Recently I’ve been laying the groundwork for a quantitative approach to value investment. The rational is as follows: simple quantitative or statistical models outperform experts in a variety of disciplines, so why not investing in general, and why not value investing in specific? Well, it seems that they do. A new research paper argues that quantitative funds outperform their qualitative brethren. In A Comparison of Quantitative and Qualitative Hedge Funds (via CXO Advisory Group blog) Ludwig Chincarini has compared the performance characteristics of quantitative and qualitative hedge funds. Chincarini finds that “both quantitative and qualitative hedge funds have positive risk-adjusted returns,” but, ”overall, quantitative hedge funds as a group have higher [alpha] than qualitative hedge funds.”

Definition of quantitative and qualitative

Chincarini distinguished between quantitative and qualitative equity-focussed funds thus:

Using return data from 6,354 hedge funds from January 1970 through June 2009, Cincarini concludes, based on the raw performance data:

Advantages and disadvantages of quantitative vs qualitative

Chincarini identifies several advantages quant funds hold over qualitative funds:

Greenbackd

http://greenbackd.com/

Definition of quantitative and qualitative

Chincarini distinguished between quantitative and qualitative equity-focussed funds thus:

Our main method used to classify was to look for the term quantitative or a description of a similar nature to place a fund in the quantative category. We also looked for words like discretionary to classify qualitative funds and systematic to classify quantitative funds. Of the four main hedge fund categories, we only found two of them reliable enough to classify. Thus, in the Equity Hedge category, we classified Equity Market Neutral and Quantitative Directional as quantitative hedge funds and Fundamental Growth and Fundamental Value as qualitative categories.Performance

…

We did not classify any of the Event Driven funds since these funds vary too substantially within the category and it was not clear from the descriptions how to separate quantitative and qualitative funds. We also did not classify any of the Relative Value funds, even though many of these funds use quantitative techniques, because the broader descriptions left us no clear cut way to divide them.

…

We classified a fund as quantitative if the following words appeared in the fund description: quantitative, mathematical, model, algorithm, econometric, statistic, or automate. Also, the fund description could not contain the word qualitative. We classified a fund as qualitative if it contained the word qualitative in its description or had none of the words mentioned for the quantitative category.

Using return data from 6,354 hedge funds from January 1970 through June 2009, Cincarini concludes, based on the raw performance data:

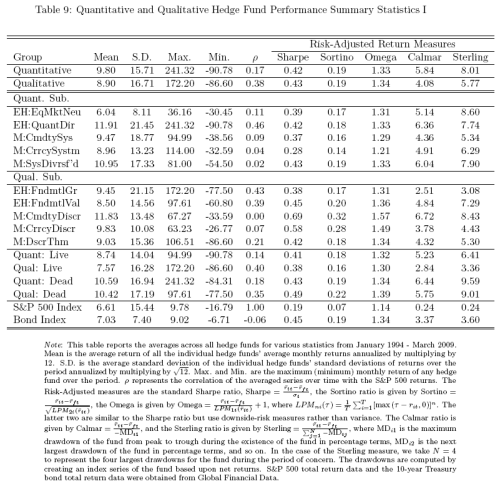

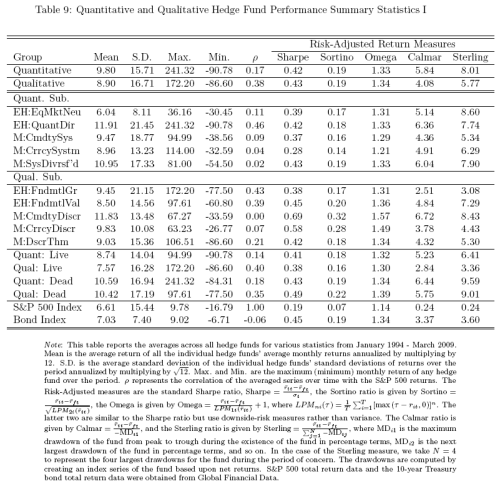

Generally, quantitative funds have a higher average return and a lower average standard deviation than qual funds. Amongst the quant funds, the highest average return comes from the Quantitative Directional strategy. The correlations of the fund categories with the S&P 500 are quite low at 0.17 and 0.38 for quant and qual respectively. The risk-adjusted return measures provide mixed evidence, but overall seems in favor of quant funds.Table 9 below shows performance summary statistics for the various funds:

…

The qual funds perform significantly better than quant funds in up markets (25% and 15% respectively). However, the quant funds do significantly better in down markets (-2% versus -16%). This is mainly driven by the presence of Equity Market Neutral funds. In the 1990s, the average qual fund return was higher than the average quant fund return. They were roughly the same from 2000 – 2009. During the financial crisis (which we measure from January 2007 - March 2009), quant funds did better than qual funds (3.29% versus -4.77%).

Advantages and disadvantages of quantitative vs qualitative

Chincarini identifies several advantages quant funds hold over qualitative funds:

…the breadth of selections, the elimination of behavioral errors (which might be particularly important during the financial crisis of 2008 – 2009), and the potential lower administration costs (after hedge fund fees).And several disadvantages:

The disadvantages for quantitative hedge funds include the reduced use of qualitative types of data, the reliance on historical data, the ability to quickly react to new economic paradigms. These three might have been especially crippling during the financial crisis of 2007 and 2009.Hat tip Abnormal Returns.

Finally, there is the potential of data mining, which will lead to strategies that aren’t as effective once implemented. In this paper, we will only focus on the return differences rather than attempting to detail which of the advantages or disadvantages in central in the return differences.

Greenbackd

http://greenbackd.com/