Enterprise Products Partners LP is one of the largest MLPs, and benefits from not having to pay Incentive Distribution Rights to any general partner.

-Seven Year Annual Revenue Growth Rate: 27%

-Seven Year Annual Distribution Growth Rate: 6.9%

-Distribution Yield: 4.82%

-Balance Sheet: Fair

EPD is in a position to potentially offer high single-digit returns over the long-term, but at the current time, I’d look for dips to the mid-$40s before purchasing.

The partnership has:

21,000+ miles of natural gas pipelines

17,000+ miles of NGL and petrochemical pipelines

6,000+ miles of crude oil pipelines

190 million barrels worth of liquids storage capacity

14 billion cubic feet of natural gas storage capacity

24 natural gas processing plants

20 NGL and propylene fractionation facilities

6 offshore hub platforms

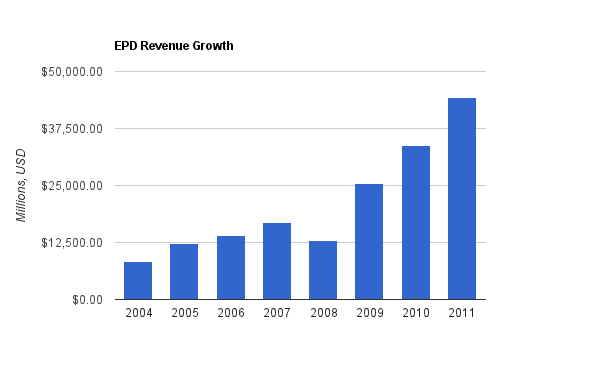

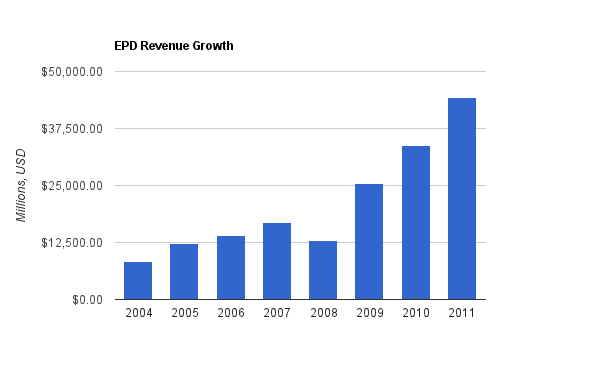

(Chart Source: DividendMonk.com)

This represents 27% annualized revenue growth. EPD, like many MLPs, has accelerated the growth of its revenue and asset base by issuing new units to fund acquisitions and organic growth projects. This way, they can pay out most of their cash flows as distributions, and yet still grow. The number of units outstanding has increased more than fourfold since 2002. Still, unitholder returns over this period have been rather substantial. When MLPs issue new units, as long as the numbers of the deal allow for continued distribution growth per share, it’s usually favorable.

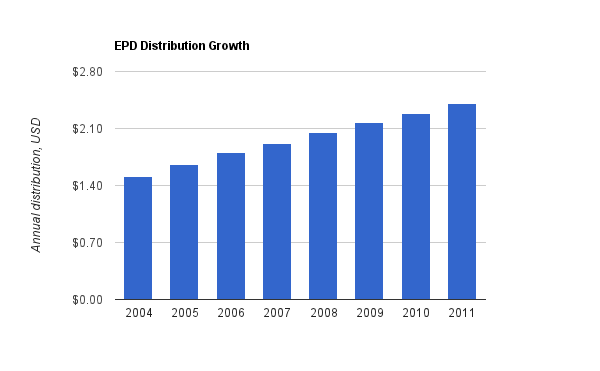

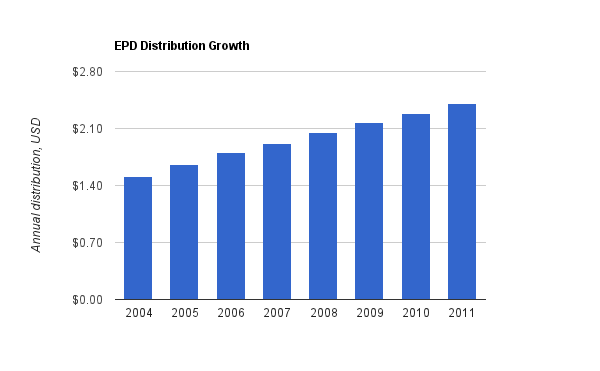

(Chart Source: DividendMonk.com)

EPD has increased the distribution for over 30 consecutive quarters. Over the last 7 years, the average annual distribution growth has been 6.9%. The current distribution yield is 4.82%.

Debt maturities over the next several years are as follows: $500 million in 2012, $1,200 million in 2013, $1,150 million in 2014, $650 million in 2015, $750 million in 2016, and $8,500 million in cumulative years after that. In comparison, EPD brought in $3,300 million in cash flows in 2011. The partnership, therefore, appears financially solid.

A risk, though, would be an increase in interest rates. If the business has to roll its debt over into higher interest debt over time, it could squeeze profitability a bit. Interest rates only have one direction to go, and that’s up. But with a comfortable-enough coverage ratio, and a fairly long successful operating history for an MLP, EPD seems well-prepared for any realistic changes.

No IDRs to Pay

A key advantage to EPD is that they no longer have to pay any Incentive Distribution Rights, thanks to a merger with their general partner, Enterprise GP Holdings, in 2010. Most MLPs have to pay IDRs, which means they pay out a growing percentage of their cash flows to the general partner as they grow their distributions to the limited partners.

This is fine at first, because it gives management a huge incentive to raise distributions and grow the whole partnership. But after a while, when the percentage of payments increases to the upper thresholds of the agreement, it can be an anchor on distribution growth for the limited partner. When these upper thresholds are reached, the general partner often still does fine, because at that point, they benefit both when limited partnership distributions are increased and when the number of limited partner units (and more particularly, the asset-base and overall cash flows) grows. Limited partners, however, don’t directly benefit from the increased number of units unless it allows the partnership to grow their distributions.

So for example, Energy Transfer Equity (ETE, Financial), the GP of Energy Transfer Partners (ETP), was able to grow its own distribution to unitholders even though ETP has not been able to do the same for its own unitholders. ETE even had to temporarily waive IDR agreements for ETP on a piece of their new acquisition for the deal to benefit everyone involved.

Enterprise Products Partners, by merging with its GP, has now avoided this problem.

Recent Developments

EPD is not at a loss of growth opportunities or places to invest capital.

-Enterprise Products Partners and Enbridge are set to expand the Seaway Pipeline to 850,000 barrels per day by 2014. This is will add a 500 mile, 30-inch pipeline.

-Enterprise Products Partners agreed to a joint program with Anadarko Petroleum and DCP Midstream. This will be a 435 mile pipeline from Colorado to Texas, expected to begin service in late 2013.

-Interest Rate Risk

-Catastrophe Risk (including Hurricane Risk along the Gulf)

-Commodity Price Risk

In addition, as an MLP, investors have additional tax filing complexity. Adding onto this, with budget deficits and tax reforms, it’s always possible that the tax advantages of the MLP structure could change.

If the dividend discount model is used, and 6% distribution growth is assumed for the next 5 years followed by 5% distribution growth thereafter, and a 10% discount rate is utilized, then the fair value is calculated to be around $48/unit. At the current price of $52, while I don’t think it’s a bad investment by any stretch, I’d hold off and look elsewhere, or for price dips. Acceptable discount rates and estimates on long-term distribution growth vary enough to provide a range of acceptable values. If one is willing to accept returns in the high single digits with little margin of safety other than the strength of the business, however, the current price is fairly easily justified.

Personally, I’d be more interested in the units in the mid-$40”²s.

Previous Analysis: Canadian National Railway (CNI)

Full Disclosure: As of this writing, I have no position in EPD. I am long ETE.

-Seven Year Annual Revenue Growth Rate: 27%

-Seven Year Annual Distribution Growth Rate: 6.9%

-Distribution Yield: 4.82%

-Balance Sheet: Fair

EPD is in a position to potentially offer high single-digit returns over the long-term, but at the current time, I’d look for dips to the mid-$40s before purchasing.

Overview

EPD had its IPO in 1998, and has grown considerably since that point. Assets have grown from around $0.7 billion to over $34 billion, which represents nearly 35% average annual growth of their asset base over more than a decade. Master Limited Partnerships are suited towards growth due to their attractive tax structure and reliable cash flows, which together, allow them to constantly issue new units and get returns on this capital that benefits the whole partnership.The partnership has:

21,000+ miles of natural gas pipelines

17,000+ miles of NGL and petrochemical pipelines

6,000+ miles of crude oil pipelines

190 million barrels worth of liquids storage capacity

14 billion cubic feet of natural gas storage capacity

24 natural gas processing plants

20 NGL and propylene fractionation facilities

6 offshore hub platforms

Revenue

(Chart Source: DividendMonk.com)

This represents 27% annualized revenue growth. EPD, like many MLPs, has accelerated the growth of its revenue and asset base by issuing new units to fund acquisitions and organic growth projects. This way, they can pay out most of their cash flows as distributions, and yet still grow. The number of units outstanding has increased more than fourfold since 2002. Still, unitholder returns over this period have been rather substantial. When MLPs issue new units, as long as the numbers of the deal allow for continued distribution growth per share, it’s usually favorable.

Distributions

(Chart Source: DividendMonk.com)

EPD has increased the distribution for over 30 consecutive quarters. Over the last 7 years, the average annual distribution growth has been 6.9%. The current distribution yield is 4.82%.

Balance Sheet

Like most MLPs, Enterprise Products Partners uses a substantial amount of leverage. The situation is currently stable, with the interest coverage ratio of well over 3. For most dividend stocks, much higher interest coverage ratios are preferable, but for asset-heavy infrastructure businesses, what passes for a good balance sheet is different.Debt maturities over the next several years are as follows: $500 million in 2012, $1,200 million in 2013, $1,150 million in 2014, $650 million in 2015, $750 million in 2016, and $8,500 million in cumulative years after that. In comparison, EPD brought in $3,300 million in cash flows in 2011. The partnership, therefore, appears financially solid.

A risk, though, would be an increase in interest rates. If the business has to roll its debt over into higher interest debt over time, it could squeeze profitability a bit. Interest rates only have one direction to go, and that’s up. But with a comfortable-enough coverage ratio, and a fairly long successful operating history for an MLP, EPD seems well-prepared for any realistic changes.

Investment Thesis

The MLP has raised quarterly distributions for over 30 consecutive quarters. The partnership is well-diversified in terms of commodity types and geography. Their assets center around Texas and Louisiana, but stretch across the U.S. from the Gulf of Mexico to the Marcellus Shale to the Eagle Ford Shale to the Permian Basin, and so forth. Practically all major domestic gas energy deposits are serviced by EPD.No IDRs to Pay

A key advantage to EPD is that they no longer have to pay any Incentive Distribution Rights, thanks to a merger with their general partner, Enterprise GP Holdings, in 2010. Most MLPs have to pay IDRs, which means they pay out a growing percentage of their cash flows to the general partner as they grow their distributions to the limited partners.

This is fine at first, because it gives management a huge incentive to raise distributions and grow the whole partnership. But after a while, when the percentage of payments increases to the upper thresholds of the agreement, it can be an anchor on distribution growth for the limited partner. When these upper thresholds are reached, the general partner often still does fine, because at that point, they benefit both when limited partnership distributions are increased and when the number of limited partner units (and more particularly, the asset-base and overall cash flows) grows. Limited partners, however, don’t directly benefit from the increased number of units unless it allows the partnership to grow their distributions.

So for example, Energy Transfer Equity (ETE, Financial), the GP of Energy Transfer Partners (ETP), was able to grow its own distribution to unitholders even though ETP has not been able to do the same for its own unitholders. ETE even had to temporarily waive IDR agreements for ETP on a piece of their new acquisition for the deal to benefit everyone involved.

Enterprise Products Partners, by merging with its GP, has now avoided this problem.

Recent Developments

EPD is not at a loss of growth opportunities or places to invest capital.

-Enterprise Products Partners and Enbridge are set to expand the Seaway Pipeline to 850,000 barrels per day by 2014. This is will add a 500 mile, 30-inch pipeline.

-Enterprise Products Partners agreed to a joint program with Anadarko Petroleum and DCP Midstream. This will be a 435 mile pipeline from Colorado to Texas, expected to begin service in late 2013.

Risks

The three key risks for EPD are:-Interest Rate Risk

-Catastrophe Risk (including Hurricane Risk along the Gulf)

-Commodity Price Risk

In addition, as an MLP, investors have additional tax filing complexity. Adding onto this, with budget deficits and tax reforms, it’s always possible that the tax advantages of the MLP structure could change.

Conclusion and Valuation

Overall, I view EPD as a solid business, but the key question always is whether the valuation is reasonable or not. For an MLP, a distribution yield of under 5% is fairly low. Over the last seven years, the distribution has grown by slightly under 7% per year.If the dividend discount model is used, and 6% distribution growth is assumed for the next 5 years followed by 5% distribution growth thereafter, and a 10% discount rate is utilized, then the fair value is calculated to be around $48/unit. At the current price of $52, while I don’t think it’s a bad investment by any stretch, I’d hold off and look elsewhere, or for price dips. Acceptable discount rates and estimates on long-term distribution growth vary enough to provide a range of acceptable values. If one is willing to accept returns in the high single digits with little margin of safety other than the strength of the business, however, the current price is fairly easily justified.

Personally, I’d be more interested in the units in the mid-$40”²s.

Previous Analysis: Canadian National Railway (CNI)

Full Disclosure: As of this writing, I have no position in EPD. I am long ETE.