Chafing at the world's reserve currency

After the excitement of the U.S. debt ceiling negotiations going down to the wire, Russian Prime Minister Vladimir Putin offered these comments about the U.S. and its dollar:

Hedging the Dollar

The steps below show how to hedge the dollar by buying optimal puts on the PowerShares DB USD Index (UUP, Financial) as a proxy for it. First, a quick reminder about what optimal puts mean in this context.

About Optimal Puts

Optimal puts are the puts that will give you the level of protection you want at the lowest possible cost. As University of Maine finance professor Dr. Robert Strong, CFA has noted, picking the most economical puts can be a complicated task. With Portfolio Armor (available on the web and as an Apple iOS app), you just enter the symbol of the stock or ETF you're looking to hedge, the number of shares you own, and the maximum decline you're willing to risk (your threshold). Then the app uses an algorithm developed by a finance Ph.D. to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

A Step-by-Step Example

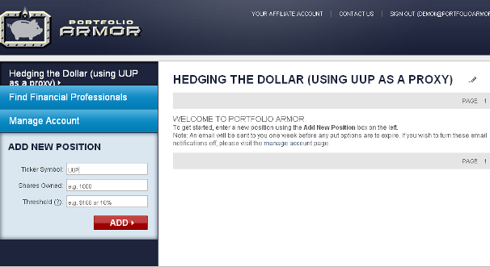

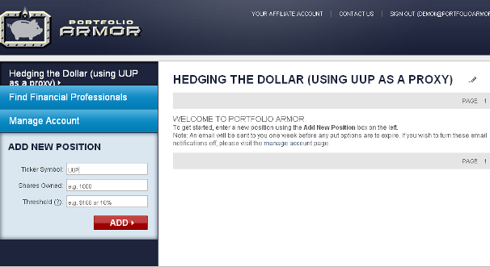

Step 1: Enter a ticker symbol.

In this case, we're using UUP as a proxy for the dollar. We've entered UUP in the Ticker Symbol field below.

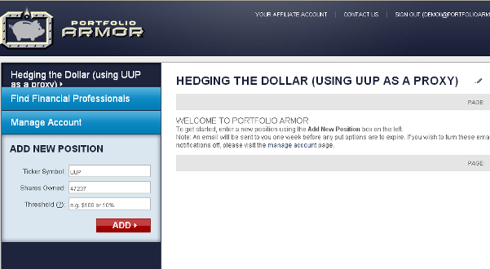

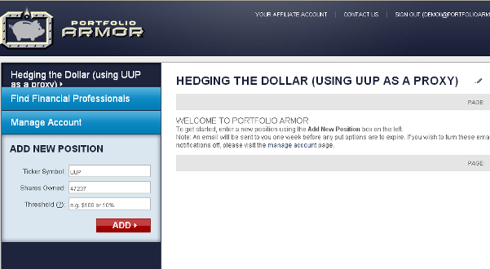

Step 2: Enter a Number of Shares.

For the purposes of this example, let's assume an investor has a $1 million portfolio, all in dollar-denominated assets. So, since we're using UUP as a proxy, the number of shares we'll enter will be $1,000,000/the most recent share price of UUP ($21.17, as of after hours Monday) = $47,236.7. We've rounded that up to $47,237 and entered that number in the "Shares Owned" field in the screen cap below.

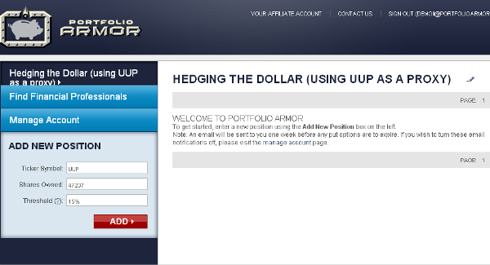

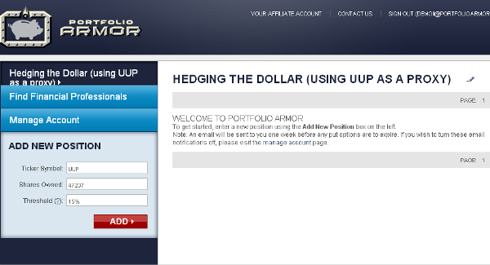

Step 3: Enter a Decline Threshold.

You can enter any percentage you like for a threshold when using Portfolio Armor (the higher the percentage though, the greater the chance you will find optimal puts for your position). I've entered 15% in the "Threshold" field below.

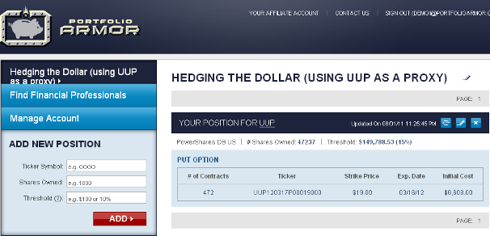

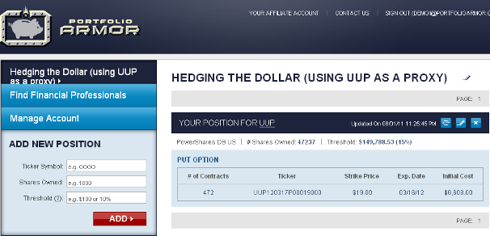

Step 4: Click the Red Button.

A moment after clicking the red button, you would see the screen cap below, which shows the optimal put option contracts to buy to hedge against a greater than 15% drop in UUP between now and March 16, 2012. The cost of this protection on a $1 million position would be $6,608, or about 0.66% of the position value.1, 2

1Note that, in this case, Portfolio Armor rounded down the number of shares of UUP we entered to the nearest hundred (since one put option contract represents the right to sell one hundred shares of the underlying security), and then presented us with 472 of the put option contracts that would slightly over-hedge the 47,200 shares of UUP they cover, so that the total value of our 47,237 shares of UUP would be protected against a greater-than-15% decline.

2To be conservative, Portfolio Armor quoted that cost based on the ask price of the optimal puts. In practice, an investor can often purchase puts for a lower price, i.e., some price between the bid and the ask.

After the excitement of the U.S. debt ceiling negotiations going down to the wire, Russian Prime Minister Vladimir Putin offered these comments about the U.S. and its dollar:

They are living like parasites off the global economy and their monopoly of the dollar.With Putin's sentiments in mind, let's look at a way to hedge against a further drop in the dollar.

[...]

If over there (in America) there is a systemic malfunction, this will affect everyone," Putin told the young Russians. "Countries like Russia and China hold a significant part of their reserves in American securities ... There should be other reserve currencies."

Hedging the Dollar

The steps below show how to hedge the dollar by buying optimal puts on the PowerShares DB USD Index (UUP, Financial) as a proxy for it. First, a quick reminder about what optimal puts mean in this context.

About Optimal Puts

Optimal puts are the puts that will give you the level of protection you want at the lowest possible cost. As University of Maine finance professor Dr. Robert Strong, CFA has noted, picking the most economical puts can be a complicated task. With Portfolio Armor (available on the web and as an Apple iOS app), you just enter the symbol of the stock or ETF you're looking to hedge, the number of shares you own, and the maximum decline you're willing to risk (your threshold). Then the app uses an algorithm developed by a finance Ph.D. to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

A Step-by-Step Example

Step 1: Enter a ticker symbol.

In this case, we're using UUP as a proxy for the dollar. We've entered UUP in the Ticker Symbol field below.

Step 2: Enter a Number of Shares.

For the purposes of this example, let's assume an investor has a $1 million portfolio, all in dollar-denominated assets. So, since we're using UUP as a proxy, the number of shares we'll enter will be $1,000,000/the most recent share price of UUP ($21.17, as of after hours Monday) = $47,236.7. We've rounded that up to $47,237 and entered that number in the "Shares Owned" field in the screen cap below.

Step 3: Enter a Decline Threshold.

You can enter any percentage you like for a threshold when using Portfolio Armor (the higher the percentage though, the greater the chance you will find optimal puts for your position). I've entered 15% in the "Threshold" field below.

Step 4: Click the Red Button.

A moment after clicking the red button, you would see the screen cap below, which shows the optimal put option contracts to buy to hedge against a greater than 15% drop in UUP between now and March 16, 2012. The cost of this protection on a $1 million position would be $6,608, or about 0.66% of the position value.1, 2

1Note that, in this case, Portfolio Armor rounded down the number of shares of UUP we entered to the nearest hundred (since one put option contract represents the right to sell one hundred shares of the underlying security), and then presented us with 472 of the put option contracts that would slightly over-hedge the 47,200 shares of UUP they cover, so that the total value of our 47,237 shares of UUP would be protected against a greater-than-15% decline.

2To be conservative, Portfolio Armor quoted that cost based on the ask price of the optimal puts. In practice, an investor can often purchase puts for a lower price, i.e., some price between the bid and the ask.