PMC Commercial Trust (PCC, Financial) is similar to Seahawk Drilling when it comes to attempts at killing the company. While the discount to book value is not as steep, quite a discount exists and the company has been consistently profitable. Even substantial markdowns on the company’s assets would leave plenty of value left over at current prices. While Bank of Internet, a company I previously profiled, has benefited from the current zero interest rate policy of the Fed, PCC has seen its revenue and profits shrink dramatically. While PCC will benefit from an increase in interest rates, the assets are very secure and are trading at a discount to their liquidation value.

PCC makes small business loans primarily to budget motels operating under brands such as Comfort Inn, Hampton Inn & Suites, Holiday Inn Express and Best Western. The loans are typically in the $1-2m range, so there is diversity in the portfolio. The loans are secured by first lien on the property and personal guarantees, as well as being capped at 80% LTV. This gives the loans a margin of safety because they are backed by hard assets, as well as incentivizing the borrower to pay the loan off. For a small business owner, a motel is likely a main source of income, but no property means no income. Assuming everything is well in the world, these assets are solid.

But let’s ask what if all is not well in the world. The company has $230m in loans receivable on the balance sheet. The most recent 10-Q has total impaired loans at $7m, which is net of reserves, leaving $223m in loans/assets. There is $85m in net debt leaving $138m in loans for shareholders compared to a market cap of $90m. The market is implying that the loans (excluding noncurrent ones) the company has made are worth 35% less than stated. This is quite a statement. At the end of 2009, the company had 90% satisfactory loans, 9% watch list (loans that have other liens on them such as taxes or franchise fees, which shows that the rent is the very last thing to go unpaid and the company pays attention to its loans), and 1% reserved. Assuming this ratio stayed constant even though 2010 was much better than 2009, that implies $200m in problem free loans, less $85m in neet debt or $115m in loans for shareholders, an implied 20% haircut.

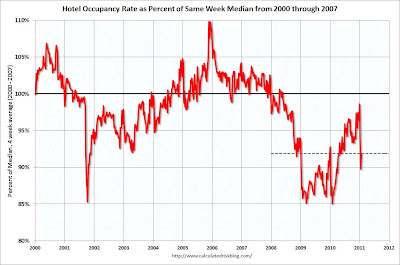

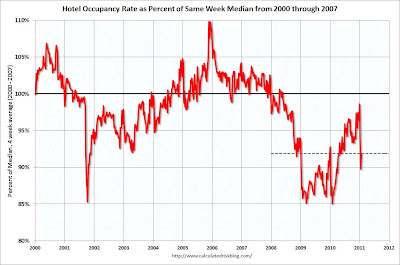

There are two reasons I believe the market would perceive this other than the little attention played to small cap stocks. The first being a concentration in the limited service hospitality (motel) sector. Over the past years, travel has been down and with that RevPAR (revenue per available room, a common hotel metric). Here is a graph showing the growth in RevPAR courtesy of Calculated Risk:

While RevPAR is down from years past, it has recovered from its lows. The company has so far indicated some impairment and losses on its loan book, but nothing nearly as dramatic as the stock price would indicate. While the motel industry will certainly not coast on through with the current economy, it is not in dire straits and it has so far proven resilient. Furthermore, borrowers are incentivized to remain current on loans backed by their earning assets.

The second reason is interest rates, a theme whose effect I recently discussed in regards to Bank of Internet. The loan book is 75% variable rate fixed to either LIBOR or prime. As those rates have decreased over the years, so has revenue from loans. Interest rates cannot go any lower at this point in my opinion, with the combination of being close to zero (the Fed might defy maths and push them even lower) and the specter of inflation from commodities.

Seeing as how RevPAR has improved in the sector and interest rates can’t get any lower, PCC is traded at a trough multiple of earnings and a depressed asset valuation. As I said before, this company is quite hard to kill. It should continue to be profitable and the downside is very limited at this point, while just the realization that the company’s assets aren’t greatly impaired could result in upside of 50% in addition to any dividend income received. Since the stock has already been pummeled, the worst case is that an investor collects 8% a year until interest rates rise. While a company catalyst has yet to rear its head, the underlying value and dividend provides a margin of safety for investors while compensating them for waiting. If the net loan book is valued at $115m or $138m the shares could be worth between $11-13.

I found this stock via this screen, which I highly recommend for any curious investor looking to do their own searching for stocks trading at big discounts to their net current asset value (NCAV). You likely won't find anything fancy - PCC is a dull asset based investment - I think it is a useful tool from beginners to experts because subjective calculations and predictions of earnings are not crucial to successful investing in this area.

Long PCC. Do your own research before investing. This site is purely informational.

PCC makes small business loans primarily to budget motels operating under brands such as Comfort Inn, Hampton Inn & Suites, Holiday Inn Express and Best Western. The loans are typically in the $1-2m range, so there is diversity in the portfolio. The loans are secured by first lien on the property and personal guarantees, as well as being capped at 80% LTV. This gives the loans a margin of safety because they are backed by hard assets, as well as incentivizing the borrower to pay the loan off. For a small business owner, a motel is likely a main source of income, but no property means no income. Assuming everything is well in the world, these assets are solid.

But let’s ask what if all is not well in the world. The company has $230m in loans receivable on the balance sheet. The most recent 10-Q has total impaired loans at $7m, which is net of reserves, leaving $223m in loans/assets. There is $85m in net debt leaving $138m in loans for shareholders compared to a market cap of $90m. The market is implying that the loans (excluding noncurrent ones) the company has made are worth 35% less than stated. This is quite a statement. At the end of 2009, the company had 90% satisfactory loans, 9% watch list (loans that have other liens on them such as taxes or franchise fees, which shows that the rent is the very last thing to go unpaid and the company pays attention to its loans), and 1% reserved. Assuming this ratio stayed constant even though 2010 was much better than 2009, that implies $200m in problem free loans, less $85m in neet debt or $115m in loans for shareholders, an implied 20% haircut.

There are two reasons I believe the market would perceive this other than the little attention played to small cap stocks. The first being a concentration in the limited service hospitality (motel) sector. Over the past years, travel has been down and with that RevPAR (revenue per available room, a common hotel metric). Here is a graph showing the growth in RevPAR courtesy of Calculated Risk:

While RevPAR is down from years past, it has recovered from its lows. The company has so far indicated some impairment and losses on its loan book, but nothing nearly as dramatic as the stock price would indicate. While the motel industry will certainly not coast on through with the current economy, it is not in dire straits and it has so far proven resilient. Furthermore, borrowers are incentivized to remain current on loans backed by their earning assets.

The second reason is interest rates, a theme whose effect I recently discussed in regards to Bank of Internet. The loan book is 75% variable rate fixed to either LIBOR or prime. As those rates have decreased over the years, so has revenue from loans. Interest rates cannot go any lower at this point in my opinion, with the combination of being close to zero (the Fed might defy maths and push them even lower) and the specter of inflation from commodities.

Seeing as how RevPAR has improved in the sector and interest rates can’t get any lower, PCC is traded at a trough multiple of earnings and a depressed asset valuation. As I said before, this company is quite hard to kill. It should continue to be profitable and the downside is very limited at this point, while just the realization that the company’s assets aren’t greatly impaired could result in upside of 50% in addition to any dividend income received. Since the stock has already been pummeled, the worst case is that an investor collects 8% a year until interest rates rise. While a company catalyst has yet to rear its head, the underlying value and dividend provides a margin of safety for investors while compensating them for waiting. If the net loan book is valued at $115m or $138m the shares could be worth between $11-13.

I found this stock via this screen, which I highly recommend for any curious investor looking to do their own searching for stocks trading at big discounts to their net current asset value (NCAV). You likely won't find anything fancy - PCC is a dull asset based investment - I think it is a useful tool from beginners to experts because subjective calculations and predictions of earnings are not crucial to successful investing in this area.

Long PCC. Do your own research before investing. This site is purely informational.