Howard Marks (Trades, Portfolio)’ Oaktree Capital Management has revealed a large addition to its position in Oaktree Special Lending Corp. (OCSL, Financial) according to GuruFocus’ Real-Time Picks, a Premium feature.

Since the formation of Oaktree in 1995, Marks has been responsible for ensuring the firm's adherence to its core investment philosophy, communicating closely with clients concerning products and strategies and managing the firm. Oaktree is involved in less efficient markets and alternative investments. The firm invests heavily in debt, preferred stocks and convertible bonds.

On May 21, the firm leaned into its Oaktree Special Lending (OCSL, Financial) holding with the addition of 524,143 shares to grow the position by 189.91%. The addition of shares marks the first time the position has changed within the firm’s portfolio since it was established in the fourth quarter of 2017. On the day of the change, the shares traded at an average price of $6.69. The addition had an overall impact of 0.06% on the portfolio and GuruFocus estimates the firm has gained 9.03% on the holding.

Oaktree Specialty Lending is a specialty finance company. It provides lending services and invests in small and mid-sized companies. The company's investment objective is to maximize its portfolio's total return by generating current income from debt investments and, to a lesser extent, capital appreciation from equity investments. Its investments generally range in size from $10 million to $100 million and are principally in the form of the first lien, second lien or collectively, senior secured and subordinated debt investments, which may also include an equity component made in connection with investments by private equity sponsors.

As of June 4, the stock was trading at $6.78 per share with a market cap of $1.22 billion. According to the Peter Lynch Chart, the stock is trading well below intrinsic value.

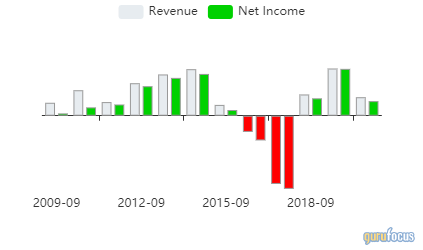

GuruFocus gives the company a financial strength rating of 2 out of 10 and a profitability rank of 2 out of 10. There is currently one severe warning sign issued for poor financial strength. The company was showing promising growth in revenue and net income after it was purchased by Oaktree in 2017, but fell back off in 2020 amidst the pandemic.

Top shareholders of the company include River Road Asset Management, LLC (Trades, Portfolio), Rivernorth Capital Management, LLC (Trades, Portfolio) and Private Management Group Inc. (Trades, Portfolio).

Portfolio overview

As of June 4, the firm’s portfolio contained 61 stocks, with eight new holdings. It was valued at $6.03 billion and has seen a turnover rate of 19%. Top holdings in the portfolio include Star Bulk Carriers Corp. (SBLK, Financial), Vistra Corp. (VST, Financial), Chesapeake Energy Corp. (CHK, Financial), Ally Financial Inc. (ALLY, Financial) and Torm PLC (TRMD, Financial).

By weight, the top three sectors represented are energy (21.19%), financial services (16.77%) and industrials (13.54%).