The nonsense where board of directors, chock full of CEOs and C-level executives from various companies, set the pay of other CEOs, has long been a pet peeve project. I used to write a lot more stories about the subject but essentially have given up the ghost.

As repeated countless times, if all company employees had their pay determined this way (a board of IT folk at 10 peer companies set the pay packages of the IT department, a board of HR folk at 10 peer companies set the pay packages of the HR department, etc) just about every company would be bankrupt within a few years, as human nature took over. But since it's just the top position where pay is set this way, it's more easily absorbed on the P&L. Therefore, the ratio of CEO pay to common worker bee has exploded from something like 40:1 in the 70s to 300:1 nowadays.

Of course we are not even discussing the signing bonuses, perks, option grants, and 'bonuses' for being fired ... err, to spend more time with the family. Somehow, executives of multinationals in Germany and Japan and other countries are able to lead their companies at far lower pay rates (and ratios versus the worker bees)- but I guess they just are not very talented people.

The Washington Post (with Bloomberg) takes a look at the country where every public company CEO is 'above average'.

Mark's note - Again, think about how this would work in the rank and file - if the 'board of directors' for your IT department said to retain talent the IT folk had to be paid above the median.... and then EVERY public company in America... or at least 90% of them... had the same view, what would happen to IT wages across the country? Then extrapolate that thinking to HR, accounting, sales, marketing, finance, R&D, engineering. Labor costs would overwhelm the company (and all companies competing in this rat race of nonsense) and they'd be going BK. It would be an outrageous concept at the worker bee level - but it is ok in the C-suite.

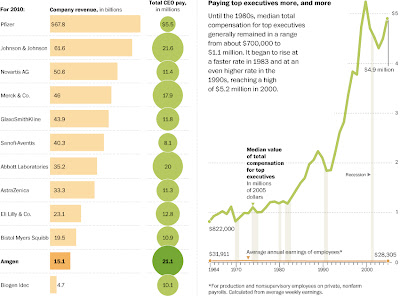

[click to enlarge]

Mark's note - So take the example of peers at 10 other companies setting the pay of yourself, and then narrow it further to say 5 of those 10 peers are personal friends. Imagine how ludicrous that would sound if you walked into the office of your boss and you explained that is how your compensation should be set... "look I can find 10 peers at other companies who do my kind of work, indeed I am personal friends with 5 of them - they know what I am worth. Err, and that's 75% percentile or higher. And by the way when those 10 people go to their companies and get their pay package set, they will of course be consulting me in return. And they are certainly worth 75% percentile or higher as well." You'd be laughed out of the room. But this is essentially the crony capitalism system we employ at the top.

The rest of the story mostly focuses on Amgen, but you get the point.

As repeated countless times, if all company employees had their pay determined this way (a board of IT folk at 10 peer companies set the pay packages of the IT department, a board of HR folk at 10 peer companies set the pay packages of the HR department, etc) just about every company would be bankrupt within a few years, as human nature took over. But since it's just the top position where pay is set this way, it's more easily absorbed on the P&L. Therefore, the ratio of CEO pay to common worker bee has exploded from something like 40:1 in the 70s to 300:1 nowadays.

Of course we are not even discussing the signing bonuses, perks, option grants, and 'bonuses' for being fired ... err, to spend more time with the family. Somehow, executives of multinationals in Germany and Japan and other countries are able to lead their companies at far lower pay rates (and ratios versus the worker bees)- but I guess they just are not very talented people.

The Washington Post (with Bloomberg) takes a look at the country where every public company CEO is 'above average'.

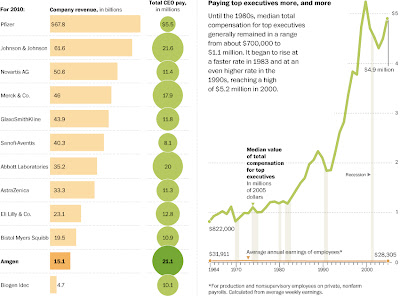

- As the board of Amgen convened at the company’s headquarters in March, chief executive Kevin W. Sharer seemed an unlikely candidate for a raise. Shareholders at the company, one of the nation’s largest biotech firms, had lost 3 percent on their investment in 2010 and 7 percent over the past five years. The company had been forced to close or shrink plants, trimming the workforce from 20,100 to 17,400. And Sharer, a 63-year-old former Navy engineer, was already earning lots of money — about $15 million in the previous year, plus such perks as two corporate jets.

- The board decided to give Sharer more. It boosted his compensation to $21 million annually, a 37 percent increase, according to the company reports. Why? The company board agreed to pay Sharer more than most chief executives in the industry — with a compensation “value closer to the 75th percentile of the peer group,” according to a 2011 regulatory filing.

- This is how it’s done in corporate America. At Amgen and at the vast majority of large U.S. companies, boards aim to pay their executives at levels equal to or above the median for executives at similar companies.

- The idea behind setting executive pay this way, known as “peer benchmarking,” is to keep talented bosses from leaving. But the practice has long been controversial because, as critics have pointed out, if every company tries to keep up with or exceed the median pay for executives, executive compensation will spiral upward, regardless of performance. Few if any corporate boards consider their executive teams to be below average, so the result has become known as the “Lake Wobegon” effect.

- It wasn’t until recently, however, that its pervasiveness and impact on executive pay became clear. Companies have long hid the way they set executive pay, but in late 2006, the Securities and Exchange Commission began compelling companies to disclose the specifics of how they use peer groups to determine executive pay.

- Since then, researchers have found that about 90 percent of major U.S. companies expressly set their executive pay targets at or above the median of their peer group.

Mark's note - Again, think about how this would work in the rank and file - if the 'board of directors' for your IT department said to retain talent the IT folk had to be paid above the median.... and then EVERY public company in America... or at least 90% of them... had the same view, what would happen to IT wages across the country? Then extrapolate that thinking to HR, accounting, sales, marketing, finance, R&D, engineering. Labor costs would overwhelm the company (and all companies competing in this rat race of nonsense) and they'd be going BK. It would be an outrageous concept at the worker bee level - but it is ok in the C-suite.

[click to enlarge]

- Moreover, the jump in pay because of peer benchmarking is significant. A chief executive’s pay is more influenced by what his or her “peers” earn than by the company’s recent performance for shareholders, (which goes against everything these boards say - i.e. 'we want the CEO pay to be aligned with shareholders returns blah blah) according to two independent research efforts based on the new disclosures. “Peer benchmarking has a significant influence on CEO pay,” Bizjak said. “Basically, you can’t have every CEO paid above average without pay ratcheting upward over time.”

- The gap between what workers and top executives make helps explain why income inequality in the United States is reaching levels unseen since the Great Depression. Since the 1970s, median pay for executives at the nation’s largest companies has more than quadrupled, even after adjusting for inflation, according to researchers. Over the same period, pay for a typical non-supervisory worker has dropped more than 10 percent, according to Bureau of Labor statistics. (now to be fair, the type of globalized companies, some of these CEOs manage, have become more complicated, and pay going up to compensate for that makes sense. But 4x as much as the 70s? Further, many public CEOs are not of the multinational type)

- Even before the extent of the practice was known, it drew criticism from prominent business figures. After the Enron scandals, a blue-ribbon committee led by Peter G. Peterson, then chairman of the Federal Reserve Bank of New York, and John Snow, former chairman of the Business Roundtable, called for setting executive pay “unconstrained by median compensation statistics.”

- Legendary investor Warren Buffett, in one of his famously plain-spoken letters to investors, likewise derided the method. “Outlandish ‘goodies’ are showered upon CEOs simply because of a corporate version of the argument we all used when children: ‘But, Mom, all the other kids have one,’” he wrote.

- The practice has persisted because corporate board members, many of whom have personal or business relationships with the chief executive, (you scratch my back, I scratch yours) have been unwilling to abandon the practice. At Amgen, for example, four of the six members of the board compensation committee had personal or business connections to Sharer before joining the board. In fact, he nominated at least two of the six to the board, according to a company source and reports.

- These kinds of ties — between chief executives and the boards that oversee them — permeate corporate America. On a typical board, the chief executive considers about about 33 percent of the board of directors as “friends” rather than as mere “acquaintances,”according to a survey of chief executives at about 350 S&P 1500 corporations conducted over 15 years by University of Michigan business professor James Westphal.

- More tellingly, the chief executive is likely to find even more friends on the compensation committees of corporate boards — almost 50 percent.

Mark's note - So take the example of peers at 10 other companies setting the pay of yourself, and then narrow it further to say 5 of those 10 peers are personal friends. Imagine how ludicrous that would sound if you walked into the office of your boss and you explained that is how your compensation should be set... "look I can find 10 peers at other companies who do my kind of work, indeed I am personal friends with 5 of them - they know what I am worth. Err, and that's 75% percentile or higher. And by the way when those 10 people go to their companies and get their pay package set, they will of course be consulting me in return. And they are certainly worth 75% percentile or higher as well." You'd be laughed out of the room. But this is essentially the crony capitalism system we employ at the top.

- Moreover, the effects of his raises are not limited to Amgen. In fact, because of peer benchmarking, raises at one company have ripple effects across corporate America: Thirty-seven other companies name Amgen as a “peer,” including Wal-Mart, MasterCard and Time-Warner, as well as other drug companies, according to Equilar. Next year, at those companies that use Amgen as a peer, Sharer’s new compensation package will be used as a benchmark, propelling executive pay upward.

The rest of the story mostly focuses on Amgen, but you get the point.