Chinese electric vehicle maker BYD Co (BYDDY, Financial)(HKSE:01211) has recently seen its stock tumble by 11% on speculation that Warren Buffett (Trades, Portfolio) may be selling his position.

Speculation runs wild

According to Bloomberg, a large stake of 225 million shares entered the Hong Kong Central Clearing and Settlement system on July 11, with Citigroup (C, Financial) serving as a custodian on the transaction.

The mammoth stake represents 20.49% of BYD’s total issued H-shares (i.e. shares of a Chinese mainland company that are listed on the Hong Kong exchange or other foreign exchanges), which exactly matches the stake Berkshire Hathaway owns.

Berkshire Hathaway has not commented on the speculation yet, and Citigroup has declined to comment as well. Thus, this is all purely speculation at the moment. BYD’s management did state that they had no information on whether Berkshire Hathaway was reducing its position, but reiterated the known consensus that large shareholders must disclose major changes in holdings.

However, analyst Steven Leung from UOB stated, “Only Berkshire would have that many shares as a single investor, so the market is worried Buffett is planning to sell.”

Other theories are that Berkshire may have lent the stock out to short sellers, which is not characteristic of Buffett’s style but is still a possibility.

The Buffett and BYD story

Buffett first invested in BYD back in 2008, when Berkshire purchased a $230 million take. This has been an incredibly successful investment for Berkshire, as, hypothetically speaking, if Buffett continued to hold the position unchanged, it would have been worth a staggering $9.3 billion before the recent selloff. If Buffett didn't actually sell the stake and still holds it today, then it would be worth $7.7 billion, which is still a meteoric gain of 3,248%.

I should note that due to Buffett's holding in this stock being on the Hong Kong stock exchange, there is a great deal of uncertainty surrounding it, as Buffett is not required to report any changes in the position to the U.S. Securities and Exchanges Commission. While large sharholders must disclose significant changes in their holdings, it is entirely possible that Buffett might have made smaller changes over the years that he was not required to report; we simply don't know, and won't know unless Buffett talks about it.

BYD has recently overtaken Tesla to become the global leader in electric vehicle sales. The company has generated a blistering 315% increase in sales and sold 641,350 new energy vehicles (NEVs) in the past six months alone, whereas Tesla sold 564,000 EVs over the same period.

Despite BYD being such a successful investment for Berkshire, Buffett didn’t want to invest originally. As I recently discovered while interviewing Mohnish Pabrai (Trades, Portfolio) on my YouTube channel Motivation 2 Invest, it was Charlie Munger (Trades, Portfolio) who convinced Buffett to invest into BYD.

Pabrai stated that Munger was captivated by BYD’s founder Wang Chuanfu, a chemist turned entrepreneur. Munger used a bold analogy that BYD’s founder was a combination of “Thomas Edison, Henry Ford and Bill Gates (Trades, Portfolio) all in the same person.”

This ultra-confident statement convinced Buffett to invest into BYD, after Munger had failed to convince him previously. However, Pabrai quotes Munger as saying “[Buffett] didn’t want to use his own money,” so he made “Mid American use their money to buy the stake." Berkshire Hathaway owned 80% of Mid American Energy at the time. This leads to the interesting insight that if Buffett originally had to have his arm twisted in order to invest into BYD, then he may be much less attached to the stock even after the major success and thus might be more inclined to engage in profit-taking.

Financials

BYD generated strong earnings results in the first quarter of 2022, with revenue of $10.54 billion, up a blistering 68% year over year. This was driven by record NEV sales, which outpaced Tesla, as mentioned prior. Gross profit also jumped by a substantial 65% from $786 million in the first quarter of 2021 to $1.307 billion in the first quarter of 2022.

Note: The currency used in the chart below is Chinese Yuan.

Operating income did decrease slightly from $232 million in in the prior-year quarter to $175.4 million in this quarter due to a $186 million increase in R&D and $173 million in other expenses. The good news is that operating income was up 140% over the previous quarter.

I also noticed that levered free cash flow was -$935 million for the first quarter of 2022, which was better than the -$1.8 billion achieved in prior-year quarter. However, this was a substantial decline from the positive $5.3 billion achieved in the fourth quarter of 2021.

BYD has a robust balance sheet with $6.9 billion in cash and short term investments and total debt of $4.4 billion. This is manageable as just $1.3 billion of this debt is current (due within the next two years).

Valuation

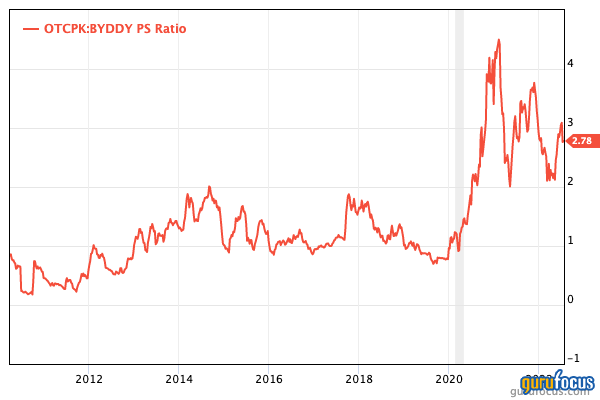

BYD trades at a price-sales ratio of 2.78, which is much higher than pre-2020 levels even after the most recent pullback.

The GF Value chart indicates a fair value of ~$73 per share for the stock, which is close to where the stock trades at the time of writing. However, this would mean that before the speculation about a Buffett sale, the stock would have been overvalued by ~10%.

Currently, we still have no idea whether Buffett is selling his stake in BYD, leaving it alone or doing something else with it. However, considering the major gains in the stock price (over 3,000%) and the fact that Buffett wasn’t too enthusiastic about investing originally, I think it's a possibility that Berskhire may have decided to take the profit.