Let there be no confusion about the purpose and intent of this article. It is intended to present a positive and enthusiastic defense and a reasoned support of our great country and its economic strength and promise. There are far too many that want to criticize and denigrate our economy and the very system within which it operates. Not only do I believe we live in the greatest country on earth, I also believe that our economy is the strongest and most prosperous that has ever existed. And as such, it is the most benevolent and generous provider for the population it serves than any other on earth.

Yes, we face economic problems from time to time, and we always have and always will. But the indomitable American spirit has met every challenge we’ve ever faced, and I believe will continue to do so for a long time to come. The late great American economist Milton Friedman said it better than I:

"So that the record of history is absolutely crystal clear. That there is no alternative way, so far discovered, of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by a free enterprise system."

Anyone who has followed my work knows that I have often written articles with optimistic undertones. The following links represent three recent examples where I have argued for optimism based on the opportunity that I believe is in front of us. Although there have been many supporters for these articles, there have also been many detractors.

The Greatest Risk We Face: To Again Falling Into a Recession

Are You Properly Positioned for the Return of the Economic Vitality of America?

Strong Standard and Poor's 500 Earnings plus Weak Stock Values equals Opportunity

The Positive Viewpoint

Although it’s hard to find supportive and positive opinions regarding our economy and the future of the American stock market, they fortunately do exist. This past week a friend sent me an uplifting piece that was authored by a financial adviser that he respects and uses. The adviser’s name is John Bodnar of Bodnar Financial Services Inc., headquartered in Florham Park, New Jersey. Here is a link to their website, for anyone who would like to learn more about John and his team. Bodnar Financial Services Inc.

I was so impressed with what John wrote that I asked if he would give me his permission to re-publish his work in its entirety and he enthusiastically agreed. What follows is John’s piece which I offer with his permission as an uplifting Holiday Season and Prosperous New Year card to all those who may be suffering from the doom and gloom that is so pervasively and relentlessly heaped upon us. I hope and wish it provides a lift of your spirit and confidence:

Can we learn from the past?

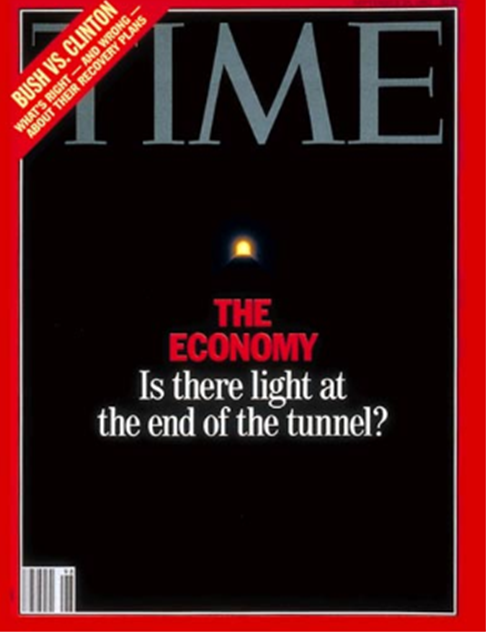

“The U.S. economy remains almost comatose… the economy is staggering under many structural burdens, as opposed to familiar cyclical problems… The structural faults represent once in a lifetime dislocations that will take years to work out. Among them: job drought, debt hangover, the banking collapse, the real estate depression, the healthcare cost explosion, and the runaway federal deficit.”

The paragraph above is a series of quotes from a TIME cover story “The Economy… Is there light at the end of the tunnel?” The headline and quotes sum up nicely how the masters-of- the-media view current events. But look closely at the cover. Can you read the ribbon in the upper left corner? It says BUSH vs. CLINTON. The date of this TIME issue was September 28, 1992. The Dow Jones Industrial Average would close that day at 3276. And if you could go back in time (having ignored TIME) and invested $1000 in an account for your new-born child or grandchild’s future college costs, 19 years hence that $1000 would be worth $3489.70; a cumulative return of 248.97%. I guess there was some light at the end of that tunnel.

Are you as fed up with the portrayal of gloom and doom as I am? In September, I celebrated my 30th anniversary in the financial advisory business. Jeanne and Lorraine gave me a gift certificate for 10 free visits to a local psychiatrist (That’s a joke. But tell the truth, for a brief moment, you thought it just might be true!). Why do we sit in front of the TV at night listening to the crazies? TV was invented to provide an escape from the pain and aggravation of everyday life. Instead, it seems the more you watch, the more uptight and angry you become.

Fear not comrades, herewith are a handful of factoids guaranteed to put a red, white, and blue grin on your face. Let’s begin with one of the golden oldies…Manufacturing. I’m sure you all have read newspaper articles or listen to a fair and balanced discussion on cable TV of how America is going to hell. The cry of “we don’t make anything anymore!” Answer me this: what country dominates in world manufacturing? And the crowd responds in unison CHINA! Wrong. The U.S. continues to be #1 in manufacturing. We are still the country of innovation and high quality engineering. Don’t believe it? Why would BMW establish a new plant to build the popular M6 series in Spartanburg, SC? Not only is the M6 Series made in America and exported back to Europe, but BMW recently announced that the 3 Series would also be manufactured in the USA as well. BMW is now the number one auto exporter in America. Boeing could have opened a manufacturing operation anywhere in the world, but they chose to stay in America where labor is skilled and material quality can be assured. Let China manufacture all the T-shirts the world needs, but when precision and engineering are needed, nothing yet can match the USA.

Talking heads on radio and TV claim that the American consumer is tapped out. Now that’s a real joke. Americans are going to stop spending money? Personal consumption expenditures are up in excess of 2% in 2011 over 2010. Spending was back as strongly in 2010 as before the crisis of 2008. Personal income for those employed has risen almost 10.5% since 2008. Granted, unemployment remains above 9%, but can we focus on the 91% who are employed and spending money?

I hear rumbling from the back of the room… but what about the housing crisis? Ah yes, yet another crisis… never let one go to waste is the tagline of many a political consultant. Agreed, there will likely be a housing hangover for several years. But, there is some good news. Nearly 40% of home purchases in the last year were ALL CASH DEALS. Florida, a state with exceptionally high foreclosure rates, posted a total of 485,286 foreclosed units in 2010. The number of foreclosures through July 2011 has declined to 71,899.

Housing is important, but it only represents 2.3% of Gross Domestic Product (GDP), core $3.3 billion. Yet we continue to dwell on this one piece of the overall economy. Did you know that capital spending by businesses represent 8.3% of GDP and is coming in at $1.1 trillion in 2011? Capital spending encompasses technology, display cases, store fixtures, etc. Capital spending is at an ALL-TIME high in 2011, far exceeding the amount spent in 2000 for the non-event known as Y2K—another example of an insignificant event that managed to dominate air time.

Now for the crisis du jour: will the Greece debt crisis bring the world economy to a halt? This one really needs to be put into perspective. Boys and girls, when it comes to economics, Greece hasn’t really mattered since 60 B.C. Greece has been in default 51% of its entire history as an independent nation. Why on earth do we act so surprised that they can’t pay their obligations now? There will be a bail out, and Greece will default again. This is nothing against the wonderful people of Greece. Love the weather; love the food; where would Western civilization be without the Greeks? But I assure you, there is not a German alive who’s willing to work to age 70 so the average Greek worker can retire at age 50. To put this one to rest: Greece’s GDP is slightly larger than West Virginia’s GDP. Come on folks, can we keep our wits about us and not fall prey to every rumor over a country the size of West Virginia?

And now for the grand finale; what about China? They are going to eat our lunch on the worldwide economic stage. Yes, China owns a huge pile of IOUs with a picture of Columbia holding her torch. But let’s drill down a little deeper. First, over the past 20 years China has done a great job of building a “new” China along their southern coastline. Keep in mind that America, the home of innovation for the past 200 years has had to transition from telegraph to telephone to fiber optics to 3G. China didn’t need to pay for those transitions; they went from NO PHONES WHATSOEVER to 3G. They are very good at implementing technology developed by other nations. They are not innovators. Infrastructure building over the past decade has been astounding, but if you venture to the interior of China, you will find many people without power, clean water, and living in dilapidated housing with minimal food to eat.

Here is a hard truth about China that you never hear discussed in the media. The labor force of China is peaking…. RIGHT NOW. Between 2000 and 2050, China’s labor force will decline by 9.8%. Over this time period, the labor force in America will grow by 4.2%. Place your chips on the table folks… China or the USA for the long haul?

Since China is one of my dear old Dad’s favorite rants of late, let me just beat this horse to the ground. China represents 23% of the world’s population yet has only 7% of the world’s fresh water supply. In fact, much of southern China (where the development is concentrated) and India share the same water source. China is damning the water upstream from India which could eventually erupt into an ugly situation. The Great Lakes region of the US contains 21% of the world’s fresh water supply. Manufacturing requires natural resources. Comparing these facts alone, I would argue that the USA will remain a dominant economic power. Not to fret Grandpa, your grandchildren and great grandchildren will have jobs and not be forced to learn Mandarin.

Corporate America, has it recovered from the 2008 financial crisis? If you believe the headlines you would think that the USA is on the precipice of another great recession, or worse, a depression. Hold on tight for this one: corporate profits hit an all-time high-repeat-ALL TIME HIGH in 2010 and are on track to exceed that number in 2011. Second quarter earnings for U.S. corporations also set a record. That’s right, the quarter that ended on June 30, 2011 was the greatest quarter for earnings in the history of American capitalism. Where were the balloons and the parade you ask? I can’t figure it out. Instead, the media tells us how the system is broken and we need fundamental change.

There have been ten ALL CASH corporate mergers from May 2011 through September 22, 2011. These are little mergers. BHP Billiton purchased Petrohawk Energy for $12.1 billion! Get the picture? One day you will look back to the autumn of 2011 and ask yourself, how did I miss it? The signs were everywhere. 1.) Investors withdrew in excess of $75 billion from equity mutual funds in the four months through August. That is more than they did in the five months after the Lehman collapse in September 2008. You will probably not need to be reminded that those latter five months represented the greatest buying opportunity in a generation, and that at their nadir offered prices which will most probably never be seen again. 2.) Corporate insiders loading up on company stock. August 2011 insider purchases were over $681 million. So, when a director of ExxonMobil ponies up $700,000, a director at Berkshire Hathaway invests $843,300, and even the CEO of Merck spends a million and a half dollars-just as the masses fall all over themselves getting out-somebody is usually trying to tell us something.

Ready to wrap this up? Let’s return to the 1992 TIME cover story. Sounds eerily like the headlines we read today. And yet, the decade of the 1990s turned out to be a boom for investors. Odd considering all the negative headwinds reported in the TIME article. I suggest we resurrect the American spirit and align ourselves with the economic realities instead of the political headlines. American businesses are doing well. They are well capitalized, sitting on loads of cash, increasing their dividends, and buying back their own stock. It is a great time to be an investor in some of the greatest companies in the world.

Significant market bottoms, when they finally occur, have less to do with fundamental economic and financial shifts than with crescendos of public panic. On this you can rely: the stock market remains an exceptionally efficient mechanism for the transfer of wealth from the inpatient to the patient.

John Bodnar, CFP ®, CIMA®

October 10, 2011

Pessimism Has Put Many of America’s Greatest Companies on Sale

After reading John’s uplifting piece I was very taken by the last two paragraphs where he talked about two important facts. First he talked about what a great time it was to be an American investor because some of the greatest companies in the world are on sale. Then he rightfully pointed out how the stock market was an exceptionally efficient mechanism to transfer wealth from the impatient to the patient. Therefore, I began looking at valuations of some of our finest companies and was frankly startled by what I found.

For the past 200 years or so, the average company has historically traded at a P/E ratio of approximately 15, and for the past 50 years the PE ratio of the average company has been closer to 20. The following portfolio review produced by F.A.S.T. Graphs™ lists 100 mostly above-average American companies that can be bought today at P/E ratios below 13. In other words, today we can buy above-average companies for less than we could typically buy average companies.

The list is produced in alphabetical order. The first column on the list shows the current P/E ratio, followed by the 15-year normal P/E ratio, followed by the 15-year historical EPS growth, followed by the estimated EPS growth and finally by the dividend yield.

Conclusions

Investors have been fleeing U.S. equities at unprecedented levels. Yet, I believe there is compelling evidence that suggests that this may be the best opportunity to invest in high-quality U.S. common stocks that we have seen in many years. The list of 100 stocks presented in this article represents only a sampling of the many companies that are selling at valuations which are lower than their fundamentals justify. The only logical reason that I can come up with for this, is extreme pessimism.

As I look to 2012 and beyond, I am astounded by the opportunity to own extremely high quality profitable businesses that can be purchased at such historically low valuations. Buying low is the first, and perhaps most important and sacred, principle of all investing. Although I can’t say with certainty that every stock on the above list is a great long-term investment, I can confidently state that you would be hard-pressed to find any on the list that will not be selling at higher prices three to five years from now. More than likely there will be a few, but I doubt that there will be many. I offer my wishes for a prosperous New Year and bright long-term future.

Disclosure: Long ABT, AFL, AVP, BBY, CVX, ENDP, EZPW, FISV, GME, HPQ, INTC, IR, ITW, JNJ, KSS, LLL, MDT, SYK, TEVA, WAG at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Yes, we face economic problems from time to time, and we always have and always will. But the indomitable American spirit has met every challenge we’ve ever faced, and I believe will continue to do so for a long time to come. The late great American economist Milton Friedman said it better than I:

"So that the record of history is absolutely crystal clear. That there is no alternative way, so far discovered, of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by a free enterprise system."

Anyone who has followed my work knows that I have often written articles with optimistic undertones. The following links represent three recent examples where I have argued for optimism based on the opportunity that I believe is in front of us. Although there have been many supporters for these articles, there have also been many detractors.

The Greatest Risk We Face: To Again Falling Into a Recession

Are You Properly Positioned for the Return of the Economic Vitality of America?

Strong Standard and Poor's 500 Earnings plus Weak Stock Values equals Opportunity

The Positive Viewpoint

Although it’s hard to find supportive and positive opinions regarding our economy and the future of the American stock market, they fortunately do exist. This past week a friend sent me an uplifting piece that was authored by a financial adviser that he respects and uses. The adviser’s name is John Bodnar of Bodnar Financial Services Inc., headquartered in Florham Park, New Jersey. Here is a link to their website, for anyone who would like to learn more about John and his team. Bodnar Financial Services Inc.

I was so impressed with what John wrote that I asked if he would give me his permission to re-publish his work in its entirety and he enthusiastically agreed. What follows is John’s piece which I offer with his permission as an uplifting Holiday Season and Prosperous New Year card to all those who may be suffering from the doom and gloom that is so pervasively and relentlessly heaped upon us. I hope and wish it provides a lift of your spirit and confidence:

Can we learn from the past?

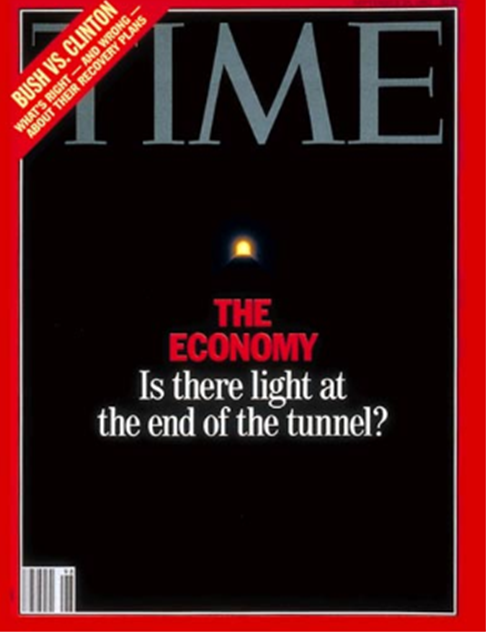

“The U.S. economy remains almost comatose… the economy is staggering under many structural burdens, as opposed to familiar cyclical problems… The structural faults represent once in a lifetime dislocations that will take years to work out. Among them: job drought, debt hangover, the banking collapse, the real estate depression, the healthcare cost explosion, and the runaway federal deficit.”

The paragraph above is a series of quotes from a TIME cover story “The Economy… Is there light at the end of the tunnel?” The headline and quotes sum up nicely how the masters-of- the-media view current events. But look closely at the cover. Can you read the ribbon in the upper left corner? It says BUSH vs. CLINTON. The date of this TIME issue was September 28, 1992. The Dow Jones Industrial Average would close that day at 3276. And if you could go back in time (having ignored TIME) and invested $1000 in an account for your new-born child or grandchild’s future college costs, 19 years hence that $1000 would be worth $3489.70; a cumulative return of 248.97%. I guess there was some light at the end of that tunnel.

Are you as fed up with the portrayal of gloom and doom as I am? In September, I celebrated my 30th anniversary in the financial advisory business. Jeanne and Lorraine gave me a gift certificate for 10 free visits to a local psychiatrist (That’s a joke. But tell the truth, for a brief moment, you thought it just might be true!). Why do we sit in front of the TV at night listening to the crazies? TV was invented to provide an escape from the pain and aggravation of everyday life. Instead, it seems the more you watch, the more uptight and angry you become.

Fear not comrades, herewith are a handful of factoids guaranteed to put a red, white, and blue grin on your face. Let’s begin with one of the golden oldies…Manufacturing. I’m sure you all have read newspaper articles or listen to a fair and balanced discussion on cable TV of how America is going to hell. The cry of “we don’t make anything anymore!” Answer me this: what country dominates in world manufacturing? And the crowd responds in unison CHINA! Wrong. The U.S. continues to be #1 in manufacturing. We are still the country of innovation and high quality engineering. Don’t believe it? Why would BMW establish a new plant to build the popular M6 series in Spartanburg, SC? Not only is the M6 Series made in America and exported back to Europe, but BMW recently announced that the 3 Series would also be manufactured in the USA as well. BMW is now the number one auto exporter in America. Boeing could have opened a manufacturing operation anywhere in the world, but they chose to stay in America where labor is skilled and material quality can be assured. Let China manufacture all the T-shirts the world needs, but when precision and engineering are needed, nothing yet can match the USA.

Talking heads on radio and TV claim that the American consumer is tapped out. Now that’s a real joke. Americans are going to stop spending money? Personal consumption expenditures are up in excess of 2% in 2011 over 2010. Spending was back as strongly in 2010 as before the crisis of 2008. Personal income for those employed has risen almost 10.5% since 2008. Granted, unemployment remains above 9%, but can we focus on the 91% who are employed and spending money?

I hear rumbling from the back of the room… but what about the housing crisis? Ah yes, yet another crisis… never let one go to waste is the tagline of many a political consultant. Agreed, there will likely be a housing hangover for several years. But, there is some good news. Nearly 40% of home purchases in the last year were ALL CASH DEALS. Florida, a state with exceptionally high foreclosure rates, posted a total of 485,286 foreclosed units in 2010. The number of foreclosures through July 2011 has declined to 71,899.

Housing is important, but it only represents 2.3% of Gross Domestic Product (GDP), core $3.3 billion. Yet we continue to dwell on this one piece of the overall economy. Did you know that capital spending by businesses represent 8.3% of GDP and is coming in at $1.1 trillion in 2011? Capital spending encompasses technology, display cases, store fixtures, etc. Capital spending is at an ALL-TIME high in 2011, far exceeding the amount spent in 2000 for the non-event known as Y2K—another example of an insignificant event that managed to dominate air time.

Now for the crisis du jour: will the Greece debt crisis bring the world economy to a halt? This one really needs to be put into perspective. Boys and girls, when it comes to economics, Greece hasn’t really mattered since 60 B.C. Greece has been in default 51% of its entire history as an independent nation. Why on earth do we act so surprised that they can’t pay their obligations now? There will be a bail out, and Greece will default again. This is nothing against the wonderful people of Greece. Love the weather; love the food; where would Western civilization be without the Greeks? But I assure you, there is not a German alive who’s willing to work to age 70 so the average Greek worker can retire at age 50. To put this one to rest: Greece’s GDP is slightly larger than West Virginia’s GDP. Come on folks, can we keep our wits about us and not fall prey to every rumor over a country the size of West Virginia?

And now for the grand finale; what about China? They are going to eat our lunch on the worldwide economic stage. Yes, China owns a huge pile of IOUs with a picture of Columbia holding her torch. But let’s drill down a little deeper. First, over the past 20 years China has done a great job of building a “new” China along their southern coastline. Keep in mind that America, the home of innovation for the past 200 years has had to transition from telegraph to telephone to fiber optics to 3G. China didn’t need to pay for those transitions; they went from NO PHONES WHATSOEVER to 3G. They are very good at implementing technology developed by other nations. They are not innovators. Infrastructure building over the past decade has been astounding, but if you venture to the interior of China, you will find many people without power, clean water, and living in dilapidated housing with minimal food to eat.

Here is a hard truth about China that you never hear discussed in the media. The labor force of China is peaking…. RIGHT NOW. Between 2000 and 2050, China’s labor force will decline by 9.8%. Over this time period, the labor force in America will grow by 4.2%. Place your chips on the table folks… China or the USA for the long haul?

Since China is one of my dear old Dad’s favorite rants of late, let me just beat this horse to the ground. China represents 23% of the world’s population yet has only 7% of the world’s fresh water supply. In fact, much of southern China (where the development is concentrated) and India share the same water source. China is damning the water upstream from India which could eventually erupt into an ugly situation. The Great Lakes region of the US contains 21% of the world’s fresh water supply. Manufacturing requires natural resources. Comparing these facts alone, I would argue that the USA will remain a dominant economic power. Not to fret Grandpa, your grandchildren and great grandchildren will have jobs and not be forced to learn Mandarin.

Corporate America, has it recovered from the 2008 financial crisis? If you believe the headlines you would think that the USA is on the precipice of another great recession, or worse, a depression. Hold on tight for this one: corporate profits hit an all-time high-repeat-ALL TIME HIGH in 2010 and are on track to exceed that number in 2011. Second quarter earnings for U.S. corporations also set a record. That’s right, the quarter that ended on June 30, 2011 was the greatest quarter for earnings in the history of American capitalism. Where were the balloons and the parade you ask? I can’t figure it out. Instead, the media tells us how the system is broken and we need fundamental change.

There have been ten ALL CASH corporate mergers from May 2011 through September 22, 2011. These are little mergers. BHP Billiton purchased Petrohawk Energy for $12.1 billion! Get the picture? One day you will look back to the autumn of 2011 and ask yourself, how did I miss it? The signs were everywhere. 1.) Investors withdrew in excess of $75 billion from equity mutual funds in the four months through August. That is more than they did in the five months after the Lehman collapse in September 2008. You will probably not need to be reminded that those latter five months represented the greatest buying opportunity in a generation, and that at their nadir offered prices which will most probably never be seen again. 2.) Corporate insiders loading up on company stock. August 2011 insider purchases were over $681 million. So, when a director of ExxonMobil ponies up $700,000, a director at Berkshire Hathaway invests $843,300, and even the CEO of Merck spends a million and a half dollars-just as the masses fall all over themselves getting out-somebody is usually trying to tell us something.

Ready to wrap this up? Let’s return to the 1992 TIME cover story. Sounds eerily like the headlines we read today. And yet, the decade of the 1990s turned out to be a boom for investors. Odd considering all the negative headwinds reported in the TIME article. I suggest we resurrect the American spirit and align ourselves with the economic realities instead of the political headlines. American businesses are doing well. They are well capitalized, sitting on loads of cash, increasing their dividends, and buying back their own stock. It is a great time to be an investor in some of the greatest companies in the world.

Significant market bottoms, when they finally occur, have less to do with fundamental economic and financial shifts than with crescendos of public panic. On this you can rely: the stock market remains an exceptionally efficient mechanism for the transfer of wealth from the inpatient to the patient.

John Bodnar, CFP ®, CIMA®

October 10, 2011

Pessimism Has Put Many of America’s Greatest Companies on Sale

After reading John’s uplifting piece I was very taken by the last two paragraphs where he talked about two important facts. First he talked about what a great time it was to be an American investor because some of the greatest companies in the world are on sale. Then he rightfully pointed out how the stock market was an exceptionally efficient mechanism to transfer wealth from the impatient to the patient. Therefore, I began looking at valuations of some of our finest companies and was frankly startled by what I found.

For the past 200 years or so, the average company has historically traded at a P/E ratio of approximately 15, and for the past 50 years the PE ratio of the average company has been closer to 20. The following portfolio review produced by F.A.S.T. Graphs™ lists 100 mostly above-average American companies that can be bought today at P/E ratios below 13. In other words, today we can buy above-average companies for less than we could typically buy average companies.

The list is produced in alphabetical order. The first column on the list shows the current P/E ratio, followed by the 15-year normal P/E ratio, followed by the 15-year historical EPS growth, followed by the estimated EPS growth and finally by the dividend yield.

Conclusions

Investors have been fleeing U.S. equities at unprecedented levels. Yet, I believe there is compelling evidence that suggests that this may be the best opportunity to invest in high-quality U.S. common stocks that we have seen in many years. The list of 100 stocks presented in this article represents only a sampling of the many companies that are selling at valuations which are lower than their fundamentals justify. The only logical reason that I can come up with for this, is extreme pessimism.

As I look to 2012 and beyond, I am astounded by the opportunity to own extremely high quality profitable businesses that can be purchased at such historically low valuations. Buying low is the first, and perhaps most important and sacred, principle of all investing. Although I can’t say with certainty that every stock on the above list is a great long-term investment, I can confidently state that you would be hard-pressed to find any on the list that will not be selling at higher prices three to five years from now. More than likely there will be a few, but I doubt that there will be many. I offer my wishes for a prosperous New Year and bright long-term future.

Disclosure: Long ABT, AFL, AVP, BBY, CVX, ENDP, EZPW, FISV, GME, HPQ, INTC, IR, ITW, JNJ, KSS, LLL, MDT, SYK, TEVA, WAG at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.