McDonald’s is one of the most well-known companies in the world, and the largest restaurant chain by revenue.

-Five Year Revenue Growth Rate: 3.3%

-Five Year Earnings Growth Rate: 17.6%

-Five Year Dividend Growth Rate: 20%

-Current Dividend Yield: 3.11%

-Balance Sheet Strength: Moderate

When I last published an analysis of MCD in March of 2010 at around $68 per share, I wrote that it was a solid buy. Now that it’s trading for around $90 (which is approximately a 35% increase for the year when dividends are included), I’m still favorable towards the purchase, but the valuation is not quite as attractive in my view. I consider it worthwhile to pick up shares at the current $90 level for what should be a fairly conservative, durable, and rewarding investment.

McDonald’s serves 64 million customers each day. That’s approximately the population of the UK or France. McDonald’s sells its products in 117 countries and operates 32,737 restaurants as of the end of 2010. Of the restaurants, 80% are franchised or licensed, and the remaining 20% are operated by the company.

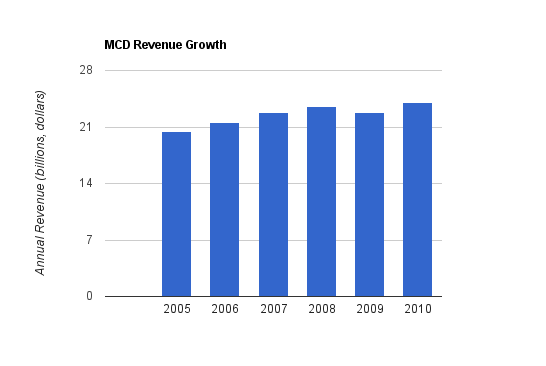

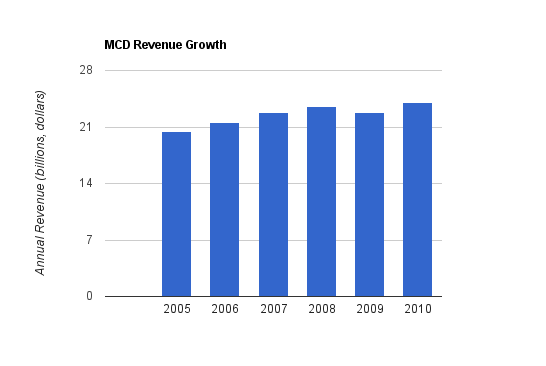

Annual revenue growth has averaged about 3.3% per year for the past five years.

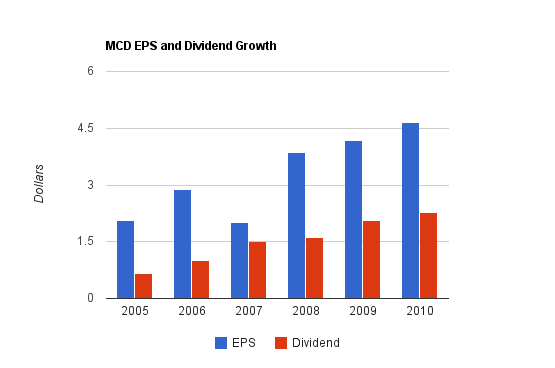

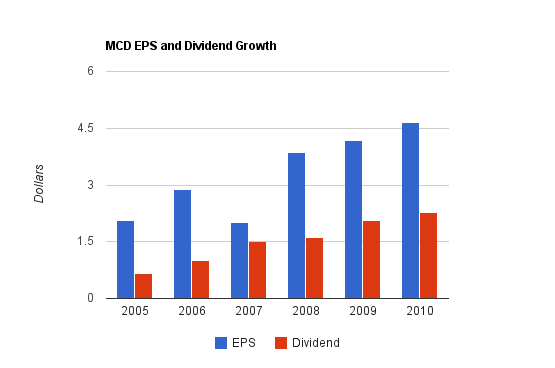

Earnings growth for the past five years has averaged around 17.6% per year. The current estimates by analysts predict 11% annualized growth for 2011 and 2012.

Cash flow has grown by a bit under 8% per year, on average, over the last five years.

Price to FCF: 21

Price to Book: 6.3

Return on Equity: 36%

Over this period, the dividend has increased by approximately 20% per year, on average. The most recent increase was from $0.61 to $0.70 per quarter, which represents a nearly 15% increase. I expect that over the long term, this rate will need to decrease to the lower double-digits and eventually to the high single digits, which would still be a great rate of dividend growth.

The earnings payout ratio for the dividend is currently a bit under 60%.

Although everyone knows McDonald’s is international, a lot of people tend to think of it as an American thing, or that its stronghold is in America. McDonald’s, however, takes in more revenue from Europe than from North America. In 2010, 34% of the company sales total was from North America, while 40% was from Europe, and 21% was from Asia/Pacific, Middle East, and Africa (called “APMEA”). APMEA currently represents the quickest growing of these main segments, but South America represents opportunity as well.

The company has a major focus on real estate. McDonald’s typically owns or has long-term leases for the restaurants they and their franchisees operate. This keeps turnover low (an established McDonald’s in a location is typically there for a very, very long time).

The company has, basically since being founded, had an emphasis on quantity over quality. They sell inexpensive, supposedly tasty food to tens of millions of people per day. In the past few years, however, McDonald’s has been focusing on quality in addition to quantity. They’ve been remodeling their stores worldwide to include softer colors and more wood to replace the lame red and yellow plastic look. Some of their highest quality stores actually look like fairly respectable dining establishments. More items like smoothies and salads appear on the menu, in addition to the traditional items. They’ve long-since launched their McCafe brand which is coffee shop and it has grown at an excellent rate. The company is properly adapting to changing customer demand.

The profit margins of McDonald’s are far and above their competitors. MCD’s net profit margin is over 20%, while this figure is 10% for Yum Brands, 10% for Starbucks, 0% for Wendy’s, and 3% for Dunkin Donuts. This is due to having more than twice the average amount of revenue per location as its competitors, and this in turn is due to being able to focus so much scale on a single brand. McDonald’s pays an enormous amount for advertising, and also holds considerable weight with its suppliers.

The franchisee owned restaurants have higher profit margins than the corporate owned restaurants (McDonald’s collects rent and royalties), but the corporate owned restaurants allow McDonald’s to develop new products and new looks and keeps management fresh and knowledgeable.

When it comes to returning value to the shareholders, few do it better than McDonalds. All of their free cash flow flows to shareholders in the form of dividends and share repurchases. The corporation has a policy in that all leaders have to own a significant amount of McDonald’s stock and hold onto it during their tenure. The CEO must own at least 6x his annual base salary worth of McDonalds stock. The President and the Board of Directors must all own at least 5x annual salary. District presidents, executive vice presidents, and senior vice presidents must own between 2x and 4x annual base salary. This keeps leaders in line with shareholders because they are significant long-term shareholders themselves.

I view McDonald’s as a fairly low risk, moderate reward investment. Over the long term, if the company can grow EPS at a high single digit rate with a combination of organic growth and share repurchases, and pays a dividend that yields around 3%, then those represent pretty good returns that are recession resistant and fairly predictable. I don’t consider the valuation, which is currently at 18x earnings, to be as attractive as it was last year, but I consider it to be a reasonable purchase for the long term.

Full Disclosure: At the time of this writing, I hold no position in MCD or any other companies mentioned.

-Five Year Revenue Growth Rate: 3.3%

-Five Year Earnings Growth Rate: 17.6%

-Five Year Dividend Growth Rate: 20%

-Current Dividend Yield: 3.11%

-Balance Sheet Strength: Moderate

When I last published an analysis of MCD in March of 2010 at around $68 per share, I wrote that it was a solid buy. Now that it’s trading for around $90 (which is approximately a 35% increase for the year when dividends are included), I’m still favorable towards the purchase, but the valuation is not quite as attractive in my view. I consider it worthwhile to pick up shares at the current $90 level for what should be a fairly conservative, durable, and rewarding investment.

Overview

McDonald’s has been in business since 1940, and now employs over 400,000 people worldwide. The company has restaurants all throughout North and South America, Europe, Australia and Asia, but are only thinly available in the Middle East and Africa. The primary food products they serve are hamburgers, cheeseburgers, chicken meals, french fries, coffee and milkshakes, but are beginning to offer healthier products like wraps and salads.McDonald’s serves 64 million customers each day. That’s approximately the population of the UK or France. McDonald’s sells its products in 117 countries and operates 32,737 restaurants as of the end of 2010. Of the restaurants, 80% are franchised or licensed, and the remaining 20% are operated by the company.

Revenue, Earnings, Cash Flow, and Metrics

McDonald’s has a fairly consistent record of growth.Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $24.075 billion |

| 2009 | $22.745 billion |

| 2008 | $23.522 billion |

| 2007 | $22.787 billion |

| 2006 | $21.586 billion |

| 2005 | $20.460 billion |

Earnings Growth

| Year | Earnings |

|---|---|

| 2010 | $4.64 |

| 2009 | $4.17 |

| 2008 | $3.83 |

| 2007 | $2.02 |

| 2006 | $2.87 |

| 2005 | $2.06 |

Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $6.342 billion |

| 2009 | $5.751 billion |

| 2008 | $5.917 billion |

| 2007 | $4.876 billion |

| 2006 | $4.342 billion |

| 2005 | $4.337 billion |

Metrics

Price to Earnings: 18Price to FCF: 21

Price to Book: 6.3

Return on Equity: 36%

Dividend Growth

McDonalds has a decades-long string of dividend increases. Based on the current dividend of $0.70 per quarter, the dividend yield is 3.11%.Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $2.53 |

| 2010 | $2.26 |

| 2009 | $2.05 |

| 2008 | $1.625 |

| 2007 | $1.50 |

| 2006 | $1.00 |

The earnings payout ratio for the dividend is currently a bit under 60%.

Balance Sheet

McDonald’s has an interest coverage ratio of over 17, which is very strong and conservative. Debt/Equity is nearly 0.8, which is moderate. A fairly small percentage of equity consists of goodwill. Although the company does hold some debt, as shown by the debt/equity ratio, it’s low interest debt, and interest payments make up only a small fraction of operating income. Therefore, I consider the balance sheet of McDonald’s to be moderately strong overall despite having a fair bit of debt.Investment Thesis

MCD has been selling various investments in order to focus on the McDonald’s brand. They performed an initial public offering of Chipolte Mexican Grill in 2006, sold Boston Market in 2007, and sold Pret A Manger in 2008. The focus has been placed on the McDonald’s brand, which is revitalizing its image and introducing new products. Most of the growth of the company is due to organic growth, which is evidenced by the low quantity of goodwill on the balance sheet.Although everyone knows McDonald’s is international, a lot of people tend to think of it as an American thing, or that its stronghold is in America. McDonald’s, however, takes in more revenue from Europe than from North America. In 2010, 34% of the company sales total was from North America, while 40% was from Europe, and 21% was from Asia/Pacific, Middle East, and Africa (called “APMEA”). APMEA currently represents the quickest growing of these main segments, but South America represents opportunity as well.

The company has a major focus on real estate. McDonald’s typically owns or has long-term leases for the restaurants they and their franchisees operate. This keeps turnover low (an established McDonald’s in a location is typically there for a very, very long time).

The company has, basically since being founded, had an emphasis on quantity over quality. They sell inexpensive, supposedly tasty food to tens of millions of people per day. In the past few years, however, McDonald’s has been focusing on quality in addition to quantity. They’ve been remodeling their stores worldwide to include softer colors and more wood to replace the lame red and yellow plastic look. Some of their highest quality stores actually look like fairly respectable dining establishments. More items like smoothies and salads appear on the menu, in addition to the traditional items. They’ve long-since launched their McCafe brand which is coffee shop and it has grown at an excellent rate. The company is properly adapting to changing customer demand.

The profit margins of McDonald’s are far and above their competitors. MCD’s net profit margin is over 20%, while this figure is 10% for Yum Brands, 10% for Starbucks, 0% for Wendy’s, and 3% for Dunkin Donuts. This is due to having more than twice the average amount of revenue per location as its competitors, and this in turn is due to being able to focus so much scale on a single brand. McDonald’s pays an enormous amount for advertising, and also holds considerable weight with its suppliers.

The franchisee owned restaurants have higher profit margins than the corporate owned restaurants (McDonald’s collects rent and royalties), but the corporate owned restaurants allow McDonald’s to develop new products and new looks and keeps management fresh and knowledgeable.

When it comes to returning value to the shareholders, few do it better than McDonalds. All of their free cash flow flows to shareholders in the form of dividends and share repurchases. The corporation has a policy in that all leaders have to own a significant amount of McDonald’s stock and hold onto it during their tenure. The CEO must own at least 6x his annual base salary worth of McDonalds stock. The President and the Board of Directors must all own at least 5x annual salary. District presidents, executive vice presidents, and senior vice presidents must own between 2x and 4x annual base salary. This keeps leaders in line with shareholders because they are significant long-term shareholders themselves.

I view McDonald’s as a fairly low risk, moderate reward investment. Over the long term, if the company can grow EPS at a high single digit rate with a combination of organic growth and share repurchases, and pays a dividend that yields around 3%, then those represent pretty good returns that are recession resistant and fairly predictable. I don’t consider the valuation, which is currently at 18x earnings, to be as attractive as it was last year, but I consider it to be a reasonable purchase for the long term.

Risks

Although some companies have less risk than others, MCD does still have risk. One need only to look at some of the income statements of their competitors to see how competitive and harsh the chain restaurant business can be. McDonald’s does have a competitive advantage due to scale and brand strength, but it’s easy for consumers to change restaurants, and it’s easy for competitors to change tactics. In addition, there is commodity cost risk, currency risks due to their global presence, and risks associated with health regulation. McDonald’s has a very stable cash-generating business, but over the long term, must continue to adapt to changing consumer expectations.Conclusion and Valuation

McDonalds currently has a PE of around 18. They’ve got massive international exposure, a relatively safe business, only moderate leverage, extremely shareholder friendly management, and a good dividend yield. Although I think getting in at under $80 would be ideal, the current share price of $90 is still attractive in my opinion. For years, I’ve avoided investing in the company due to not being particularly fond of it, but it has been on my watch list for quite a while, and I have been considering starting a position.Full Disclosure: At the time of this writing, I hold no position in MCD or any other companies mentioned.