Automatic Data Processing (ADP, Financial) is a conservatively managed, diversified company that has increased its dividend every year for over 3 decades.

-Five year revenue growth: 2%

-Five year EPS growth: negative

-Five year cash flow growth: negative

-Dividend yield: 2.88%

-Dividend growth: 13%

-Balance Sheet: Perfect

Overall, I consider ADP to be somewhat expensive at the current price. There are, however, some positives that ADP likely has in its favor that are probably accounted for in its current stock valuation. For those interested in buying ADP as a defensive dividend grower, it would be prudent, in my view, to look for dips rather than to buy at the current price.

ADP also assists companies in certain industries with computing needs. For client businesses that sell cars, boats, are involved with heavy trucking, or similar fields, ADP can supply important software to help the business operate, from inventory, to networking, to data integration.

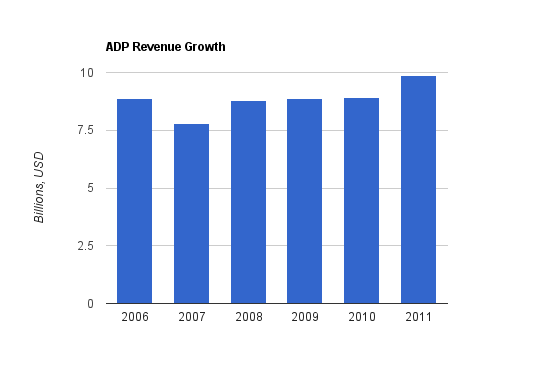

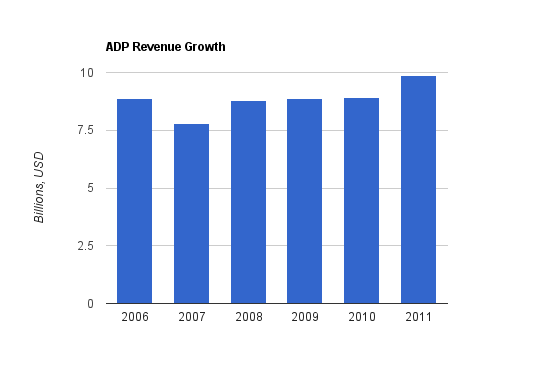

Revenue growth over this period has averaged only a bit over 2% annually, which is a rather slow pace. A positive note is that although growth was largely flat or down for the first half of this time period, revenue did grow by over 10% between 2010 and 2011. Revenue over the latest trailing twelve month period has breached $10 billion.

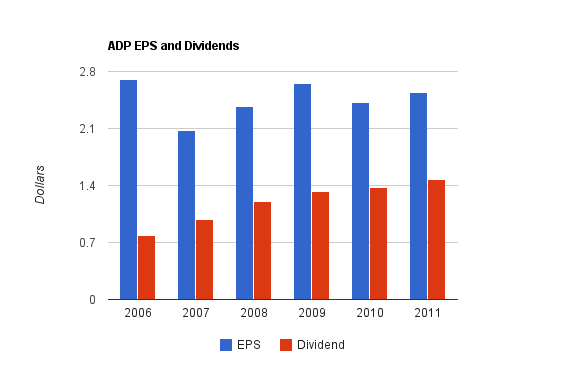

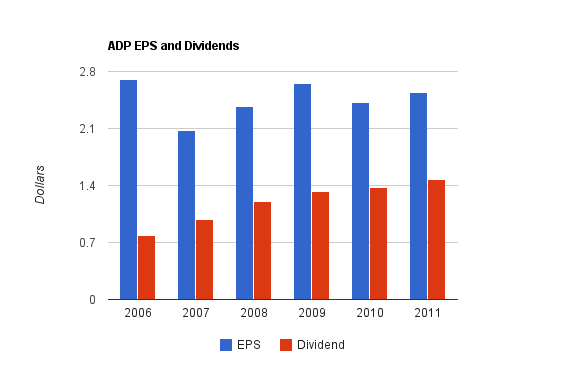

EPS growth has been erratic, and overall, negative during this period. Even over a full 10 year period, EPS growth has only averaged around 4% annually. Analysts have estimated high single-digit EPS growth for 2012 and 2013.

ADP has had negative cash flow growth over this period as well.

Price to FCF: 19

Price to Book: 4.5

Return on Equity: 21%

Over the past 5 years, ADP has grown its dividend by an average of 13.4% annually, which is solid. The most recent quarterly increase at the end of 2011 was a bit under 10%. The dividend payout ratio, with respect to earnings, has been increasing. Over the long term, dividend growth must eventually slow down to the level of EPS growth (or EPS growth must accelerate), since the payout ratio cannot comfortably exceed past a certain point.

However, it’s a great business, and I haven’t published an analysis on it for a year and a half, so it’s worth watching the company for dips. As explained below in the catalyst section, there is a case for optimism in terms of future growth that justifies at least a part of the current premium stock valuation, although I still propose that it’s overly expensive at the current price if one desires good returns.

There are a number of things that could be said for ADP’s strong market position. Although the company does have competitors, they’re not on the same scale as ADP. Their largest competitor is Paychex (PAYX), which has revenue of approximately one-fifth of ADP. Since ADP offers services that are so essential, so widespread, and go so deeply into a business, the company’s services have very high switching costs. For a business to switch a big segment of its human resources, payroll, and administrative components, it would be a significant expense and hassle. This is why the average client stays with ADP for over 10 years. Lastly, their strong balance sheet allows them to weather nearly any financial difficulty.

The company has over a half-million clients, and none of the larger ones account for even 2% of revenue each. In addition, the business has been expanding successful internationally. For instance, ADP’s “GlobalView” service had 105 multinational/global client contracts that account for nearly 1 million employees total.

Catalyst for Growth: Interest Rates

The recession has had more than the obvious effect on ADP. Apart from facing the same economic downturns as everyone else (and handling them defensively with their essential and widespread services), the company has faced the problem of low interest rates. Unlike other companies that use debt and therefore benefit from low interest rates, ADP would prefer higher interest rates for growth.

This is because ADP holds an enormous amount of client funds that they use for payroll and other functions. The result is similar to an insurance company, where an insurance company collects premiums, pays out claims, and uses that float, that collection of billions of dollars, to invest in income-producing assets from which get to keep the income. As of 2011, ADP holds nearly $17 billion in client funds, uses those funds for client purposes, but gets to keep the investment income that comes from those funds. Of course, ADP is conservatively managed and must keep these funds safe, so they invest in AAA/AA investments that produce a reliable, but low-return investment income. Due to the recession, interest rates have been held artificially low for an abnormal amount of time, which has affected ADP’s interest income.

Interest rates play a large role in ADP profitability. In 2011, the company reported $540 million in interest income. This fell slightly from 2010 levels of $543 million, because although their base of client funds grew by 11%, interest rates on their investments fell from 3.6% to 3.2%. The interest rate was 4.0% in 2009, 4.4% in 2008, 4.5% in 2007, and 4.1% in 2006. The following chart presents the information more clearly.

This is an important chart, because it helps to show a part of ADP’s “real” growth as compared to their reported income growth, which has been negatively affected by reduced interest rates. In addition to other metrics of growth such as number of clients, number of employees served, total revenue growth, and more, funds held for clients is a rather important metric of continued business growth and expansion for ADP. The amount of funds held grew by almost 4.5% annually over this period, on average, but reduced interest rates have kept interest income flat. ADP defends against interest rate changes by laddering the expiration of their investments, but as the interest rates have been held low for so long, ADP has had to continually reinvest the funds into lower-return investments.

Interest income only accounts for a small portion of revenue. Out of $9,880 million in 2011 revenue, interest from client funds was only $540 million, or less than 5.5%. However, total net income for 2011 was $1,254 million, so a major change of a couple hundred million dollars in total interest income has a considerable effect on net income and EPS results. This is part of the reason that ADP growth looks so slow; interest rates have been affecting their income and margins even as the business continues to grow. If a 4.0% interest rate were fixed onto the 2011 figure for client funds instead of the actual 3.2% figure, it would have boosted 2011 reported net income by $135 million, or more than 10%. If a 4.5% interest rate were fixed onto the 2011 figure for client funds, it would have boosted 2011 reported net income by $220 million, or over 17%.

Over time, interest rates will increase eventually, and this should act as a tailwind, rather than the headwind that it has been, for ADP’s reported net income and EPS. I believe that optimism of the current valuation is taking this into account, although interest rates will likely stay low for quite some time and even with generous interest rates factored in, the valuation is still a bit expensive in my opinion.

Full Disclosure: I have no position in ADP at the time of this writing.

-Five year revenue growth: 2%

-Five year EPS growth: negative

-Five year cash flow growth: negative

-Dividend yield: 2.88%

-Dividend growth: 13%

-Balance Sheet: Perfect

Overall, I consider ADP to be somewhat expensive at the current price. There are, however, some positives that ADP likely has in its favor that are probably accounted for in its current stock valuation. For those interested in buying ADP as a defensive dividend grower, it would be prudent, in my view, to look for dips rather than to buy at the current price.

Overview

Automatic Data Processing (ADP) is one of the world’s largest outsourcing companies. ADP handles human resource needs, benefits, payroll, and computing processes for many companies around the world. They prepare employee payroll checks, direct deposits, and tax reports. They capture, calculate, and record employee time and attendance. They perform hiring services. They provide record-keeping and administrative services for retirement plans.ADP also assists companies in certain industries with computing needs. For client businesses that sell cars, boats, are involved with heavy trucking, or similar fields, ADP can supply important software to help the business operate, from inventory, to networking, to data integration.

Revenue, Earnings, Cash Flow, and Margins

ADP has had slow business growth over the past several years, but nonetheless remains strong.Revenue Growth

| Year | Revenue |

|---|---|

| 2011 | $9.88 billion |

| 2010 | $8.93 billion |

| 2009 | $8.87 billion |

| 2008 | $8.78 billion |

| 2007 | $7.80 billion |

| 2006 | $8.88 billion |

Earnings Growth

| Year | EPS |

|---|---|

| 2011 | $2.54 |

| 2010 | $2.42 |

| 2009 | $2.65 |

| 2008 | $2.37 |

| 2007 | $2.07 |

| 2006 | $2.70 |

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2011 | $1.71 billion |

| 2010 | $1.68 billion |

| 2009 | $1.56 billion |

| 2008 | $1.79 billion |

| 2007 | $1.30 billion |

| 2006 | $1.81 billion |

Metrics

Price to Earnings: 21Price to FCF: 19

Price to Book: 4.5

Return on Equity: 21%

Dividend Growth

ADP has paid growing dividends for over 3 decades. The current yield has slipped under 3% to only 2.88%, and the payout ratio is a bit over 60%.Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.475 |

| 2010 | $1.38 |

| 2009 | $1.33 |

| 2008 | $1.20 |

| 2007 | $0.98 |

| 2006 | $0.785 |

Share Repurchases

ADP has been spending more money on share repurchases than on dividends. For the three years of 2009, 2010, and 2011, ADP has paid out approximately $2 billion in dividends, and has spent slightly over $2 billion on net share repurchases. This has resulted in decreasing the number of shares outstanding by a bit over 5% over those three years. Before the recession, ADP was regularly spending at least twice the amount of money on share repurchases as on dividends. Over ten years, the number of shares outstanding has decreased from approximately 630 million to 490 million. The amount of money spent on dividends and share repurchases each year exceeds earnings, and approximately matches free cash flow over the long term. However, with a P/E of 21, I find that share repurchases are not the best use of returns for shareholders; the rate of return just isn’t particularly high.Balance Sheet

ADP’s balance sheet is very, very strong. Total debt/equity is practically zero, and the interest coverage ratio is therefore practically infinite. However, approximately 50% of the shareholder equity consists of goodwill, but this isn’t a problem. ADP is one of only four non-financial US companies that currently hold a perfect AAA credit rating from the top rating agencies. (The other three are Exxon Mobil (XOM), Johnson and Johnson (JNJ), and Microsoft (MSFT), and as a disclosure, I own all three.) Rating agencies have received criticism for having been rather useless with regards to the financial collapse, but looking at ADP’s balance sheet, it’s rather clear why they receive the rating they do. The business has diverse revenue and income streams, practically zero debt, a large and defensive business that can withstand a major recession, etc.Investment Thesis

When I analyzed ADP a year and a half ago, it was trading at slightly above $40/share, and I wrote that it was attractively priced. It has since gone up to $55, which may be great for short term investors who could have made basically a 40% rate of return over that period, but for longer term investors, I believe that means ADP is somewhat overvalued now. EPS has not grown at that rate, and therefore the P/E is higher, the dividend yield is lower.However, it’s a great business, and I haven’t published an analysis on it for a year and a half, so it’s worth watching the company for dips. As explained below in the catalyst section, there is a case for optimism in terms of future growth that justifies at least a part of the current premium stock valuation, although I still propose that it’s overly expensive at the current price if one desires good returns.

There are a number of things that could be said for ADP’s strong market position. Although the company does have competitors, they’re not on the same scale as ADP. Their largest competitor is Paychex (PAYX), which has revenue of approximately one-fifth of ADP. Since ADP offers services that are so essential, so widespread, and go so deeply into a business, the company’s services have very high switching costs. For a business to switch a big segment of its human resources, payroll, and administrative components, it would be a significant expense and hassle. This is why the average client stays with ADP for over 10 years. Lastly, their strong balance sheet allows them to weather nearly any financial difficulty.

The company has over a half-million clients, and none of the larger ones account for even 2% of revenue each. In addition, the business has been expanding successful internationally. For instance, ADP’s “GlobalView” service had 105 multinational/global client contracts that account for nearly 1 million employees total.

Catalyst for Growth: Interest Rates

The recession has had more than the obvious effect on ADP. Apart from facing the same economic downturns as everyone else (and handling them defensively with their essential and widespread services), the company has faced the problem of low interest rates. Unlike other companies that use debt and therefore benefit from low interest rates, ADP would prefer higher interest rates for growth.

This is because ADP holds an enormous amount of client funds that they use for payroll and other functions. The result is similar to an insurance company, where an insurance company collects premiums, pays out claims, and uses that float, that collection of billions of dollars, to invest in income-producing assets from which get to keep the income. As of 2011, ADP holds nearly $17 billion in client funds, uses those funds for client purposes, but gets to keep the investment income that comes from those funds. Of course, ADP is conservatively managed and must keep these funds safe, so they invest in AAA/AA investments that produce a reliable, but low-return investment income. Due to the recession, interest rates have been held artificially low for an abnormal amount of time, which has affected ADP’s interest income.

Interest rates play a large role in ADP profitability. In 2011, the company reported $540 million in interest income. This fell slightly from 2010 levels of $543 million, because although their base of client funds grew by 11%, interest rates on their investments fell from 3.6% to 3.2%. The interest rate was 4.0% in 2009, 4.4% in 2008, 4.5% in 2007, and 4.1% in 2006. The following chart presents the information more clearly.

| Year | Client Funds | Average Interest Rate | Interest Income |

|---|---|---|---|

| 2011 | $16.87 billion | 3.2% | $540.1 million |

| 2010 | $15.19 billion | 3.6% | $542.8 million |

| 2009 | $15.16 billion | 4.0% | $609.8 million |

| 2008 | $15.65 billion | 4.4% | $684.5 million |

| 2007 | $14.68 billion | 4.5% | $653.6 million |

| 2006 | $13.57 billion | 4.1% | $549.8 million |

Interest income only accounts for a small portion of revenue. Out of $9,880 million in 2011 revenue, interest from client funds was only $540 million, or less than 5.5%. However, total net income for 2011 was $1,254 million, so a major change of a couple hundred million dollars in total interest income has a considerable effect on net income and EPS results. This is part of the reason that ADP growth looks so slow; interest rates have been affecting their income and margins even as the business continues to grow. If a 4.0% interest rate were fixed onto the 2011 figure for client funds instead of the actual 3.2% figure, it would have boosted 2011 reported net income by $135 million, or more than 10%. If a 4.5% interest rate were fixed onto the 2011 figure for client funds, it would have boosted 2011 reported net income by $220 million, or over 17%.

Over time, interest rates will increase eventually, and this should act as a tailwind, rather than the headwind that it has been, for ADP’s reported net income and EPS. I believe that optimism of the current valuation is taking this into account, although interest rates will likely stay low for quite some time and even with generous interest rates factored in, the valuation is still a bit expensive in my opinion.

Risks

ADP is a very defensive, diverse, business. They do have a bit of concentration with auto dealers, and ADP in general is susceptible to global economic downturns. If there are high numbers of closing businesses in tough economic environments (which is more likely among their smaller clients), then ADP’s growth and profitability get impacted. Plus as with all large businesses, ADP has regulatory risk and some currency risk. Low interest rates, as previously described, can be a problem as far as net income is concerned. I believe most of the risk associated with the stock, at the current time, has more to do with the valuation than the underlying fundamental business. Slow business growth is a concern (even when taking into account the previous and current interest rate changes), as slow business growth can fundamentally impact stock valuation.Conclusion and Valuation

In conclusion, I think ADP is a bit expensive, although I think there are more positives for the company than one might expect by looking at previous growth history alone. Based on the rather slow growth (with the potential for improved moderate growth ahead over the long term), and based on the excellent balance sheet and defensive nature of the business, I think ADP would be a decent buy at around $45 or so per share. Writing puts at a strike price of $48 for January 2013 with an intention of buying the stock should the option be assigned might be an acceptable use of capital for those looking to enter a position. Or, one could invest elsewhere for the time being and look to buy ADP on market weakness, if one were so inclined. The current $55 stock price seems to me to be too expensive; I’d hold at the current price if I owned ADP but wouldn’t buy.Full Disclosure: I have no position in ADP at the time of this writing.