Chubb Corporation (CB, Financial) is an international property and casualty insurer.

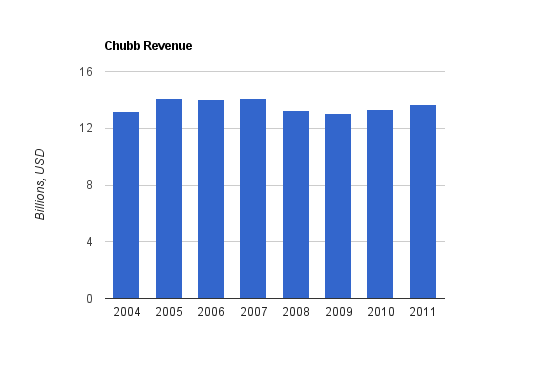

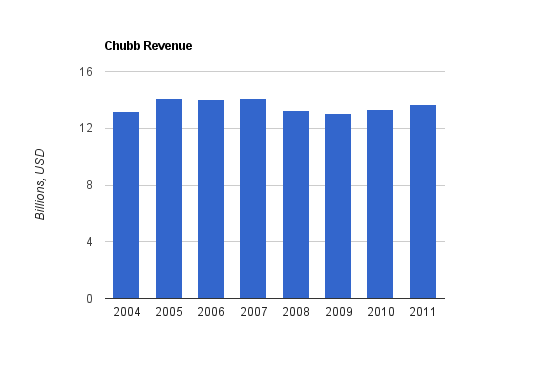

-Seven year revenue growth: 0%

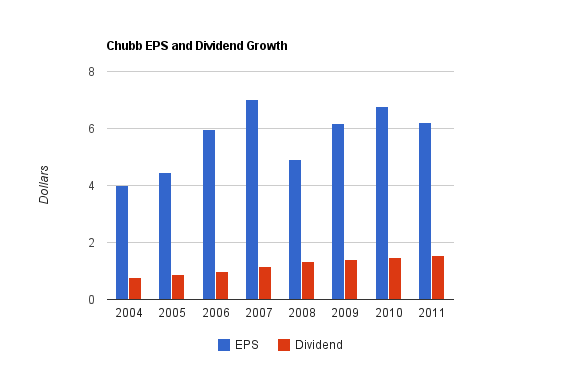

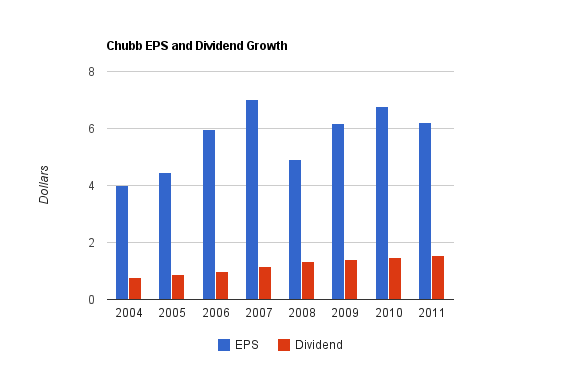

-Seven year EPS growth: 6.4%

-Seven year dividend growth: 10.4%

-Current dividend yield: 2.30%

In my opinion, with a long dividend history, a modest stock valuation, solid business standards, and a sizable net payout, Chubb would make a decent investment at under $70/share.

The premise behind an insurance company is that they spread risk out over a wide number of people and businesses. They collect premiums (payments) from clients and in return those clients are covered in case of a serious loss. From an insurance business standpoint, it’s ideal to collect more in premiums than you pay out for losses. This is not the primary form of earnings, though. An insurance business, after collecting all of the premiums, holds a great deal of assets that, over time, are paid out for client losses. Since they constantly receive premiums and pay out for losses, as long as they are prudent with their business, they get to constantly keep this large sum of stored-up assets as a float. As any investor reading this knows, a great sum of money can be used to generate income from investments, and that’s how an insurance company really makes money. They invest the insurance float in conservative and liquid securities in order to produce business income. Chubb, however, is unusually adept at ensuring that their premiums exceed their payouts, so compared to many other insurers, Chubb receives significant income from their underwriting businesses as well.

Chubb brings in 74% of its premiums from the United States and the other 26% from outside the United States.

Commercial Insurance

This segment accounted for $4.7 billion in premiums in 2010, representing 42% of the total. Insurance products are offered for casualty, peril, workers compensation, property, and marine.

Personal Insurance

This segment accounted for $3.8 billion in premiums in 2010, representing 34% of the total. Insurance products are offered for fine homes, automobiles, and possessions.

Specialty Insurance

This segment accounted for $2.7 billion in premiums in 2010, representing 24% of the total. Insurance products are offered for specialty professional liability for companies, institutions, firms, and healthcare organizations.

Premiums and overall revenue growth over this period was basically flat.

Between 2004 and 2010, average invested assets (the assets that generate investment income for Chubb), increased from $26.8 billion to $38.3 billion. Investment income increased at a somewhat slower pace than the asset growth due to a mild but sustained reduction in the interest rates on their investment assets over this period. The interest rate on Chubb’s investments dropped from around four and a half percent to only around 4 percent, and since the Fed stated that interest rates will likely remain low throughout 2014, I expect Chubb’s interest rates on its assets to continue to mildly decrease.

Chubb grew EPS by an annualized rate of 6.4% over this period.

Book value per share grew at an annualized rate of 10.4% per year.

Chubb has grown its dividend by a rate of 10.4% per year over this period. The most recent increase from 2010 to 2011, however, was only 5.4%. I’m hoping for a larger increase in 2012.

In other words, Chubb is indeed returning considerable value to shareholders with these repurchases and dividends combined. Management sends approximately 100% of net income to shareholders in the form of dividends and net share repurchases. The repurchases fuel EPS growth, dividend growth, and book value growth.

I evaluate the effectiveness of share repurchases on a case by case basis, based mostly on a) consistency of the share repurchases, b) whether the shares were repurchased at a fair price, and c) how effectively it is reducing the share count. I believe Chubb performs well with regard to all of these criteria, which is in contrast to Costco (COST) which I demonstrated had a flawed share repurchase history, as most companies do.

I’d prefer, however, for Chubb to double its dividend so that it yields comfortably over 4%, and then, and only then, worry about share repurchases. This would slow EPS growth and book value growth down moderately, but the dividend yield would be bigger. I think that would serve investors slightly better than the current policy of low dividends and big share repurchases. Let the shareholders decide if, when, and how to invest their share of the earnings; in my view.

Price to Book: 1.3

Combined Loss to Expense ratio was reported to be 89.3% in 2010, which is excellent. In fact, Chubb has has kept this ratio below 100% every year since 2003, when the current CEO took over. As I mentioned previously, an insurer doesn’t even necessarily have to keep this ratio below 100%; they could carry a slight loss of claims compared to premiums, and recoup that with investment income. But by having such strict and profitable underwriting standards, Chubb generates not only investment income, but substantial income from the difference between premiums earned and claims paid. The combined ratio looks like it’ll be somewhat higher in 2011 due to an increase in catastrophic losses; perhaps in the upper-90”²s. But this comparatively poor combined ratio for Chubb will be a solid combined ratio for the industry, as Chubb’s ratios are atypically low in most years, which is a great thing.

The company has stated that they focus primarily on bottom line growth; profitability. They look to boost premiums where possible, but not at the expense of profitability. Their business model has been summed up as follows by the son of the founder of the business:

I find that many insurers are having stagnant premium growth over the last several years. Many businesses have gone out of business or have decreased in size, which means less insurance demand. Less demand for insurance means lower premiums. In addition, interest rates have been held unusually low for an unusually long period of time due to the recession, and this affects the interest income on insurance portfolios, which is generally the primary source of income for an insurance company. Chubb is a bit buffered from that by their strong underwriting standards (they earn meaningful profits aside from interest), but the low interest environment still does negatively affect them.

Chubb’s policy of strong underwriting principles and an inflexibility with regards to lower premiums to capture market share leads to weakness in soft insurance markets, and leads to strength in stronger insurance markets. Basically the whole second half of the last decade was difficult for Chubb, but I believe that over the long term, their fortunes will improve. Their international expansion is good news, and I believe that Chubb will rebound as businesses become stronger. Over the long term (2+ years away), higher interest rates should act as a minor tailwind as well.

The good news to contrast the bad news of no premium growth, is that Chubb stock is basically priced for no growth. This company, which has grown its dividend every year for four-and-a-half consecutive decades and is among the most respected companies in the industry, has a P/E of under 12. This means that through dividends and share repurchases (and I’d prefer that ratio to lean more towards dividends), Chubb can still provide solid shareholder returns through dividend growth and stock price appreciation.

Overall, during a time when I am not finding very many great value opportunities on the market, I believe Chubb is a fair investment.

Insurance companies have little to no competitive advantages, or moats. Their insurance products are basically a commodity. What’s worse, is that customers often don’t get to appreciate the difference in quality of products until a claim is filed. Chubb specializes and has a great reputation in certain niches and is among the largest in its industry, which reduces risk, but it doesn’t provide a convincingly robust long-term competitive advantage in my view. Chubb is as good as its management is at any given time. Fortunately, the company has had a history of good management in my opinion, present management included.

Chubb was around $56/share last year when I wrote a positive analysis of it and called it a solid buy. Now that the market as a whole is offering fewer appealing investments in my view, Chubb’s increased stock valuation at $68/share makes it still decent, yet not quite as appealing as last year. I’m willing to buy at the current price of under $70/share.

Full Disclosure: At the time of this writing, I am long CB.

-Seven year revenue growth: 0%

-Seven year EPS growth: 6.4%

-Seven year dividend growth: 10.4%

-Current dividend yield: 2.30%

In my opinion, with a long dividend history, a modest stock valuation, solid business standards, and a sizable net payout, Chubb would make a decent investment at under $70/share.

Overview

Chubb Corporation (NYSE: CB) was founded in 1882 as a marine underwriting business in New York, and now exists as an international property and casualty insurance company with over 10,000 employees.The premise behind an insurance company is that they spread risk out over a wide number of people and businesses. They collect premiums (payments) from clients and in return those clients are covered in case of a serious loss. From an insurance business standpoint, it’s ideal to collect more in premiums than you pay out for losses. This is not the primary form of earnings, though. An insurance business, after collecting all of the premiums, holds a great deal of assets that, over time, are paid out for client losses. Since they constantly receive premiums and pay out for losses, as long as they are prudent with their business, they get to constantly keep this large sum of stored-up assets as a float. As any investor reading this knows, a great sum of money can be used to generate income from investments, and that’s how an insurance company really makes money. They invest the insurance float in conservative and liquid securities in order to produce business income. Chubb, however, is unusually adept at ensuring that their premiums exceed their payouts, so compared to many other insurers, Chubb receives significant income from their underwriting businesses as well.

Chubb brings in 74% of its premiums from the United States and the other 26% from outside the United States.

Business Segments

Chubb has three business segments, and the executives expect an underwriting profit from each of them.Commercial Insurance

This segment accounted for $4.7 billion in premiums in 2010, representing 42% of the total. Insurance products are offered for casualty, peril, workers compensation, property, and marine.

Personal Insurance

This segment accounted for $3.8 billion in premiums in 2010, representing 34% of the total. Insurance products are offered for fine homes, automobiles, and possessions.

Specialty Insurance

This segment accounted for $2.7 billion in premiums in 2010, representing 24% of the total. Insurance products are offered for specialty professional liability for companies, institutions, firms, and healthcare organizations.

Revenue, Profit, and Equity

Chubb receives revenue from premiums written, in addition to income earned from investments and a few other areas.Revenue

| Year | Premiums Earned | Investment Income | Other Sources | Total Revenue |

|---|---|---|---|---|

| TTM | $11.535 billion | $1.652 billion | $464 million | $13.651 billion |

| 2010 | $11.215 billion | $1.665 billion | $439 million | $13.319 billion |

| 2009 | $11.331 billion | $1.649 billion | $36 million | $13.016 billion |

| 2008 | $11.828 billion | $1.732 billion | ($339 million) | $13.221 billion |

| 2007 | $11.946 billion | $1.738 billion | $423 million | $14.107 billion |

| 2006 | $11.958 billion | $1.580 billion | $465 million | $14.003 billion |

| 2005 | $12.176 billion | $1.408 billion | $499 million | $14.083 billion |

| 2004 | $11.636 billion | $1.256 billion | $285 million | $13.177 billion |

Between 2004 and 2010, average invested assets (the assets that generate investment income for Chubb), increased from $26.8 billion to $38.3 billion. Investment income increased at a somewhat slower pace than the asset growth due to a mild but sustained reduction in the interest rates on their investment assets over this period. The interest rate on Chubb’s investments dropped from around four and a half percent to only around 4 percent, and since the Fed stated that interest rates will likely remain low throughout 2014, I expect Chubb’s interest rates on its assets to continue to mildly decrease.

Earnings Growth

| Year | EPS |

|---|---|

| TTM | $6.20 |

| 2010 | $6.76 |

| 2009 | $6.18 |

| 2008 | $4.92 |

| 2007 | $7.01 |

| 2006 | $5.98 |

| 2005 | $4.47 |

| 2004 | $4.01 |

Growth of Book Value Per Share

| Year | Book Value |

|---|---|

| 2011 | $52.53 |

| 2010 | $48.29 |

| 2009 | $44.29 |

| 2008 | $36.62 |

| 2007 | $36.07 |

| 2006 | $32.79 |

| 2005 | $30.37 |

| 2004 | $26.19 |

Dividend Growth

Chubb has increased its dividend consecutively every year for well over four decades, currently offers a 2.30% dividend yield, and has a payout ratio of around 25%. (They are, however, scheduled for a dividend increase in the first quarter of 2012 which will lift these figures somewhat).Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.56 |

| 2010 | $1.48 |

| 2009 | $1.40 |

| 2008 | $1.32 |

| 2007 | $1.16 |

| 2006 | $1.00 |

| 2005 | $0.86 |

| 2004 | $0.78 |

Share Repurchases

Chubb repurchases a tremendous amount of shares each year. Between 2003 and now, Chubb has reduced the total number of shares outstanding from 387 million to 298 million. This means that investors that hold their shares over this period own a larger and larger portion of the company. It’s as though Chubb paid dividends but reinvested it in their stock on your behalf. Over the past 12 months, Chubb has paid out $455 million in dividends, but has repurchased $1,738 million worth of net shares. By net shares, I mean that this figure already takes into account the shares they issue in executive compensation, which is a comparatively small figure.In other words, Chubb is indeed returning considerable value to shareholders with these repurchases and dividends combined. Management sends approximately 100% of net income to shareholders in the form of dividends and net share repurchases. The repurchases fuel EPS growth, dividend growth, and book value growth.

I evaluate the effectiveness of share repurchases on a case by case basis, based mostly on a) consistency of the share repurchases, b) whether the shares were repurchased at a fair price, and c) how effectively it is reducing the share count. I believe Chubb performs well with regard to all of these criteria, which is in contrast to Costco (COST) which I demonstrated had a flawed share repurchase history, as most companies do.

I’d prefer, however, for Chubb to double its dividend so that it yields comfortably over 4%, and then, and only then, worry about share repurchases. This would slow EPS growth and book value growth down moderately, but the dividend yield would be bigger. I think that would serve investors slightly better than the current policy of low dividends and big share repurchases. Let the shareholders decide if, when, and how to invest their share of the earnings; in my view.

Metrics

Price to Earnings: 11Price to Book: 1.3

Balance Sheet

Chubb’s Property and Casualty Finance strength has been given an AA rating by Standard and Poor’s, and comparable ratings by other agencies. The company holds a comparatively small amount of debt compared to their assets.Combined Loss to Expense ratio was reported to be 89.3% in 2010, which is excellent. In fact, Chubb has has kept this ratio below 100% every year since 2003, when the current CEO took over. As I mentioned previously, an insurer doesn’t even necessarily have to keep this ratio below 100%; they could carry a slight loss of claims compared to premiums, and recoup that with investment income. But by having such strict and profitable underwriting standards, Chubb generates not only investment income, but substantial income from the difference between premiums earned and claims paid. The combined ratio looks like it’ll be somewhat higher in 2011 due to an increase in catastrophic losses; perhaps in the upper-90”²s. But this comparatively poor combined ratio for Chubb will be a solid combined ratio for the industry, as Chubb’s ratios are atypically low in most years, which is a great thing.

Investment Thesis

Chubb has a business model that is slightly different than some other insurers. The premiums they charge tend to be a bit high, but they typically offer superior claim service. They strive to be the gold standard of the industry, and are one of the largest businesses in the industry. Management insists on a culture where the company does not chase premium growth at the expense of having to under-charge on insurance products. The company conservatively allocates its resources, and has weathered mass asbestos claims, hurricane Katrina, and the economic crisis of 2008. The company has significant market share among high net worth individuals, which includes insurance of expensive homes and cars, as well as personal liability insurance of large amounts.The company has stated that they focus primarily on bottom line growth; profitability. They look to boost premiums where possible, but not at the expense of profitability. Their business model has been summed up as follows by the son of the founder of the business:

The way to success is to select good risks and cover them. Obviously this does not lead to great size, but it should produce profitable business.By offering great claim service for slightly higher premiums, the company hopes to be looked upon as the select company in their various niches. This is working quite well for their Masterpiece policy, which is an insurance product for the affluent.

-Percy Chubb, 1857-1930

I find that many insurers are having stagnant premium growth over the last several years. Many businesses have gone out of business or have decreased in size, which means less insurance demand. Less demand for insurance means lower premiums. In addition, interest rates have been held unusually low for an unusually long period of time due to the recession, and this affects the interest income on insurance portfolios, which is generally the primary source of income for an insurance company. Chubb is a bit buffered from that by their strong underwriting standards (they earn meaningful profits aside from interest), but the low interest environment still does negatively affect them.

Chubb’s policy of strong underwriting principles and an inflexibility with regards to lower premiums to capture market share leads to weakness in soft insurance markets, and leads to strength in stronger insurance markets. Basically the whole second half of the last decade was difficult for Chubb, but I believe that over the long term, their fortunes will improve. Their international expansion is good news, and I believe that Chubb will rebound as businesses become stronger. Over the long term (2+ years away), higher interest rates should act as a minor tailwind as well.

The good news to contrast the bad news of no premium growth, is that Chubb stock is basically priced for no growth. This company, which has grown its dividend every year for four-and-a-half consecutive decades and is among the most respected companies in the industry, has a P/E of under 12. This means that through dividends and share repurchases (and I’d prefer that ratio to lean more towards dividends), Chubb can still provide solid shareholder returns through dividend growth and stock price appreciation.

Overall, during a time when I am not finding very many great value opportunities on the market, I believe Chubb is a fair investment.

Risks

All companies face risk. Insurance companies are businesses about reducing risk and spreading it out, and they even insure their own operations against risk. Chubb faces the risk of a continued difficult global economy, as well as catastrophic losses, continued low interest rates, lack of premium growth, and currency risk. If their underwriting quality were to decrease, it would have a negative impact on profitability.Insurance companies have little to no competitive advantages, or moats. Their insurance products are basically a commodity. What’s worse, is that customers often don’t get to appreciate the difference in quality of products until a claim is filed. Chubb specializes and has a great reputation in certain niches and is among the largest in its industry, which reduces risk, but it doesn’t provide a convincingly robust long-term competitive advantage in my view. Chubb is as good as its management is at any given time. Fortunately, the company has had a history of good management in my opinion, present management included.

Conclusion and Valuation

In conclusion, Chubb looks like a decent dividend growth investment at current prices. Management seems quite adept at investing and building value, but time will tell whether they can grow their market share, boost profits, and improve premiums earned. Chubb can grow its dividend and EPS despite static company-wide results due to its continual repurchasing of its own cheap shares. With a strong balance sheet, good earnings, prudent management, and growing dividends, this represents a good way to add some conservative financial exposure to a portfolio. The low P/E of under 12 combined with the strong financial condition of this business and their long history of consecutive dividend increases provides a little margin of safety.Chubb was around $56/share last year when I wrote a positive analysis of it and called it a solid buy. Now that the market as a whole is offering fewer appealing investments in my view, Chubb’s increased stock valuation at $68/share makes it still decent, yet not quite as appealing as last year. I’m willing to buy at the current price of under $70/share.

Full Disclosure: At the time of this writing, I am long CB.