Ingles Markets (IMKTA, Financial) is different than most other grocery stores chains because it owns (rather than leases or rents) its properties. Ideally, as the business inside continues to be good, the property on which it sits continues to rise in value. It has a grocery store and real estate model that benefits shareholders and pays them dividends.

Although the share price has backed off a bit from its December 2021 all-time high, the chart for Ingles Markets has a generally bullish tone.

Market capitalization comes to $1.58 billion with an enterprise value of $2.07 billion.

The value metrics look like this: the price-earnings ratio of 6.1 is low. The price-book value at 1.51 is relatively low as well. Price-sales is 0.30 and price-to-free cash flow is 9.03. All of these measures point to the kind of value stock Benjamin Graham might have pursued based on his classic book on the subject, "The Intelligent Investor."

Earnings per share look good; they are up by 47.30% for this year and the past five-year earnings per share growth rate is 30.20%.

Ingles Markets' long-term debt exceeds its shareholder equity, but the current ratio is 1.90.

Investors receive a 66 cents per share dividend, which comes to an annualized yield of 0.79%.

Average daily volume for the stock comes to a light 112,000 shares. The short float is 5.84%, somewhat higher than similar names in the sector but enough that it could fuel a rally if those shorts are ever forced to cover.

While business has been good for Ingles Markets, the transition from the recent pandemic-related buying to what is now a clearly inflationary environment may be difficult for supermarkets. Since the company is almost entirely based in the Southeastern United States, this lack of geographic diversification may be a consideration for some investors.

The GuruFocus summary of Ingles' finiancials shows five good signs and four medium warning signs:

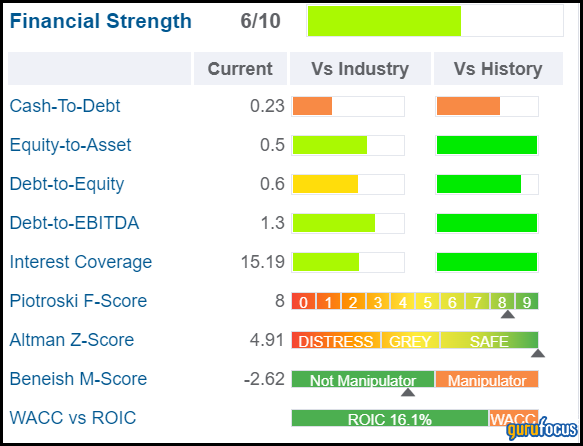

The financial strength factors for Ingles Markets look like this:

Key competitors include Sprouts Farmers Market Inc. (SFM, Financial), Grocery Outlet Holding Corp. (GO, Financial), Weis Markets Inc. (WMK, Financial) and Natural Grocers by Vitamin Cottage Inc. (NGVC, Financial).