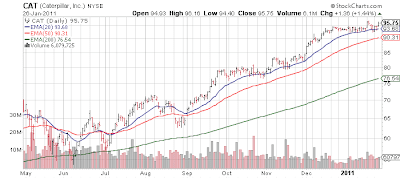

Caterpillar (CAT, Financial) continues to showcase the strength of being a cyclical industrial U.S. multinational. Especially in an environment where government's worldwide are stimulating with 'infrastructure' buildouts. Year over year sales are up an astounding 64%, and with a materially smaller workforce (despite recent hires) versus a few years ago, the profits are surging. The company came in at $1.47 vs analysts $1.27, on $12.81B in sales. This puts the year of 2010 in the books at $4.15; the company is guiding for $6 in 2011. Even going out an entire year, the valuation is quite rich at 16x forward estimates (23.5x trailing) for a company with some nice secular headwinds, but at its core a cyclical. That said, the EPS estimate for 2011 does not include Bucyrus (BUCY, Financial) so there should be some upside depending on when this transaction closes. (CAT believes this to be mid 2011, depending on Dept of Jutice inquiry)

Full report here.

The company provides one of the most comprehensive earnings reports in the entire market, including a lot of good nuggets in its outlook.

-------------------------------

We expect most governments will maintain economic policies designed to extend the economic recovery through 2011. We are forecasting that the world economy should grow more than 3.5 percent—a growth rate similar to 2010. In addition, we expect construction activity to improve in most countries. Key factors and assumptions underlying our forecast include:

- We expect sales and revenues in 2011 to exceed $50 billion and profit to be near $6.00 per share. That is an increase from sales and revenues of $42.588 billion and profit of $4.15 per share in 2010. The outlook for 2011 includes the acquisition of Electro-Motive Diesel, Inc. (EMD), but does not include the acquisitions of Motoren-Werke Mannheim Holding GmbH (MWM) or Bucyrus International, Inc. (Bucyrus) because they have not yet closed.

Full report here.

The company provides one of the most comprehensive earnings reports in the entire market, including a lot of good nuggets in its outlook.

-------------------------------

We expect most governments will maintain economic policies designed to extend the economic recovery through 2011. We are forecasting that the world economy should grow more than 3.5 percent—a growth rate similar to 2010. In addition, we expect construction activity to improve in most countries. Key factors and assumptions underlying our forecast include:

- Industrial production is recovering throughout the world but has not returned to pre-recession levels in most countries. We believe that incomplete recoveries in industrial production, coupled with high levels of unemployment in many countries, indicate that the world economy has capacity for above average growth.

- Inflation increased in most countries from lows reached during the financial crisis but remained well below prior peaks. We believe that excess capacity and generally moderate rates of money growth suggest inflation problems will be largely confined to some of the faster growing developing economies.

- Most governments and central banks are expected to regard job creation rather than inflation fighting as their dominant economic problem. Central banks in many developing countries are expected to increase interest rates but keep them below 2008 peaks. Major developed economies, faced with high unemployment, will likely be cautious about tightening economic policies.

- Most energy and metals prices have increased since early 2009, and most are currently very attractive for new investment. We expect average prices to be higher in 2011 than in 2010. Our forecast assumes copper prices will average $4.25 per pound; West Texas Intermediate oil, $92 per barrel; and Central Appalachian coal, $72 per ton.

- Growth in consumption of most commodities is concentrated in Asia/Pacific, and meeting that demand will likely require increased commodity production and investment. We project worldwide production of key metals will increase, ranging from approximately 2 percent for copper, which faces production constraints, to 9 percent for iron ore.

- Higher commodity prices, particularly for oil, are expected to drive inflation concerns similar to those that occurred prior to the financial crisis. Our analysis suggests that higher prices are a result of insufficient production capacity to meet the needs of a growing world economy. The recent recession showed that sharply lower demand provided only temporary price relief at a cost of delaying needed capacity investment.