Energy Transfer Equity, L.P. (ETE, Financial) is a publicly traded partnership that holds the general partner, incentive distribution rights, and a portion of the limited partner units, of both Energy Transfer Partners (ETP, Financial) and Regency Energy Partners (RGNC, Financial), which are Master Limited Partnerships (MLPs).

Distribution Yield: 6.78%

Distribution Growth: 14%

Currently, I think ETE would make a solid addition to a portfolio at the current price of about $37 for both income and total return, assuming one has a high level of risk tolerance and a willingness to deal with the tax consequences of a publicly traded partnership.

Specifically, ETE owns the 1.8% general partner interest of ETP, 50,226,967 common units of ETP, the 2% general partner interest of Regency, 26,266,791 common units of Regency, and 100% of the Incentive Distribution Rights of both ETP and Regency.

The structure of this whole entity is as follows. The general partner, LE GP, LLC is a private GP that has 0.31% general partner interest in Energy Transfer Equity, L.P., and the rest of the partnership is held by approximately 223 million common units and 3 million preferred units. Energy Transfer Equity, L.P., holds the 1.8% general partner interest, 100% incentive distribution rights, and approximately 50 million limited partner units both directly and through a LLC, of Energy Transfer Partners LP. The rest of Energy Transfer Partners is held by common unitholders. Energy Transfer Equity LP, also holds the 2% general partner interest, 100% incentive distribution rights, and approximately 26 million limited partner units both directly and through a LLC, of Regency Energy Partners L.P.. The rest of Regency is held by the common unitholders. Both ETP and Regency have multiple subsidiaries and joint ventures.

Analyzing both ETP and Regency is necessary for understanding ETE. Investors can buy public common units of both ETP and Regency, but the risk/reward structure is different for owning public common units of ETE compared to owning public units of either ETP or Regency. This is because ETE owns the general partnership and most specifically, the Incentive Distribution Rights, of these other two entities.

Energy Transfer Partners

Energy Transfer Partners LP (ETP) is an MLP that holds the largest intrastate natural gas pipeline system in Texas, which includes interconnections between major hubs and major production sites. ETP also holds major interstate pipeline assets, major midstream assets, and one of the largest propane marketers in the US. ETP is a large and established partnership that has already reached and surpassed its highest target distribution and therefore pays plentiful Incentive Distribution Rights to ETE.

Energy Transfer Partners MLP Analysis

Regency Energy Partners

Regency Energy Partners LP (RGNC) is an MLP that holds valuable midstream assets in Texas and other states, including a large natural gas gathering and processing system, a contract compression segment, and a contract treating segment. In addition, Regency also holds joint ventures in some intrastate and interstate transportation natural gas pipelines. Regency is a fairly small and new partnership, and is still in the early stages of its target distributions.

Regency Energy Partners MLP Analysis

The advantage of an MLP over a corporation is that a partnership is not subject to double taxation as corporations are. When a corporation makes a profit, they are heavily taxed on that profit. Then, out of their after-tax profit, they may pay dividends to shareholders, and the shareholders then have to pay taxes on those dividends. So each dollar of a dividend is taxed twice- once at the corporate level and once at the shareholder level. ETE is a partnership and therefore is a flow-through entity. Unit-holders of a partnership pay taxes on their portion of the income and pay taxes when they sell their units. This way, earnings are only taxed at the individual level. It’s usually advantageous to be a partnership over a corporation, but the law only allows certain types of entities to become partnerships.

Since ETE is a partnership, it means investors receive tax advantages as a unitholder compared to a shareholder in a corporation. An investor’s income will typically be taxed fairly modestly, and the taxes will be partially deferred (which is good, because this money is used for compounding until it is paid). The disadvantage is that a partnership potentially complicates your taxes because you need to file an additional form.

As can be seen, ETE is primarily reliant on ETP, and especially ETP’s distributions to ETE based on ETE’s incentive distribution rights of ETP’s cash.

ETE’s balance sheet is based on the combination of ETP and Regency, but ETE also carries its own parent debt of $1.8 billion, and its ability to continue to pay its obligations is dependent on its continued reception of distributions from ETP and Regency.

The Incentive Distribution Rights are the most valuable aspect of a general partner investment, but they do not count as equity. ETE’s equity holdings are the general partners of ETP and Regency, as well as their several million common units of both. But the real cash generator is the Incentive Distribution Rights, which are explained in the Investment Thesis section in more detail. The IDRs provide ample cash flow and cover debt interest payments nicely, but do not show up on a balance sheet directly.

The two primary ways to analyze ETE’s balance sheet and total income statement are: a) analyze RTP and ETP independently, and then consider ETE’s reported balance sheets and income statements which combine total operations and exclude minority interest or b) treat ETE as a separate public entity that only receives distributions, and judge the risk of those distributions compared to their interest payments. The risky part of ETE is that all entities are separately leveraged, so ETE carries leverage on its investment in ETP and Regency, which are already leveraged.

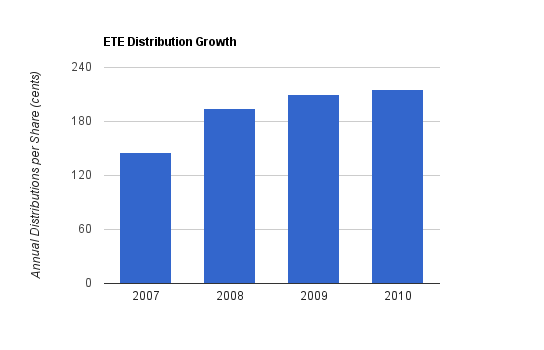

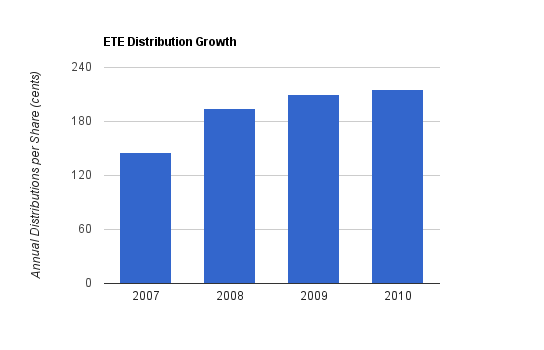

ETE has grown distributions by 14% annually over this period, and another 8% or 9% total increase looks likely for 2011 (based on the first three quarterly distribution payments so far). Growth slowed during the financial crisis, but the partnership recently boosted its quarterly distribution from $0.54 to $0.56 and then to $0.625.

Distribution growth, as previously stated, has slowed due to the halt of distribution growth of ETP and Regency. Currently, ETE’s distribution growth is fueled by ETP’s increasing distribution payments due to the Incentive Distribution Rights of ETE, and this should continue as long as ETP continues making equity offerings for acquisitions and growth. Eventually, if ETP and Regency resume distribution growth, ETE’s own distribution growth should accelerate.

The key for this investment is the 100% Incentive Distribution Rights (IDRs) which ETE holds for both ETP and Regency. IDRs are what gives a general partner a huge incentive to operate well and to increase distributions. In addition to holding limited and general partnership interest in both ETP and RGNC that pay regular distributions, ETE receives a significant portion of its income from IDRs. The percentage of total incoming cash that ETE gets due to IDRs was set forth upon the founding of the partnerships.

ETP

For Energy Transfer Partners, the IDR payouts are as follows:

-When the limited partner distribution payout is under $0.275 per unit per quarter, no incentive distribution payouts are paid to ETE.

-IDRs pay 13% to ETE when the limited partner distribution is under $0.3175.

-IDRs pay 23% to ETE when the limited partner distribution is under $0.4125.

-IDRs pay 48% to ETE when the limited partner distribution is over $0.4125.

Currently, ETP is paying $0.89375 per unit per quarter in distributions. The partnership has been operating for quite a while, and has met and exceeded all of the above target distribution levels. This doesn’t mean, however, that ETP is paying 48% of its cash as IDRs, or that it cannot grow its IDR payout anymore. Only a percentage of the total cash is paid out at 48%, and the rest is paid out at the lower levels. If ETP continues to grow its distribution, ETE will continue to receive a larger percentage of the cash, because a larger percentage of the total payout will be above the top target distribution level.

RGNC

For Regency Energy Partners, the IDR payouts are as follows:

-When the limited partner distribution payout is under $0.4025 per unit per quarter, no incentive distribution payouts are paid to ETE.

-IDRs pay 13% to ETE when the limited partner distribution is under $0.4375.

-IDRs pay 23% to ETE when the limited partner distribution is under $0.5250.

-IDRs pay 48% to ETE when the limited partner distribution is over $0.5250.

Currently, RGNC is paying $0.45 per unit per quarter in distributions, so it’s on the low end of its target distribution levels. If, over the following years, RGNC can raise its distribution to over $0.60 or $0.70, the percentage it pays to ETE will grow abundantly.

Increasing Equity

Not only do the incentive distributions for ETE increase as ETP and Regency increase their distributions; they also increase when ETP and Regency issue more units to acquire equity as well. Once certain target distribution levels are reached and incentive distributions begin to be paid, then the general partner increases its total reception of incentive distributions by either continuing to boost the distributions of its limited partners, or by continually offering more units, which increases the whole cash flow. Since Incentive Distribution Rights give the general partner, ETE, access to a certain percentage of the total available cash, the larger that ETP and Regency become by issuing units, the more cash ETE gets in incentive distributions. This is how ETE continued increasing its distributions even as ETP and Regency did not; both ETP and Regency continued issuing units to fuel growth, and ETP in particular paid larger and larger incentive distributions to ETE even as per-unit distribution levels remained flat for ETP unitholders.

Issuing equity is an important path of growth for partnerships. Since they send out most of their incoming cash to investors as high-yielding distributions, they don’t retain much capital for growth. For most partnerships, nearly all of the growth capital is raised by issuing more units. Good management can put this raised capital to good use and get good returns on investments to ensure that over time, they not only increase the total size of the partnership, but also increase the value of each individual unit even as they increase the number of units. This is why IDRs are structured as they are; in order for the holder of the IDRs to receive maximum financial benefit from the arrangement, they have to both increase the total number of units and continue growing the distribution per share to a level significantly above the highest target distribution level. It is this combination that makes MLPs such a powerful tool for their purpose of infrastructure growth.

The above table shows the weighted average number of units outstanding for ETP each year between 2006 and 2010.

The above table shows the weighted average number of units outstanding for Regency each year between 2006 and 2010.

By issuing so much equity, these partnerships have grown substantially, and ETE’s share of capital based on its IDRs has increased. In most optimal cases, increasing equity should benefit both limited partners and the general partner, but over these past three years, neither ETP or Regency have been able to increase their distributions. As the economy recovers and investments continue to be made, prudent management should be able to benefit both limited and general partners.

Southern Union Acquisition

In July, ETE announced plans to acquire all of the assets of Southern Union (SUG). After this, a bidding war occurred between ETE and Williams Companies, which ETE has appeared to have won. Southern Union has large natural gas transportation and storage resources, and in particular has strong interstate operations. ETE will pay $5.7 billion to SUG unitholders in the form of both ETE units and cash, and will assume the debt of SUG, for a total transaction cost of about $9.4 billion. Paying a premium for SUG assets is acceptable, because the assets are currently taxed as a corporate entity but will instead be shifted to existing under a MLP structure, meaning ETE will get more profit out of them than SUG does.

ETE will draw upon multiple options to finance this transaction. In part, they will issue more units, but they will also do “drop down” transactions. For instance, ETP will use debt and issue new units to purchase SUG’s ownership in a large Florida pipeline system, so ETE will acquire this from SUG and then drop it down to ETP, taking some of the financial pressure off of ETE. It’s probable that other portions of SUG will eventually be dropped down to ETP and Regency. In order to drop these assets down to ETP, ETE had to waive its IDRs on these assets for four years. This made the deal profitable for both ETE and ETP; ETP will likely be able to raise its distribution, and ETE is continuing to set itself up for good long term returns, and will moderately benefit in the short term as well.

This is important in a few ways. First, it greatly diversifies ETE. The principle risk of ETE is that it is leveraged on the performance of certain assets, and in particular is vulnerable to decreases in distributions by ETP. With SUG units, it has a greater source of income, and particularly strengthens its asset base outside of Texas. Secondly, it gives ETE a war chest of assets that it can drop down to ETP and Regency. As previously described, MLPs primarily grow by issuing equity to construct or acquire new infrastructure, and now ETE has assets to potentially sell to its partnerships. This should be profitable for both ETP and Regency, and should set up ETE for long term IDR growth and good total returns.

Insider Ownership and Activity

It’s worth noting that ETE’s CEO, Kelcy Warren, owns hundreds of millions of dollars worth of ETE, and in July purchased approximately $30 million more at a price of approximately $42.

The risks for ETE are mostly the same as the risks for ETP and Regency, but ETE is leveraged on these entities due to its Incentive Distribution Rights and its parent debt. A key risk for unitholders of ETE would be to lose some or all of the incentive distributions for ETP, which would result if ETP were to significantly cut its distribution. If ETP were to encounter problems that force them to decrease their distributions to below the target distribution levels, ETP unit holders would be disadvantaged, but ETE unitholders would be hit even harder, because much of ETE’s incoming cash flow is derived from the incentive distributions rather than from the general partner or limited partner ownership interests. It’s like a house of cards; if something were to happen to the bottom card, the top card would fall. In this case, that means that if ETP were to encounter a serious problem and have to significantly decrease its distribution, ETE could be unable to service its debts unless the problem was resolved quickly. The good news is that natural gas partnerships are rather unlike cards in the sense that they are sturdy businesses that typically achieve solid cash flows. Regency is in an earlier stage of its operation, so the incentive distribution from Regency to ETE is currently small, and therefore any setback for Regency represents a significant future loss for ETE rather than a large current loss.

Overall, ETE is more diversified than either ETP or Regency because it holds stake in both, and is able to grow its own distributions even if ETP and Regency do not as long as those partnerships continue issuing equity. Now that ETE is likely acquiring SUG assets, it further diversifies itself. But, ETE currently is highly dependent on receiving the incentive distributions of ETP and should be considered somewhat riskier than either ETP or Regency.

There is the issue of leveraged debt as well; both ETP and Regency have levels of debt, and ETE holds stake in both of these partnerships and also holds its own parent debt. MLPs always have quite a bit of debt because they need it to operate, but ETP is a bit more leveraged than average, and ETE’s leverage on top of that makes the structure rather sensitive.

As the incentive distribution rights reach a mature phase, it increases the cost of capital for a partnership, and it can potentially become harder to raise distributions. A tangible example of this is the case of ETE having to waive its IDRs for ETP to acquire SUG’s interest in a Florida pipeline system. There are, however, examples of partnerships that continued to perform well even long after distributions exceeded the top target levels.

The current price of under $37 represents a strong buy in my opinion, and I’d be willing to pay up to $45 based on the current fundamentals.

Full Disclosure: I own units of ETE.

Distribution Yield: 6.78%

Distribution Growth: 14%

Currently, I think ETE would make a solid addition to a portfolio at the current price of about $37 for both income and total return, assuming one has a high level of risk tolerance and a willingness to deal with the tax consequences of a publicly traded partnership.

Overview

Energy Transfer Equity, L.P. (ETE) is a publicly traded partnership that acts as a holding company of two MLPs: Energy Transfer Partners (ETP) and Regency Energy Partners (RGNC).Specifically, ETE owns the 1.8% general partner interest of ETP, 50,226,967 common units of ETP, the 2% general partner interest of Regency, 26,266,791 common units of Regency, and 100% of the Incentive Distribution Rights of both ETP and Regency.

The structure of this whole entity is as follows. The general partner, LE GP, LLC is a private GP that has 0.31% general partner interest in Energy Transfer Equity, L.P., and the rest of the partnership is held by approximately 223 million common units and 3 million preferred units. Energy Transfer Equity, L.P., holds the 1.8% general partner interest, 100% incentive distribution rights, and approximately 50 million limited partner units both directly and through a LLC, of Energy Transfer Partners LP. The rest of Energy Transfer Partners is held by common unitholders. Energy Transfer Equity LP, also holds the 2% general partner interest, 100% incentive distribution rights, and approximately 26 million limited partner units both directly and through a LLC, of Regency Energy Partners L.P.. The rest of Regency is held by the common unitholders. Both ETP and Regency have multiple subsidiaries and joint ventures.

Analyzing both ETP and Regency is necessary for understanding ETE. Investors can buy public common units of both ETP and Regency, but the risk/reward structure is different for owning public common units of ETE compared to owning public units of either ETP or Regency. This is because ETE owns the general partnership and most specifically, the Incentive Distribution Rights, of these other two entities.

Energy Transfer Partners

Energy Transfer Partners LP (ETP) is an MLP that holds the largest intrastate natural gas pipeline system in Texas, which includes interconnections between major hubs and major production sites. ETP also holds major interstate pipeline assets, major midstream assets, and one of the largest propane marketers in the US. ETP is a large and established partnership that has already reached and surpassed its highest target distribution and therefore pays plentiful Incentive Distribution Rights to ETE.

Energy Transfer Partners MLP Analysis

Regency Energy Partners

Regency Energy Partners LP (RGNC) is an MLP that holds valuable midstream assets in Texas and other states, including a large natural gas gathering and processing system, a contract compression segment, and a contract treating segment. In addition, Regency also holds joint ventures in some intrastate and interstate transportation natural gas pipelines. Regency is a fairly small and new partnership, and is still in the early stages of its target distributions.

Regency Energy Partners MLP Analysis

The advantage of an MLP over a corporation is that a partnership is not subject to double taxation as corporations are. When a corporation makes a profit, they are heavily taxed on that profit. Then, out of their after-tax profit, they may pay dividends to shareholders, and the shareholders then have to pay taxes on those dividends. So each dollar of a dividend is taxed twice- once at the corporate level and once at the shareholder level. ETE is a partnership and therefore is a flow-through entity. Unit-holders of a partnership pay taxes on their portion of the income and pay taxes when they sell their units. This way, earnings are only taxed at the individual level. It’s usually advantageous to be a partnership over a corporation, but the law only allows certain types of entities to become partnerships.

Since ETE is a partnership, it means investors receive tax advantages as a unitholder compared to a shareholder in a corporation. An investor’s income will typically be taxed fairly modestly, and the taxes will be partially deferred (which is good, because this money is used for compounding until it is paid). The disadvantage is that a partnership potentially complicates your taxes because you need to file an additional form.

Financial

ETE receives its income in the form of distributions from its common units, general partnership interests, and incentive distribution rights of both ETP and Regency.Distributions Received from ETP and RGNC

| ETP Limited Partner Interest | $190.531 million |

| ETP General Partner Interest | $19.524 million |

| ETP Incentive Distribution Rights | $375.979 million |

| ETP Total Distributions | $586.034 million |

|---|---|

| RGNC Limited Partner Interest | $35.066 million |

| RGNC General Partner Interest | $3.640 million |

| RGNC Incentive Distribution Rights | $3.016 million |

| RGNC Total Distributions | $41.722 million |

Balance Sheet

Analyzing the strength of the balance sheet for ETE is atypical compared to standard analysis. Typically, one would compare debt to equity, but with ETE, one will find that their equity is almost nothing (resulting in a bit of irony based on their name), meaning the debt/equity ratio is skewed. There is a reason for this and it has to do with the Incentive Distribution Rights and the leveraged separate structure of these entities.ETE’s balance sheet is based on the combination of ETP and Regency, but ETE also carries its own parent debt of $1.8 billion, and its ability to continue to pay its obligations is dependent on its continued reception of distributions from ETP and Regency.

The Incentive Distribution Rights are the most valuable aspect of a general partner investment, but they do not count as equity. ETE’s equity holdings are the general partners of ETP and Regency, as well as their several million common units of both. But the real cash generator is the Incentive Distribution Rights, which are explained in the Investment Thesis section in more detail. The IDRs provide ample cash flow and cover debt interest payments nicely, but do not show up on a balance sheet directly.

The two primary ways to analyze ETE’s balance sheet and total income statement are: a) analyze RTP and ETP independently, and then consider ETE’s reported balance sheets and income statements which combine total operations and exclude minority interest or b) treat ETE as a separate public entity that only receives distributions, and judge the risk of those distributions compared to their interest payments. The risky part of ETE is that all entities are separately leveraged, so ETE carries leverage on its investment in ETP and Regency, which are already leveraged.

Distribution

ETE recently raised its quarterly distribution from $0.56 to $0.625 (an 11.6% increase), resulting in a current distribution yield of 6.78% and an annual distribution total that is on track to reach $2.35 or higher for 2011. The partnership has had significant distribution growth, and the growth of the distribution for ETE would accelerate further if ETP and Regency resume their own distribution increases, which have unfortunately been completely flat for 12 consecutive quarters. Regency recently announced a small increase, and it’s probable that ETP will increase its distribution in the near future.Distribution Growth

| Year | Quarterly Distribution |

|---|---|

| 2010 | $2.16 |

| 2009 | $2.105 |

| 2008 | $1.95 |

| 2007 | $1.4585 |

Distribution growth, as previously stated, has slowed due to the halt of distribution growth of ETP and Regency. Currently, ETE’s distribution growth is fueled by ETP’s increasing distribution payments due to the Incentive Distribution Rights of ETE, and this should continue as long as ETP continues making equity offerings for acquisitions and growth. Eventually, if ETP and Regency resume distribution growth, ETE’s own distribution growth should accelerate.

Investing Thesis

Master Limited Partnerships (MLPs) are investment structures that can present great opportunity for investors, both in the form of yield and total return. An MLP is structured in the following way- there is a general partner which is run by a management team, and large numbers of limited partners. Limited partners contribute capital, while the general partner entity manages the operations of the partnership and owns a small stake in the overall partnership. Only businesses that derive income from certain sources can exist as MLPs, and MLPs are structured for a fairly specific purpose- to encourage infrastructure growth. The MLP begins by paying minimum quarterly distributions (basically large dividends), and over time, hopefully raises these distributions. As it meets certain target distribution levels, the general partner of the MLP is entitled to increasing percentages of the total cash flow of the partnership, and these entitlements are known as Incentive Distribution Rights (IDRs). So, the general partner not only receives its equity percentage of cash flow, it also receives extra cash based on performance. The bigger and more profitable the pie becomes, the larger and larger percentage of the pie the holder of the IDRs is entitled to.The key for this investment is the 100% Incentive Distribution Rights (IDRs) which ETE holds for both ETP and Regency. IDRs are what gives a general partner a huge incentive to operate well and to increase distributions. In addition to holding limited and general partnership interest in both ETP and RGNC that pay regular distributions, ETE receives a significant portion of its income from IDRs. The percentage of total incoming cash that ETE gets due to IDRs was set forth upon the founding of the partnerships.

ETP

For Energy Transfer Partners, the IDR payouts are as follows:

-When the limited partner distribution payout is under $0.275 per unit per quarter, no incentive distribution payouts are paid to ETE.

-IDRs pay 13% to ETE when the limited partner distribution is under $0.3175.

-IDRs pay 23% to ETE when the limited partner distribution is under $0.4125.

-IDRs pay 48% to ETE when the limited partner distribution is over $0.4125.

Currently, ETP is paying $0.89375 per unit per quarter in distributions. The partnership has been operating for quite a while, and has met and exceeded all of the above target distribution levels. This doesn’t mean, however, that ETP is paying 48% of its cash as IDRs, or that it cannot grow its IDR payout anymore. Only a percentage of the total cash is paid out at 48%, and the rest is paid out at the lower levels. If ETP continues to grow its distribution, ETE will continue to receive a larger percentage of the cash, because a larger percentage of the total payout will be above the top target distribution level.

RGNC

For Regency Energy Partners, the IDR payouts are as follows:

-When the limited partner distribution payout is under $0.4025 per unit per quarter, no incentive distribution payouts are paid to ETE.

-IDRs pay 13% to ETE when the limited partner distribution is under $0.4375.

-IDRs pay 23% to ETE when the limited partner distribution is under $0.5250.

-IDRs pay 48% to ETE when the limited partner distribution is over $0.5250.

Currently, RGNC is paying $0.45 per unit per quarter in distributions, so it’s on the low end of its target distribution levels. If, over the following years, RGNC can raise its distribution to over $0.60 or $0.70, the percentage it pays to ETE will grow abundantly.

Increasing Equity

Not only do the incentive distributions for ETE increase as ETP and Regency increase their distributions; they also increase when ETP and Regency issue more units to acquire equity as well. Once certain target distribution levels are reached and incentive distributions begin to be paid, then the general partner increases its total reception of incentive distributions by either continuing to boost the distributions of its limited partners, or by continually offering more units, which increases the whole cash flow. Since Incentive Distribution Rights give the general partner, ETE, access to a certain percentage of the total available cash, the larger that ETP and Regency become by issuing units, the more cash ETE gets in incentive distributions. This is how ETE continued increasing its distributions even as ETP and Regency did not; both ETP and Regency continued issuing units to fuel growth, and ETP in particular paid larger and larger incentive distributions to ETE even as per-unit distribution levels remained flat for ETP unitholders.

Issuing equity is an important path of growth for partnerships. Since they send out most of their incoming cash to investors as high-yielding distributions, they don’t retain much capital for growth. For most partnerships, nearly all of the growth capital is raised by issuing more units. Good management can put this raised capital to good use and get good returns on investments to ensure that over time, they not only increase the total size of the partnership, but also increase the value of each individual unit even as they increase the number of units. This is why IDRs are structured as they are; in order for the holder of the IDRs to receive maximum financial benefit from the arrangement, they have to both increase the total number of units and continue growing the distribution per share to a level significantly above the highest target distribution level. It is this combination that makes MLPs such a powerful tool for their purpose of infrastructure growth.

Number of ETP Outstanding Common Units

| Year | # Units |

|---|---|

| 2010 | 188.1 million |

| 2009 | 167.3 million |

| 2008 | 146.9 million |

| 2007 | 137.6 million |

| 2006 | 109.0 million |

Number of Outstanding Regency Common Units

| Year | # Units |

|---|---|

| 2010 | 130.6 million |

| 2009 | 80.6 million |

| 2008 | 66.2 million |

| 2007 | 51.1 million |

| 2006 | 38.2 million |

By issuing so much equity, these partnerships have grown substantially, and ETE’s share of capital based on its IDRs has increased. In most optimal cases, increasing equity should benefit both limited partners and the general partner, but over these past three years, neither ETP or Regency have been able to increase their distributions. As the economy recovers and investments continue to be made, prudent management should be able to benefit both limited and general partners.

Southern Union Acquisition

In July, ETE announced plans to acquire all of the assets of Southern Union (SUG). After this, a bidding war occurred between ETE and Williams Companies, which ETE has appeared to have won. Southern Union has large natural gas transportation and storage resources, and in particular has strong interstate operations. ETE will pay $5.7 billion to SUG unitholders in the form of both ETE units and cash, and will assume the debt of SUG, for a total transaction cost of about $9.4 billion. Paying a premium for SUG assets is acceptable, because the assets are currently taxed as a corporate entity but will instead be shifted to existing under a MLP structure, meaning ETE will get more profit out of them than SUG does.

ETE will draw upon multiple options to finance this transaction. In part, they will issue more units, but they will also do “drop down” transactions. For instance, ETP will use debt and issue new units to purchase SUG’s ownership in a large Florida pipeline system, so ETE will acquire this from SUG and then drop it down to ETP, taking some of the financial pressure off of ETE. It’s probable that other portions of SUG will eventually be dropped down to ETP and Regency. In order to drop these assets down to ETP, ETE had to waive its IDRs on these assets for four years. This made the deal profitable for both ETE and ETP; ETP will likely be able to raise its distribution, and ETE is continuing to set itself up for good long term returns, and will moderately benefit in the short term as well.

This is important in a few ways. First, it greatly diversifies ETE. The principle risk of ETE is that it is leveraged on the performance of certain assets, and in particular is vulnerable to decreases in distributions by ETP. With SUG units, it has a greater source of income, and particularly strengthens its asset base outside of Texas. Secondly, it gives ETE a war chest of assets that it can drop down to ETP and Regency. As previously described, MLPs primarily grow by issuing equity to construct or acquire new infrastructure, and now ETE has assets to potentially sell to its partnerships. This should be profitable for both ETP and Regency, and should set up ETE for long term IDR growth and good total returns.

Insider Ownership and Activity

It’s worth noting that ETE’s CEO, Kelcy Warren, owns hundreds of millions of dollars worth of ETE, and in July purchased approximately $30 million more at a price of approximately $42.

Risks

ETP and Regency individual risks are discussed in my analysis articles of those entities.The risks for ETE are mostly the same as the risks for ETP and Regency, but ETE is leveraged on these entities due to its Incentive Distribution Rights and its parent debt. A key risk for unitholders of ETE would be to lose some or all of the incentive distributions for ETP, which would result if ETP were to significantly cut its distribution. If ETP were to encounter problems that force them to decrease their distributions to below the target distribution levels, ETP unit holders would be disadvantaged, but ETE unitholders would be hit even harder, because much of ETE’s incoming cash flow is derived from the incentive distributions rather than from the general partner or limited partner ownership interests. It’s like a house of cards; if something were to happen to the bottom card, the top card would fall. In this case, that means that if ETP were to encounter a serious problem and have to significantly decrease its distribution, ETE could be unable to service its debts unless the problem was resolved quickly. The good news is that natural gas partnerships are rather unlike cards in the sense that they are sturdy businesses that typically achieve solid cash flows. Regency is in an earlier stage of its operation, so the incentive distribution from Regency to ETE is currently small, and therefore any setback for Regency represents a significant future loss for ETE rather than a large current loss.

Overall, ETE is more diversified than either ETP or Regency because it holds stake in both, and is able to grow its own distributions even if ETP and Regency do not as long as those partnerships continue issuing equity. Now that ETE is likely acquiring SUG assets, it further diversifies itself. But, ETE currently is highly dependent on receiving the incentive distributions of ETP and should be considered somewhat riskier than either ETP or Regency.

There is the issue of leveraged debt as well; both ETP and Regency have levels of debt, and ETE holds stake in both of these partnerships and also holds its own parent debt. MLPs always have quite a bit of debt because they need it to operate, but ETP is a bit more leveraged than average, and ETE’s leverage on top of that makes the structure rather sensitive.

As the incentive distribution rights reach a mature phase, it increases the cost of capital for a partnership, and it can potentially become harder to raise distributions. A tangible example of this is the case of ETE having to waive its IDRs for ETP to acquire SUG’s interest in a Florida pipeline system. There are, however, examples of partnerships that continued to perform well even long after distributions exceeded the top target levels.

Conclusion and Valuation

In conclusion, ETE represents an interesting opportunity to acquire both significant current yield, and substantial distribution growth, for a potentially above-average rate of return. ETE benefits when ETP and Regency increase their distribution or when they grow by issuing equity, and by growing Regency and putting the SUG assets to good use if it ultimately acquires them, ETE will significantly diversify its cash flows and reduce total risk. But ETE is not without its substantial risks at the current time, as its benefits and drawbacks are amplified compared to ETP and Regency. Investors wanting to own a more typical limited partnership stake in a publicly traded partnership might do better to own either ETP, Regency, or another MLP, but investors that are bullish on the futures of both ETP and Regency have a good opportunity with ETE to achieve significant total returns. Due to the nature of the risk, MLPs should only be owned as part of a diversified portfolio.The current price of under $37 represents a strong buy in my opinion, and I’d be willing to pay up to $45 based on the current fundamentals.

Full Disclosure: I own units of ETE.