What does this all mean? Here is my theory…

Let’s look at St. Joe…

We all know the story, Bruce has 30% (~27M of 92M shares). David Einhorn is short (we have no idea how much). The stock is battle ground stock and has a market cap of $2.4B

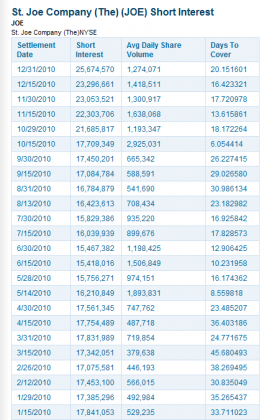

Roughly 30% of the stock is short as of 12/31:

This gives us roughly 40% of the stock that is in play. Berkowitz isn’t selling and the shorts as of 12/31 aren’t covering. Fairholme recently terminated an agreement with Berkowitz that capped his ownership at 30% and added he and Charlie Fernandez th the JOE Board.

That is the 3 min. replay.

My thought process is Bruce is going to engineer a mega-short squeeze in St. Joe. When he receives the 1/27 GGP dividend of ~$600m and the $800M from Brookfield Asset, he will have an additional $1.4B of liquidity. With only 40% of JOE shares in play, it would take ~$960M to eliminate those shares meaning the shorts would have nowhere to run to buyback the shares they sold. The race to cover with essentially no float would cause the price to rocket.

Should he buy >$1B of JOE (> the 40% not shorted/own by him) there simply would no be enough shares for the shorts to cover. He could easily do with with a tender offer for outstanding JOE shares or just start buying large blocks on the open market. Even a few large purchases would make his intentions known and the shorts would start scurrying, driving up the stock price.

Could they short more to drive the price back down? Yes. But they would lose as this is a simple numbers games. The more they drive the price down, the cheaper they make it for Berkowitz to eliminated the remaining shares and cause the squeeze. They would in essence hasten their fate. He has the cash to do it….

How to play it? The cheapest way is options, although if he doesn’t, remember you own nothing. If you believe in the LT real estate story, buying shares and waiting is the better way to go. There is no guarantee he does this, this is just my conjecture.

Shares have risen just under 20% since the 12/31 short report above. We’ll have to see if that price rise has been due to short covering or not (my guess is yes). Even so, there are still plenty left for the above to be true…

Gonna be very exciting to watch…

- Brookfield Consortium Increases Interest in General GrowthWhy is Berkowitz doing this?

- Fairholme Acquires 4.5% Interest in Brookfield

Toronto, Ontario, January 18, 2011 - Brookfield Asset Management Inc. (TSX/NYSE: BAM; EURONEXT: BAMA) today announced it has signed an agreement to acquire 113.3 million common shares in General Growth Properties Inc., a leading U.S. mall operator, from the Fairholme Fund, in a transaction valued at approximately $1.7 billion. The transaction increases Brookfield’s consortium’s ownership of General Growth from approximately 27% to 38%.

Brookfield will issue 27.5 million Class A shares valued at $907 million to Fairholme based on stock market prices and pay $804 million in cash from general corporate sources to acquire the General Growth shares. On completion of the transaction, Fairholme will own a 4.5% equity interest in Brookfield.

Fairholme is selling its entire common share holding in General Growth, but continues to own warrants to acquire common shares in General Growth.

“We are pleased to have this opportunity to substantially increase our ownership in General Growth’s market dominant portfolio of premier shopping malls at an attractive valuation,” said Bruce Flatt, Chief Executive Officer of Brookfield. “Fairholme’s team provided unwavering support during the recapitalization of General Growth and as one of the top performing mutual fund managers of the last decade, we welcome them as investors in Brookfield.”

Fairholme has agreed to certain restrictions on the acquisition of additional shares of Brookfield. Brookfield’s purchase of Fairholme’s shares in General Growth complies with the agreement entered into at the time of the restructuring of General Growth, which limits the Brookfield consortium’s ownership to 45% of General Growth.

Brookfield Asset Management Inc., focused on property, renewable power and infrastructure assets, has over $100 billion of assets under management and is co-listed on the New York and Toronto Stock Exchanges under the symbol BAM and on NYSE Euronext under the symbol BAMA. For more information, please visit our website at www.brookfield.com.

Let’s look at St. Joe…

We all know the story, Bruce has 30% (~27M of 92M shares). David Einhorn is short (we have no idea how much). The stock is battle ground stock and has a market cap of $2.4B

Roughly 30% of the stock is short as of 12/31:

This gives us roughly 40% of the stock that is in play. Berkowitz isn’t selling and the shorts as of 12/31 aren’t covering. Fairholme recently terminated an agreement with Berkowitz that capped his ownership at 30% and added he and Charlie Fernandez th the JOE Board.

That is the 3 min. replay.

My thought process is Bruce is going to engineer a mega-short squeeze in St. Joe. When he receives the 1/27 GGP dividend of ~$600m and the $800M from Brookfield Asset, he will have an additional $1.4B of liquidity. With only 40% of JOE shares in play, it would take ~$960M to eliminate those shares meaning the shorts would have nowhere to run to buyback the shares they sold. The race to cover with essentially no float would cause the price to rocket.

Should he buy >$1B of JOE (> the 40% not shorted/own by him) there simply would no be enough shares for the shorts to cover. He could easily do with with a tender offer for outstanding JOE shares or just start buying large blocks on the open market. Even a few large purchases would make his intentions known and the shorts would start scurrying, driving up the stock price.

Could they short more to drive the price back down? Yes. But they would lose as this is a simple numbers games. The more they drive the price down, the cheaper they make it for Berkowitz to eliminated the remaining shares and cause the squeeze. They would in essence hasten their fate. He has the cash to do it….

How to play it? The cheapest way is options, although if he doesn’t, remember you own nothing. If you believe in the LT real estate story, buying shares and waiting is the better way to go. There is no guarantee he does this, this is just my conjecture.

Shares have risen just under 20% since the 12/31 short report above. We’ll have to see if that price rise has been due to short covering or not (my guess is yes). Even so, there are still plenty left for the above to be true…

Gonna be very exciting to watch…