The companies presented in this article, much like others in the biotech sector, are likely to give high returns over the next three years based off of their technological advancements and large markets they intend to serve. Sophisticated investors should note that, while investing in biotech stocks can produce great returns, it is risky because FDA approvals of drugs offer a binary outcome either the company makes it or it does not.

Mannkind (MNKD)

The stock has been on a downward trend since January 2011 after the FDA failed to approve its new inhaled insulin device (Afrezza), and requested two additional clinical studies. The stock price is currently trading around $2. The price changes are shown in the chart below.

Mannkind is mainly focused on R&D. Afrezza remains its most promising product. Mannkind's competitors are all big pharma players that have a strong diabetes franchise: Novo-Nordisk, Lilly and Glaxo-Smithkline. Mannkind appears as a challenger since it has clinical trials in phase 3 on inhaled insulin. Its big pharma competitors tried to launch similar drugs but did not get approval from the FDA. In spite of a first setback, the company is still running two clinical studies on inhaled insulin. This is why the stock is still risky. The company has currently opened a public offering, and could see an uptick once dilution concerns are allayed.

Arena pharmaceuticals (ARNA)

The stock trades around $2. In August 2011, the stock started to rise significantly and, although it tumbled at the beginning of 2012, the overall upward trend still continues. Arena invested a lot in R&D (up to $110 million) to develop its new weight loss drug Lorcaserin. Just days ago, the FDA announced the formation of an advisory committee to discuss Lorcaserin (two studies in phase III), which drove the share price from $1.60 to $2. Sales for the company reached $16 million in 2010, mostly due to its manufacturing services, up from around $10 million in 2008. The company has been experiencing significant losses due to high R&D charges to support a very diverse portfolio of diabetes and osteoarthritis drug projects.

Arena has two big pharma competitors, Roche and GSK, as well as another pharmaceutical company called Origenex. However, Arena's most advanced product, Lorcaserin, in its weight loss franchise, clearly stands out, and will be very lucrative once marketed. Analysts say that Arena has a 300% upside potential given the high likelihood of commercialization of this drug. Even if drug candidates in diabetes and osteoarthritis are still in phase I, the company is proposing new therapeutic solutions in these areas. Osteoarthritis is mainly treated with Areva (Sanofi) and Methotrexate, which both have significant side-effects. I strongly recommend this stock as a buy right now.

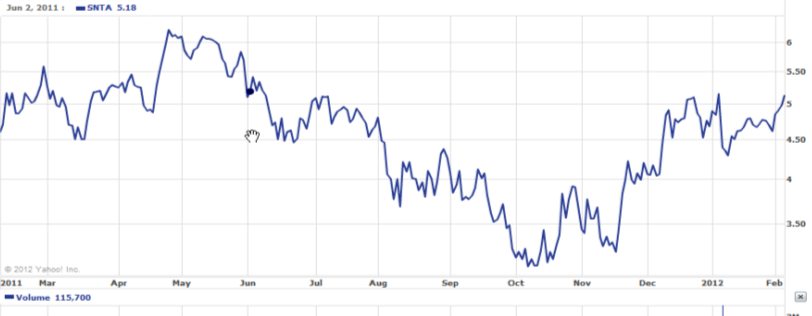

Synta Pharmaceuticals (SNTA, Financial)

The stock currently trades around $5. It has been on an upward trend since December 2011 after a significant drop between May and November, following the widening of the company's quarterly loss.

The stock took a boost in December after the company announced a public offering of 7 million shares and positive results for its breast cancer study.

Novartis is its big pharma competitor, followed by two smaller companies, Exelixis and Myrexys. Exelixis (EXEL) also reportedpositive outcomes for its phase 1b trial recently. It remains a strong competitor, and although much smaller, some analysts think that EXEL might behave more consistently vis-à -vis the market. Myrexis is more focused on neuro-oncology with its compound in phase 2b Azixa and is much less known by investors.

I consider Synta a solid long-term investment given its new cancer drug, which may pay off greatly two or three years from now. The company also has the structure to grow, compared to Exelixis, which has experienced many ups and downs in its drug development process, particularly regarding the way to approachFDA requests.

Cell Therapeutics Inc (CTIC, Financial)

The stock currently trades around $1. The stock price has taken a big hit recently following the

company's announcement involving the withdrawal of its marketing application of its cancer drug. However, there should be a re-submission before the end of 2012, which gives hope for an upward movement in the share price this year.

The company has a rich R&D pipeline. This is particularly true for Tosedostat, against Acute Myeloid Leukemia (AML), OPAXIO in oncology (taxanes family), and Brostallicin, for the treatment of breast cancer, currently in phase 2. Such a portfolio, combined with a potential approval of the current NDA this year, will boost the stock price and generate high returns for investors. Competitors (Sanofi, Roche, BMS) do not represent a great threat, given the novelty of the compounds produced by the company. On the contrary, the company represents an opportunity for an exit strategy that could be very favorable to investors.

Mannkind (MNKD)

The stock has been on a downward trend since January 2011 after the FDA failed to approve its new inhaled insulin device (Afrezza), and requested two additional clinical studies. The stock price is currently trading around $2. The price changes are shown in the chart below.

Mannkind is mainly focused on R&D. Afrezza remains its most promising product. Mannkind's competitors are all big pharma players that have a strong diabetes franchise: Novo-Nordisk, Lilly and Glaxo-Smithkline. Mannkind appears as a challenger since it has clinical trials in phase 3 on inhaled insulin. Its big pharma competitors tried to launch similar drugs but did not get approval from the FDA. In spite of a first setback, the company is still running two clinical studies on inhaled insulin. This is why the stock is still risky. The company has currently opened a public offering, and could see an uptick once dilution concerns are allayed.

Arena pharmaceuticals (ARNA)

The stock trades around $2. In August 2011, the stock started to rise significantly and, although it tumbled at the beginning of 2012, the overall upward trend still continues. Arena invested a lot in R&D (up to $110 million) to develop its new weight loss drug Lorcaserin. Just days ago, the FDA announced the formation of an advisory committee to discuss Lorcaserin (two studies in phase III), which drove the share price from $1.60 to $2. Sales for the company reached $16 million in 2010, mostly due to its manufacturing services, up from around $10 million in 2008. The company has been experiencing significant losses due to high R&D charges to support a very diverse portfolio of diabetes and osteoarthritis drug projects.

Arena has two big pharma competitors, Roche and GSK, as well as another pharmaceutical company called Origenex. However, Arena's most advanced product, Lorcaserin, in its weight loss franchise, clearly stands out, and will be very lucrative once marketed. Analysts say that Arena has a 300% upside potential given the high likelihood of commercialization of this drug. Even if drug candidates in diabetes and osteoarthritis are still in phase I, the company is proposing new therapeutic solutions in these areas. Osteoarthritis is mainly treated with Areva (Sanofi) and Methotrexate, which both have significant side-effects. I strongly recommend this stock as a buy right now.

Synta Pharmaceuticals (SNTA, Financial)

The stock currently trades around $5. It has been on an upward trend since December 2011 after a significant drop between May and November, following the widening of the company's quarterly loss.

The stock took a boost in December after the company announced a public offering of 7 million shares and positive results for its breast cancer study.

Novartis is its big pharma competitor, followed by two smaller companies, Exelixis and Myrexys. Exelixis (EXEL) also reportedpositive outcomes for its phase 1b trial recently. It remains a strong competitor, and although much smaller, some analysts think that EXEL might behave more consistently vis-à -vis the market. Myrexis is more focused on neuro-oncology with its compound in phase 2b Azixa and is much less known by investors.

I consider Synta a solid long-term investment given its new cancer drug, which may pay off greatly two or three years from now. The company also has the structure to grow, compared to Exelixis, which has experienced many ups and downs in its drug development process, particularly regarding the way to approachFDA requests.

Cell Therapeutics Inc (CTIC, Financial)

The stock currently trades around $1. The stock price has taken a big hit recently following the

company's announcement involving the withdrawal of its marketing application of its cancer drug. However, there should be a re-submission before the end of 2012, which gives hope for an upward movement in the share price this year.

The company has a rich R&D pipeline. This is particularly true for Tosedostat, against Acute Myeloid Leukemia (AML), OPAXIO in oncology (taxanes family), and Brostallicin, for the treatment of breast cancer, currently in phase 2. Such a portfolio, combined with a potential approval of the current NDA this year, will boost the stock price and generate high returns for investors. Competitors (Sanofi, Roche, BMS) do not represent a great threat, given the novelty of the compounds produced by the company. On the contrary, the company represents an opportunity for an exit strategy that could be very favorable to investors.