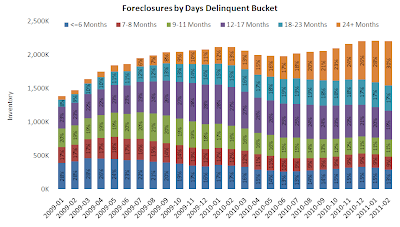

Nearly a year and a half ago I was one of the first to identify a huge stealth stimulus the government, Fed, and banking system was creating - the strategic default stimulus. [Nov 25, 2009: America's Stealth Stimulus Plan; Allowing It's Home "Owners" to be Deadbeats] By the spring of 2010, Cramer and quite a few in the financial blogosphere began picking up on it. Now as we enter spring 2011, we are seeing truly how pervasive this stimulus has become per a whopping statistic on Mish Shedlock's blog. Regular readers will know that 1 in 10 American households that has a mortgage is now in default. But of that 10% of our home "ownership" class (I use the word loosely) living 'rent free', nearly 1 in 3 has not made a mortgage payment in 2 years. That's astounding.

[click to enlarge]

Another 17% has not made a payment in 18-23 months. So roughly HALF of defaulters have not made a payment in a year and a half. Mull that for a moment....

However, as I wrote throughout 2010 that is a BOON to the economy. Granted, it's a hit to the banks and/or those who hold the securitized mortgages but the Fed is taking care of that problem to compensate them [Mar 31, 2010: Ben Bernanke Content to Sacrifice American Savors to Recapitalize Banks and Benefit Debtors] [Apr 20, 2009: How Banks will "Outearn" their Losses] Just another method of ponzi scheme in the new paradigm economy.

You can do the math pretty easy on the benefits to a typical household - let's say a $1300 mortgage x 24 months = $31,200 into the pockets of the home "owner" to spend on vacations, eating out, car payments, iPads, et al - that's a huge stealth stimulus. Just imagine what you could do with an extra $15-$16K a year. Of course many have mortgages in excess of $1300 a month, hence have even greater benefit. And we're not even discussing all the people who have not made a payment for 12 months, 15 months, etc.

Perversely, one of the major things that will slow down the economy in the next few years is when these households are finally forced out of the "rent free living arrangement", and have to make a house payment again. Frankly, it's a wonder consumer spending is not doing better with so many Americans living in a household where the view is those who make mortgage payments are "suckers".

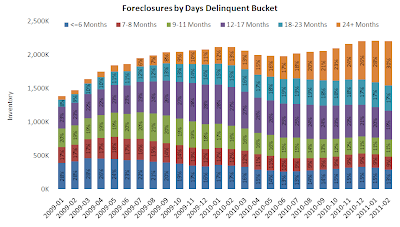

[click to enlarge]

Another 17% has not made a payment in 18-23 months. So roughly HALF of defaulters have not made a payment in a year and a half. Mull that for a moment....

However, as I wrote throughout 2010 that is a BOON to the economy. Granted, it's a hit to the banks and/or those who hold the securitized mortgages but the Fed is taking care of that problem to compensate them [Mar 31, 2010: Ben Bernanke Content to Sacrifice American Savors to Recapitalize Banks and Benefit Debtors] [Apr 20, 2009: How Banks will "Outearn" their Losses] Just another method of ponzi scheme in the new paradigm economy.

You can do the math pretty easy on the benefits to a typical household - let's say a $1300 mortgage x 24 months = $31,200 into the pockets of the home "owner" to spend on vacations, eating out, car payments, iPads, et al - that's a huge stealth stimulus. Just imagine what you could do with an extra $15-$16K a year. Of course many have mortgages in excess of $1300 a month, hence have even greater benefit. And we're not even discussing all the people who have not made a payment for 12 months, 15 months, etc.

Perversely, one of the major things that will slow down the economy in the next few years is when these households are finally forced out of the "rent free living arrangement", and have to make a house payment again. Frankly, it's a wonder consumer spending is not doing better with so many Americans living in a household where the view is those who make mortgage payments are "suckers".