Diageo is a leading producer of spirits, wines, and beers in the world.

-Sales growth over the last four-year period: 7.5%

-Earnings growth over the last four-year period: 8%

-Dividend growth over the last four-year period: 5.4%

-Current Dividend Yield: 3.05%

-Balance Sheet: Weak but Stable

Overall, I think the company would make a decent investment, I but would like to see it at a lower price. The ADR would be a good buy under $75 in my view.

For 2011, the North American segment accounted for approximately 34% of company net sales. Volume growth was flat for the year, and sales growth was 3%. Marketing expenditure and operating profit increased 7% and 8%, respectively.

International

For 2011, the International segment accounted for approximately 28% of company net sales. Volume and sales were up 9% and 13%, respectively for the year, while marketing expenditure increased 23% and operating profit increased 19%.

Europe

For 2011, the European segment accounted for approximately 26% of company net sales. Volume and sales were down 2% and 3%, respectively, for the year, while marketing expenditure decreased 4% and operating profit decreased by 7%.

Asia Pacific

For 2011, the Asia Pacific segment accounted for approximately 12% of company net sales. Volume and sales were up 9% and 9%, respectively, for the year, while marketing expenditure increased 13% and operating profit increased 13%.

Scotch: 27%

Beer: 22%

Vodka: 11%

Ready to Drink: 8%

Whiskey: 6%

Rum: 6%

Liqueur: 6%

Wine: 5%

Gin: 3%

Tequila: 3%

Other: 3%

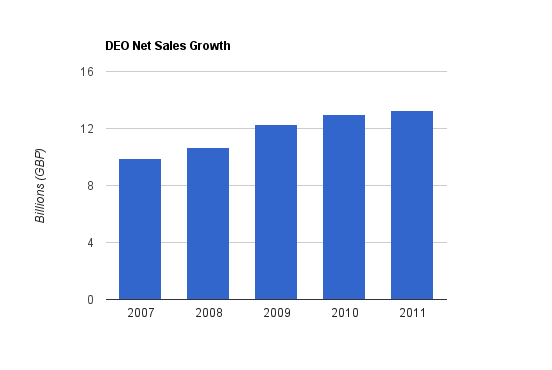

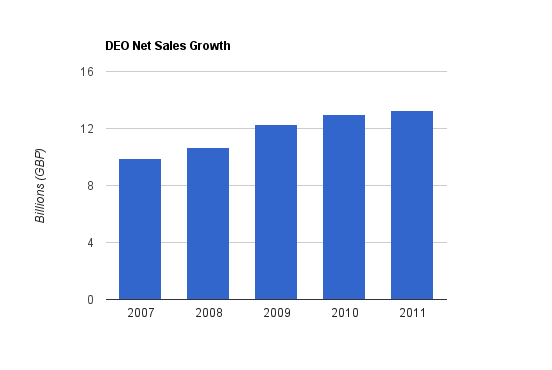

Net sales have grown by a bit under 7.5% per year on average, over this four-year period.

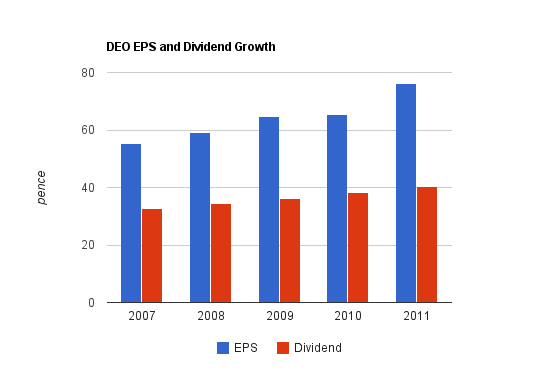

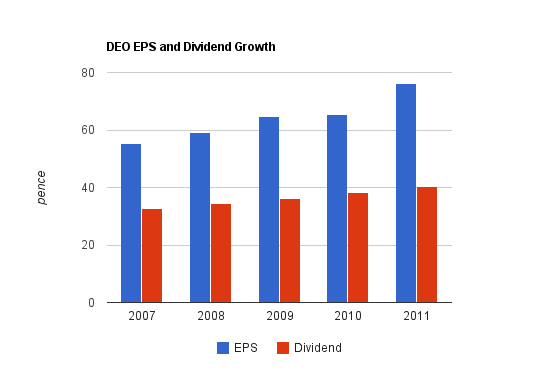

Earnings per share increased by over 8% per year, on average, over this four year period.

Cash flow growth averaged nearly 6.5% annually over this four-year time period.

Over this time period, the company has grown its annual dividend by about 5.4% per year, on average. Actual growth rate in US currency will be based on the actual dividend growth rate, as well as currency conversation changes.

What this means is that while Diageo’s balance sheet is indeed stable, it’s not particularly flexible. A quarter of operating earnings goes towards paying off interest, and higher debt levels would result in higher interest rates. I usually prefer investing in cleaner balance sheets than this, at least for most of my holdings, and while a balance sheet of this nature is acceptable, it should in my view decrease what the valuation of the stock would otherwise be if it had a stronger balance sheet.

-Smirnoff Vodka is the best selling premium spirit in the world by volume according to Diageo.

-Johnnie Walker is number one in Scotch, worldwide. (And reported the best 2011 growth out of any other brand of the company.)

-Guinness is number one in stout.

-Captain Morgan is number two in rum.

-Baileys is number one in liqueur.

34% of total sales are from emerging markets, and the company’s “International” segment is by-far their fastest growing segment. Between 2009 and 2011, the percentage of net sales that came from emerging markets increased from 30% to 34%. The company expects that by 2015, approximately 50% of net sales will come from emerging markets.

This is a good type of company for dividend growth investors to look into because the company doesn’t have to change much to grow. It’s not a company that has to spend huge amounts on research and development, or has extremely complex products, or operates in a fast-changing industry. They just make alcoholic beverages in a variety of price ranges, in a variety of categories, with a variety of top brands, and use marketing to try to keep their top position and expand their business. Their size gives them increased distribution efficiency over their competitors which extends to 180 countries, that provides them with a respectable economic advantage. Their focus is on marketing in emerging and developed areas to strengthen or expand their top brands, and to make small or medium sized acquisitions to increase their brand portfolio.

More specifically, the company has the goal to increase core EPS in the low double-digit range, which involves organic growth, margin improvement, and select acquisitions. As far as I know, it’s not a stated goal of the company, but another potential “growth” area would be to pay down some of the debt, which would increase EPS and reduce future interest rates. So there are a lot of areas where Diageo can allocate capital for increased EPS and dividend growth.

For investors looking for dividend income from the ADR, a risk is that even if the company raises its dividend in a given year, the dividend in US currency might be lower than the previous year (or the opposite could be true). In addition, the economic weakness in Europe is likely to offset some of the growth from emerging markets as far as DEO’s earnings and sales are concerned.

I do like the company’s vast international exposure in an industry that’s not going away, and their collection of market-leading brands. The dividend yield is solid, the dividend growth is respectable, revenue is climbing, and I can’t particularly envision a large chance of an investment in this company turning sour over the long-term; it likely represents a decent risk-adjusted long term rate of return even at these prices. I’d personally look elsewhere for the time being, however.

Full Disclosure: I do not have any position in DEO at the time of this writing.

-Sales growth over the last four-year period: 7.5%

-Earnings growth over the last four-year period: 8%

-Dividend growth over the last four-year period: 5.4%

-Current Dividend Yield: 3.05%

-Balance Sheet: Weak but Stable

Overall, I think the company would make a decent investment, I but would like to see it at a lower price. The ADR would be a good buy under $75 in my view.

Overview

Formed in 1997 as the result of a merger between Guinness and Grand Metropolitan, Diageo (LGE: DGE, NYSE: DEO) is the world’s largest producer of premium spirits. Headquartered in London, the company is traded on the London Stock Exchange and has an ADR on the NYSE. The ADR represents 4 shares of the company.Geographic Segments

North AmericaFor 2011, the North American segment accounted for approximately 34% of company net sales. Volume growth was flat for the year, and sales growth was 3%. Marketing expenditure and operating profit increased 7% and 8%, respectively.

International

For 2011, the International segment accounted for approximately 28% of company net sales. Volume and sales were up 9% and 13%, respectively for the year, while marketing expenditure increased 23% and operating profit increased 19%.

Europe

For 2011, the European segment accounted for approximately 26% of company net sales. Volume and sales were down 2% and 3%, respectively, for the year, while marketing expenditure decreased 4% and operating profit decreased by 7%.

Asia Pacific

For 2011, the Asia Pacific segment accounted for approximately 12% of company net sales. Volume and sales were up 9% and 9%, respectively, for the year, while marketing expenditure increased 13% and operating profit increased 13%.

Category Sales

Diageo sells a diverse collection of alcohol types. This is a listing of what percentage of net sales were from each product type.Scotch: 27%

Beer: 22%

Vodka: 11%

Ready to Drink: 8%

Whiskey: 6%

Rum: 6%

Liqueur: 6%

Wine: 5%

Gin: 3%

Tequila: 3%

Other: 3%

Sales, Earnings, Cash Flow

Revenue, Earnings, and Cash flow have seen fairly consistent growth.Sales Growth

| Year | Total Sales |

|---|---|

| 2011 | £13.232 billion |

| 2010 | £12.958 billion |

| 2009 | £12.283 billion |

| 2008 | £10.643 billion |

| 2007 | £9.917 billion |

Earnings Growth

| Year | EPS |

|---|---|

| 2011 | 76.2p |

| 2010 | 65.5p |

| 2009 | 64.6p |

| 2008 | 59.0p |

| 2007 | 55.4p |

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2011 | £2.091 billion |

| 2010 | £2.298 billion |

| 2009 | £1.591 billion |

| 2008 | £1.563 billion |

| 2007 | £1.627 billion |

Dividends

Diageo pays an interim and a final dividend each year, with the final dividend being the larger of the two. The earnings payout ratio is 53%. As of this writing, the dividend yield on the NYSE ADR for DEO is approximately 3.05%.Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | 40.40p |

| 2010 | 38.10p |

| 2009 | 36.10p |

| 2008 | 34.35p |

| 2007 | 32.70p |

Balance Sheet

The balance sheet is a weak point for Diageo. The company has £7 billion in long-term debt. The Total Debt/Equity ratio is approximately 1.6. The interest coverage ratio is around 4. Less than 10% of equity consists of goodwill, which is solid. Diageo’s dependable, global, defensive business allows it to safely take on this level of leverage.What this means is that while Diageo’s balance sheet is indeed stable, it’s not particularly flexible. A quarter of operating earnings goes towards paying off interest, and higher debt levels would result in higher interest rates. I usually prefer investing in cleaner balance sheets than this, at least for most of my holdings, and while a balance sheet of this nature is acceptable, it should in my view decrease what the valuation of the stock would otherwise be if it had a stronger balance sheet.

Investment Thesis

Diageo’s market share and brand strength are unparalleled. Diageo holds 27% of the global premium spirits market by volume, which is a larger market share than any competitor.-Smirnoff Vodka is the best selling premium spirit in the world by volume according to Diageo.

-Johnnie Walker is number one in Scotch, worldwide. (And reported the best 2011 growth out of any other brand of the company.)

-Guinness is number one in stout.

-Captain Morgan is number two in rum.

-Baileys is number one in liqueur.

34% of total sales are from emerging markets, and the company’s “International” segment is by-far their fastest growing segment. Between 2009 and 2011, the percentage of net sales that came from emerging markets increased from 30% to 34%. The company expects that by 2015, approximately 50% of net sales will come from emerging markets.

This is a good type of company for dividend growth investors to look into because the company doesn’t have to change much to grow. It’s not a company that has to spend huge amounts on research and development, or has extremely complex products, or operates in a fast-changing industry. They just make alcoholic beverages in a variety of price ranges, in a variety of categories, with a variety of top brands, and use marketing to try to keep their top position and expand their business. Their size gives them increased distribution efficiency over their competitors which extends to 180 countries, that provides them with a respectable economic advantage. Their focus is on marketing in emerging and developed areas to strengthen or expand their top brands, and to make small or medium sized acquisitions to increase their brand portfolio.

More specifically, the company has the goal to increase core EPS in the low double-digit range, which involves organic growth, margin improvement, and select acquisitions. As far as I know, it’s not a stated goal of the company, but another potential “growth” area would be to pay down some of the debt, which would increase EPS and reduce future interest rates. So there are a lot of areas where Diageo can allocate capital for increased EPS and dividend growth.

Risks

Every company has risk. Diageo has regulatory risk, currency risk, competition risk, commodity cost risk, and more. The company’s large collection of top brands operates in a fairly recession-resistant industry in a globally diverse market, which offers it some safety. Alcoholic beverages can be fairly health-neutral in the right amounts and contexts, but can be dangerous and unhealthy if consumed in the wrong amounts, at the wrong times, or for the wrong reasons. Associating alcohol with status, as Diageo does, can have deleterious effects even if it is good for business.For investors looking for dividend income from the ADR, a risk is that even if the company raises its dividend in a given year, the dividend in US currency might be lower than the previous year (or the opposite could be true). In addition, the economic weakness in Europe is likely to offset some of the growth from emerging markets as far as DEO’s earnings and sales are concerned.

Conclusion and Valuation

In conclusion, I find this to be a very respectable company at a price that is not too attractive to me at the moment. Although I do think this would make a respectable investment at the current price, with 3+% yield and 5+% dividend growth, I am not too keen on paying a P/E of over 17 for a company with this balance sheet. Either the debt would have to be lower, the growth more impressive, or the price reduced for me to be a buyer of this stock. I would classify it as fair/hold at the current price level.I do like the company’s vast international exposure in an industry that’s not going away, and their collection of market-leading brands. The dividend yield is solid, the dividend growth is respectable, revenue is climbing, and I can’t particularly envision a large chance of an investment in this company turning sour over the long-term; it likely represents a decent risk-adjusted long term rate of return even at these prices. I’d personally look elsewhere for the time being, however.

Full Disclosure: I do not have any position in DEO at the time of this writing.