Hedging a High Yield Long Idea

In a post Wednesday morning ("High-Yield Long Idea Idea Continues Strong"), Tim Knight noted the continued strong performance of his long position in the SPDR Barclays High Yield Bond ETF JNK. Back in August, I looked at the cost of hedging JNK, but I thought it might be worth taking another look after seeing Tim's post. It turns out JNK is pretty inexpensive to hedge right now. The table below shows the cost, as of Wednesday's close, of hedging it against a greater-than-20% drop over the next several months.

A Comparison

For comparison purposes, I've added six of the most actively traded ETFs to the table. First, a reminder about what optimal puts are, and a note about decline thresholds; then, a screen capture showing the optimal puts to hedge JNK.

About Optimal Puts

Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor (available on the web and as an Apple iOS app) uses an algorithm developed by a finance Ph.D. to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

Decline Thresholds

In this context, "threshold" refers to the maximum decline you are willing to risk in the value of your position in a security. You can enter any percentage you like for a decline threshold when scanning for optimal puts (the higher the percentage though, the greater the chance you will find optimal puts for your position). I have used 20% thresholds for each of the securities below.

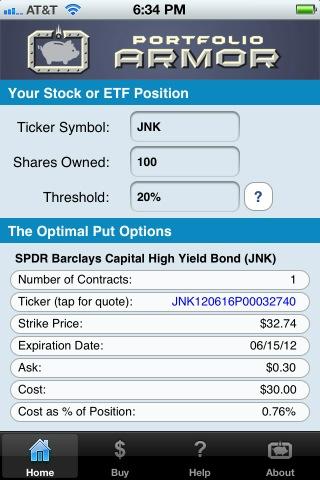

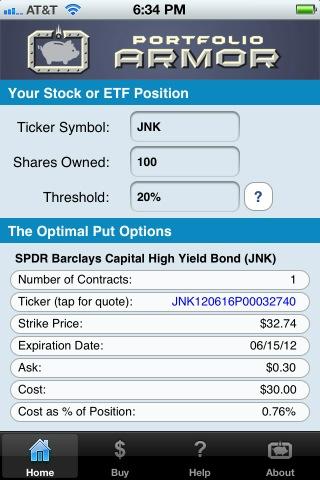

The Optimal Puts for JNK

Below is a screen capture showing the optimal put option contract to buy to hedge 100 shares of JNK against a greater-than-20% drop between now and June 15th. A note about these optimal put options and their cost: to be conservative, Portfolio Armor calculated the cost based on the ask price of the optimal puts. In practice, an investor can often purchase puts for a lower price, i.e., some price between the bid and the ask (the same is true of the other names in the table below).

[url=http://static.seekingalpha.com/uploads/2011/10/18/131469-131898772810179-David-Pinsen_origin.png] [/url]

[/url]

Hedging Costs as of Wednesday's Close

The data below is as of Wednesday's close, and is presented as percentages of position values.

*Based on optimal puts expiring in June

**Based on optimal puts expiring in July

***Based on optimal puts expiring in August

In a post Wednesday morning ("High-Yield Long Idea Idea Continues Strong"), Tim Knight noted the continued strong performance of his long position in the SPDR Barclays High Yield Bond ETF JNK. Back in August, I looked at the cost of hedging JNK, but I thought it might be worth taking another look after seeing Tim's post. It turns out JNK is pretty inexpensive to hedge right now. The table below shows the cost, as of Wednesday's close, of hedging it against a greater-than-20% drop over the next several months.

A Comparison

For comparison purposes, I've added six of the most actively traded ETFs to the table. First, a reminder about what optimal puts are, and a note about decline thresholds; then, a screen capture showing the optimal puts to hedge JNK.

About Optimal Puts

Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor (available on the web and as an Apple iOS app) uses an algorithm developed by a finance Ph.D. to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

Decline Thresholds

In this context, "threshold" refers to the maximum decline you are willing to risk in the value of your position in a security. You can enter any percentage you like for a decline threshold when scanning for optimal puts (the higher the percentage though, the greater the chance you will find optimal puts for your position). I have used 20% thresholds for each of the securities below.

The Optimal Puts for JNK

Below is a screen capture showing the optimal put option contract to buy to hedge 100 shares of JNK against a greater-than-20% drop between now and June 15th. A note about these optimal put options and their cost: to be conservative, Portfolio Armor calculated the cost based on the ask price of the optimal puts. In practice, an investor can often purchase puts for a lower price, i.e., some price between the bid and the ask (the same is true of the other names in the table below).

[url=http://static.seekingalpha.com/uploads/2011/10/18/131469-131898772810179-David-Pinsen_origin.png]

[/url]

[/url]Hedging Costs as of Wednesday's Close

The data below is as of Wednesday's close, and is presented as percentages of position values.

| Symbol | Name | Hedging Cost |

| SPY | SPDR Trust | 1.09%* |

| XLF | Financial Sector SPDR | 2.11%* |

| IWM | iShares Russell 2000 Index | 3.53%*** |

| EEM | iShares MSCI Emerging Mkt | 2.17%* |

| QQQ | PowerShares QQQ Trust | 1.26%* |

| IAU | iShares Comex Gold Trust | 1.50%** |

| JNK | SPDR Barclays High Yield | 0.76%* |

**Based on optimal puts expiring in July

***Based on optimal puts expiring in August