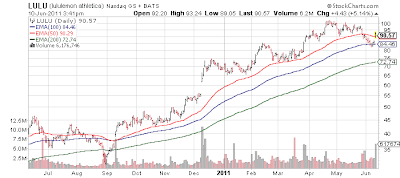

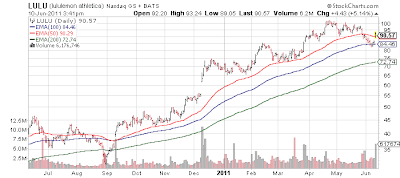

Lululemon (LULU, Financial) is one name I've watched from afar the past few years, and never taken a part of - mostly due to valuations. Very similar to Chipotle (CMG, Financial). In retrospect a bad decision - highly valued stocks can remain so for quarters if not years. Something I am trying to incorporate more in my framework the past 6 months.

Based on today's results, there appears to be no recession in the yoga set. Obviously investors the past few weeks thought otherwise as the stock sold off sharply. Always a bull market somewhere.

The gross margin levels and expansion for a retailer, is very impressive.

Via AP:

Via Barron's

Short CNBC video on the report below - 2minutes

Based on today's results, there appears to be no recession in the yoga set. Obviously investors the past few weeks thought otherwise as the stock sold off sharply. Always a bull market somewhere.

The gross margin levels and expansion for a retailer, is very impressive.

Via AP:

- Net income rose to $33.4 million, or 46 cents per share, for the three months ended May 1 from $19.6 million, or 27 cents per share, a year ago. Excluding a one-time adjustment related to recognizing input tax credits, earnings came to 44 cents per share. That was far higher than the 38 cents per share analysts expected, according to FactSet.

- Revenue rose 35 percent to $186.8 million from $138.3 million a year ago. Analysts expected $180.1 million.

- Revenue in stores open at least one year rose 16 percent.

- The company raised its guidance for the year. It now expects net income of $2.10 to $2.16 per share on revenue of $915 million to $930 million. That's up from prior guidance of net income of $1.90 to $2 per share on revenue of $885 million to $900 million. Analysts expect earnings of $2.04 per share on revenue of $915.2 million.

- During the recession, many company increased mark downs to clear out excess inventory. But Lululemon, which carved out a niche for itself by selling "yoga-inspired" workout gear, is facing the opposite problem: it is scrambling to increase inventory to keep up with demand. Its inventory at the first quarter was up about 27 percent year-over-year.

- "This is consistent with management's prior commentary that they would be in inventory `chase' mode for the first half of the year due to its successful Christmas selling season," said RBC Capital Markets analyst Howard Tubin.

- For the second quarter, it expects net income of 42 cents to 44 cents per share on revenue of $200 million to $205 million. Analysts expect net income of 39 cents per share on revenue of $196.5 million.

Via Barron's

- The stock had been down 12% in the two weeks before earnings.

- ...gross margins grew to 58.7% from 53.8% in the previous year.

- “Another beat and raise — not the magnitude the Street is accustomed to but solid considering light inventories limited upside,” wrote Weeden & Co. analyst Amy Noblin, who rates the shares at Hold. “The growth opportunities here are unique but we think largely reflected in the valuation with the stock trading at 35 times [next fiscal year's estimated earnings]. We would look for a better entry point and would have hoped for more on the recent pullback in the group.”

Short CNBC video on the report below - 2minutes