Bed Bath and Beyond Inc. (BBBY, Financial) is a home goods big-box retailer that was caught up in the “Reddit frenzy” earlier this year with massive price swings in a handful of stocks, driven by newbie retail investors influenced by posts on Reddit's WallStreetBets and powered by the "free" trading app Robinhood (of which Gamestop (GME, Financial) and AMC (AMC, Financial) were the most well known).

Since then, the stock has come back to earth. At its pre-pandemic level, is it a buy now?

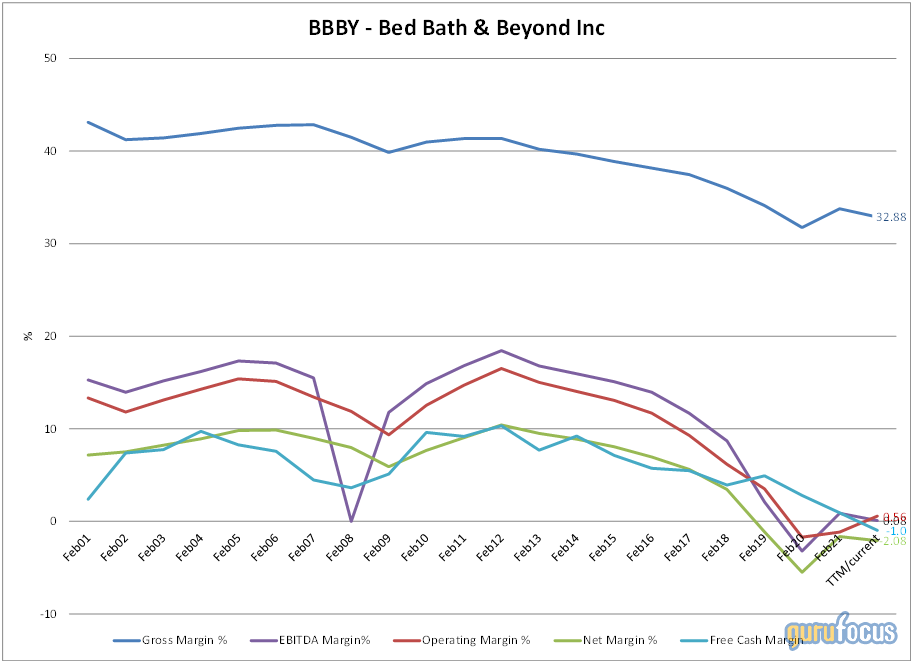

Bed Bath & Beyond was able to dial back on price promotions throughout the pandemic due to strong stay-at-home demand, but now that consumers are returning to work it is experiencing weakness in sales and is planning to ramp back up use of its coupons. Pre-pandemic, the company had a long history of margin pressure from overreliance on coupons. The retailer recently released dismal second-quarter results with non-GAAP earnings of 4 cents per share missing projections by 48 cents, a GAAP earnings loss of 72 cents fell short of expectations by $1.25 and revenue of $1.99 billion (a decline of 26% year over year) missed estmates by $70 million. Management blamed it on supply chain issues, but things have been going downhill for a while.

At one time, Bed Bath & Beyond was a high flyer with the stock hitting $80 in late 2013. The company has been voracious buyer of its own stock and is a case study of why you should not catch a falling knife.

Its obvious that the company is in long-term decline and stock buybacks are a futile attempt to stem the leakage. The following index chart shows the key metrics over the last 10 years.

The share price has dropped from an index of 100 to 24 (green line), a 76% decline, while earnings per share has fared even worse, falling from 100 to-43 in spite of the fact that shares outstanding have been reduced by 58%. Overall, it is a horrible picture and the amount of money wasted by buying back a falling stock over the years is mind-boggling.

Summary

Bed Bath & Beyond appears to be a value trap and should be avoided. It could be compared to a J.C. Penney (JCPNQ, Financial) or Radio Shack situation. While the Altman Z-Score shows that bankruptcy is not imminent, investors are dying by a thousand cuts. While the company under new management is closing stores, I think it's too little, too late.