The Console Universe

Video game consoles have been around for quite some time. In fact, they are now in their seventh generation. This is the period that started with the introduction of Microsoft’s Xbox 360 in November 2005. The other representatives of the seventh generation are Sony’s PlayStation 3 and Nintendo’s Wii. On the hand-held scene there are only two generations, the second being the current one — Nintendo’s DS and Sony’s PlayStation Portable.

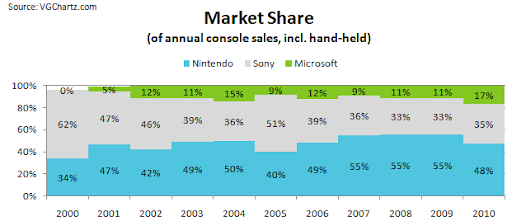

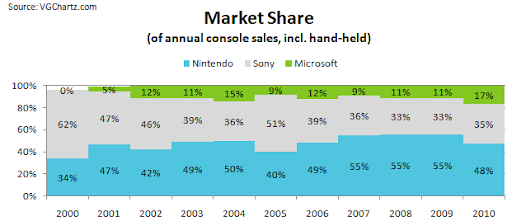

As of fiscal 2011 (ending March 2011), Nintendo had a market share of 48% — 22% for the Wii and 26% for the DS — of the combined console market. This compares with 35% for Sony — 18% for the PS3 and 12% for the PSP — and 17% for the Xbox 360.

The Wii has 45% of the global installed base of seventh generation home consoles. PS3 and Xbox 360 share the remaining 27% and 28% respectively. Of the second generation hand-helds the DS dominates, at 68%, the PSP, at 32%.

Traditionally the largest markets have been the USA, Europe and Japan. And traditionally, in the last decade since Sega left the stage after it botched the Dreamcast, the big dogs have been Sony and Nintendo, while Microsoft (MSFT, Financial) has slowly and with mixed success been stealing market share from them.

Recently, it has made excellent progress with the introduction of the Kinect and of very successful sequels to its flagman games. According to VGChartz data, 6 out of the top 10 most pre-ordered games in the Americas (North and South) as of last week (ending August 6) are for the Xbox 360, 3 are for the PS3 and 1 for the PC. In comparison, Nintendo has just one title in the top 20. However, looking at the best selling games for the past decade, reveals the opposite picture — 15 out of the top 20 titles are for Nintendo’s platforms (4 for the Wii, 7 for the DS, and 4 for the GameBoy and GameBoy Advance), the remaining 5 being for the PS2.

This very well summarizes the trend in Nintendo’s development. It has the largest installed base thanks to the success of the Wii and the DS, but this advantage is fading as the competitors are making progress in capturing parts of the casual gaming market as the next generation of consoles is about to be launched.

Nintendo’s Foresight

What Nintendo did with the introduction of the Wii and the DS was to expand the global gaming population by including seniors and girls, who until their launch were barely represented among people playing video games. Thanks to this foresight, Nintendo has occupied around 50% of the global market for consoles (home and hand-held) for the past five years (since the introduction of the Wii in 2006). That’s how it managed to get ahead in the competition with Sony.

Nintendo accomplished this by offering games for the casual (as opposed to the hardcore) gamers in a way that suited them best — via easygoing, team games and fun, engaging (physically as well) and user-friendly controllers. Today a similar experience is delivered by smart phones and easygoing, touch- and accelerometer-controlled games for them. The experience is of lesser graphic and controller quality but it’s free or next to free because the phone is already available (sunk cost) and games are free or cost a nominal fee.

Nintendo’s core development concept is offering an integrated hardware-software experience. Apple (AAPL) swears by the same banner. People saying that Nintendo should embrace the iPhone and the iPad just don’t get this. It’s like suggesting that because there are so many PCs and smart phones out there, Apple should release its operating system for all these devices. That’s not what these companies do. Change in this respect is not likely.

Nintendo has to compete in this new environment. Its answer was the Nintendo 3DS (March 2011) — a 3D version of the DS — which was not well-accepted and the company had to cut its price by 40% five months after the launch. This gaffe caused the CEO to publicly apologize and offer gifts to those who had just bought at the higher price. The situation is made worse by the lack of titles for the device. The home console part of Nintendo’s answer will come around mid-2012 in the form of the new Wii U, which offers a unique controller. Early reviews have been mixed.

Meanwhile, Competition Is Stiff…

Sony and Microsoft launched fancy controllers of their own. Microsoft’s Kinect, launched in November 2010, quickly went on to become the fastest selling consumer electronics product in history. They have realized that expanding the gaming population to include people who were on the sidelines and capturing large parts of it is a great strategy. The bad news for Nintendo is that now everyone has included controllers in the calculation. Success similar to the Wii’s is unthinkable.

Sony has the best hardware, as far as computing power and graphics performance is concerned, in its home console, the PlayStation 3, and by the end of the year it will have the best hardware in its hand-held PlayStation Vita, the replacement of the PSP. The two devices will be integrated in a way that allows the user to use both of them interchangeably and even pick up the game where one left off no matter which device one picks up.

…and Clouds Are Gathering

Aside from the pressures from Sony and Microsoft, there is a new threat to all console manufacturers and game distributors. Services like OnLive are offering gaming in the cloud that doesn’t require people to own a console or a supercomputer to play video games. They offer a subscription service that allows people to play straight on a TV screen or on any old computer able to stream high quality video over the Internet.

There are some concerns over how such services are going to scale with increases in the user base and how they will handle certain constraints of the Internet infrastructure. A conservative assessment would put their becoming mainstream some 5-10 years away. Nevertheless, such services make more sense than the current model of entertainment content distribution and as they develop, they will put companies like Nintendo in the position in which the Internet put newspapers and Netflix (NFLX, Financial) put Blockbuster. The trend is toward easy, synchronized access to content from any point.

Why Nintendo Then?

Because a bad business can be a good investment. And Nintendo is not half bad a business. Nevertheless, its price has fallen over 50% since the beginning of the year and over 80% since the pre-crisis peak in 2007.

Nintendo has a fortress of a balance sheet.

Sales and margins have declined in the past two years. The major factors for this have been:

The problematic launch (high price and lack of titles) of the 3DS only added insult to injury. Finally, facing tougher competition in the market for controllers from Sony and Microsoft puts a big question mark on how the Wii U, which relies on a conceptually new controller, will fare. All this has caused the market to overreact. The volatility in the past couple of weeks further fueled the downtrend.

Right now it would be good for investors to remember that Nintendo is the creator of three of the best-selling consoles of all time: DS, Wii, and GameBoy. The top five is rounded by Sony’s PlayStation and PlayStation 2. Despite the competitive threats, Nintendo is still coming up with innovative products. The company was the first to embrace the strategy of gaming population expansion, which was later emulated by others. All of the above speaks to management’s abilities.

Apart from consoles, Nintendo holds the rights to some of the best video game franchises of all time: Donkey Kong, Mario, Zelda, and the various Wii sports games. While the Wii sports titles can easily be substituted for similar products by the competitors should they offer a better experience through their controllers, franchises like Super Mario and The Legend of Zelda have a solid following. They have been around for the past quarter of a century and will continue to be around for quite some time.

Besides, the competition is grappling with problems of its own. Sony is suffering from a lack of focus typical for conglomerates. Microsoft is trying to realize its potential in a hit-and-miss fashion. Both companies merit thorough analysis which is beyond the scope of this report.

Furthermore, all three companies are up against the omnipresent Apple, whose products, some people tend to be lulled into thinking, will substitute any other piece of consumer electronics out there. I have my doubts.

The Numbers Add Up

The charts below draw Nintendo’s picture over the last 10 years. It is clear that in the past two years things have not been going too well for the company. However, the question is whether it deserves such massive discounting of its profitable, long-standing franchises and management abilities.

The decreasing sales and profitability are obvious. But what is a sustainable level for the company? Much depends on how the Wii U will do against the competition and how quickly Nintendo comes up with new titles for the 3DS, although it might have badly missed the opportunity to capitalize on its introduction.

Even if Nintendo doesn’t do any better than before the introduction of the Wii and the DS, the market seems to be pricing a rather grim future for the company. And while this will most probably be the case once the cloud engulfs us all, there may still time to make a buck.

Based on average 10-year free cash flows of ¥143 billon and a modest (10x) to normal (15x) multiple, Nintendo is worth between ¥1.43 and ¥2.14 trillion. With 127,879,069 shares outstanding, the per share amounts are ¥11,180 and ¥16,770. The company has ¥1.17 trillion or ¥9,160 per share in cash and short-term investments. NCAV is ¥1.12 trillion or ¥8,720 per share.

As of Friday, Aug. 14, 2011, Nintendo was selling for ¥10,900 on the Tokyo Stock Exchange, number 7974. For U.S. investors there are unsponsored ADRs trading on the OTC market under the symbol NTDOY, representing 1/8 of a share, selling at $17.87.

The company is selling a little below the lower end of the valuation and only 25% over liquidation value. I don’t see Nintendo liquidating any time soon. So, at this price and below, I think it’s a buy.

Disclosure: No positions in the companies discussed.

Video game consoles have been around for quite some time. In fact, they are now in their seventh generation. This is the period that started with the introduction of Microsoft’s Xbox 360 in November 2005. The other representatives of the seventh generation are Sony’s PlayStation 3 and Nintendo’s Wii. On the hand-held scene there are only two generations, the second being the current one — Nintendo’s DS and Sony’s PlayStation Portable.

As of fiscal 2011 (ending March 2011), Nintendo had a market share of 48% — 22% for the Wii and 26% for the DS — of the combined console market. This compares with 35% for Sony — 18% for the PS3 and 12% for the PSP — and 17% for the Xbox 360.

The Wii has 45% of the global installed base of seventh generation home consoles. PS3 and Xbox 360 share the remaining 27% and 28% respectively. Of the second generation hand-helds the DS dominates, at 68%, the PSP, at 32%.

Traditionally the largest markets have been the USA, Europe and Japan. And traditionally, in the last decade since Sega left the stage after it botched the Dreamcast, the big dogs have been Sony and Nintendo, while Microsoft (MSFT, Financial) has slowly and with mixed success been stealing market share from them.

Recently, it has made excellent progress with the introduction of the Kinect and of very successful sequels to its flagman games. According to VGChartz data, 6 out of the top 10 most pre-ordered games in the Americas (North and South) as of last week (ending August 6) are for the Xbox 360, 3 are for the PS3 and 1 for the PC. In comparison, Nintendo has just one title in the top 20. However, looking at the best selling games for the past decade, reveals the opposite picture — 15 out of the top 20 titles are for Nintendo’s platforms (4 for the Wii, 7 for the DS, and 4 for the GameBoy and GameBoy Advance), the remaining 5 being for the PS2.

This very well summarizes the trend in Nintendo’s development. It has the largest installed base thanks to the success of the Wii and the DS, but this advantage is fading as the competitors are making progress in capturing parts of the casual gaming market as the next generation of consoles is about to be launched.

Nintendo’s Foresight

What Nintendo did with the introduction of the Wii and the DS was to expand the global gaming population by including seniors and girls, who until their launch were barely represented among people playing video games. Thanks to this foresight, Nintendo has occupied around 50% of the global market for consoles (home and hand-held) for the past five years (since the introduction of the Wii in 2006). That’s how it managed to get ahead in the competition with Sony.

Nintendo accomplished this by offering games for the casual (as opposed to the hardcore) gamers in a way that suited them best — via easygoing, team games and fun, engaging (physically as well) and user-friendly controllers. Today a similar experience is delivered by smart phones and easygoing, touch- and accelerometer-controlled games for them. The experience is of lesser graphic and controller quality but it’s free or next to free because the phone is already available (sunk cost) and games are free or cost a nominal fee.

Nintendo’s core development concept is offering an integrated hardware-software experience. Apple (AAPL) swears by the same banner. People saying that Nintendo should embrace the iPhone and the iPad just don’t get this. It’s like suggesting that because there are so many PCs and smart phones out there, Apple should release its operating system for all these devices. That’s not what these companies do. Change in this respect is not likely.

Nintendo has to compete in this new environment. Its answer was the Nintendo 3DS (March 2011) — a 3D version of the DS — which was not well-accepted and the company had to cut its price by 40% five months after the launch. This gaffe caused the CEO to publicly apologize and offer gifts to those who had just bought at the higher price. The situation is made worse by the lack of titles for the device. The home console part of Nintendo’s answer will come around mid-2012 in the form of the new Wii U, which offers a unique controller. Early reviews have been mixed.

Meanwhile, Competition Is Stiff…

Sony and Microsoft launched fancy controllers of their own. Microsoft’s Kinect, launched in November 2010, quickly went on to become the fastest selling consumer electronics product in history. They have realized that expanding the gaming population to include people who were on the sidelines and capturing large parts of it is a great strategy. The bad news for Nintendo is that now everyone has included controllers in the calculation. Success similar to the Wii’s is unthinkable.

Sony has the best hardware, as far as computing power and graphics performance is concerned, in its home console, the PlayStation 3, and by the end of the year it will have the best hardware in its hand-held PlayStation Vita, the replacement of the PSP. The two devices will be integrated in a way that allows the user to use both of them interchangeably and even pick up the game where one left off no matter which device one picks up.

…and Clouds Are Gathering

Aside from the pressures from Sony and Microsoft, there is a new threat to all console manufacturers and game distributors. Services like OnLive are offering gaming in the cloud that doesn’t require people to own a console or a supercomputer to play video games. They offer a subscription service that allows people to play straight on a TV screen or on any old computer able to stream high quality video over the Internet.

There are some concerns over how such services are going to scale with increases in the user base and how they will handle certain constraints of the Internet infrastructure. A conservative assessment would put their becoming mainstream some 5-10 years away. Nevertheless, such services make more sense than the current model of entertainment content distribution and as they develop, they will put companies like Nintendo in the position in which the Internet put newspapers and Netflix (NFLX, Financial) put Blockbuster. The trend is toward easy, synchronized access to content from any point.

Why Nintendo Then?

Because a bad business can be a good investment. And Nintendo is not half bad a business. Nevertheless, its price has fallen over 50% since the beginning of the year and over 80% since the pre-crisis peak in 2007.

Nintendo has a fortress of a balance sheet.

- A little over 70% of its total assets are in cash and short-term investments.

- Inventories and receivables make up another 14%.

- Intangibles are less than a basis point.

- No debt

- No large operating leases

- Negligible unfunded retirement benefit obligation (assumptions used in calculating it are normal to conservative – 1.2-5.3% discount rate and 1.3-7.5% expected return)

Sales and margins have declined in the past two years. The major factors for this have been:

- the Great Recession,

- the strengthening yen,

- the competition catching up in the controller race,

- the Wii’s movement towards the decline phase of its lifecycle.

The problematic launch (high price and lack of titles) of the 3DS only added insult to injury. Finally, facing tougher competition in the market for controllers from Sony and Microsoft puts a big question mark on how the Wii U, which relies on a conceptually new controller, will fare. All this has caused the market to overreact. The volatility in the past couple of weeks further fueled the downtrend.

Right now it would be good for investors to remember that Nintendo is the creator of three of the best-selling consoles of all time: DS, Wii, and GameBoy. The top five is rounded by Sony’s PlayStation and PlayStation 2. Despite the competitive threats, Nintendo is still coming up with innovative products. The company was the first to embrace the strategy of gaming population expansion, which was later emulated by others. All of the above speaks to management’s abilities.

Apart from consoles, Nintendo holds the rights to some of the best video game franchises of all time: Donkey Kong, Mario, Zelda, and the various Wii sports games. While the Wii sports titles can easily be substituted for similar products by the competitors should they offer a better experience through their controllers, franchises like Super Mario and The Legend of Zelda have a solid following. They have been around for the past quarter of a century and will continue to be around for quite some time.

Besides, the competition is grappling with problems of its own. Sony is suffering from a lack of focus typical for conglomerates. Microsoft is trying to realize its potential in a hit-and-miss fashion. Both companies merit thorough analysis which is beyond the scope of this report.

Furthermore, all three companies are up against the omnipresent Apple, whose products, some people tend to be lulled into thinking, will substitute any other piece of consumer electronics out there. I have my doubts.

The Numbers Add Up

The charts below draw Nintendo’s picture over the last 10 years. It is clear that in the past two years things have not been going too well for the company. However, the question is whether it deserves such massive discounting of its profitable, long-standing franchises and management abilities.

The decreasing sales and profitability are obvious. But what is a sustainable level for the company? Much depends on how the Wii U will do against the competition and how quickly Nintendo comes up with new titles for the 3DS, although it might have badly missed the opportunity to capitalize on its introduction.

Even if Nintendo doesn’t do any better than before the introduction of the Wii and the DS, the market seems to be pricing a rather grim future for the company. And while this will most probably be the case once the cloud engulfs us all, there may still time to make a buck.

Based on average 10-year free cash flows of ¥143 billon and a modest (10x) to normal (15x) multiple, Nintendo is worth between ¥1.43 and ¥2.14 trillion. With 127,879,069 shares outstanding, the per share amounts are ¥11,180 and ¥16,770. The company has ¥1.17 trillion or ¥9,160 per share in cash and short-term investments. NCAV is ¥1.12 trillion or ¥8,720 per share.

As of Friday, Aug. 14, 2011, Nintendo was selling for ¥10,900 on the Tokyo Stock Exchange, number 7974. For U.S. investors there are unsponsored ADRs trading on the OTC market under the symbol NTDOY, representing 1/8 of a share, selling at $17.87.

The company is selling a little below the lower end of the valuation and only 25% over liquidation value. I don’t see Nintendo liquidating any time soon. So, at this price and below, I think it’s a buy.

Disclosure: No positions in the companies discussed.