You might recall that bitter coffee divorce from last December when Kraft Food (KFT, Financial) took Starbucks (SBUX, Financial) to court to prevent Starbucks from unwinding a 13-year packaged coffee distribution partnership. Well, that food fight has finally come to close with the partnership officially dissolved on March 1 after Kraft lost the court battle, although Kraft and Starbucks are still in arbitration to settle financial and some other outstanding matters.

So, how’s life otherwise like after the corporate divorce?

In my earlier analysis, I mapped out the logical course post-breakup for each company as follows:

In March 2011, Starbucks struck a deal with Green Mountain Coffee Roasters (GMCR) to sell packs of Starbucks and Tazo coffee and tea for use in Green Mountain’s Keurig single-cup brewers. Starbucks will sell those single-serving coffee and tea packs at its own stores as well as at other North America retailers, beginning this fall.

Starbucks is also trying to move beyond café and into consumer products via a planned aggressive expansion of branded consumer product lineup to be distributed through food retailers. And true to its NASDAQ listing, Starbucks has also dabbled in technology by pushing out a cool smart phone mobile payment app in January. The Starbucks Card Mobile app, available for Apple (AAPL) iPhone, RIM Blackberry, and Google's (GOOG) Android, is linked to a prepaid Starbucks card, and lets customers scan and pay using their smart phones.

In less than three-month's time, Starbucks (SBUX) announced that more than 3 million people have used the nifty app to pay for their grande lattes. Starbucks addicts can earn rewards through the Starbucks prepaid card, but can potentially get even more bang for their buck by funding the prepaid card with some of the best credit card programs that offer cash back, among other rewards. The success of the Starbucks mobile payment app has already prompted some people to predict that a whole new next generation retail payment network 2.0 will emerge in the near future.

At the same time, Kraft has moved on as well by announcing it will replace Starbucks with its premium Swedish coffee brand Gevalia at U.S. supermarkets and mass retailers. Kraft said Gevalia will be available in 10 varieties in August, which will get Kraft back into the U.S. premium grocery coffee business.

But Kraft declined to say how long it would take for sales of Gevalia to match the $500 million a year revenue the bagged Starbucks used to generate for Kraft. Gevalia, now sold only online or through mail order in the United States, is a nearly $400 million brand and a part of Kraft's $5 billion global coffee business. But it is nevertheless still unproven in the supermarket retail channel.

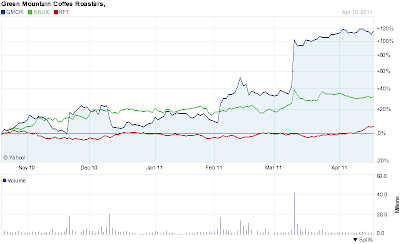

From the stocks comparison chart above, it looks like Green Mountain Coffee Roasters is clearly the one that has benefited the most from the breakup between Kraft and Starbucks, while both Kraft and Starbucks might need some time to develop and adjust to their respective new partner and business model.

Now, FT.com on April 20 reported that coffee prices have surged through $3 a pound level for the first time in more than 34 years. Supplies of arabica beans are getting scarce because of lower-than-expected crops in Columbia, Mexico and some other producing regions. Inventories are currently at 50-year low and unlikely to build up this year, according to International Coffee Organization, the industry trade group.

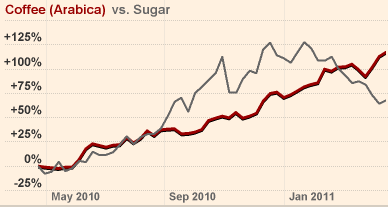

Arabica coffee prices have surged 23.6% this year and 117.2% since January 2010, and is expected to rally further, while sugar prices in New York also touched a 30-year high in February, but have since dropped 36%. (See Chart)

So, near term, cost and margin pressures are building at Starbucks, Kraft and their competitors such as J.M. Smucker Company (SJM, Financial), and Peet's Coffee & Tea Inc. (PEET, Financial), as these companies may have difficulties passing through the raw material cost increases of coffee and sugar, for example, to consumers.

Longer term, since McDonald's still has twice as many locations worldwide as Starbucks, the buck probably does not stop here for Starbucks, as long as the company keeps innovating and successfully executing the right mix of growth and new region entry strategy, all without repeating its past so-called growing pains.

EconMatters, April 21, 2011

So, how’s life otherwise like after the corporate divorce?

In my earlier analysis, I mapped out the logical course post-breakup for each company as follows:

“With the breakup, it is a low risk proposition for Starbucks (SBUX) to form a partnership with Green Mountain Coffee Roasters (GMCR, Financial) single serving Keurig, a primary rival of Kraft’s Tassimo.“

“With the potential of facing Starbucks on multiple fronts, longer term, Kraft (KFT) needs to either find another premium brand partner to bolster its existing lineup, or need a serious makeover of market differentiations in order to compete in the supermarket coffee isle.”So far, it looks like both Kraft and Starbucks are right on track.

In March 2011, Starbucks struck a deal with Green Mountain Coffee Roasters (GMCR) to sell packs of Starbucks and Tazo coffee and tea for use in Green Mountain’s Keurig single-cup brewers. Starbucks will sell those single-serving coffee and tea packs at its own stores as well as at other North America retailers, beginning this fall.

Starbucks is also trying to move beyond café and into consumer products via a planned aggressive expansion of branded consumer product lineup to be distributed through food retailers. And true to its NASDAQ listing, Starbucks has also dabbled in technology by pushing out a cool smart phone mobile payment app in January. The Starbucks Card Mobile app, available for Apple (AAPL) iPhone, RIM Blackberry, and Google's (GOOG) Android, is linked to a prepaid Starbucks card, and lets customers scan and pay using their smart phones.

In less than three-month's time, Starbucks (SBUX) announced that more than 3 million people have used the nifty app to pay for their grande lattes. Starbucks addicts can earn rewards through the Starbucks prepaid card, but can potentially get even more bang for their buck by funding the prepaid card with some of the best credit card programs that offer cash back, among other rewards. The success of the Starbucks mobile payment app has already prompted some people to predict that a whole new next generation retail payment network 2.0 will emerge in the near future.

At the same time, Kraft has moved on as well by announcing it will replace Starbucks with its premium Swedish coffee brand Gevalia at U.S. supermarkets and mass retailers. Kraft said Gevalia will be available in 10 varieties in August, which will get Kraft back into the U.S. premium grocery coffee business.

But Kraft declined to say how long it would take for sales of Gevalia to match the $500 million a year revenue the bagged Starbucks used to generate for Kraft. Gevalia, now sold only online or through mail order in the United States, is a nearly $400 million brand and a part of Kraft's $5 billion global coffee business. But it is nevertheless still unproven in the supermarket retail channel.

From the stocks comparison chart above, it looks like Green Mountain Coffee Roasters is clearly the one that has benefited the most from the breakup between Kraft and Starbucks, while both Kraft and Starbucks might need some time to develop and adjust to their respective new partner and business model.

Now, FT.com on April 20 reported that coffee prices have surged through $3 a pound level for the first time in more than 34 years. Supplies of arabica beans are getting scarce because of lower-than-expected crops in Columbia, Mexico and some other producing regions. Inventories are currently at 50-year low and unlikely to build up this year, according to International Coffee Organization, the industry trade group.

Arabica coffee prices have surged 23.6% this year and 117.2% since January 2010, and is expected to rally further, while sugar prices in New York also touched a 30-year high in February, but have since dropped 36%. (See Chart)

So, near term, cost and margin pressures are building at Starbucks, Kraft and their competitors such as J.M. Smucker Company (SJM, Financial), and Peet's Coffee & Tea Inc. (PEET, Financial), as these companies may have difficulties passing through the raw material cost increases of coffee and sugar, for example, to consumers.

Longer term, since McDonald's still has twice as many locations worldwide as Starbucks, the buck probably does not stop here for Starbucks, as long as the company keeps innovating and successfully executing the right mix of growth and new region entry strategy, all without repeating its past so-called growing pains.

EconMatters, April 21, 2011