Many investors can agree that the stock market has been on an uncertain wicket for 2021, but it’s been another successful year for most equity holders thus far. As such, I wanted to do a quick summary of what I expect for U.S. and emerging market equities for the final quarter of the year; European equities aren’t discussed.

U.S. equities

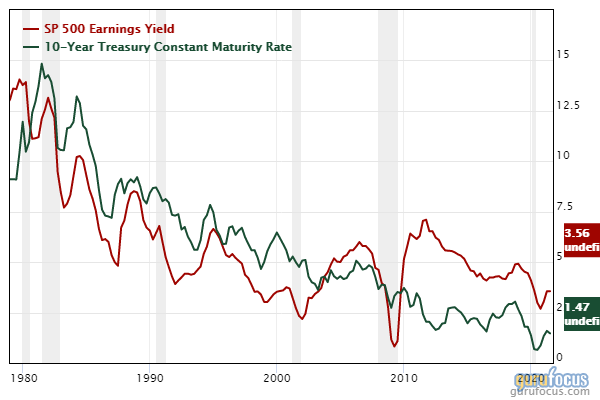

The VIX is down by 30% for the year, but shot up last week after the China Evergrande (HKSE:03333, Financial) story. In combination with that, there’s been talk of tapering and a sign of convergence between the S&P 500 earnings yield and the 10-year bond yield.

Looking at these factors in isolation would paint a very doom and gloom picture, but we need to bear in mind that we’re in a changing world and we’ve been coping with a pandemic; the market has also adjusted to these realities.

What I expect moving forward is further ignorance from equity holders regarding the Federal Reserve model (earnings yield versus bond yield), a further decrease in the VIX towards pre-pandemic levels and an unexpected surge in real gross domestic produc growth as the delta variant’s effects diminish.

These factors could mean that growth stocks linked to GDP growth, with negative correlations to the Fed model’s effect, could do well. These will predominantly be low PEG tech stocks outside of the Russell 1000.

I also anticipate energy stocks to continue their strong growth as there’s no sign of oil and gas prices slowing down amid supply chain bottlenecks. We’re also entering the winter, which could add a pull-type of inflation to the current environment.

Bank stocks will definitely do well when rates are higher. They are trading at significant discounts to other sectors, so while it might be slightly early to buy them now, you don’t want to enter too late and miss out on potential gains; they’re only going up from here.

Finally, big tech could be a space that will start lagging soon. The Federal Trade Commission, Department of Justice and Securities and Exchange Commission seem determined to quell the power of big tech companies with constant litigation, so many investors may go from overweight big tech to neutral in the fourth quarter.

Emerging markets, and China in particular

Emerging markets seem like an attractive space at the moment. The basic materials demand seems to be igniting mining stocks in particular. South Africa's Johannesburg Stock Exchange is currently trading around a 25% discount to other emerging markets, while India could be set for a rebound soon after its stellar 2020, early 2021 performance was halted by a massive surge in Covid-19 infections and political volatility.

China is a no-go for me at this stage. If you’re suggesting that the country is a “buy the dip” opportunity, you’re simply gambling. Asset pricing premiums would have skyrocketed after hard political lines were drawn to increase the competitive landscapes of industries in the country and reduce debt burdens.

China is an economy that has grown by over 9% a year on average since 1989. A contraction to the real economy in 2020 has been amplified by the Chinese Communist Party's new policies, which could see a situation such as Evergrande be the first of many large corporations to fall.

Below is the GDP growth stakeholders were anticipating:

Source: Statista

Final word

Considering the current climate, it’s only fitting to finish with the Evergrande versus Lehman analogy.

Investors need to understand the stakeholders involved in China. Developed nations have overleveraged and invested in China, which was a surety for return on investment. Additionally, emerging economies have become overly reliant on selling their basic materials to China, which is now at the center of the commodity chain. So there are a host of economies who are tied to the real GDP growth of China, so contagion isn’t even a debate, but until an extraordinary scenario happens, I can’t see the U.S. markets getting shook. I can see China struggling until the systemic risk has priced in fully, but the U.S. market will lag behind.