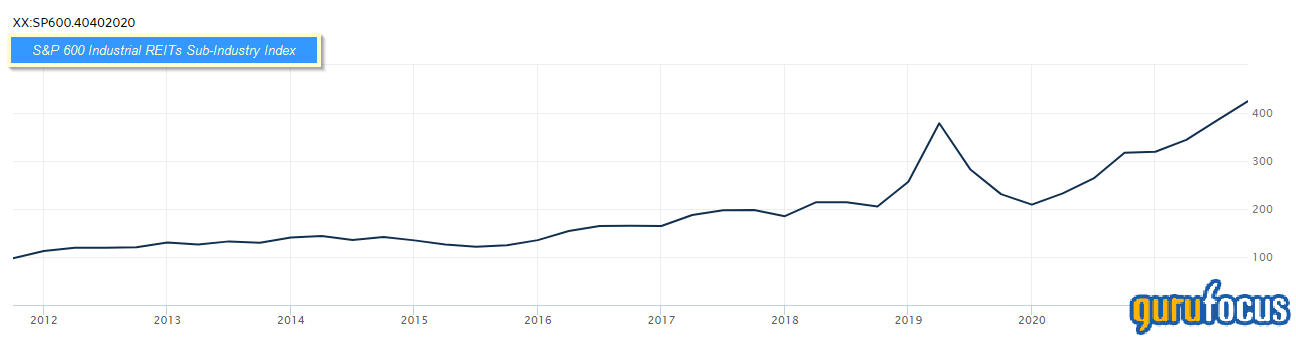

Industrial real estate investment trusts (REITs) have been a hot asset class lately, particularly REITs with e-commerce warehouse properties. Industrial REIT prices have quadrupled in the past 10 years, as shown in the chart below.

Industrial Logistics Properties Trust (ILPT, Financial) is one such REIT that is in the business of owning and leasing distribution and logistics properties that serve the growing needs of e-commerce. Its portfolio consists of more than 290 properties containing approximately 36 million rentable square feet leased to over 260 tenants in 33 states. More than 70% of Industrial Logistics Properties Trust's annual rental revenues are derived from investment grade tenants or Hawaii land leases. Industrial Logistics Properties Trust is externally managed by an operating subsidiary of The RMR Group Inc. (RMR, Financial), an alternative asset management company with more than $32 billion in assets under management and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. Industrial Logistics Properties Trust is headquartered in Newton, Massachusetts.

The Monmouth deal

The company announced on Nov. 5 that it has entered an agreement to acquire all the outstanding shares of competitor Monmouth Real Estate Investment Corporation (MNR, Financial) for $21.00 per share in an all-cash transaction, valued at approximately $4.0 billion, including committed Monmouth acquisitions, transaction costs and the assumption of $409 million of debt. The transaction adds 126 new Class A, single tenant, net leased, e-commerce focused industrial properties to Industrial Logistics Properties Trust's existing high-quality portfolio and improves geographic and tenant diversity. The portfolio contains over 26 million square feet of space, has a weighted average remaining lease term of approximately eight years, is over 80% leased to investment grade rated tenants and generates annualized rental revenue of $169.4 million. Industrial Logistics Properties Trust expects this transaction to be immediately accretive to Normalized Funds from Operations, or FFO, per share.

The deal came about after Monmouth Real Estate Investment's agreement to be acquired by Equity Commonwealth (EQC, Financial) fell apart because Monmouth shareholders rejected the deal as inadequate. Another suitor, Starwood Capital, then offered to acquire Monmouth in August for $19.20 a share but was also rejected.

From Industrial Logistics Properties Trust's perspective, highlights of the acquired Monmouth portfolio include:

- 126 industrial and logistics properties with approximately 26.3 million rentable square feet.

- Geographically diverse portfolio across thirty-two states with an average age of approximately nine years.

- 99.7% occupied with a weighted average lease term of approximately eight years.

- Over 80% of annual rents come from investment grade tenants.

- Annualized rental revenue of $169.4 million as of Sept. 30.

- Manageable near-term lease expirations average 6.4% of contractual rents per year over the next three years.

Industrial Logistics Properties Trust expects the transaction to be immediately value accretive. The ultimate amount of accretion will primarily depend on the size and structure of the joint venture used to finance this acquisition. The year one cash cap rate on this acquisition is 4.0% and the GAAP cap rate is approximately 4.3%, both of which Industrial Logistics Properties Trust believes are higher than could be achieved if the properties were acquired one off in marketed transactions.

How will the acquisition be funded?

To finance this acquisition, Industrial Logistics Properties Trust plans to enter a joint venture with one or more institutional investors for equity investments of between approximately $430 million and $1.3 billion. Accordingly, the company does not currently plan to issue common shares in connection with this transaction. Industrial Logistics Properties Trust plans to finance the balance of the $4.0 billion purchase with proceeds from new mortgage debt and the assumption of approximately $409 million of existing Monmouth mortgage debt. Depending on the ultimate size of the joint venture equity investments, the company may also use proceeds from the sale of up to approximately $1.6 billion of Monmouth properties to finance this transaction.

Following the closing of the acquisition and execution of the financing plan described above, the ratio of consolidated net debt to adjusted Ebitda is expected to be between 6 and 8 at the end of 2022. To ensure it can finance the closing of this transaction, Industrial Logistics Properties Trust has secured commitments from lenders for a $4.0 billion bridge loan facility.

A potential value opportunity?

The transaction is subject to customary closing conditions, including Monmouth shareholder approval, and is expected to close in the first half of 2022.

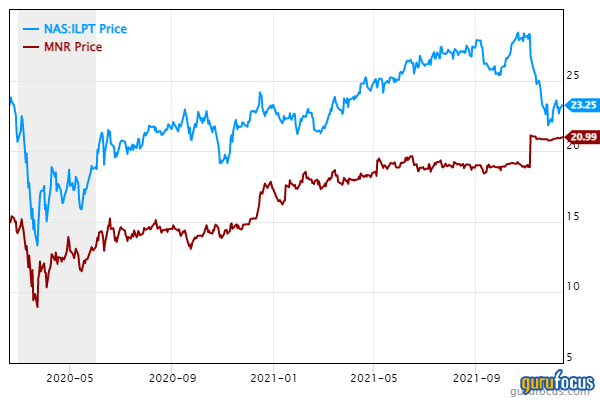

The following chart shows Industrial Logistics Properties Trust and Monmouth's stock prices from the start of the pandemic in February 2020. After the initial shock in March 2020, both REITs began a steady climb as the impact on e-commerce came to be appreciated by the market.

However, since the deal was announced on Nov. 5, Industrial Logistics Properties Trust shares have declined nearly 20%, while Monmouth have risen to the deal price of $21.

The market may be thinking that Industrial Logistics Properties Trust is paying too much for Monmouth and may have to cut its distribution to do the deal. However, this goes against what the management is saying, which is that the deal is value-accretive. From my analysis of how the deal will be financed, I think the dividend distribution is safe.

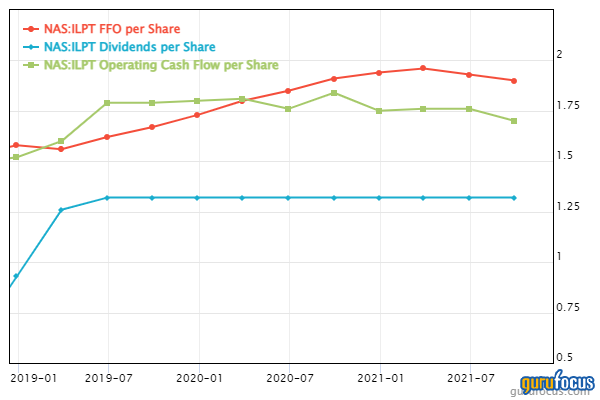

The following are some key metrics for Industrial Logistics Properties Trust, Monmouth and selected peers. Industrial Logistics Properties Trust's numbers look good, and support the view that the deal is accretive, in my opinion. I think the company generates enough cash flow to make this work. The company's capitalization rate and cash return are the highest of the industrial REIT peers listed below. It is currently paying a dividend yield of 5.6%, and this looks well covered by funds from operations (FFO) and operating cash flow (OCF) per share.

| Ticker | Company | Industry | Market Cap($M) | Capitalization Rate | FCF Yield % | Cash Return % | |||

| OCF ÷ Enterprise value | FCF ÷ market cap. | Free Cash Flow | InterestExpense | EnterpriseValue ($M) | (FCF + interest expense) ÷ Enterprise value | ||||

| ILPT | Industrial Logistics Properties Trust | REITs | 1,520.66 | 0.06 | 7.38 | 110.55 | -37.46 | 2,472.58 | 5.99 |

| MNR | Monmouth Real Estate Investment Corp | REITs | 2,064.14 | 0.04 | 3.73 | 76.85 | -37.88 | 3,495.98 | 3.28 |

| IIPR | Innovative Industrial Properties Inc | REITs | 5,885.64 | 0.02 | 2.70 | 175.20 | -12.79 | 6,426.53 | 2.93 |

| NSA | National Storage Affiliates Trust | REITs | 5,800.14 | 0.04 | 3.67 | 268.51 | -68.45 | 7,939.88 | 4.24 |

| LAND | Gladstone Land Corp | REITs | 1,030.75 | 0.03 | 2.87 | 24.61 | -23.91 | 1,628.12 | 2.98 |

| PLYM | Plymouth Industrial REIT Inc | REITs | 1,023.28 | 0.04 | 5.40 | 45.52 | -17.51 | 1,688.93 | 3.73 |

| TRNO | Terreno Realty Corp | REITs | 6,111.17 | 0.02 | 2.21 | 122.12 | -17.04 | 6,458.75 | 2.15 |

| STAG | Stag Industrial Inc | REITs | 7,994.97 | 0.04 | 2.42 | 170.21 | -62.58 | 9,750.33 | 2.39 |

Conclusion

Industrial Logistics Properties Trust was trading with a $28 handle prior to its announcement of the acquisition of Monmouth. With stock having fallen by roughly 20%, it looks as if the market may have negatively reacted to the deal, potentially because of the high cost.

In fact, Industrial Logistics Properties Trust has dropped to below pre-pandemic levels. This is a bit too pessimistic, in my view. Personally, I do not think the company is overpaying by much if Monmouth's cap rate and cash return are in line with other peers. If management is right and the deal is accretive, then Industrial Logistics Properties Trust shares should bounce back to get in line with peer valuations given the high-quality combined portfolio. Therefore, I believe that Industrial Logistics Properties Trust is heavily undervalued courtesy of Mr. Market's overreactions.