Each of these three equities trades at below book value. Each one pays a dividend and trades on the New York Stock Exchange, so there’s plenty of financial information available if you want to look into it.

Risk considerations apply: stocks trade at less than book value because they’re being avoided generally for a reason. On the other hand, such issues tend to show up on the screens of large investors looking for buyout candidates or for simple basic value.

ARC Document Solutions

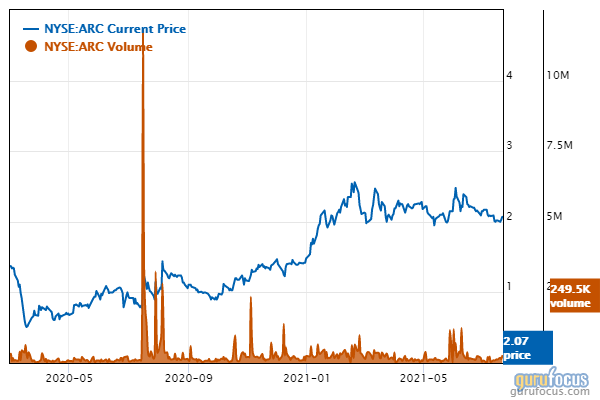

ARC Document Solutions Inc. (ARC, Financial) is definitely a microcap stock at just $2.03 per share. Even at that low, low price, the liquidity is something to consider with a mere 209,000 shares of average daily volume. The book value per share is $3.50, so it’s trading at only 57% of book. The price-earnings ratio of 13.8 is much lower that the S&P 500’s Shiller price-earnings ratio of 37.9. ARC pays an 8 cents per share dividend that comes to a 3.94% yield. The five-year earnings record is in the red by 41%, but this year’s earnings are a positive 115%. Shareholder equity is twice long-term debt and the current ratio is green at 1.4.

Did ARC bottom during the March, 2020 pandemic lows? This chart shows the strong rally from then until now. After peaking early this year at about $2.50, it’s been consolidating in a sideways range.

ArcelorMittal

ArcelorMittal SA (MT, Financial) can be purchased at an 11% discount from book value and the price-earnings ratio is 13.5. This years earnings are excellent at 73.5% and the five-year earnings are a more than decent 42%. Analysts are predicting lower earnings per share next year and the forward price-earnings ratio is 5. Long-term debt is less than shareholder equity and they’ve got a positive current ratio of 1.3. ArcelorMittal is paying a dividend of 30 cents per share for a yield of 0.99%. Liquidity should not be a problem with average daily volume of 4.5 million shares.

You can see the strength of the rally from the March 2020 low at about $7 to the current price of $31. ArcelorMittal broke above the 2019 highs and continued upward.

Oppenheimer Holdings

Oppenheimer Holdings Inc. (OPY, Financial) has a scarily low price-earnings ratio of 3.65, so much lower than that of the market as a whole that it requires a close look. (A much larger financial sector equity, Citigroup (C, Financial), trades with a price-earnings ratio of 6.) The stock trades at 74% of its book value. Earnings per share this year are very good at 143%. The five-year earnings per share growth is 104%. Shareholder equity greatly exceeds long-term debt. Oppenheimer’s average daily volume is a relatively low 110,000 shares.

From a price of $14 in the first quarter of 2020 all the way up to above $54 earlier this year. The stock sold off this summer and now trades at $43. The fact Oppenheimer is still trading at a discount from book after a rally of this magnitude is unusual.

Conclusion

Equities that trade below book value are out of favor for a reason. That’s why it’s important to conduct further research in situations such as these three companies. Since each trades on the New York Stock Exchange, it’s likely that extensive information is available about the risks that may be involved. If there weren’t risks, then you would be unable to find stocks trading at this type of discount. These names are ideas presented for further study.

Not investment advice. Do your own research and be sure to consult with a registered investment advisor before making any decisions.