merger Corp IV | 2017-06-27 | 1,487,500 | 4.99 | 7,422,625 |

| PAACU | Pacific Special Acquisition Corp | 2016-12-22 | 530,500 | 10.50 | 5,570,250 |

| BHAC | Barington/Hilco Acquisition Corp | 2016-07-20 | 565,000 | 9.85 | 5,565,250 |

| ROCL | Roth CH Acquisition V Co | 2023-12-05 | 486,435 | 10.90 | 5,302,142 |

| ACBA | Ace Global Business Acquisition Ltd | 2023-05-03 | 378,900 | 12.23 | 4,633,947 |

| CBRG | Chain Bridge I | 2023-06-02 | 415,000 | 11.08 | 4,598,200 |

| GENK | GEN Restaurant Group Inc | 2023-11-15 | 410,316 | 11.09 | 4,550,404 |

| FLAG | First Light Acquisition Group Inc | 2022-10-19 | 412,800 | 8.00 | 3,302,400 |

| PPHP | PHP Ventures Acquisition Corp | 2023-08-10 | 271,847 | 11.07 | 3,009,346 |

| GIA | GigCapital5 Inc | 2023-03-24 | 797,620 | 3.54 | 2,823,575 |

| ORSN | Orisun Acquisition Corp | 2020-10-14 | 247,008 | 8.17 | 2,018,055 |

| YTRA | Yatra Online Inc | 2016-10-20 | 488,016 | 1.48 | 722,264 |

| ARR | ARMOUR Residential REIT Inc | 2009-11-06 | 11,000 | 19.11 | 210,210 |

| SG | Sirius International Insurance Group Ltd | 2018-11-02 | 13,900 | 12.75 | 177,225 |

| DMSL | Digital Media Solutions Inc | 2019-04-09 | 133,267 | 0.60 | 79,960 |

| CLNN | Tottenham Acquisition I Ltd | 2020-09-22 | 3,226 | 11.57 | 37,325 |

| KXIN | Kaixin Holdings | 2019-01-03 | 175,333 | 0.13 | 23,354 |

| ISUN | iSun Inc | 2018-09-28 | 16,355 | 0.15 | 2,371 |

| WINR | Simplicity Esports and Gaming Co | 2019-04-17 | 25,477 | 0.00 | 15 |

| TRON | Corner Growth Acquisition Corp 2 | 2022-12-01 | 0 | 11.60 | 0 |

Holding Weightings of Polar Asset Management Partners Inc.

Polar Asset Management Partners Inc. Form 4 Trading Tracker

According to the SEC Form 4 filings, Polar Asset Management Partners Inc. has made a total of 1 transactions in Tortoise Acquisition Corp (SHLL) over the past 5 years, including 0 buys and 1 sells. The most-recent trade in Tortoise Acquisition Corp is the sale of 1,550,000 shares on June 19, 2020, which brought Polar Asset Management Partners Inc. around $21 Million.

According to the SEC Form 4 filings, Polar Asset Management Partners Inc. has made a total of 1 transactions in Trinity Merger Corp (TMCX) over the past 5 years, including 0 buys and 1 sells. The most-recent trade in Trinity Merger Corp is the sale of 540,000 shares on June 19, 2019, which brought Polar Asset Management Partners Inc. around $6 Million.

According to the SEC Form 4 filings, Polar Asset Management Partners Inc. has made a total of 1 transactions in Tuscan Holdings Corp (THCB) over the past 5 years, including 0 buys and 1 sells. The most-recent trade in Tuscan Holdings Corp is the sale of 950,000 shares on May 7, 2020, which brought Polar Asset Management Partners Inc. around $10 Million.

More details on Polar Asset Management Partners Inc.'s insider transactions can be found in the Insider Trading History of Polar Asset Management Partners Inc. table.Insider Trading History of Polar Asset Management Partners Inc.

- 1

Polar Asset Management Partners Inc. Trading Performance

GuruFocus tracks the stock performance after each of Polar Asset Management Partners Inc.'s buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Polar Asset Management Partners Inc. is 2.1%. GuruFocus also compares Polar Asset Management Partners Inc.'s trading performance to market benchmark return within the same time period. The performance of stocks bought by Polar Asset Management Partners Inc. within 3 months outperforms 0 times out of 2 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Polar Asset Management Partners Inc.'s insider trading performs compared to the benchmark.

Performance of Polar Asset Management Partners Inc.

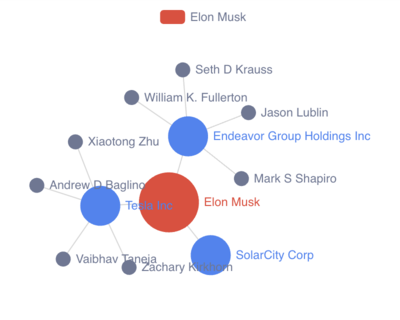

Polar Asset Management Partners Inc. Ownership Network

Polar Asset Management Partners Inc. Owned Company Details

What does Orisun Acquisition Corp do?

Who are the key executives at Orisun Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Orisun Acquisition Corp. Other key executives at Orisun Acquisition Corp include 10 percent owner Glazer Capital, Llc , 10 percent owner Paul J Glazer , and director & 10 percent owner & Chief Executive Officer Wei Lin Chen .

Orisun Acquisition Corp (ORSNU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Orisun Acquisition Corp (ORSNU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Orisun Acquisition Corp (ORSNU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Orisun Acquisition Corp (ORSNU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Orisun Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Tottenham Acquisition I Ltd do?

Who are the key executives at Tottenham Acquisition I Ltd?

Polar Asset Management Partners Inc. is the 10 percent owner of Tottenham Acquisition I Ltd. Other key executives at Tottenham Acquisition I Ltd include 10 percent owner Mizuho Securities Usa Llc , other: Indirect Beneficial Owner Mizuho Financial Group Inc , and other: Indirect Beneficial Owner Mizuho Bank, Ltd. .

Tottenham Acquisition I Ltd (TOTAU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Tottenham Acquisition I Ltd (TOTAU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Tottenham Acquisition I Ltd (TOTAU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Tottenham Acquisition I Ltd (TOTAU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Tottenham Acquisition I Ltd Insider Transactions

- Download to Excel(.xls)

What does Tortoise Acquisition Corp do?

Who are the key executives at Tortoise Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Tortoise Acquisition Corp. Other key executives at Tortoise Acquisition Corp include director & 10 percent owner Howard M Jenkins , 10 percent owner Tortoiseecofin Investments, Llc , and 10 percent owner Tortoiseecofin Borrower Llc .

Tortoise Acquisition Corp (SHLL.U) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Tortoise Acquisition Corp (SHLL.U) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Tortoise Acquisition Corp (SHLL.U) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Tortoise Acquisition Corp (SHLL.U)'s detailed insider trading history can be found in Insider Trading Tracker table.

Tortoise Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Silver Spike Acquisition Corp do?

Who are the key executives at Silver Spike Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Silver Spike Acquisition Corp. Other key executives at Silver Spike Acquisition Corp include 10 percent owner Silver Spike Sponsor, Llc , Chief Operating Officer Mohammed Grimeh , and director & CEO and Chairman Scott Gordon .

Silver Spike Acquisition Corp (SSPKU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Silver Spike Acquisition Corp (SSPKU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Silver Spike Acquisition Corp (SSPKU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Silver Spike Acquisition Corp (SSPKU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Silver Spike Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Tuscan Holdings Corp do?

Who are the key executives at Tuscan Holdings Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Tuscan Holdings Corp. Other key executives at Tuscan Holdings Corp include director & 10 percent owner & Chief Executive Officer Stephen A Vogel , and director & Chief Financial Officer & Pres Ruth Epstein .

Tuscan Holdings Corp (THCBU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Tuscan Holdings Corp (THCBU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Tuscan Holdings Corp (THCBU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Tuscan Holdings Corp (THCBU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Tuscan Holdings Corp Insider Transactions

- Download to Excel(.xls)

What does SC Health Corp do?

Who are the key executives at SC Health Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of SC Health Corp. Other key executives at SC Health Corp include 10 percent owner Glazer Capital, Llc , 10 percent owner Paul J Glazer , and director & 10 percent owner David Sin .

SC Health Corp (SCPE.U) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of SC Health Corp (SCPE.U) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of SC Health Corp (SCPE.U) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

SC Health Corp (SCPE.U)'s detailed insider trading history can be found in Insider Trading Tracker table.

SC Health Corp Insider Transactions

- Download to Excel(.xls)

What does Fellazo Inc do?

Who are the key executives at Fellazo Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Fellazo Inc.

Fellazo Inc (FLLCU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Fellazo Inc (FLLCU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Fellazo Inc (FLLCU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Fellazo Inc (FLLCU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Fellazo Inc Insider Transactions

- Download to Excel(.xls)

What does Big Rock Partners Acquisition Corp do?

Who are the key executives at Big Rock Partners Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Big Rock Partners Acquisition Corp. Other key executives at Big Rock Partners Acquisition Corp include director & President and CEO Big Rock Partners Sponsor, Llc , director & President and CEO Richard Ackerman , and 10 percent owner David M Nussbaum .

Big Rock Partners Acquisition Corp (BRPAU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Big Rock Partners Acquisition Corp (BRPAU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Big Rock Partners Acquisition Corp (BRPAU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Big Rock Partners Acquisition Corp (BRPAU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Big Rock Partners Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does GSE Systems Inc do?

Who are the key executives at GSE Systems Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of GSE Systems Inc. Other key executives at GSE Systems Inc include Chief Technology Officer Bahram Meyssami , VP & GSE Workforce Solutions Brian Greene , and President & GSE Engineering Donald Horn .

GSE Systems Inc (GVP) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in GSE Systems Inc (GVP). Other recent insider transactions involving GSE Systems Inc (GVP) include a net purchase of 80,000 shares made by Kyle Justin Loudermilk , a net sale of 740,747 shares made by Ngp Energy Technology Partners Ii, L.p. , and a net purchase of 15,000 shares made by Kathryn O'connor .

In summary, during the past 3 months, insiders sold 0 shares of GSE Systems Inc (GVP) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 74,075 shares of GSE Systems Inc (GVP) were sold and 9,500 shares were bought by its insiders, resulting in a net sale of 64,575 shares.

GSE Systems Inc (GVP)'s detailed insider trading history can be found in Insider Trading Tracker table.

GSE Systems Inc Insider Transactions

- Download to Excel(.xls)

What does Sentinel Energy Services Inc do?

Who are the key executives at Sentinel Energy Services Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Sentinel Energy Services Inc. Other key executives at Sentinel Energy Services Inc include director & Chief Executive Officer Krishna Shivram , and CFO and CAO Gerald Cimador .

Sentinel Energy Services Inc (STNLU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Sentinel Energy Services Inc (STNLU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Sentinel Energy Services Inc (STNLU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Sentinel Energy Services Inc (STNLU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Sentinel Energy Services Inc Insider Transactions

- Download to Excel(.xls)

What does iSun Inc do?

Who are the key executives at iSun Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of iSun Inc. Other key executives at iSun Inc include director & 10 percent owner & Executive Vice President Frederick Jr Myrick , director & 10 percent owner & Chief Executive Officer Jeffrey Peck , and Chief Financial Officer John Patrick Sullivan .

iSun Inc (ISUN) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in iSun Inc (ISUN). Other recent insider transactions involving iSun Inc (ISUN) include a net sale of 7,250 shares made by Claudia Michel Meer , a net purchase of 50,000 shares made by John Patrick Sullivan , and a net purchase of 50,000 shares made by Jeffrey Peck .

In summary, during the past 3 months, insiders sold 0 shares of iSun Inc (ISUN) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 363 shares of iSun Inc (ISUN) were sold and 6,000 shares were bought by its insiders, resulting in a net purchase of 5,638 shares.

iSun Inc (ISUN)'s detailed insider trading history can be found in Insider Trading Tracker table.

iSun Inc Insider Transactions

- Download to Excel(.xls)

What does Trinity Merger Corp do?

Who are the key executives at Trinity Merger Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Trinity Merger Corp.

Trinity Merger Corp (TMCXU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Trinity Merger Corp (TMCXU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Trinity Merger Corp (TMCXU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Trinity Merger Corp (TMCXU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Trinity Merger Corp Insider Transactions

- Download to Excel(.xls)

What does Kaleyra Inc do?

Who are the key executives at Kaleyra Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Kaleyra Inc. Other key executives at Kaleyra Inc include See Remarks Giacomo Dall'aglio , Executive Vice President Mauro Carobene , and 10 percent owner Effe Pi Societa Semplice .

Kaleyra Inc (KLR) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Kaleyra Inc (KLR). Other recent insider transactions involving Kaleyra Inc (KLR) include a net sale of 44,756 shares made by Matteo Lodrini , a net sale of 50,000 shares made by Giacomo Dall'aglio , and a net sale of 20,800 shares made by Avi S Katz .

In summary, during the past 3 months, insiders sold 0 shares of Kaleyra Inc (KLR) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 251,852 shares of Kaleyra Inc (KLR) were sold and 219,348 shares were bought by its insiders, resulting in a net sale of 32,505 shares.

Kaleyra Inc (KLR)'s detailed insider trading history can be found in Insider Trading Tracker table.

Kaleyra Inc Insider Transactions

- Download to Excel(.xls)

What does I-AM Capital Acquisition Co do?

Who are the key executives at I-AM Capital Acquisition Co?

Polar Asset Management Partners Inc. is the 10 percent owner of I-AM Capital Acquisition Co. Other key executives at I-AM Capital Acquisition Co include 10 percent owner K2 Principal Fund, L.p. , 10 percent owner Shawn Kimel Investments, Inc. , and 10 percent owner K2 & Associates Investment Management Inc. .

I-AM Capital Acquisition Co (IAMXU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of I-AM Capital Acquisition Co (IAMXU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of I-AM Capital Acquisition Co (IAMXU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

I-AM Capital Acquisition Co (IAMXU)'s detailed insider trading history can be found in Insider Trading Tracker table.

I-AM Capital Acquisition Co Insider Transactions

- Download to Excel(.xls)

What does Digital Media Solutions Inc do?

Who are the key executives at Digital Media Solutions Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Digital Media Solutions Inc. Other key executives at Digital Media Solutions Inc include 10 percent owner Clairvest Group Inc , director & Chief Operating Officer Fernando Borghese , and 10 percent owner Cep V Co-investment Limited Partnership .

Digital Media Solutions Inc (LHC.U) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Digital Media Solutions Inc (LHC.U) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Digital Media Solutions Inc (LHC.U) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Digital Media Solutions Inc (LHC.U)'s detailed insider trading history can be found in Insider Trading Tracker table.

Digital Media Solutions Inc Insider Transactions

- Download to Excel(.xls)

What does DermTech Inc do?

Who are the key executives at DermTech Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of DermTech Inc. Other key executives at DermTech Inc include Chief Commercial Officer Todd Michael Wood , director & Chief Executive Officer John Dobak , and Chief Operating Officer Claudia Ibarra .

DermTech Inc (CNACU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of DermTech Inc (CNACU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of DermTech Inc (CNACU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

DermTech Inc (CNACU)'s detailed insider trading history can be found in Insider Trading Tracker table.

DermTech Inc Insider Transactions

- Download to Excel(.xls)

What does Repay Holdings Corp do?

Who are the key executives at Repay Holdings Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Repay Holdings Corp. Other key executives at Repay Holdings Corp include director & President Shaler Alias , Chief Revenue Officer Susan Perlmutter , and Chief Operating Officer Michael Frank Jackson .

Repay Holdings Corp (TBRGU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Repay Holdings Corp (TBRGU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Repay Holdings Corp (TBRGU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Repay Holdings Corp (TBRGU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Repay Holdings Corp Insider Transactions

- Download to Excel(.xls)

What does KBL Merger Corp IV do?

Who are the key executives at KBL Merger Corp IV?

Polar Asset Management Partners Inc. is the 10 percent owner of KBL Merger Corp IV. Other key executives at KBL Merger Corp IV include 10 percent owner Oxford Asset Management Llp , 10 percent owner Mizuho Securities Usa Llc , and 10 percent owner Weiss Asset Management Lp .

KBL Merger Corp IV (KBLMU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of KBL Merger Corp IV (KBLMU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of KBL Merger Corp IV (KBLMU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

KBL Merger Corp IV (KBLMU)'s detailed insider trading history can be found in Insider Trading Tracker table.

KBL Merger Corp IV Insider Transactions

- Download to Excel(.xls)

What does Kaixin Auto Holdings do?

Who are the key executives at Kaixin Auto Holdings?

Polar Asset Management Partners Inc. is the 10 percent owner of Kaixin Auto Holdings. Other key executives at Kaixin Auto Holdings include 10 percent owner Value Fund Shareholder , Chief Executive Officer Chen Ji , and Vice President of Marketing Xiaoguang Li .

Kaixin Auto Holdings (CMSSU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Kaixin Auto Holdings (CMSSU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Kaixin Auto Holdings (CMSSU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Kaixin Auto Holdings (CMSSU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Kaixin Auto Holdings Insider Transactions

- Download to Excel(.xls)

What does Industrea Acquisition Corp do?

Who are the key executives at Industrea Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Industrea Acquisition Corp. Other key executives at Industrea Acquisition Corp include director & 10 percent owner Brent M Stevens , director & 10 percent owner & other: See below Argand Partners, Lp , and director & Chief Executive Officer Bruce F. Young .

Industrea Acquisition Corp (INDUU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Industrea Acquisition Corp (INDUU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Industrea Acquisition Corp (INDUU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Industrea Acquisition Corp (INDUU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Industrea Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Draper Oakwood Technology Acquisition Inc do?

Who are the key executives at Draper Oakwood Technology Acquisition Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Draper Oakwood Technology Acquisition Inc.

Draper Oakwood Technology Acquisition Inc (DOTAU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Draper Oakwood Technology Acquisition Inc (DOTAU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Draper Oakwood Technology Acquisition Inc (DOTAU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Draper Oakwood Technology Acquisition Inc (DOTAU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Draper Oakwood Technology Acquisition Inc Insider Transactions

- Download to Excel(.xls)

What does Hunter Maritime Acquisition Corp do?

Who are the key executives at Hunter Maritime Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Hunter Maritime Acquisition Corp. Other key executives at Hunter Maritime Acquisition Corp include and 10 percent owner Oxford Asset Management Llp .

Hunter Maritime Acquisition Corp (HUNTF) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Hunter Maritime Acquisition Corp (HUNTF) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Hunter Maritime Acquisition Corp (HUNTF) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Hunter Maritime Acquisition Corp (HUNTF)'s detailed insider trading history can be found in Insider Trading Tracker table.

Hunter Maritime Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Sirius International Insurance Group Ltd do?

Who are the key executives at Sirius International Insurance Group Ltd?

Polar Asset Management Partners Inc. is the 10 percent owner of Sirius International Insurance Group Ltd. Other key executives at Sirius International Insurance Group Ltd include director & 10 percent owner & other: Chairman of the Board Darrell W Crate , director & 10 percent owner & CEO Avshalom Kalichstein , and 10 percent owner Jefferies Financial Group Inc. .

Sirius International Insurance Group Ltd (EACQU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Sirius International Insurance Group Ltd (EACQU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Sirius International Insurance Group Ltd (EACQU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Sirius International Insurance Group Ltd (EACQU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Sirius International Insurance Group Ltd Insider Transactions

- Download to Excel(.xls)

What does Origo Acquisition Corp do?

Who are the key executives at Origo Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Origo Acquisition Corp. Other key executives at Origo Acquisition Corp include director & 10 percent owner & CEO and President Edward J Fred , director & 10 percent owner & Co-Chairman and CEO Rosenwald Lindsay A Md , and 10 percent owner Fortress Biotech, Inc. .

Origo Acquisition Corp (OACQF) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Origo Acquisition Corp (OACQF) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Origo Acquisition Corp (OACQF) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Origo Acquisition Corp (OACQF)'s detailed insider trading history can be found in Insider Trading Tracker table.

Origo Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does FinTech Acquisition Corp II do?

Who are the key executives at FinTech Acquisition Corp II?

Polar Asset Management Partners Inc. is the 10 percent owner of FinTech Acquisition Corp II. Other key executives at FinTech Acquisition Corp II include other: part of a 10% ownership group Robert Lisy Family Revocable Trust , 10 percent owner & other: Member of 10% Owner Group Spc Intermex Representative Llc , and 10 percent owner & other: Member of 10% Owner Group Spc Intermex Gp, Llc .

FinTech Acquisition Corp II (FNTE) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of FinTech Acquisition Corp II (FNTE) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of FinTech Acquisition Corp II (FNTE) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

FinTech Acquisition Corp II (FNTE)'s detailed insider trading history can be found in Insider Trading Tracker table.

FinTech Acquisition Corp II Insider Transactions

- Download to Excel(.xls)

What does Electrum Special Acquisition Corp do?

Who are the key executives at Electrum Special Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Electrum Special Acquisition Corp. Other key executives at Electrum Special Acquisition Corp include and director & 10 percent owner & Chairman of the Board Thomas Scott Kaplan .

Electrum Special Acquisition Corp (ELEC) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Electrum Special Acquisition Corp (ELEC) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Electrum Special Acquisition Corp (ELEC) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Electrum Special Acquisition Corp (ELEC)'s detailed insider trading history can be found in Insider Trading Tracker table.

Electrum Special Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does ConvergeOne Holdings Inc do?

Who are the key executives at ConvergeOne Holdings Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of ConvergeOne Holdings Inc. Other key executives at ConvergeOne Holdings Inc include director & 10 percent owner Jose Enrique Feliciano , Chief Financial Officer Jeffrey E Nachbor , and director & 10 percent owner Behdad Eghbali .

ConvergeOne Holdings Inc (CVON) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of ConvergeOne Holdings Inc (CVON) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of ConvergeOne Holdings Inc (CVON) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

ConvergeOne Holdings Inc (CVON)'s detailed insider trading history can be found in Insider Trading Tracker table.

ConvergeOne Holdings Inc Insider Transactions

- Download to Excel(.xls)

What does Rimini Street Inc do?

Who are the key executives at Rimini Street Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Rimini Street Inc. Other key executives at Rimini Street Inc include SVP & Global Sales Kevin Maddock , SVP & CMO David W. Rowe , and EVP & Chief Financial Officer Michael L. Perica .

Rimini Street Inc (RMNI) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Rimini Street Inc (RMNI). Other recent insider transactions involving Rimini Street Inc (RMNI) include a net sale of 107,229 shares made by Michael L. Perica , a net sale of 56,078 shares made by Nancy Lyskawa , and a net sale of 35,624 shares made by Kevin Maddock .

In summary, during the past 3 months, insiders sold 170,736 shares of Rimini Street Inc (RMNI) in total and bought 0 shares, with a net sale of 170,736 shares. During the past 18 months, 1,224,211 shares of Rimini Street Inc (RMNI) were sold and 0 shares were bought by its insiders, resulting in a net sale of 1,224,211 shares.

Rimini Street Inc (RMNI)'s detailed insider trading history can be found in Insider Trading Tracker table.

Rimini Street Inc Insider Transactions

- Download to Excel(.xls)

What does Atlantic Acquisition Corp do?

Who are the key executives at Atlantic Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Atlantic Acquisition Corp. Other key executives at Atlantic Acquisition Corp include director & 10 percent owner & Co-Chief Executive Officer Zhou Min Ni , director & Co-Chief Executive Officer Xiao Mou Zhang , and 10 percent owner Spot Light Investments, Llc .

Atlantic Acquisition Corp (ATACU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Atlantic Acquisition Corp (ATACU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Atlantic Acquisition Corp (ATACU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Atlantic Acquisition Corp (ATACU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Atlantic Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does NextDecade Corp do?

Who are the key executives at NextDecade Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of NextDecade Corp. Other key executives at NextDecade Corp include 10 percent owner James G Dinan , 10 percent owner Hanwha Impact Global Corp , and director & 10 percent owner Se Totalenergies .

NextDecade Corp (NEXT) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in NextDecade Corp (NEXT). Other recent insider transactions involving NextDecade Corp (NEXT) include a net sale of 1,402,254 shares made by Halcyon Mount Bonnell Fund Lp , and a net sale of 1,402,254 shares made by Halcyon Capital Management Lp .

In summary, during the past 3 months, insiders sold 0 shares of NextDecade Corp (NEXT) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 2,804,508 shares of NextDecade Corp (NEXT) were sold and 0 shares were bought by its insiders, resulting in a net sale of 2,804,508 shares.

NextDecade Corp (NEXT)'s detailed insider trading history can be found in Insider Trading Tracker table.

NextDecade Corp Insider Transactions

- Download to Excel(.xls)

What does E-compass Acquisition Corp do?

Who are the key executives at E-compass Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of E-compass Acquisition Corp. Other key executives at E-compass Acquisition Corp include director & CEO & Chairman & Director Richard Xu , Chief Financial Officer Amy He , and director & Vice Chairman & Director Nicholas Clements .

E-compass Acquisition Corp (ECACU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of E-compass Acquisition Corp (ECACU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of E-compass Acquisition Corp (ECACU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

E-compass Acquisition Corp (ECACU)'s detailed insider trading history can be found in Insider Trading Tracker table.

E-compass Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Rosehill Resources Inc do?

Who are the key executives at Rosehill Resources Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Rosehill Resources Inc. Other key executives at Rosehill Resources Inc include See remarks David Mora , See Remarks Jennifer Lynn Johnson , and Chief Financial Officer Robert Craig Owen .

Rosehill Resources Inc (ROSEQ) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Rosehill Resources Inc (ROSEQ) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Rosehill Resources Inc (ROSEQ) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Rosehill Resources Inc (ROSEQ)'s detailed insider trading history can be found in Insider Trading Tracker table.

Rosehill Resources Inc Insider Transactions

- Download to Excel(.xls)

What does Borqs Technologies Inc do?

Who are the key executives at Borqs Technologies Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Borqs Technologies Inc. Other key executives at Borqs Technologies Inc include 10 percent owner Norwest Venture Partners X L P , EVP Corp Affairs & China Sale Bob Li , and 10 percent owner Intel Corp .

Borqs Technologies Inc (BRQSF) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Borqs Technologies Inc (BRQSF) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Borqs Technologies Inc (BRQSF) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Borqs Technologies Inc (BRQSF)'s detailed insider trading history can be found in Insider Trading Tracker table.

Borqs Technologies Inc Insider Transactions

- Download to Excel(.xls)

What does Inspired Entertainment Inc do?

Who are the key executives at Inspired Entertainment Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Inspired Entertainment Inc. Other key executives at Inspired Entertainment Inc include See Remarks Andrew C Stone , 10 percent owner Evan Wainhouse Davis , and President and COO Brooks H Pierce .

Inspired Entertainment Inc (INSE) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Inspired Entertainment Inc (INSE) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Inspired Entertainment Inc (INSE) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Inspired Entertainment Inc (INSE)'s detailed insider trading history can be found in Insider Trading Tracker table.

Inspired Entertainment Inc Insider Transactions

- Download to Excel(.xls)

What does Barington/Hilco Acquisition Corp do?

Who are the key executives at Barington/Hilco Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Barington/Hilco Acquisition Corp. Other key executives at Barington/Hilco Acquisition Corp include director & 10 percent owner James A Mitarotonda , director & Chairman of the Board Jeffrey D Nuechterlein , and 10 percent owner Barington Companies Advisors, Llc .

Barington/Hilco Acquisition Corp (BHAC) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Barington/Hilco Acquisition Corp (BHAC) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Barington/Hilco Acquisition Corp (BHAC) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Barington/Hilco Acquisition Corp (BHAC)'s detailed insider trading history can be found in Insider Trading Tracker table.

Barington/Hilco Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Garnero Group Acquisition Co do?

Who are the key executives at Garnero Group Acquisition Co?

Polar Asset Management Partners Inc. is the 10 percent owner of Garnero Group Acquisition Co. Other key executives at Garnero Group Acquisition Co include 10 percent owner Barry Rubenstein , 10 percent owner Marilyn Rubenstein , and 10 percent owner North Pole Capital Master Fund .

Garnero Group Acquisition Co (GGAC) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Garnero Group Acquisition Co (GGAC) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Garnero Group Acquisition Co (GGAC) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Garnero Group Acquisition Co (GGAC)'s detailed insider trading history can be found in Insider Trading Tracker table.

Garnero Group Acquisition Co Insider Transactions

- Download to Excel(.xls)

What does North American Construction Group Ltd do?

Who are the key executives at North American Construction Group Ltd?

Polar Asset Management Partners Inc. is the 10 percent owner of North American Construction Group Ltd. Other key executives at North American Construction Group Ltd include and 10 percent owner Cannell Capital Llc .

North American Construction Group Ltd (NOA) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of North American Construction Group Ltd (NOA) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of North American Construction Group Ltd (NOA) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

North American Construction Group Ltd (NOA)'s detailed insider trading history can be found in Insider Trading Tracker table.

North American Construction Group Ltd Insider Transactions

- Download to Excel(.xls)

What does Roan Holdings Group Co Ltd do?

Who are the key executives at Roan Holdings Group Co Ltd?

Polar Asset Management Partners Inc. is the 10 percent owner of Roan Holdings Group Co Ltd. Other key executives at Roan Holdings Group Co Ltd include Caital Market Director Wen Wang , Vice President Jianfeng Zhang , and Chief Financial Officer Chan Stephen Sung Him .

Roan Holdings Group Co Ltd (RAHGF) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Roan Holdings Group Co Ltd (RAHGF) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Roan Holdings Group Co Ltd (RAHGF) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Roan Holdings Group Co Ltd (RAHGF)'s detailed insider trading history can be found in Insider Trading Tracker table.

Roan Holdings Group Co Ltd Insider Transactions

- Download to Excel(.xls)

What does CardConnect Corp do?

Who are the key executives at CardConnect Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of CardConnect Corp. Other key executives at CardConnect Corp include 10 percent owner First Data Corp , 10 percent owner Hale James C Iii , and 10 percent owner Bradford E Bernstein .

CardConnect Corp (CCN) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of CardConnect Corp (CCN) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of CardConnect Corp (CCN) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

CardConnect Corp (CCN)'s detailed insider trading history can be found in Insider Trading Tracker table.

CardConnect Corp Insider Transactions

- Download to Excel(.xls)

What does STG Group Inc do?

Who are the key executives at STG Group Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of STG Group Inc. Other key executives at STG Group Inc include and 10 percent owner North Pole Capital Master Fund .

STG Group Inc (STGGQ) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of STG Group Inc (STGGQ) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of STG Group Inc (STGGQ) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

STG Group Inc (STGGQ)'s detailed insider trading history can be found in Insider Trading Tracker table.

STG Group Inc Insider Transactions

- Download to Excel(.xls)

What does ARMOUR Residential REIT Inc do?

Who are the key executives at ARMOUR Residential REIT Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of ARMOUR Residential REIT Inc. Other key executives at ARMOUR Residential REIT Inc include Chief Financial Officer James R Mountain , director & Co-CEO and President Jeffrey J Zimmer , and director & Co-CEO and CIO Scott Ulm .

ARMOUR Residential REIT Inc (ARR) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in ARMOUR Residential REIT Inc (ARR). Other recent insider transactions involving ARMOUR Residential REIT Inc (ARR) include a net sale of 61,682 shares made by Daniel C Staton , a net sale of 33,378 shares made by Jeffrey J Zimmer , and a net sale of 740 shares made by James R Mountain .

In summary, during the past 3 months, insiders sold 0 shares of ARMOUR Residential REIT Inc (ARR) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 69,098 shares of ARMOUR Residential REIT Inc (ARR) were sold and 0 shares were bought by its insiders, resulting in a net sale of 69,098 shares.

ARMOUR Residential REIT Inc (ARR)'s detailed insider trading history can be found in Insider Trading Tracker table.

ARMOUR Residential REIT Inc Insider Transactions

- Download to Excel(.xls)

What does Hurco Companies Inc do?

Who are the key executives at Hurco Companies Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Hurco Companies Inc. Other key executives at Hurco Companies Inc include director & Chairman & CEO Michael Doar , General Counsel/Corp Secretary Jonathon D. Wright , and EVP-Technology and Operations Gregory S Volovic .

Hurco Companies Inc (HURC) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Hurco Companies Inc (HURC). Other recent insider transactions involving Hurco Companies Inc (HURC) include a net purchase of 9,200 shares made by Michael Doar , a net sale of 2,430 shares made by Richard R. Porter , and a net purchase of 2,357 shares made by Gregory S Volovic .

In summary, during the past 3 months, insiders sold 0 shares of Hurco Companies Inc (HURC) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 2,430 shares of Hurco Companies Inc (HURC) were sold and 13,898 shares were bought by its insiders, resulting in a net purchase of 11,468 shares.

Hurco Companies Inc (HURC)'s detailed insider trading history can be found in Insider Trading Tracker table.

Hurco Companies Inc Insider Transactions

- Download to Excel(.xls)

What does DermTech Inc do?

Who are the key executives at DermTech Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of DermTech Inc. Other key executives at DermTech Inc include Chief Financial Officer Kevin M Sun , Chief Operating Officer Claudia Ibarra , and General Counsel Ramin Akhavan .

DermTech Inc (DMTK) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in DermTech Inc (DMTK). Other recent insider transactions involving DermTech Inc (DMTK) include a net sale of 34,113 shares made by Claudia Ibarra , a net sale of 35,516 shares made by Kevin M Sun , and a net sale of 15,456 shares made by Todd Michael Wood .

In summary, during the past 3 months, insiders sold 0 shares of DermTech Inc (DMTK) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 130,984 shares of DermTech Inc (DMTK) were sold and 0 shares were bought by its insiders, resulting in a net sale of 130,984 shares.

DermTech Inc (DMTK)'s detailed insider trading history can be found in Insider Trading Tracker table.

DermTech Inc Insider Transactions

- Download to Excel(.xls)

What does HF Foods Group Inc do?

Who are the key executives at HF Foods Group Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of HF Foods Group Inc. Other key executives at HF Foods Group Inc include director & Chief Executive Officer Xiao Mou Zhang , Chief Operating Officer Xi Lin , and See Remarks Christine Chang .

HF Foods Group Inc (HFFG) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in HF Foods Group Inc (HFFG). Other recent insider transactions involving HF Foods Group Inc (HFFG) include a net purchase of 140,000 shares made by Xiao Mou Zhang ,

In summary, during the past 3 months, insiders sold 0 shares of HF Foods Group Inc (HFFG) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of HF Foods Group Inc (HFFG) were sold and 140,000 shares were bought by its insiders, resulting in a net purchase of 140,000 shares.

HF Foods Group Inc (HFFG)'s detailed insider trading history can be found in Insider Trading Tracker table.

HF Foods Group Inc Insider Transactions

- Download to Excel(.xls)

What does International Money Express Inc do?

Who are the key executives at International Money Express Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of International Money Express Inc. Other key executives at International Money Express Inc include Chief Operating Officer Joseph Aguilar , director & CEO & President and Chairman Robert Lisy , and Chief Operating Officer Christopher D. Hunt .

International Money Express Inc (IMXI) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in International Money Express Inc (IMXI). Other recent insider transactions involving International Money Express Inc (IMXI) include a net sale of 266,000 shares made by Robert Lisy , a net sale of 46,945 shares made by John Rincon , and a net sale of 23,700 shares made by Joseph Aguilar .

In summary, during the past 3 months, insiders sold 23,700 shares of International Money Express Inc (IMXI) in total and bought 0 shares, with a net sale of 23,700 shares. During the past 18 months, 336,645 shares of International Money Express Inc (IMXI) were sold and 0 shares were bought by its insiders, resulting in a net sale of 336,645 shares.

International Money Express Inc (IMXI)'s detailed insider trading history can be found in Insider Trading Tracker table.

International Money Express Inc Insider Transactions

- Download to Excel(.xls)

What does 180 Life Sciences Corp do?

Who are the key executives at 180 Life Sciences Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of 180 Life Sciences Corp. Other key executives at 180 Life Sciences Corp include director & Chief Executive Officer James N. Woody , COO / Chief Business Officer Quan Anh Vu , and Interim CFO Ozan Pamir .

180 Life Sciences Corp (ATNF) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in 180 Life Sciences Corp (ATNF). Other recent insider transactions involving 180 Life Sciences Corp (ATNF) include a net purchase of 65,000 shares made by James N. Woody , a net purchase of 25,000 shares made by Mcgovern Jr. Donald A. , and a net sale of 25,000 shares made by Marc Feldmann .

In summary, during the past 3 months, insiders sold 0 shares of 180 Life Sciences Corp (ATNF) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 1,316 shares of 180 Life Sciences Corp (ATNF) were sold and 5,684 shares were bought by its insiders, resulting in a net purchase of 4,368 shares.

180 Life Sciences Corp (ATNF)'s detailed insider trading history can be found in Insider Trading Tracker table.

180 Life Sciences Corp Insider Transactions

- Download to Excel(.xls)

What does Concrete Pumping Holdings Inc do?

Who are the key executives at Concrete Pumping Holdings Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Concrete Pumping Holdings Inc. Other key executives at Concrete Pumping Holdings Inc include director & Chief Executive Officer Bruce F. Young , director & 10 percent owner Brent M Stevens , and 10 percent owner Argand Partners, Lp .

Concrete Pumping Holdings Inc (BBCP) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Concrete Pumping Holdings Inc (BBCP). Other recent insider transactions involving Concrete Pumping Holdings Inc (BBCP) include a net sale of 50,652 shares made by Bruce F. Young ,

In summary, during the past 3 months, insiders sold 13,522 shares of Concrete Pumping Holdings Inc (BBCP) in total and bought 0 shares, with a net sale of 13,522 shares. During the past 18 months, 50,652 shares of Concrete Pumping Holdings Inc (BBCP) were sold and 0 shares were bought by its insiders, resulting in a net sale of 50,652 shares.

Concrete Pumping Holdings Inc (BBCP)'s detailed insider trading history can be found in Insider Trading Tracker table.

Concrete Pumping Holdings Inc Insider Transactions

- Download to Excel(.xls)

What does Simplicity Esports and Gaming Co do?

Who are the key executives at Simplicity Esports and Gaming Co?

Polar Asset Management Partners Inc. is the 10 percent owner of Simplicity Esports and Gaming Co. Other key executives at Simplicity Esports and Gaming Co include director & President Roman Nehemiah Franklin , director & CEO and Interim CFO Jed Philip Kaplan , and Chief Financial Officer Nancy L. Hennessey .

Simplicity Esports and Gaming Co (WINR) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Simplicity Esports and Gaming Co (WINR) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Simplicity Esports and Gaming Co (WINR) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Simplicity Esports and Gaming Co (WINR)'s detailed insider trading history can be found in Insider Trading Tracker table.

Simplicity Esports and Gaming Co Insider Transactions

- Download to Excel(.xls)

What does Kaixin Holdings do?

Who are the key executives at Kaixin Holdings?

Polar Asset Management Partners Inc. is the 10 percent owner of Kaixin Holdings. Other key executives at Kaixin Holdings include 10 percent owner Value Fund Shareholder , Chief Executive Officer Chen Ji , and Vice President of Marketing Xiaoguang Li .

Kaixin Holdings (KXIN) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Kaixin Holdings (KXIN) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Kaixin Holdings (KXIN) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Kaixin Holdings (KXIN)'s detailed insider trading history can be found in Insider Trading Tracker table.

Kaixin Holdings Insider Transactions

- Download to Excel(.xls)

What does NRX Pharmaceuticals Inc do?

Who are the key executives at NRX Pharmaceuticals Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of NRX Pharmaceuticals Inc. Other key executives at NRX Pharmaceuticals Inc include Interim CFO Richard Clavano Narido , director & 10 percent owner & Chief Scientist Jonathan C Javitt , and director & Chief Executive Officer Stephen H Willard .

NRX Pharmaceuticals Inc (NRXP) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in NRX Pharmaceuticals Inc (NRXP). Other recent insider transactions involving NRX Pharmaceuticals Inc (NRXP) include a net purchase of 1,070,000 shares made by Chaim Hurvitz , a net sale of 100,000 shares made by Jonathan C Javitt , and a net purchase of 62,674 shares made by Voorhees Seth Van .

In summary, during the past 3 months, insiders sold 0 shares of NRX Pharmaceuticals Inc (NRXP) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 58,891 shares of NRX Pharmaceuticals Inc (NRXP) were sold and 152,942 shares were bought by its insiders, resulting in a net purchase of 94,052 shares.

NRX Pharmaceuticals Inc (NRXP)'s detailed insider trading history can be found in Insider Trading Tracker table.

NRX Pharmaceuticals Inc Insider Transactions

- Download to Excel(.xls)

What does Repay Holdings Corp do?

Who are the key executives at Repay Holdings Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Repay Holdings Corp. Other key executives at Repay Holdings Corp include Chief Financial Officer Timothy John Murphy , VP & Controller Thomas Eugene Sullivan , and General Counsel Tyler B Dempsey .

Repay Holdings Corp (RPAY) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Repay Holdings Corp (RPAY). Other recent insider transactions involving Repay Holdings Corp (RPAY) include a net sale of 2,000,000 shares made by Shaler Alias , a net sale of 181,176 shares made by Timothy John Murphy , and a net sale of 16,874 shares made by Robert Herman Hartheimer .

In summary, during the past 3 months, insiders sold 181,176 shares of Repay Holdings Corp (RPAY) in total and bought 0 shares, with a net sale of 181,176 shares. During the past 18 months, 2,356,550 shares of Repay Holdings Corp (RPAY) were sold and 0 shares were bought by its insiders, resulting in a net sale of 2,356,550 shares.

Repay Holdings Corp (RPAY)'s detailed insider trading history can be found in Insider Trading Tracker table.

Repay Holdings Corp Insider Transactions

- Download to Excel(.xls)

What does Digital Media Solutions Inc do?

Who are the key executives at Digital Media Solutions Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Digital Media Solutions Inc. Other key executives at Digital Media Solutions Inc include Interim CFO Vanessa Guzman-clark , EVP & Human Resources Jessica Jones , and Chief Financial Officer Vasundara Srenivas .

Digital Media Solutions Inc (DMSL) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Digital Media Solutions Inc (DMSL) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Digital Media Solutions Inc (DMSL) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Digital Media Solutions Inc (DMSL)'s detailed insider trading history can be found in Insider Trading Tracker table.

Digital Media Solutions Inc Insider Transactions

- Download to Excel(.xls)

What does Hyliion Holdings Corp do?

Who are the key executives at Hyliion Holdings Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Hyliion Holdings Corp. Other key executives at Hyliion Holdings Corp include CHIEF STRATEGY OFFICER Cheri Lantz , Chief Operating Officer Dennis M. Gallagher , and director & 10 percent owner & Chief Executive Officer Thomas J. Healy .

Hyliion Holdings Corp (HYLN) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Hyliion Holdings Corp (HYLN). Other recent insider transactions involving Hyliion Holdings Corp (HYLN) include a net purchase of 60,000 shares made by Dennis M. Gallagher , a net purchase of 30,000 shares made by Card Andrew H Jr , and a net purchase of 250,000 shares made by Thomas J. Healy .

In summary, during the past 3 months, insiders sold 0 shares of Hyliion Holdings Corp (HYLN) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 37,500 shares of Hyliion Holdings Corp (HYLN) were sold and 636,000 shares were bought by its insiders, resulting in a net purchase of 598,500 shares.

Hyliion Holdings Corp (HYLN)'s detailed insider trading history can be found in Insider Trading Tracker table.

Hyliion Holdings Corp Insider Transactions

- Download to Excel(.xls)

What does Microvast Holdings Inc do?

Who are the key executives at Microvast Holdings Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of Microvast Holdings Inc. Other key executives at Microvast Holdings Inc include director & CFO & Director Yanzhuan Zheng , President & Microvast Energy Zachariah Ward , and COO & President & Microvast US Shane Smith .

Microvast Holdings Inc (MVST) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Microvast Holdings Inc (MVST). Other recent insider transactions involving Microvast Holdings Inc (MVST) include a net sale of 1,313,009 shares made by Yanzhuan Zheng , and a net purchase of 13,000 shares made by Craig Webster .

In summary, during the past 3 months, insiders sold 0 shares of Microvast Holdings Inc (MVST) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 1,313,009 shares of Microvast Holdings Inc (MVST) were sold and 13,000 shares were bought by its insiders, resulting in a net sale of 1,300,009 shares.

Microvast Holdings Inc (MVST)'s detailed insider trading history can be found in Insider Trading Tracker table.

Microvast Holdings Inc Insider Transactions

- Download to Excel(.xls)

What does WM Technology Inc do?

Who are the key executives at WM Technology Inc?

Polar Asset Management Partners Inc. is the 10 percent owner of WM Technology Inc. Other key executives at WM Technology Inc include Chief Technology Officer Duncan Grazier , General Counsel Brian Camire , and director & CEO and Chairman Scott Gordon .

WM Technology Inc (MAPS) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in WM Technology Inc (MAPS). Other recent insider transactions involving WM Technology Inc (MAPS) include a net sale of 131,701 shares made by Brian Camire , a net sale of 78,310 shares made by Arden Lee , and a net sale of 43,818 shares made by Duncan Grazier .

In summary, during the past 3 months, insiders sold 6,676 shares of WM Technology Inc (MAPS) in total and bought 0 shares, with a net sale of 6,676 shares. During the past 18 months, 497,147 shares of WM Technology Inc (MAPS) were sold and 0 shares were bought by its insiders, resulting in a net sale of 497,147 shares.

WM Technology Inc (MAPS)'s detailed insider trading history can be found in Insider Trading Tracker table.

WM Technology Inc Insider Transactions

- Download to Excel(.xls)

What does Bowman Consulting Group Ltd do?

Who are the key executives at Bowman Consulting Group Ltd?

Polar Asset Management Partners Inc. is the 10 percent owner of Bowman Consulting Group Ltd. Other key executives at Bowman Consulting Group Ltd include director & 10 percent owner Gary Bowman , Chief Financial Officer Bruce J Labovitz , and director & Chief Operating Officer Michael Bruen .

Bowman Consulting Group Ltd (BWMN) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in Bowman Consulting Group Ltd (BWMN). Other recent insider transactions involving Bowman Consulting Group Ltd (BWMN) include a net sale of 88,500 shares made by Michael Bruen , a net sale of 175,729 shares made by Gary Bowman , and a net sale of 53,009 shares made by Bruce J Labovitz .

In summary, during the past 3 months, insiders sold 77,500 shares of Bowman Consulting Group Ltd (BWMN) in total and bought 0 shares, with a net sale of 77,500 shares. During the past 18 months, 364,463 shares of Bowman Consulting Group Ltd (BWMN) were sold and 0 shares were bought by its insiders, resulting in a net sale of 364,463 shares.

Bowman Consulting Group Ltd (BWMN)'s detailed insider trading history can be found in Insider Trading Tracker table.

Bowman Consulting Group Ltd Insider Transactions

- Download to Excel(.xls)

What does Corner Growth Acquisition Corp 2 do?

Who are the key executives at Corner Growth Acquisition Corp 2?

Polar Asset Management Partners Inc. is the 10 percent owner of Corner Growth Acquisition Corp 2. Other key executives at Corner Growth Acquisition Corp 2 include 10 percent owner Taconic Capital Advisors Lp , 10 percent owner Highbridge Capital Management Llc , and 10 percent owner Frank Brosens .

Corner Growth Acquisition Corp 2 (TRON) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made 1 insider transaction in Corner Growth Acquisition Corp 2 (TRON) with a net sale of 999,999. Other recent insider transactions involving Corner Growth Acquisition Corp 2 (TRON) include a net sale of 300,000 shares made by Taconic Capital Advisors Lp ,

In summary, during the past 3 months, insiders sold 0 shares of Corner Growth Acquisition Corp 2 (TRON) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 1,299,999 shares of Corner Growth Acquisition Corp 2 (TRON) were sold and 0 shares were bought by its insiders, resulting in a net sale of 1,299,999 shares.

Corner Growth Acquisition Corp 2 (TRON)'s detailed insider trading history can be found in Insider Trading Tracker table.

Corner Growth Acquisition Corp 2 Insider Transactions

- Download to Excel(.xls)

What does KludeIn I Acquisition Corp do?

Who are the key executives at KludeIn I Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of KludeIn I Acquisition Corp. Other key executives at KludeIn I Acquisition Corp include 10 percent owner Blake Ross , Co-President Ashish Gupta , and 10 percent owner Kludein Prime Llc .

KludeIn I Acquisition Corp (INKA) Insider Trades Summary

Over the past 18 months, Polar Asset Management Partners Inc. made no insider transaction in KludeIn I Acquisition Corp (INKA). Other recent insider transactions involving KludeIn I Acquisition Corp (INKA) include a net sale of 304,206 shares made by Blake Ross ,

In summary, during the past 3 months, insiders sold 0 shares of KludeIn I Acquisition Corp (INKA) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 304,206 shares of KludeIn I Acquisition Corp (INKA) were sold and 0 shares were bought by its insiders, resulting in a net sale of 304,206 shares.

KludeIn I Acquisition Corp (INKA)'s detailed insider trading history can be found in Insider Trading Tracker table.

KludeIn I Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Chavant Capital Acquisition Corp do?

Who are the key executives at Chavant Capital Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Chavant Capital Acquisition Corp. Other key executives at Chavant Capital Acquisition Corp include director & CEO and President Jiong Ma , 10 percent owner Chavant Capital Partners Llc , and Chief Financial Officer Michael Lee .

Chavant Capital Acquisition Corp (CLAY) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Chavant Capital Acquisition Corp (CLAY) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Chavant Capital Acquisition Corp (CLAY) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Chavant Capital Acquisition Corp (CLAY)'s detailed insider trading history can be found in Insider Trading Tracker table.

Chavant Capital Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does KludeIn I Acquisition Corp do?

Who are the key executives at KludeIn I Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of KludeIn I Acquisition Corp. Other key executives at KludeIn I Acquisition Corp include 10 percent owner Blake Ross , Co-President Ashish Gupta , and 10 percent owner Kludein Prime Llc .

KludeIn I Acquisition Corp (INKAU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of KludeIn I Acquisition Corp (INKAU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of KludeIn I Acquisition Corp (INKAU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

KludeIn I Acquisition Corp (INKAU)'s detailed insider trading history can be found in Insider Trading Tracker table.

KludeIn I Acquisition Corp Insider Transactions

- Download to Excel(.xls)

What does Tailwind Acquisition Corp do?

Who are the key executives at Tailwind Acquisition Corp?

Polar Asset Management Partners Inc. is the 10 percent owner of Tailwind Acquisition Corp. Other key executives at Tailwind Acquisition Corp include 10 percent owner Ventures International Capital , 10 percent owner G1 Execution Services, Llc , and 10 percent owner Susquehanna Securities, Llc .

Tailwind Acquisition Corp (TWND) Insider Trades Summary