An OUTDATED article (written on 24 Feb 2012) that is still relevant in today’s context.

Sypnosis:

With a modest intrinsic value per share of $60 based on a price/normalized earnings of 15x, the yield on AIG common stock is 120%. But why invest in the common stock when you can invest in the warrants with a maturity date on 19 Jan 2021 that would yield much bigger gains as book value and earnings would continue to grow at a modest rate in 9 years time?

Assuming a very conservative 6% CAGR growth in AIG’s book value and earnings, the intrinsic value per share 9 years later would be in the range of $100. While the 9-year yield on common stock becomes 270%, the warrants have a yield of 610%! Forget about AIG common stock; Consider the warrants!

Readers should note that our investment thesis and hence, the format of our article on BofA warrants is similar to that of AIG warrants, in which we have previously written in the article titled ‘Why invest in Bank of America common stock when you can invest in BofA warrants?’. The similarities of both AIG and BofA include (1) a business that has minimum leverage/excess liquidity due to the actions taken during the 2008 financial crisis, (2) have bad loans/investments written off (or be taken care of) and (3) the underlying share prices of the warrants have a dramatic upside potential when the respective business cycle turns.

Introduction on AIG common stock. As of 24 Feb 2012, AIG common stock has a share price of $29, with a book value per share of approximately $45 on 1,797 million of shares outstanding. As the annual earnings power in the past three years has been masked by (1) huge interest expenses (due to the government loan), (2) unfavorable market valuations in the investment portfolio mainly due to mortgage backed securities and the like, (3) catastrophic insurance losses, (4) insurance reserve strengthening and (5) goodwill impairments, we have adjusted the profit excluding these items and consequently, the normalized profit after tax is $4 per share. All these translate to P/B of 0.64x and P/normalized earnings of 7.25x.

(More on how we have calculated the normalized profit after tax, we have factored in a combined ratio of 108% (2006-2007 figures) on a low annual premium volume of $48bn (2010 figure) and a net investment income/premiums ratio of 37% (2006,2007 and 2009 figures) and a 30% tax figure.)

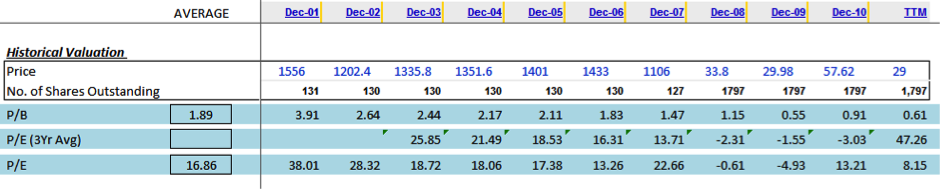

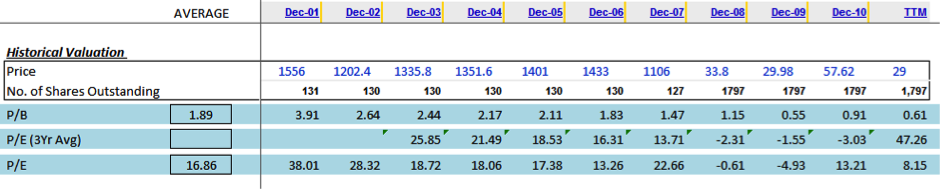

A modest intrinsic value per share of $60. The above table shows the past P/B and P/E that AIG common stock has been trading for the past 10 years. The average P/B and P/E of 1.89x and 16.86x is calculated based on the Dec 2003-2006 figures (Dec 2001-2002 figures are unrealistic). If a range of intrinsic value estimates is calculated based on past average P/B and P/E, there exists a profit potential of 100-200%. My estimated intrinsic value per share of $60, therefore, is modest. (The author suggests you do the calculations yourself – and be amazed!)

More on AIG. The recapitalization has more-or-less been completed as AIG has repaid government debt through asset sales and the bulk of the toxic assets have been written off through special vehicles in Maiden Lane 2 & 3 that have been put in place to absorb these assets. Forget about the Old AIG. The current AIG is a New AIG with (1) plenty of liquidity, (2) little or no debt, (3) assumed-to-be-undervalued mortgage-backed assets in its investment portfolio, (4) under-utilized insurance assets as certain wholesale channels are still off-bounds due to the AIG meltdown saga in 2008 and (5) $25bn or $14 per share of deferred tax asset to be utilized which is not found on the balance sheet (hence, not in GAAP book value calculation). All these points to both an undervalued GAAP book value per share of $45 and normalized earnings per share of $4.

If, through verification, you are stupefied by how undervalued AIG common stock is, you can forget about AIG common stock; Consider AIG warrants:

Introduction on AIG warrants. Unlike the typical short-dated warrant which is no different from a bet on a horse-race or a soccer-match, AIG warrants are long-dated with a maturity date on 19 Jan 2021 or approximately 9 more years before maturity. The current warrants price is $7.77, with a strike price of $45 (approximately equal to BV per share). The break-even share price, therefore, would be $52.77.

Downside risk is zero? Based on the current price and long-term nature of the warrants, we believe the downside risk is close to zero, if not zero. Of course, the authors disregard opportunity cost in their argument that follows. The payoff structure of a warrant is such that the investor of AIG warrants will lose its capital if the share price of AIG falls below $52.77. Assuming a very conservative 6% CAGR growth in AIG’s book value and earnings, the intrinsic value per share 9 years later would be in the range of $100. The break-even share price of $52.77 is approximately 48% below the estimated intrinsic value of $100, 9 years later. (Book value per share and EPS would increase to $76 and $6.75 respectively. At the break-even share price of $52.77, the P/B becomes 0.69x and P/E becomes 7.8x.) What is the probability that on 19 Jan 2021, AIG share price would fall below $52.77 or trading below P/B of 0.69x and P/E of 7.8x?

An awesome 9-year yield of 610% on the warrants! Now on the upside: With an estimated 9-years-later intrinsic value per share of $100, P/B and P/E would become 1.33x and 15x respectively. The main flaw in our argument is, of course, earnings and book value do not compound at a rate of 6% per annum moving forward. However, with a conservative ROE of 10% moving forward and a well-known fact that AIG retains the bulk of the earnings, my projected growth is absolutely conservative. Assuming our argument is not flawed, the warrants will yield an awesome 610%! (AIG common stock, meanwhile, only yield 245% though)

What if, on 19 Jan 2021, the price of AIG common stock is not 1.33x, but 3.00x of book value? With an estimated book value of $76 on 19 Jan 2021, the warrants would have a yield of 2255%!

Confessions of the authors: We have no idea why we have such a huge stake in BofA warrants. See http://valueground.blogspot.com/p/portfolio.html to understand why.

Sypnosis:

With a modest intrinsic value per share of $60 based on a price/normalized earnings of 15x, the yield on AIG common stock is 120%. But why invest in the common stock when you can invest in the warrants with a maturity date on 19 Jan 2021 that would yield much bigger gains as book value and earnings would continue to grow at a modest rate in 9 years time?

Assuming a very conservative 6% CAGR growth in AIG’s book value and earnings, the intrinsic value per share 9 years later would be in the range of $100. While the 9-year yield on common stock becomes 270%, the warrants have a yield of 610%! Forget about AIG common stock; Consider the warrants!

Readers should note that our investment thesis and hence, the format of our article on BofA warrants is similar to that of AIG warrants, in which we have previously written in the article titled ‘Why invest in Bank of America common stock when you can invest in BofA warrants?’. The similarities of both AIG and BofA include (1) a business that has minimum leverage/excess liquidity due to the actions taken during the 2008 financial crisis, (2) have bad loans/investments written off (or be taken care of) and (3) the underlying share prices of the warrants have a dramatic upside potential when the respective business cycle turns.

Introduction on AIG common stock. As of 24 Feb 2012, AIG common stock has a share price of $29, with a book value per share of approximately $45 on 1,797 million of shares outstanding. As the annual earnings power in the past three years has been masked by (1) huge interest expenses (due to the government loan), (2) unfavorable market valuations in the investment portfolio mainly due to mortgage backed securities and the like, (3) catastrophic insurance losses, (4) insurance reserve strengthening and (5) goodwill impairments, we have adjusted the profit excluding these items and consequently, the normalized profit after tax is $4 per share. All these translate to P/B of 0.64x and P/normalized earnings of 7.25x.

(More on how we have calculated the normalized profit after tax, we have factored in a combined ratio of 108% (2006-2007 figures) on a low annual premium volume of $48bn (2010 figure) and a net investment income/premiums ratio of 37% (2006,2007 and 2009 figures) and a 30% tax figure.)

A modest intrinsic value per share of $60. The above table shows the past P/B and P/E that AIG common stock has been trading for the past 10 years. The average P/B and P/E of 1.89x and 16.86x is calculated based on the Dec 2003-2006 figures (Dec 2001-2002 figures are unrealistic). If a range of intrinsic value estimates is calculated based on past average P/B and P/E, there exists a profit potential of 100-200%. My estimated intrinsic value per share of $60, therefore, is modest. (The author suggests you do the calculations yourself – and be amazed!)

More on AIG. The recapitalization has more-or-less been completed as AIG has repaid government debt through asset sales and the bulk of the toxic assets have been written off through special vehicles in Maiden Lane 2 & 3 that have been put in place to absorb these assets. Forget about the Old AIG. The current AIG is a New AIG with (1) plenty of liquidity, (2) little or no debt, (3) assumed-to-be-undervalued mortgage-backed assets in its investment portfolio, (4) under-utilized insurance assets as certain wholesale channels are still off-bounds due to the AIG meltdown saga in 2008 and (5) $25bn or $14 per share of deferred tax asset to be utilized which is not found on the balance sheet (hence, not in GAAP book value calculation). All these points to both an undervalued GAAP book value per share of $45 and normalized earnings per share of $4.

If, through verification, you are stupefied by how undervalued AIG common stock is, you can forget about AIG common stock; Consider AIG warrants:

Introduction on AIG warrants. Unlike the typical short-dated warrant which is no different from a bet on a horse-race or a soccer-match, AIG warrants are long-dated with a maturity date on 19 Jan 2021 or approximately 9 more years before maturity. The current warrants price is $7.77, with a strike price of $45 (approximately equal to BV per share). The break-even share price, therefore, would be $52.77.

Downside risk is zero? Based on the current price and long-term nature of the warrants, we believe the downside risk is close to zero, if not zero. Of course, the authors disregard opportunity cost in their argument that follows. The payoff structure of a warrant is such that the investor of AIG warrants will lose its capital if the share price of AIG falls below $52.77. Assuming a very conservative 6% CAGR growth in AIG’s book value and earnings, the intrinsic value per share 9 years later would be in the range of $100. The break-even share price of $52.77 is approximately 48% below the estimated intrinsic value of $100, 9 years later. (Book value per share and EPS would increase to $76 and $6.75 respectively. At the break-even share price of $52.77, the P/B becomes 0.69x and P/E becomes 7.8x.) What is the probability that on 19 Jan 2021, AIG share price would fall below $52.77 or trading below P/B of 0.69x and P/E of 7.8x?

An awesome 9-year yield of 610% on the warrants! Now on the upside: With an estimated 9-years-later intrinsic value per share of $100, P/B and P/E would become 1.33x and 15x respectively. The main flaw in our argument is, of course, earnings and book value do not compound at a rate of 6% per annum moving forward. However, with a conservative ROE of 10% moving forward and a well-known fact that AIG retains the bulk of the earnings, my projected growth is absolutely conservative. Assuming our argument is not flawed, the warrants will yield an awesome 610%! (AIG common stock, meanwhile, only yield 245% though)

What if, on 19 Jan 2021, the price of AIG common stock is not 1.33x, but 3.00x of book value? With an estimated book value of $76 on 19 Jan 2021, the warrants would have a yield of 2255%!

Confessions of the authors: We have no idea why we have such a huge stake in BofA warrants. See http://valueground.blogspot.com/p/portfolio.html to understand why.