Palantir Technologies (PLTR, Financial) lit the house on fire in 2020 after its post-IPO surge. However, the stock has shed most of its gains in the past 18 months, labelling it as one of the worst risk/return stocks on the market.

Nevertheless, certain Wall Street analysts are turning bullish on the stock, with Raymond James and Bank of America (BAC, Financial) both providing bullish coverage earlier this month.

Wall Street's take forms an interesting juxtaposition with the way investors seem to be scorning the stock, as demonstrated by the selloff. While its government contracts are promising, the company is not yet profitable, and the human rights issues posed by some of its operations don't do it any favors in terms of popularity.

Raymond James initiates coverage

Recently, Raymond James decided to initiate coverage on Palantir and assigned a $20 price target. According to Brian Gesuale, who is the Raymond James analyst that covered the stock, Palantir is a "cultural unicorn" with a stronghold in a mega addressable market with potential for growth.

In a recent note, Gesuale said: "The company then nearly doubled its revenue from 2018 to 2020, crossing the billion dollar sales mark, and we believe the company will nearly double again and flirt with the $2B revenue mark in 2022."

Bank of America's upbeat tone

Earlier this month, Perez Mora of Bank of America stated his opinion that Palantir would likely benefit from the U.S. government's increased usage of the company's facial recognition technology.

In addition, Mora noted that the company's foundry business provides granular access controls, oversight of data usage and secure cross-agency collaboration, which has been proliferated by the fact that the company has provided transparency on the software.

Bank of America places a modest $13 short-term price target on Palantir, which, if captured, could present investors with approximately 25% in upside.

Valuation

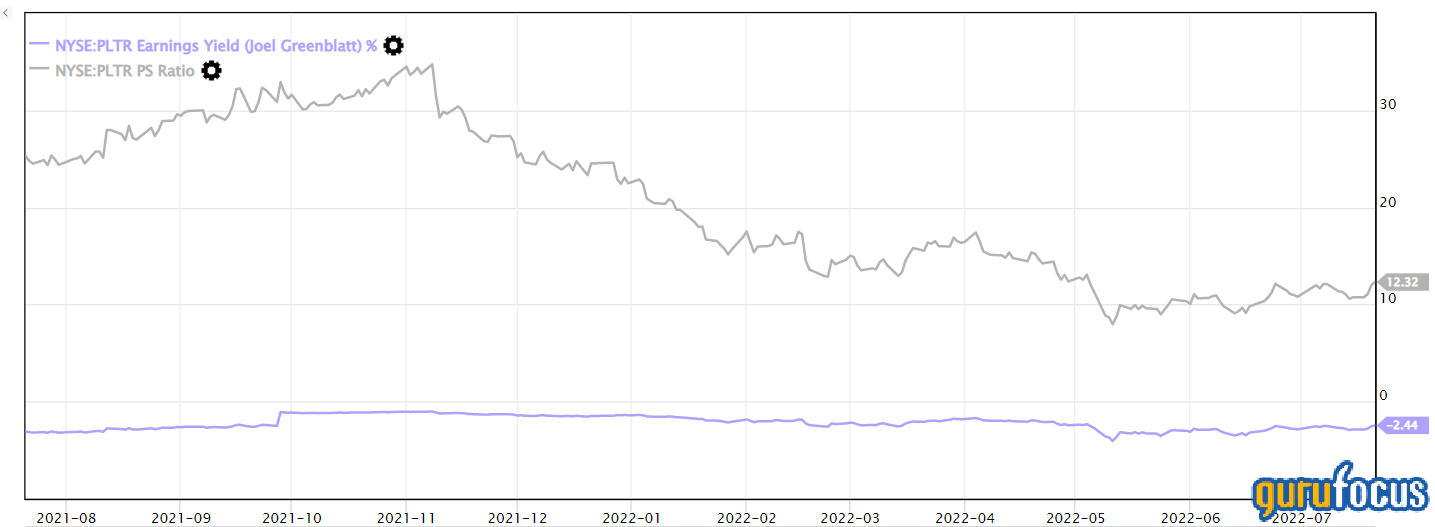

Although Wall Street seems bullish on Palantir, the stock exhibits a few valuation concerns, which the growth trajectory can't necessarily justify. For instance, Palantir is trading at more than 12 times its sales with a negative earnings yield.

Furthermore, although Palantir's top-line growth has shined in the past year, growing by 36.73%, the company is struggling to provide its shareholders with value as its Ebitda has receded by a phenomenal 72.36% in the past year.

Moreover, Palantir is still fighting for market position as it only holds down roughly 1.31% of the data and analytics market, meaning that it's likely to spend excessively in the coming years to enhance its market presence, which could, in turn, erode investors' value even more.