Wal-Mart Stores, Inc. (WMT, Financial) is one of the largest retailers in the world, and a shareholder friendly company.

-Four year average revenue growth: 6%

-Four year average income growth: 8%

-Four year average EPS growth: 11%

-Four year average cash flow growth: 6%

-Dividend Yield: 2.76%

-Dividend Growth Rate: 17%

Although the company has seen some disappointing numbers, I find the current Walmart (WMT) stock valuation at approximately $53 per share to be reasonably attractive for decent risk-adjusted returns.

Walmart is a rather infamous business. It’s criticized for destroying ma and pa businesses, for harsh and discriminatory employee treatment, and for selling mostly inexpensive imported goods. On the other hand, Walmart has used its scale to help save consumers money on everyday items. When hurricane Katrina struck the United States, Walmart used its enormous and efficient logistics system to provide supplies and aid, along with money, faster than the US federal government could respond.

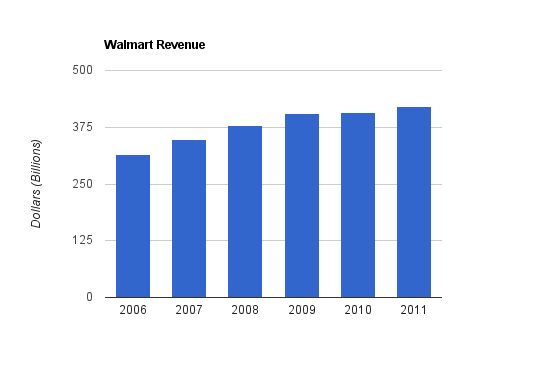

Over this time period, WMT has grown revenue by an average of 6% per year.

Over this time period, WMT has grown earnings by an average of 8% annually.

Over the same period, EPS increased by nearly 11% annually due to share repurchases.

WMT has grown cash flow by approximately 6% per year on average over this time period.

Price to FCF: 15.2

Price to Book: 2.7

Return on Equity: 23%

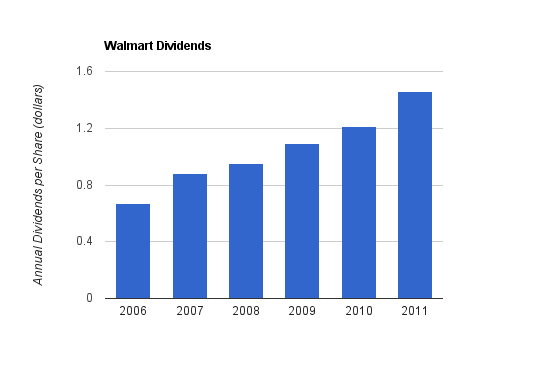

WMT has grown their dividend by an average of nearly 17% over this time period, which is very good. The current dividend yield is 2.76%, among the highest yield that Walmart stock has recently offered, though still mediocre compared to many other dividend stocks. The increase for 2011 was over 20%.

Walmart should provide substantial dividend growth for years to come, but can’t keep the growth rate at 17% or so indefinitely. In the long-run, as the payout ratio increases, the company will only be able to grow its dividend sustainably at a rate that matches EPS growth. Currently that’s under 11%.

Wal-Mart could be paying a considerably larger dividend if management used less money for share repurchases. But doing share repurchases reserves dividend flexibility for the company, since they keep the payout ratio low and so dividend increases are large and reliable. It also boosts EPS, which can eventually boost the stock price, which looks good for executive performance. All in all, the share repurchases aren’t a bad thing for investors that would be reinvesting their dividends into WMT stock anyway, since it reduces dividend taxes, but it is unhelpful for investors that want to spend dividends or that want more control over their investment choices by having a larger dividend to choose to invest or not.

The main growth area for WMT will rely outside of the United States. Walmart has 3,804 retailer locations in the United States and 4,557 locations in other countries (accounting for $260 billion and $109 billion in sales, respectively), along with 609 Sam’s Club locations (accounting for $49 billion in sales). Non-US stores are typically smaller, since despite having more locations worldwide, the international segment only has 287 million square feet of space while the US domestic segment has 617 million. Their number of locations internationally grew by 7.8% last year, and sales grew by 12.1%. Although ethical or economic questions may arise as to whether something like Walmart should continue to grow, there is basically nothing stopping it from doing so. Their business is straightforward, they generate tons of cash, and they can use that cash to open or acquire new locations in places around the globe. The scalability of this industry is nearly limitless as long as a competitive advantage is established and maintained.

Another form of growth is for Walmart to offer different services in the US. It is growing its online retail business to offer alternatives to competitors like Amazon, and now that it has acquired Vudu, it’s in the business of offering streaming videos. If Walmart can apply the same scale to other businesses as they can their brick and mortar retail business, then they may be able to expand revenue and income in the United States for a great deal of time to come. Alternatively, these side businesses may fail, or distract, from the core business, or may cannibalize from primary store sales.

In addition, WMT is recession-resistant. In some ways, it even does well in a recession as consumers flock to cheaper options. The company has also been improving the quality of some of its stores to cater to a different demographic group.

Walmart constitutes much of the wealth of the Walton family, so shareholder growth is aligned with management objectives. It’s good to find companies that are at least partially family owned, since management is likely to be especially aligned with the interest of shareholders.

Although it’s difficult for such a large company to grow at a rate that is appealing for investors, WMT seems to offer a reliable and steady growth story combined with dividends and share repurchases to offer a pretty good value. At the current time, the stock has a P/E of only around 12. It seems as though Walmart’s stock, along with everything they sell, is at a fairly low price. In comparison, Costco is trading with a P/E of 24. Although I think Costco deserves a higher multiple, I think Walmart represents the better value at the current time.

Walmart’s international business operations have not enjoyed the same consistency and success as the early expansion in the US. Growth is robust, and should continue to post good numbers, but the company hasn’t been able to generate the domestic efficiency on a worldwide basis. And on the domestic side, over the last two years, comparable same-store sales have decreased.

Revenue growth has slowed recently, and online competitors threaten to undermine the business model, at least to a certain extent. Continued growth for the company will have to come from successful international expansion and defensive positioning in the US, such as through strengthening of the online business and keeping physical locations as relevant as possible. Side businesses like video streaming, if performed well, can add some profitability, but they aren’t the growth drivers.

In addition, Walmart faces some pretty harsh criticism. They are viewed negatively when it comes to treating their employees well, and also have faced numerous charges of gender discrimination. Their rival Costco is known for taking much better care of their employees, and that can go a long way.

Full Disclosure: I do not own WMT stock at the time of this writing.

-Four year average revenue growth: 6%

-Four year average income growth: 8%

-Four year average EPS growth: 11%

-Four year average cash flow growth: 6%

-Dividend Yield: 2.76%

-Dividend Growth Rate: 17%

Although the company has seen some disappointing numbers, I find the current Walmart (WMT) stock valuation at approximately $53 per share to be reasonably attractive for decent risk-adjusted returns.

Overview

Everyone knows Walmart. Founded in Arkansas in 1962 by Sam Walton, Walmart is now one of the largest companies in the world, with revenue of over $400 billion and with more than 2 million employees. They have stores under a variety of brands in 15 countries around the world. In addition to being a massive retailer, it’s the largest seller of groceries in the United States. Walmart also owns Sam’s Club, which is a membership warehouse much like Costco that offers bulk products for a reduced cost to people that pay for a membership.Walmart is a rather infamous business. It’s criticized for destroying ma and pa businesses, for harsh and discriminatory employee treatment, and for selling mostly inexpensive imported goods. On the other hand, Walmart has used its scale to help save consumers money on everyday items. When hurricane Katrina struck the United States, Walmart used its enormous and efficient logistics system to provide supplies and aid, along with money, faster than the US federal government could respond.

Revenue, Income, Cash Flow, and Metrics

Walmart’s fiscal year ends in January, so for instance when they report numbers for 2011, the numbers are really for 2010.Revenue Growth

| Year | Revenue |

|---|---|

| 2011 | $421.8 billion |

| 2010 | $408.2 billion |

| 2009 | $405.6 billion |

| 2008 | $378.8 billion |

| 2007 | $348.6 billion |

| 2006 | $315.6 billion |

Income Growth

| Year | Income |

|---|---|

| 2011 | $16.4 billion |

| 2010 | $14.3 billion |

| 2009 | $13.4 billion |

| 2008 | $12.7 billion |

| 2007 | $11.3 billion |

| 2006 | $11.2 billion |

Over the same period, EPS increased by nearly 11% annually due to share repurchases.

Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2011 | $23.6 billion |

| 2010 | $26.2 billion |

| 2009 | $23.1 billion |

| 2008 | $20.3 billion |

| 2007 | $20.1 billion |

| 2006 | $17.6 billion |

Metrics

Price to Earnings: 12Price to FCF: 15.2

Price to Book: 2.7

Return on Equity: 23%

Dividends

Walmart currently has a dividend yield of 2.76%. The company has a long history of consecutive annual dividend increases stretching back to 1974, and currently has a payout ratio of under 35%.Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.46 |

| 2010 | $1.21 |

| 2009 | $1.09 |

| 2008 | $0.95 |

| 2007 | $0.88 |

| 2006 | $0.67 |

Walmart should provide substantial dividend growth for years to come, but can’t keep the growth rate at 17% or so indefinitely. In the long-run, as the payout ratio increases, the company will only be able to grow its dividend sustainably at a rate that matches EPS growth. Currently that’s under 11%.

Share Repurchases

WMT repurchases a varying amount of shares each year. Their total share repurchases over many of the recent years have exceeded dividend payouts, showing that WMT is redirecting most of its income to shareholders. Repurchasing shares when the P/E is 12 helps fuel EPS and dividend growth, but the rate of return is mediocre. Stretching back for at least a decade, Walmart has increased the EPS every year, in part because of the reliability of share repurchases.Wal-Mart could be paying a considerably larger dividend if management used less money for share repurchases. But doing share repurchases reserves dividend flexibility for the company, since they keep the payout ratio low and so dividend increases are large and reliable. It also boosts EPS, which can eventually boost the stock price, which looks good for executive performance. All in all, the share repurchases aren’t a bad thing for investors that would be reinvesting their dividends into WMT stock anyway, since it reduces dividend taxes, but it is unhelpful for investors that want to spend dividends or that want more control over their investment choices by having a larger dividend to choose to invest or not.

Balance Sheet

WMT currently sports a moderately solid balance sheet. The total debt/equity ratio is 0.68. Goodwill is only a small portion of shareholder equity. The interest coverage ratio is over 11. Walmart seems to be somewhat aggressively but appropriately leveraged, which keeps the ROE high and fuels growth, while the company remains stable.Investment Thesis

It’s important to invest in companies that have durable competitive advantages over their rivals, and WMT is that sort of company. Due to Walmart’s immense size, they can purchase products in enormous quantities for very low prices, and then pass those low prices to their customers, thereby beating the prices of most rival retailers. This creates a catch-22, or a negative loop, for rival companies, because in order to grow in size they need customers, but Walmart draws customers away from them with their lower prices, and these rivals can’t usually match those prices because they aren’t large enough. In order to compete with Walmart, companies have to find new ways to offer low prices. Online retailers can cut costs by eliminating many expenses associated with a brick-and-mortar business. Costco derives most of its income with its membership fees, and therefore sells its products at nearly the same price it purchased them in order to try to keep prices low. A company like Costco can put up with very low profit margins over a significant period of time in order to gradually grow and pierce the competitive shield of Walmart. Still, Walmart is indeed in a very strong and difficult-to-shake position among retailers.The main growth area for WMT will rely outside of the United States. Walmart has 3,804 retailer locations in the United States and 4,557 locations in other countries (accounting for $260 billion and $109 billion in sales, respectively), along with 609 Sam’s Club locations (accounting for $49 billion in sales). Non-US stores are typically smaller, since despite having more locations worldwide, the international segment only has 287 million square feet of space while the US domestic segment has 617 million. Their number of locations internationally grew by 7.8% last year, and sales grew by 12.1%. Although ethical or economic questions may arise as to whether something like Walmart should continue to grow, there is basically nothing stopping it from doing so. Their business is straightforward, they generate tons of cash, and they can use that cash to open or acquire new locations in places around the globe. The scalability of this industry is nearly limitless as long as a competitive advantage is established and maintained.

Another form of growth is for Walmart to offer different services in the US. It is growing its online retail business to offer alternatives to competitors like Amazon, and now that it has acquired Vudu, it’s in the business of offering streaming videos. If Walmart can apply the same scale to other businesses as they can their brick and mortar retail business, then they may be able to expand revenue and income in the United States for a great deal of time to come. Alternatively, these side businesses may fail, or distract, from the core business, or may cannibalize from primary store sales.

In addition, WMT is recession-resistant. In some ways, it even does well in a recession as consumers flock to cheaper options. The company has also been improving the quality of some of its stores to cater to a different demographic group.

Walmart constitutes much of the wealth of the Walton family, so shareholder growth is aligned with management objectives. It’s good to find companies that are at least partially family owned, since management is likely to be especially aligned with the interest of shareholders.

Although it’s difficult for such a large company to grow at a rate that is appealing for investors, WMT seems to offer a reliable and steady growth story combined with dividends and share repurchases to offer a pretty good value. At the current time, the stock has a P/E of only around 12. It seems as though Walmart’s stock, along with everything they sell, is at a fairly low price. In comparison, Costco is trading with a P/E of 24. Although I think Costco deserves a higher multiple, I think Walmart represents the better value at the current time.

Risks

Walmart, like any other company, has risks. When all is said and done, Walmart is really just a middle-man, buying products of others and selling them to you. They are vulnerable to changes in consumer demand.Walmart’s international business operations have not enjoyed the same consistency and success as the early expansion in the US. Growth is robust, and should continue to post good numbers, but the company hasn’t been able to generate the domestic efficiency on a worldwide basis. And on the domestic side, over the last two years, comparable same-store sales have decreased.

Revenue growth has slowed recently, and online competitors threaten to undermine the business model, at least to a certain extent. Continued growth for the company will have to come from successful international expansion and defensive positioning in the US, such as through strengthening of the online business and keeping physical locations as relevant as possible. Side businesses like video streaming, if performed well, can add some profitability, but they aren’t the growth drivers.

In addition, Walmart faces some pretty harsh criticism. They are viewed negatively when it comes to treating their employees well, and also have faced numerous charges of gender discrimination. Their rival Costco is known for taking much better care of their employees, and that can go a long way.

Conclusion and Valuation

Overall, WMT seems to be a healthy and growing large company with a low valuation. The stock may deserve placement as a fairly conservative pick in a dividend-growth portfolio. In my opinion, the stock represents a fairly good value while it remains in the low-to-mid $50s. The business is highly scalable, and if the company can defend its domestic businesses and continue to grow at a reasonable pace internationally, while all the while generating substantial free cash flows used to pay dividends and buy back inexpensive shares, shareholder returns should be healthy and consistent. Due to the predictability of dividends and buybacks, WMT currently grows dividends and EPS like clockwork.Full Disclosure: I do not own WMT stock at the time of this writing.