To date, the stock market has largely shrugged off the evidence of oncoming recession, in the confidence that the Federal Reserve will easily prevent that outcome and defend the market from any material losses. On that point, it is helpful to remember that the real economic effects of Fed actions in recent years have been limited to short-lived bursts of pent-up demand over a quarter or two. Not surprisingly, as interest rates are already low, and risk-premiums on more aggressive assets are already remarkably thin, the impact of quantitative easing around the globe continues to show evidence of diminishing returns.

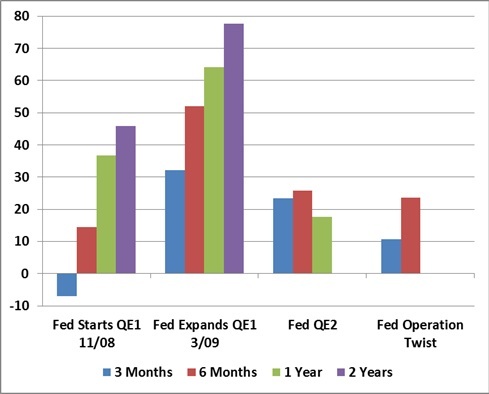

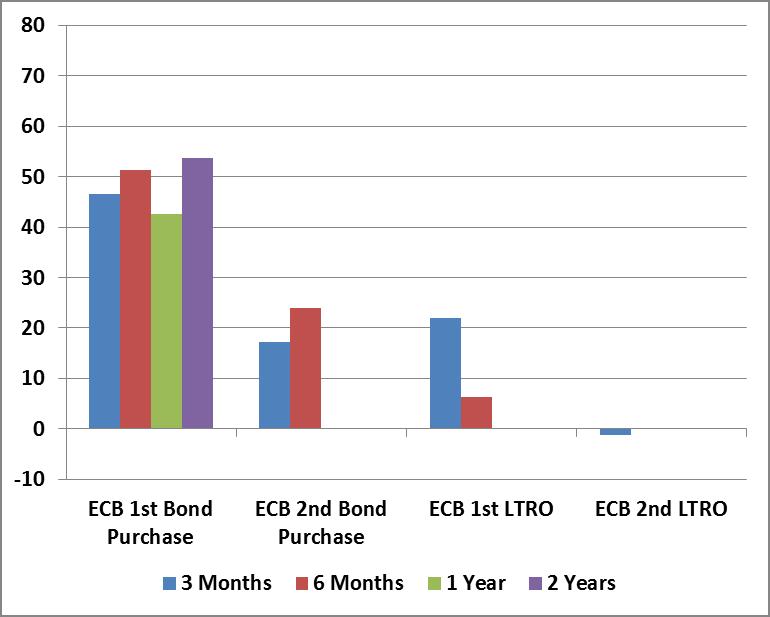

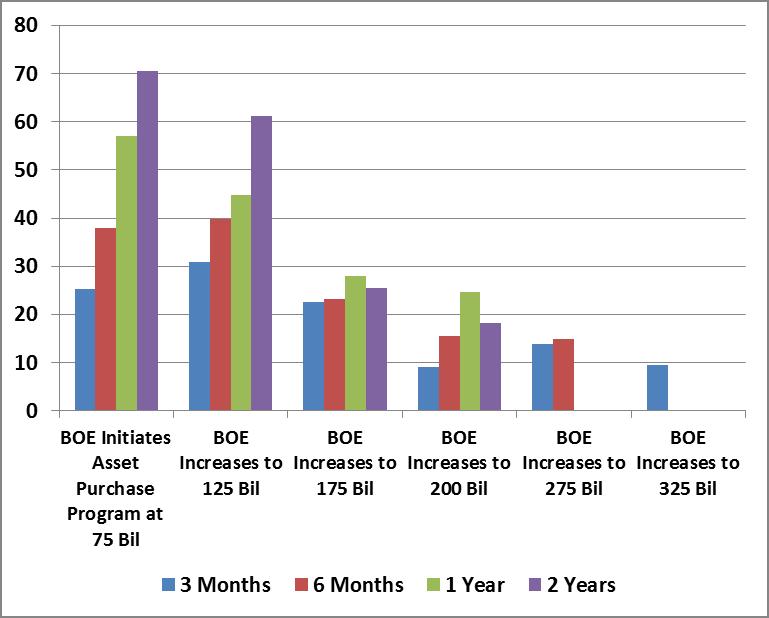

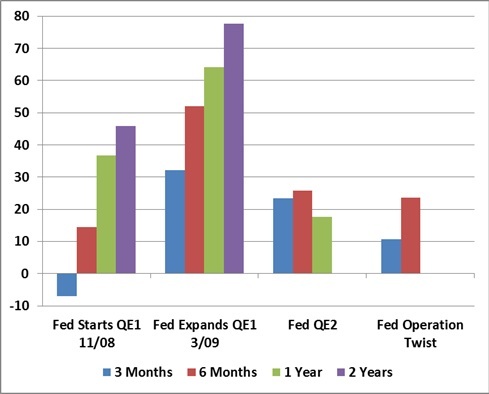

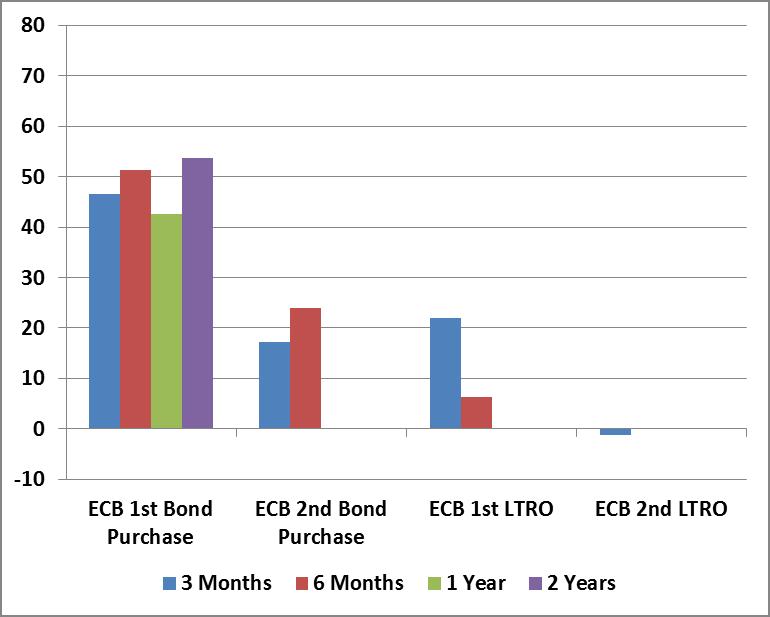

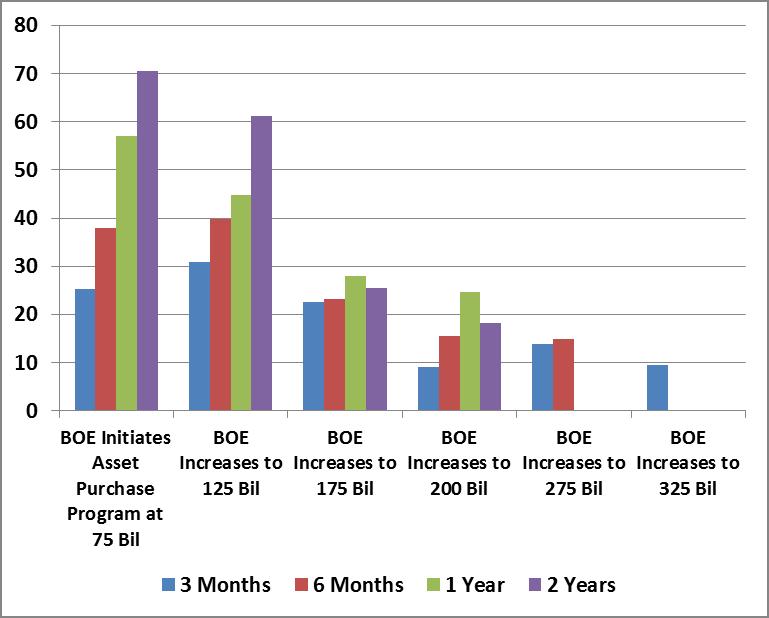

With the help of some preliminary work from Nautilus Capital, the following charts present the market gains, in percent, that followed versions of quantitative easing by the Federal Reserve, the European Central Bank, and the Bank of England on their respective stock markets (measured by the S&P 500, the Dow Jones EuroStoxx Index, and the FTSE Composite, respectively). In order to give QE the greatest benefit of the doubt and account for any “announcement effects,” the advances in each chart are based on the 3-month, 6-month, 1-year and 2-year gains in each index following the initiation of the intervention, plus any amount of gain enjoyed by the market from its lowest point in the 2 months preceding the actual intervention. The effects of most interventions would look weaker without that boost.

Remember that quantitative easing “works” through central bank hoarding of long-duration government bonds, paid for by flooding the financial markets with currency and reserves that essentially bear no interest. As a result, investors in aggregate have more zero-interest cash, and feel forced to reach for yield and speculative gains in more aggressive assets. Of course, in equilibrium, somebody has to hold the cash until it is actually retired (in aggregate, “sideline” cash can’t and doesn’t “go” anywhere). Increasing the quantity simply forces yield discomfort on more and more individuals. The process of bidding up speculative assets ends when holders of zero-interest cash are indifferent between continuing to hold that cash versus holding some other security. In short, the objective of QE is to force risky assets to be priced so richly that they closely compete with zero-interest cash.

Read the complete story

With the help of some preliminary work from Nautilus Capital, the following charts present the market gains, in percent, that followed versions of quantitative easing by the Federal Reserve, the European Central Bank, and the Bank of England on their respective stock markets (measured by the S&P 500, the Dow Jones EuroStoxx Index, and the FTSE Composite, respectively). In order to give QE the greatest benefit of the doubt and account for any “announcement effects,” the advances in each chart are based on the 3-month, 6-month, 1-year and 2-year gains in each index following the initiation of the intervention, plus any amount of gain enjoyed by the market from its lowest point in the 2 months preceding the actual intervention. The effects of most interventions would look weaker without that boost.

Remember that quantitative easing “works” through central bank hoarding of long-duration government bonds, paid for by flooding the financial markets with currency and reserves that essentially bear no interest. As a result, investors in aggregate have more zero-interest cash, and feel forced to reach for yield and speculative gains in more aggressive assets. Of course, in equilibrium, somebody has to hold the cash until it is actually retired (in aggregate, “sideline” cash can’t and doesn’t “go” anywhere). Increasing the quantity simply forces yield discomfort on more and more individuals. The process of bidding up speculative assets ends when holders of zero-interest cash are indifferent between continuing to hold that cash versus holding some other security. In short, the objective of QE is to force risky assets to be priced so richly that they closely compete with zero-interest cash.

Read the complete story