According to the GuruFocus All-In-One Screener, a Premium feature, the following energy companies were trading with low price-sales ratios as of June 10.

REX American Resources

Shares of REX American Resources Corp. (REX) were trading around $92.85 with a price-sales ratio of 1.24 and a price-earnings ratio of 30.44.

The holding company has a $556.36 million market cap. The share price has risen at an annualized rate of 19.44% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $45.03, suggesting it is overpriced by 106%.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)’ Renaissance Technology with 6.58% of outstanding shares, followed by HOTCHKIS & WILEY with 0.92% and Paul Tudor Jones (Trades, Portfolio) with 0.06%.

Transportadora de Gas

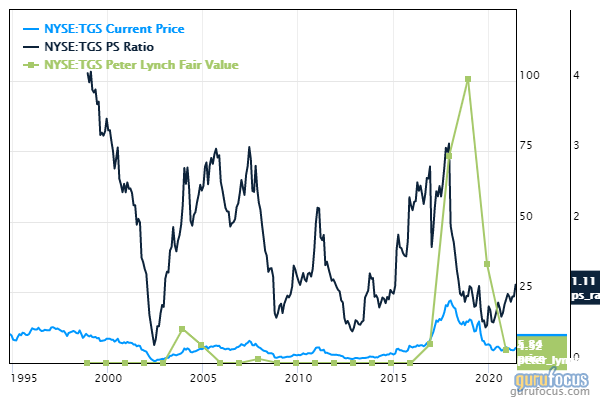

On Thursday, Transportadora de Gas del Sur SA (TGS) was trading around $5.36 with a price-sales ratio of 2.32 and a price-earnings ratio of 41.62.

One of the largest transporters of natural gas in Latin America has a market cap of $805.46 million. The stock has risen at an annualized rate of 8.07% over the past 10 years.

The discounted cash flow calculator gives the stock a fair value of $3.82, suggesting it is overpriced by 39.79%.

With a 1.32% stake, Howard Marks (Trades, Portfolio) is the company's largest guru shareholder, followed by Simons’ firm with 0.04%.

Global Partners

Global Partners LP (GLP) was trading around $26.86 on Thursday with a price-sales ratio of 0.11 and a price-earnings ratio of 10.73.

The U.S. company, which operates as a midstream logistics and marketing company, has a market cap of $911.59 million. The stock has risen at an annualized rate of 6.95% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $36.90, suggesting it is undervalued with a 27.56% of margin of safety.

North American Construction

North American Construction Group Ltd. (NOA) was trading around $14.14 with a price-sales ratio of 1.19 and a price-book ratio of 10.89.

The Canadian company, which contracts heavy civil construction and mining, has a market cap of $400.31 million. The stock has risen at an annualized rate of 6.98% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $17.99, suggesting it is undervalued with a 21.62% margin of safety.

With a 1.89% stake, Simons’ firm is the company's largest guru shareholder, followed by Chuck Royce (Trades, Portfolio) with 0.18%.

Vertex Energy

Vertex Energy Inc. (VTNR) shares were trading around $7.86 with a price-sales ratio of 2.45.

The environmental services company has a $426.62 million market cap. The share price has risen at an annualized rate of 16.09% over the past decade.

The company's largest guru shareholder is Simons’ firm with 1.40% of outstanding shares.