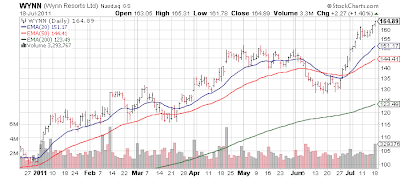

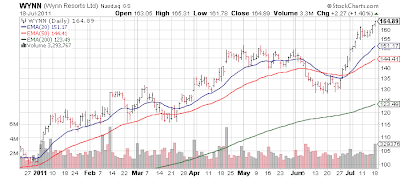

Thus far 2011 has been another excellent year for Wynn Resorts (WYNN, Financial) both on the profit side, and the stock appreciation angle. The stock has advanced some 60% despite a quite heady valuation. Wynn currently trades near 35x FORWARD earning estimates, even accounting for yesterday's substantial beat on the bottom line - but as part of the golden child crew, valuation does not seem to matter to fund managers who constantly pile in.

Last night the company did not disappoint with another very good earnings report. Keep in mind this is essentially an Asian play at this point, with a U.S. kicker. That said, Vegas. is finally showing some signs of life.

No position

Last night the company did not disappoint with another very good earnings report. Keep in mind this is essentially an Asian play at this point, with a U.S. kicker. That said, Vegas. is finally showing some signs of life.

- Wynn Resorts Ltd posted second-quarter profit and revenue that handily topped Wall Street estimates as revenue at its Wynn Macau unit soared 36.7 percent and business in Las Vegas improved.

- Driven by robust demand from mainland Chinese, gambling revenue in Macau, the only place in China where gambling is legal, surged 52 percent in June from a year earlier, according to government statistics.

- "They had stupendous results in both Macau and Vegas," said Janet Brashear, an analyst with Sanford C. Bernstein & Co. "Vegas is the biggest surprise," she said, with earnings "a lot more solid for the balance of the year than we might have expected."

- Adjusting for one-time items, Wynn earned $200.8 million, or $1.60 per share, beating analysts' average forecast of $1.04 per share, according to Thomson Reuters I/B/E/S.

- Wynn operates two casino-resorts in Las Vegas and two in Macau, where it is poised to begin construction on a third property on the Cotai Strip, pending final government clearance.

- Quarterly net revenue rose 32.4 percent to $1.37 billion from $1.03 billion last year. Analysts, on average, had expected $1.27 billion.

- Wynn's revenue in Las Vegas rose 22.8 percent to $390.8 millon. Adjusted property earnings rose 103.7 percent to $132.7 million. The rise was due to higher margins "really across the board," CFO Matt Maddox said on the call, including in gambling revenue, VIP services, and non-gaming segments including nightclubs, catering, and restaurants.

- The company's Macau revenue climbed 36.7 percent to $976.5 million, while property earnings rose 45.4 percent to $314.3 million in the second quarter.

- The shares have risen 59 percent so far this year.

No position