The S&P 500 Index currently trades with a price-earnings multiple in the high 30s. Therefore, it is hardly surprising that investors looking for value are having a difficult time finding stocks with a reasonable price-earnings ratio, which could put a lid on potential returns.

We will look at three names that all trade below their intrinsic value as calculated by GuruFocus. Each stock discussed has the potential to provide approximately 10% or more in terms of total return when combining possible share price appreciation and dividend yield.

Clorox

The Clorox Co. (CLX, Financial) is a leading provider of consumer and professional products. The company operates four business segments, including Cleaning, which houses the Clorox line of cleaners, PineSol and Liquid-Plumr, Bags and Wraps such as Glad, Food, which contains Brita, Hidden valley and Burt's Bees, and Grilling, which includes Kingsford. Clorox also has a large other segment, which contributes approximately a quarter of all sales. The company has a market capitalization of nearly $23 billion and generated revenue $7.5 billion over the last four quarters.

Clorox has compounded its earnings per share at a rate of almost 14% over the last decade, with most of the growth occurring in the first half of this period. However, the Covid-19 pandemic has been a significant tailwind to Clorox's results in the most recent fiscal year (the company's fiscal year ends Jue 30) due to increased demand for cleaning. Fiscal year 2020 earnings per share grew 16.5%.

Even with a pre-Covid slowdown in earnings growth, Clorox's lineup of household products has enabled it to grow its dividend for a considerable amount of time. Following a 4.7% dividend increase for the Aug. 14, 2020 payment, Clorox extended its dividend growth steak to 43 years. The dividend has a compound annual growth rate of 6.5% over the last 10 years.

Clorox has an annualized dividend payment of $4.44. With Wall Street analysts expecting $7.60 of earnings per share for the fiscal 2021, the payout ratio is a very reasonable 58%. Excluding the unusually high payout ratio in 2011 that resulted from a severe decrease in earnings per share, Clorox has an average payout ratio of 54% over the last decade.

Shares yield 2.5% based on Monday's closing price of $180.66, matching the five-year average yield exactly, but coming in below the 10-year average yield of 2.9%.

Using the most recent closing price and expected earnings per share for the fiscal year, Clorox has a forward price-earnings ratio of 23.4. Again excluding 2011, Clorox has a long-term average price-earnings ratio of 21.7. The valuation is currently above this level, but the premium appears warranted given how well the company has performed during the pandemic.

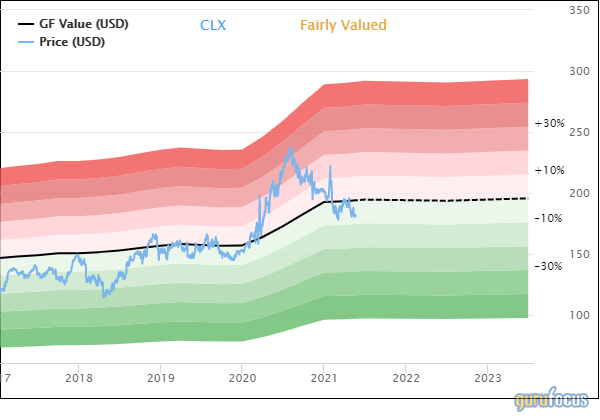

GuruFocus believes the stock is trading below its intrinsic value. As a reminder, GuruFocus uses historical multiples, past returns and growth and future estimates to determine the GF Value.

Clorox has a GF Value of $194.13, resulting in a price-to-GF Value of 1.07, earning the stock a rating of fairly valued. Shares would return 7.5% were they to trade with their GF Value.

Add in the dividend yield and the total return could reach almost 10%. This would be a solid return for Clorox, considering the demand for its products as well as the company's lengthy track record of dividend growth.

Gilead

Gilead Sciences Inc. (GILD, Financial) is a leading biotechnology company that focuses on antiviral medication and treatments. The company is best known for its Hepatitis C and HIV line of treatments. Gilead produced revenue of almost $26 billion in 2020 and is currently valued at $90 billion.

Gilead has been a victim of its own success in some ways. Its HCV drugs were very effective at curing different strands of Hepatitis, leading to a drastically reduced patient pool. After peaking in 2015, adjusted earnings per share fell five consecutive years. Growth did return last year as adjusted earnings per share improved 7%, due in part to the use of Remdesivir as a treatment option for Covid-19 patients. The company also has invested in research and development and has some promising immunotherapeutic treatments.

While the business has faced headwinds, the company has been rather aggressive in growing its dividend. Since its initiation in 2015, Gilead's dividend has a compound annual growth rate of 12%. Most recently, shareholders received a 4.4% increase for the payment made March 30. This raise gives Gilead six consecutive year of dividend growth.

The annualized dividend of $2.84 is projected to consume just 40% of Gilead's expected adjusted earnings per share of $7.06 this year. This is above the five-year average payout ratio of 31%, but not to the point where a dividend cut appears imminent. The stock yields 4.2%, topping the five-year average yield of 3.5%.

Gilead closed the most recent trading session at $68.50, resulting in a forward price-earnings ratio of 9.7. The stock's valuation has been fairly volatile over the last 10 years, with a range in the high single digits all the way the low 30s. The average valuation over this period of time is 14.6.

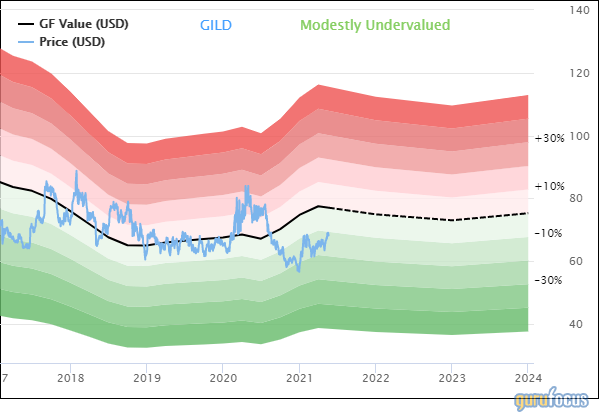

Gilead also looks undervalued when considering its GF Value.

The stock has a GF Value of $77.06 today. Using the current price, Gilead had a price-to-GF Value of 0.89. The stock is rated as modestly undervalued by GuruFocus. Those buying at the latest price would see a 12.5% return on their investment were the stock to reach its GF Value. With the dividend, total returns could be in the mid-double digits.

The market has clearly penalized Gilead for the effectiveness of its HCV portfolio over the past few years, but the company does have a successful HIV portfolio and other products in its pipeline. Shares trade at a discount both to their historical average and intrinsic value. At the same time, investors are being paid to wait for future growth and the dividend is well covered. Those with a longer-term view could do well owning Gilead at the current level.

Old Republic

Old Republic International Corp. (ORI, Financial) is a insurance company that markets, underwrites and manages a range of specialty and general insurance products. The company's products include life, title, property and liability and disability insurance. The company is valued at $7.8 billion and had revenue of $8.3 billion last year.

Insurance is often thought of as a boring business and it can be, until disasters disrupt results. The last decade has seen numerous events that have led to higher claims payouts. The company did earn $2.24 per share last year and earnings per share have compounded at a rate of 8.8% over the past five years. Adjusting for a growing share count, net profit has improved at a 10.2% annual rate since 2016.

Old Republic increased its dividend 4.8% for the March 9 payment, giving the insurance company four decades of dividend growth. Dividend growth has been minimal over the last decade, with a CAGR of just 1.8%. On the other hand, shareholders have also received a $1 special dividend in three out of the past four years.

Not including the special dividend, Old Republic shareholders should see 88 cents of dividends in 2021. Analysts expect earnings per share of $2.33 for the year, leading to an expected payout ratio of 38%. This is below the long-term average payout ratio of 56%.

Old Republic yields 3.4% at the moment, which is much better than the average yield for the market index. At the same time, this is below the stock's 10-year average yield of 4.8%.

Shares have traded hands with an average price-earnings ratio of 13 since 2013. With the stock trading at $26.09 today, the stock has a forward price-earnings ratio of 11.2 based on analysts' estimates.

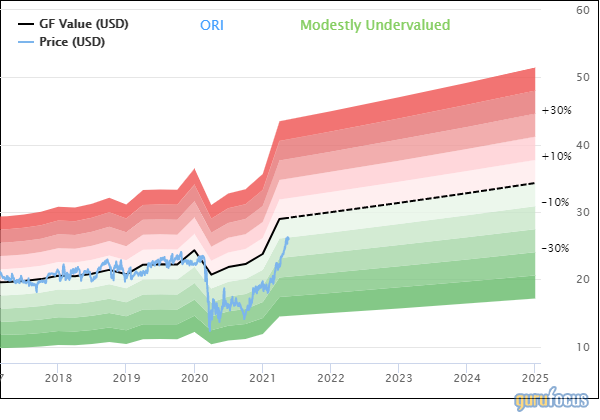

The stock price is also below its intrinsic value.

With a GF Value of $29.15, Old Republic has a price-to-GF Value of 0.90. The stock is rated as modestly undervalued and could return 11.7% if it reached its GF Value. As with Gilead, total returns would push into the double-digits when factoring in the dividend yield.

Old Republic has a very long dividend growth streak in an industry that can be prone to wild swings due to unforeseen disasters impacting the number of claims paid out. However, the stock has managed to raise its dividend for 40 years even in the face of this volatility. The special dividends, though somewhat rare long term, are also an added bonus. Investors looking for a solid yield and a well-covered dividend in the insurance industry could do well owning Old Republic.

Final thoughts

Finding decent value remains challenging today, but there are stocks to be bought. Clorox, Gilead and Old Republic all trade either close to or below their historical valuations. Each name also trades below their respective intrinsic values. Combining possible growth from reaching the GF Value and the dividend yield all could produce a total return of roughly 10% or more. This is a solid return considering the valuation of the market.

Disclosure: The author has no position in any stocks mentioned in this article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.