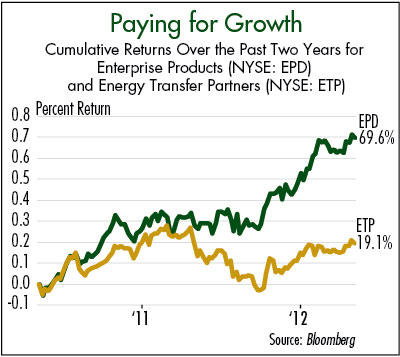

“Paying for Growth” compares the returns posted by one of my favorite MLP investments, Enterprise Products Partners LP (EPD, Financial) to units of fellow midstream master limited partnership

(MLP), Energy Transfer Partners LP(ETP, Financial).

The pair’s cumulative returns tracked each other closely until mid-2008. At that point, Energy Transfer Partners stopped making regular distribution increases, while Enterprise Products Partners hiked its payout at an average annual rate of 5 percent.

Over the past two years, units of Enterprise Products Partners have returned 44 percentage points more than an investment in Energy Transfer Partners. I remain bullish on Enterprise Products Partners’ long-term growth prospects. However, the stock yields only 4.9 percent after the recent rally and appears overbought.

Based on valuation and near-term growth prospects, units of Energy Transfer Partners appear a better buy.

The master limited partnership has been in the news recently for its $5.3 billion takeover bid for Sunoco (SUN), which would immediately add a wealth of oil- and liquids-related transportation assets to the firm’s rich portfolio of assets.

Energy Transfer Partners’ coverage ratio-distributable cash flow divided by the quarterly payout-expanded to a solid 1.58-to-1 in the first quarter, the first reporting period since the company unloaded its propane distribution arm.

Next quarter’s results will include its 50 percent interest in the Florida Gas Transmission pipeline, as well as new assets coming onstream from its joint venture with Regency Energy Partners LP (RGP).

Energy Transfer Partners’ general partner, Energy Transfer Equity LP (ETE, Financial), recently acquired pipeline owner Southern Union and plans to drop down additional assets in deals that should be accretive to the MLP’s cash flow. These growth prospects, coupled with the MLP’s impressive first-quarter performance, suggest that distribution growth will come sooner rather than later.

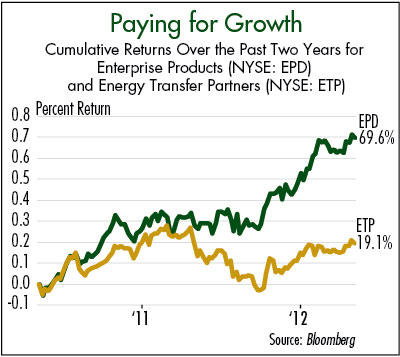

(MLP), Energy Transfer Partners LP(ETP, Financial).

The pair’s cumulative returns tracked each other closely until mid-2008. At that point, Energy Transfer Partners stopped making regular distribution increases, while Enterprise Products Partners hiked its payout at an average annual rate of 5 percent.

Over the past two years, units of Enterprise Products Partners have returned 44 percentage points more than an investment in Energy Transfer Partners. I remain bullish on Enterprise Products Partners’ long-term growth prospects. However, the stock yields only 4.9 percent after the recent rally and appears overbought.

Based on valuation and near-term growth prospects, units of Energy Transfer Partners appear a better buy.

The master limited partnership has been in the news recently for its $5.3 billion takeover bid for Sunoco (SUN), which would immediately add a wealth of oil- and liquids-related transportation assets to the firm’s rich portfolio of assets.

Energy Transfer Partners’ coverage ratio-distributable cash flow divided by the quarterly payout-expanded to a solid 1.58-to-1 in the first quarter, the first reporting period since the company unloaded its propane distribution arm.

Next quarter’s results will include its 50 percent interest in the Florida Gas Transmission pipeline, as well as new assets coming onstream from its joint venture with Regency Energy Partners LP (RGP).

Energy Transfer Partners’ general partner, Energy Transfer Equity LP (ETE, Financial), recently acquired pipeline owner Southern Union and plans to drop down additional assets in deals that should be accretive to the MLP’s cash flow. These growth prospects, coupled with the MLP’s impressive first-quarter performance, suggest that distribution growth will come sooner rather than later.