The Coca Cola Company is the largest beverage company in the world, and among the most well-known of dividend stocks.

-Seven Year Revenue Growth Rate: 11.3%

-Seven Year EPS Growth Rate: 9.1%

-Seven Year Dividend Growth Rate: 9.4%

-Current Dividend Yield: 2.75%

-Balance Sheet: Fairly Strong

Currently, I view Coca Cola as being on the high side of fairly valued. The current valuation may be expected to provide 8+% returns over a long term, which after taking into account Coca Cola’s resiliency and dependability, looks acceptable in today’s market.

The Coca Cola Company:

-Has been in business for over 125 years

-Offers more than 3,500 beverages, and targets certain brands for certain markets (with only the flagship Coca Cola being sold in every single one of their markets)

-Works with over 300 bottlers around the world, and owns substantial stakes in some of the larger ones

-Includes 15 brands that have $1 billion or more in annual sales

-Sells its products in 200 countries

-Offers 1.7 billion servings per day

-Employs 146,000 people directly, and over 700,000 people if the bottlers are included in their role as independent contractors

Geographic Mix

In 2011, the Coca Cola Company sold 22% of the volume of its products to North America, 29% to South America, 15% to Europe, 16% to Eurasia and Africa (which includes India), and 18% to Pacific (which includes China).

Price to Free Cash Flow: 26

Price to Book: 5.2

Return on Equity: 26%

(Chart Source: DividendMonk.com)

Coca Cola’s revenue and free cash flow growth rates over this period were 11.3% and 3.3%, respectively. Revenue spiked to a high level because the company acquired its major North American bottler in late 2010. The bottler had profit margins that were much lower than that of Coca Cola, so when they paid a multiple of the earnings, they were getting a lot of revenue along with it, but this revenue does not imply the same rate of growth of profits over the course of this period.

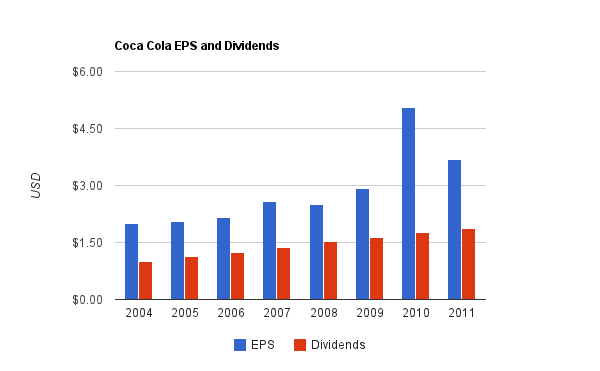

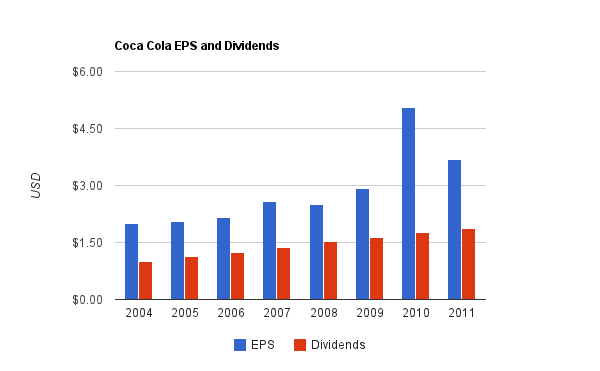

(Chart Source: DividendMonk.com)

The EPS spike on the chart is related to the bottler acquisition, and is best ignored. Coca Cola grew EPS by a respectable 9.1% per year, on average, over the last 7 years. The dividend grew by a similar rate of 9.4% per year, on average, over the same period. The dividend payout ratio from earnings is currently around 55%, and the dividend payout ratio from free cash flow is around 65%, which is quite safe. The latest quarterly dividend increase, from $0.47 to $0.51, represents a decent 8.5% dividend growth rate for the year.

For the fiscal years 2009, 2010, and 2011 in summation, Coca Cola brought in around $20 billion in free cash flow, and spent around $12.2 billion on dividends and another $5 billion on net share repurchases (value of shares purchased minus the value of shares issued).

2020 Vision

Coca Cola currently has what they call the “2020 Vision”. It’s a specific long-term plan for growth. This is substantial because it shows that the company is looking ahead and setting tangible long-term expectations and benchmarks for their company. Most shareholder-friendly companies of course have objectives like “create shareholder value over the long run”, but this is a rather specific set of goals for a ten-year period from a large company.

The most concrete and useful goal is the volume growth. The 2020 Vision states that Coca Cola will increase it’s global servings per day to 3 billion (compared to 1.7 billion currently). That would represent rather aggressive volume growth.

The company has committed to investing $30 billion in their overall system over the next five years to achieve this goal. Coca Cola’s immense worldwide distribution system is a critical aspect of its sturdy economic moat, and investments at this scale further distance itself from its competitors.

Volume Growth

Over the past three years, Coca Cola has done a solid job at increasing volume of their products. They sold 24.4 billion cases (representing 192 ounces of finished beverage each) in 2009, 25.5 billion in 2010, and 26.7 billion in 2011. This represents 4.6% volume growth, which if extrapolated would lead to about about 40 billion cases per year or 2.6 billion servings per day in 2020. The company will therefore have to accelerate volume growth a bit to meet their 3 billion servings per day goal, but this is nonetheless very solid business growth.

Approximately half of their volume of products solid consists of the Coca Cola trademark brands, while the other half consists of the rest of their brands combined. Their Coca Cola brand grew by 3% in 2011, their total sparkling brand lineup grew by 4%, and their total still brand lineup grew by 8%. So the company is slowly aligning itself a bit away from carbonated beverages, although they still have the majority part of the volume.

Per Capita Consumption

Currently the annual per-capita worldwide consumption of all Coca Cola products (which includes all of their various brands), is 92 eight-ounce servings. This is up from 69 in 2001 and 44 in 1991.

-The United States, with 313 million people, consumes 403 per capita servings, which is down from 407 in 2001. This is more than one eight-ounce serving per day, per person, on average. This could come from a Coke product, another soda, one of their juices or teas, or bottled water, etc.

-In Latin America, the per capita annual consumption is also pretty high, at 318 servings, which is up from 209 in 2001. Mexico leads this group, and the world, with 728 per capita servings.

-In Europe, the annual per capita consumption is only 179, although this is up from 148 in 2001. Europe also happens to be more populated than North America, so marginal per capita increases are quite helpful for Coca Cola’s overall volume growth.

-In Eurasia and Africa, the annual per capita consumption is only 32 servings, although up from 17 in 2001. This includes India (population: 1.2 billion) with only 12 per capita annual servings, Pakistan (population 180 million) with only 17 servings, Nigeria (population 162 million) with only 27 servings, Russia (population 143 million) with 73 servings, and others.

-In the Pacific group, 52 servings are consumed annually, per capita. This is up from 33 in 2001. This includes only 38 servings in China (population over 1.3 billion), and only 14 servings in Indonesia (population 237 million). Some of the more economically developed east Asian countries consume more.

In other words, while Coca Cola is extremely global, they are not nearly as penetrated into several high population markets as they are in North America and Latin America. Several of the most populous countries in the world, including China, India, Indonesia, Pakistan, and Nigeria, consume less than a tenth or twentieth of what Americans consume. Coca Cola only needs to achieve moderate per-capita volume growth in these population-dense countries in order to increase global volume by a fairly robust amount.

In terms of Coca Cola attempting to achieve 3 billion servings per day in 2020, and the previously mentioned need for mild volume acceleration compared to what they’re currently doing, it looks like this is where it’ll have to come from. The company seems to be predicting that it’ll hit certain critical points that allow some pretty solid overall volume growth from these populated regions.

They also face strong competition from Pepsico, and there isn’t really a move that one company can make that the other can’t copy. Both of them acquired their North American bottlers recently, for example. Coca Cola will have to continually invest in its global bottling and distribution system if it hopes to continue to hold and take market share from their principle competitor.

Unhealthy beverages face headwinds in developed markets. A majority of the company’s products primarily consist of sugar water, which adds calories of a rather unhealthy variety to a typical daily diet, and likely contributes to “diseases of affluence”. Even some of the juices and other drinks are not what one would call healthy, though the company does have some healthier options in their overall product lineup. Political forces or consumer trends could adversely affect the volume growth of the business, but the company does have significant geographic diversification to buffer their bottom line from any specific market problems. In addition, the company can make key acquisitions or offer new options within its existing brands, to continually match consumer preference.

The company’s solid EPS growth of over 9% per year over the last 7 year period, combined with a 2-3% dividend yield, has been good performance for a large and stable company. Based on the assumption of 4% long term free cash flow growth, the company’s current valuation at $74/share implies a long term rate of return of around 8% per year according to my DCF estimation.

In a slightly more optimistic scenario, if the company can meet its 2020 Vision of 3 billion servings per day, then this implies approximately 6% annual volume growth. If pricing power is maintained in the currencies the company operates in, then free cash flow growth could somewhat accelerate, and this estimate would end up being conservative.

Overall, while I believe there are some better values out there such as Philip Morris, in terms of risk-adjusted returns, KO stock looks acceptable. If an investor targets a moderately reliable high single digit rate of return over the next decade, Coca Cola might not be a bad place to park some cash. Coca Cola is fairly recession resistant, and only 15% of the volume is attributed to Europe, so some of the key macroeconomic concerns are somewhat side-stepped by the company.

With continued volume growth and fairly ambitious long-term targets, the company looks quite solid.

Full Disclosure: As of this writing, I own shares of KO.

-Seven Year Revenue Growth Rate: 11.3%

-Seven Year EPS Growth Rate: 9.1%

-Seven Year Dividend Growth Rate: 9.4%

-Current Dividend Yield: 2.75%

-Balance Sheet: Fairly Strong

Currently, I view Coca Cola as being on the high side of fairly valued. The current valuation may be expected to provide 8+% returns over a long term, which after taking into account Coca Cola’s resiliency and dependability, looks acceptable in today’s market.

Overview

The Coca Cola Company (KO, Financial), with one of the strongest brands in the world, is the largest non-alcoholic beverage company around. Established in 1886, Coca Cola has been growing sales for over a century now and has a presence in over 200 countries with more than 500 total brands, ranging from carbonated beverages to juices to teas to water. The company is a dividend aristocrat, and it has increased dividends every year for around five consecutive decades. Ironically, while the company has grown considerably in the past 15 years, it has been a fairly bad investment because it was valued so highly back in the 90s.The Coca Cola Company:

-Has been in business for over 125 years

-Offers more than 3,500 beverages, and targets certain brands for certain markets (with only the flagship Coca Cola being sold in every single one of their markets)

-Works with over 300 bottlers around the world, and owns substantial stakes in some of the larger ones

-Includes 15 brands that have $1 billion or more in annual sales

-Sells its products in 200 countries

-Offers 1.7 billion servings per day

-Employs 146,000 people directly, and over 700,000 people if the bottlers are included in their role as independent contractors

Geographic Mix

In 2011, the Coca Cola Company sold 22% of the volume of its products to North America, 29% to South America, 15% to Europe, 16% to Eurasia and Africa (which includes India), and 18% to Pacific (which includes China).

Ratios

Price to Earnings: 20Price to Free Cash Flow: 26

Price to Book: 5.2

Return on Equity: 26%

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

Coca Cola’s revenue and free cash flow growth rates over this period were 11.3% and 3.3%, respectively. Revenue spiked to a high level because the company acquired its major North American bottler in late 2010. The bottler had profit margins that were much lower than that of Coca Cola, so when they paid a multiple of the earnings, they were getting a lot of revenue along with it, but this revenue does not imply the same rate of growth of profits over the course of this period.

Earnings and Dividends

(Chart Source: DividendMonk.com)

The EPS spike on the chart is related to the bottler acquisition, and is best ignored. Coca Cola grew EPS by a respectable 9.1% per year, on average, over the last 7 years. The dividend grew by a similar rate of 9.4% per year, on average, over the same period. The dividend payout ratio from earnings is currently around 55%, and the dividend payout ratio from free cash flow is around 65%, which is quite safe. The latest quarterly dividend increase, from $0.47 to $0.51, represents a decent 8.5% dividend growth rate for the year.

For the fiscal years 2009, 2010, and 2011 in summation, Coca Cola brought in around $20 billion in free cash flow, and spent around $12.2 billion on dividends and another $5 billion on net share repurchases (value of shares purchased minus the value of shares issued).

Balance Sheet

Although the bottler acquisition stretched Coca Cola’s balance sheet a bit beyond its normal state, the financial position remains quite solid overall. The interest coverage ratio is over 25, which is extremely healthy, and the long term debt/equity ratio is around 0.5, which is solid. The company does have some short term debt as well, but the overall current ratio is above 1. Goodwill on the balance sheet went from under $4 billion to over $12 billion during the course of the acquisition of their major bottler, but the goodwill/equity ratio is under 40%.Investment Thesis

Coca Cola potentially has a place in a portfolio as a defensive core dividend-growth holding.2020 Vision

Coca Cola currently has what they call the “2020 Vision”. It’s a specific long-term plan for growth. This is substantial because it shows that the company is looking ahead and setting tangible long-term expectations and benchmarks for their company. Most shareholder-friendly companies of course have objectives like “create shareholder value over the long run”, but this is a rather specific set of goals for a ten-year period from a large company.

The most concrete and useful goal is the volume growth. The 2020 Vision states that Coca Cola will increase it’s global servings per day to 3 billion (compared to 1.7 billion currently). That would represent rather aggressive volume growth.

The company has committed to investing $30 billion in their overall system over the next five years to achieve this goal. Coca Cola’s immense worldwide distribution system is a critical aspect of its sturdy economic moat, and investments at this scale further distance itself from its competitors.

Volume Growth

Over the past three years, Coca Cola has done a solid job at increasing volume of their products. They sold 24.4 billion cases (representing 192 ounces of finished beverage each) in 2009, 25.5 billion in 2010, and 26.7 billion in 2011. This represents 4.6% volume growth, which if extrapolated would lead to about about 40 billion cases per year or 2.6 billion servings per day in 2020. The company will therefore have to accelerate volume growth a bit to meet their 3 billion servings per day goal, but this is nonetheless very solid business growth.

Approximately half of their volume of products solid consists of the Coca Cola trademark brands, while the other half consists of the rest of their brands combined. Their Coca Cola brand grew by 3% in 2011, their total sparkling brand lineup grew by 4%, and their total still brand lineup grew by 8%. So the company is slowly aligning itself a bit away from carbonated beverages, although they still have the majority part of the volume.

Per Capita Consumption

Currently the annual per-capita worldwide consumption of all Coca Cola products (which includes all of their various brands), is 92 eight-ounce servings. This is up from 69 in 2001 and 44 in 1991.

-The United States, with 313 million people, consumes 403 per capita servings, which is down from 407 in 2001. This is more than one eight-ounce serving per day, per person, on average. This could come from a Coke product, another soda, one of their juices or teas, or bottled water, etc.

-In Latin America, the per capita annual consumption is also pretty high, at 318 servings, which is up from 209 in 2001. Mexico leads this group, and the world, with 728 per capita servings.

-In Europe, the annual per capita consumption is only 179, although this is up from 148 in 2001. Europe also happens to be more populated than North America, so marginal per capita increases are quite helpful for Coca Cola’s overall volume growth.

-In Eurasia and Africa, the annual per capita consumption is only 32 servings, although up from 17 in 2001. This includes India (population: 1.2 billion) with only 12 per capita annual servings, Pakistan (population 180 million) with only 17 servings, Nigeria (population 162 million) with only 27 servings, Russia (population 143 million) with 73 servings, and others.

-In the Pacific group, 52 servings are consumed annually, per capita. This is up from 33 in 2001. This includes only 38 servings in China (population over 1.3 billion), and only 14 servings in Indonesia (population 237 million). Some of the more economically developed east Asian countries consume more.

In other words, while Coca Cola is extremely global, they are not nearly as penetrated into several high population markets as they are in North America and Latin America. Several of the most populous countries in the world, including China, India, Indonesia, Pakistan, and Nigeria, consume less than a tenth or twentieth of what Americans consume. Coca Cola only needs to achieve moderate per-capita volume growth in these population-dense countries in order to increase global volume by a fairly robust amount.

In terms of Coca Cola attempting to achieve 3 billion servings per day in 2020, and the previously mentioned need for mild volume acceleration compared to what they’re currently doing, it looks like this is where it’ll have to come from. The company seems to be predicting that it’ll hit certain critical points that allow some pretty solid overall volume growth from these populated regions.

Risks

Coca Cola faces the usual currency, litigation, and geographic catastrophe risks associated with all global businesses.They also face strong competition from Pepsico, and there isn’t really a move that one company can make that the other can’t copy. Both of them acquired their North American bottlers recently, for example. Coca Cola will have to continually invest in its global bottling and distribution system if it hopes to continue to hold and take market share from their principle competitor.

Unhealthy beverages face headwinds in developed markets. A majority of the company’s products primarily consist of sugar water, which adds calories of a rather unhealthy variety to a typical daily diet, and likely contributes to “diseases of affluence”. Even some of the juices and other drinks are not what one would call healthy, though the company does have some healthier options in their overall product lineup. Political forces or consumer trends could adversely affect the volume growth of the business, but the company does have significant geographic diversification to buffer their bottom line from any specific market problems. In addition, the company can make key acquisitions or offer new options within its existing brands, to continually match consumer preference.

Conclusion and Valuation

Because the Coca Cola Company has an extremely diverse lineup of products across the world, and their products remain fairly consistent year to year, I view their overall risk as low.The company’s solid EPS growth of over 9% per year over the last 7 year period, combined with a 2-3% dividend yield, has been good performance for a large and stable company. Based on the assumption of 4% long term free cash flow growth, the company’s current valuation at $74/share implies a long term rate of return of around 8% per year according to my DCF estimation.

In a slightly more optimistic scenario, if the company can meet its 2020 Vision of 3 billion servings per day, then this implies approximately 6% annual volume growth. If pricing power is maintained in the currencies the company operates in, then free cash flow growth could somewhat accelerate, and this estimate would end up being conservative.

Overall, while I believe there are some better values out there such as Philip Morris, in terms of risk-adjusted returns, KO stock looks acceptable. If an investor targets a moderately reliable high single digit rate of return over the next decade, Coca Cola might not be a bad place to park some cash. Coca Cola is fairly recession resistant, and only 15% of the volume is attributed to Europe, so some of the key macroeconomic concerns are somewhat side-stepped by the company.

With continued volume growth and fairly ambitious long-term targets, the company looks quite solid.

Full Disclosure: As of this writing, I own shares of KO.