Western Union's (WU, Financial) P/E fell below 10 the other day as a weaker than expected outlook resulted in a share price fall of almost 10%. The stock now trades some 30% lower than it did in 2008 even though the company's profits are higher now than they were then as the company has clearly benefited from having a moat.

Western Union gets the vast majority of its revenues (and profits) from consumer to consumer money transfers. For example, an immigrant in the US will go to one of Western Union's 485,000 dealers with cash and send money to family in Mexico, where it can be picked up in a different currency from another Western Union dealer within minutes. Western Union has by far the widest dealer network and largest profits in this industry, giving it distribution and marketing scale that appears to have provided it with a competitive advantage.

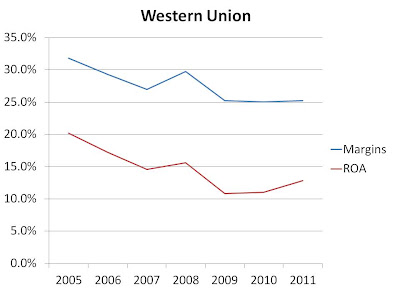

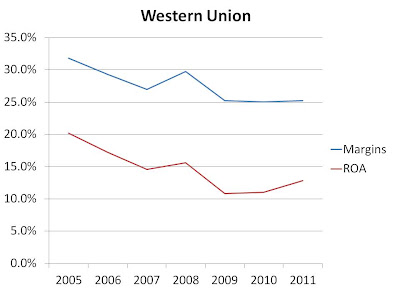

As a result, consider the moat-like ROA and margins Western Union has enjoyed:

If Western Union's moat were to continue as is, it may make for a very profitable investment at a P/E under 10. However, could this moat be under attack? There may be a few ways in which Western Union's advantage may be eroded.

First, while Western Union does enjoy global economies of scale, other companies can take advantage of individual corridors without requiring global scale. For example, a company with distribution in the US and Mexico or India or China, for example, could become a regional competitor, matching Western Union in scale where it counts, on the most important money-transfer routes.

Second, while there are no larger competitors currently, there are larger potential competitors. Credit-card processing companies have worldwide distribution and could conceivably create competing products, while international banks could partner to offer competing services.

Third, potential disruption could occur through internet-based solutions. The growth of mobile communications is allowing developing countries to accept payment by mobile phone, whereas internet-based services like Paypal already enjoy significant mind-share in the developed world. As cash use declines and consumers migrate toward such solutions, Western Union's margins could erode further.

Finally, consider the extent to which these factors may already be playing a role. The charts above show that margins and ROIC have been declining of late. Further investigation also reveals that Western Union has recently reduced prices in some segments. A lack of pricing power suggests a moat may not be too strong. (Though in fairness, the price decreases could be the result of Western Union defending its moat from would-be entrants, which would lead to a stronger moat in the future.)

If Western Union's moat erodes, it could find itself in great difficulty. It has a ton of debt relative to equity, which it will be hard-pressed to pay off if Internet competitors erode margins quickly. If the moat stays how it is, however, the company will continue to throw off a ton of cash, using that money to buy back shares.

Whether you invest in Western Union, therefore, depends on whether it's in your circle of competence. If it is, you can determine whether their moat can be defended, or whether there is a strong chance that it may soon be eroded.

Disclosure: No position

Western Union gets the vast majority of its revenues (and profits) from consumer to consumer money transfers. For example, an immigrant in the US will go to one of Western Union's 485,000 dealers with cash and send money to family in Mexico, where it can be picked up in a different currency from another Western Union dealer within minutes. Western Union has by far the widest dealer network and largest profits in this industry, giving it distribution and marketing scale that appears to have provided it with a competitive advantage.

As a result, consider the moat-like ROA and margins Western Union has enjoyed:

If Western Union's moat were to continue as is, it may make for a very profitable investment at a P/E under 10. However, could this moat be under attack? There may be a few ways in which Western Union's advantage may be eroded.

First, while Western Union does enjoy global economies of scale, other companies can take advantage of individual corridors without requiring global scale. For example, a company with distribution in the US and Mexico or India or China, for example, could become a regional competitor, matching Western Union in scale where it counts, on the most important money-transfer routes.

Second, while there are no larger competitors currently, there are larger potential competitors. Credit-card processing companies have worldwide distribution and could conceivably create competing products, while international banks could partner to offer competing services.

Third, potential disruption could occur through internet-based solutions. The growth of mobile communications is allowing developing countries to accept payment by mobile phone, whereas internet-based services like Paypal already enjoy significant mind-share in the developed world. As cash use declines and consumers migrate toward such solutions, Western Union's margins could erode further.

Finally, consider the extent to which these factors may already be playing a role. The charts above show that margins and ROIC have been declining of late. Further investigation also reveals that Western Union has recently reduced prices in some segments. A lack of pricing power suggests a moat may not be too strong. (Though in fairness, the price decreases could be the result of Western Union defending its moat from would-be entrants, which would lead to a stronger moat in the future.)

If Western Union's moat erodes, it could find itself in great difficulty. It has a ton of debt relative to equity, which it will be hard-pressed to pay off if Internet competitors erode margins quickly. If the moat stays how it is, however, the company will continue to throw off a ton of cash, using that money to buy back shares.

Whether you invest in Western Union, therefore, depends on whether it's in your circle of competence. If it is, you can determine whether their moat can be defended, or whether there is a strong chance that it may soon be eroded.

Disclosure: No position