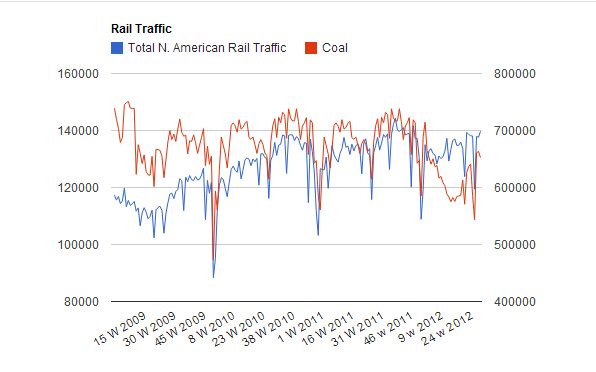

Total N.American rail traffic cam in at 698K last week which made it the highest level of 2012. That was 12k cars ahead of last year without taking into account the 4k drop in natural gas shipments. Particular strength was seen in auto and intermodal as both were up sharply.

Here is the chart:

Once again, not to be redundant, repeat myself, or say the same thing over and over, but these numbers are not recessionary. They are showing month over month and year over year growth. Now, it isn’t spectacular growth, but it is growth nonetheless. I know people want to classify you as either a raging bull or bear. I’m neither. I think the economy is slugging along and growing, not running but certainly not falling backwards. When you couple rail data with what is happening in both the auto sector and now the housing sector we have to discount the recession talk.

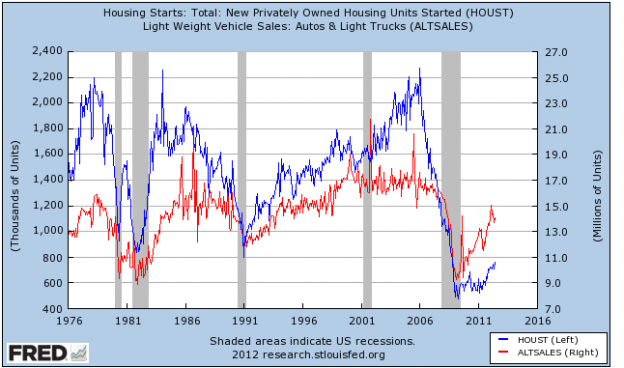

Here are housing and auto:

Do you know the last time we had increasing home construction, increasing auto production/sales and increasing YOY rail traffic that we had a recession??

The answer is never….

Now, this isn’t to say the picture might not change by December, but I am hearing out there people claiming we “already are in a recession” but based on these numbers that is just patently false.

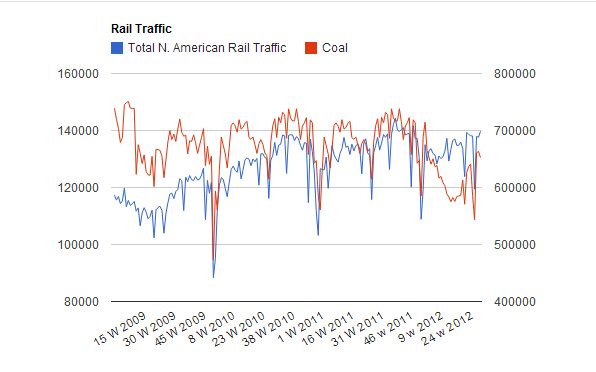

Here is the chart:

Once again, not to be redundant, repeat myself, or say the same thing over and over, but these numbers are not recessionary. They are showing month over month and year over year growth. Now, it isn’t spectacular growth, but it is growth nonetheless. I know people want to classify you as either a raging bull or bear. I’m neither. I think the economy is slugging along and growing, not running but certainly not falling backwards. When you couple rail data with what is happening in both the auto sector and now the housing sector we have to discount the recession talk.

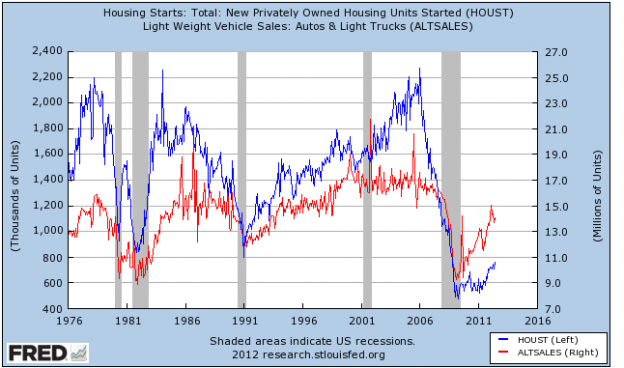

Here are housing and auto:

Do you know the last time we had increasing home construction, increasing auto production/sales and increasing YOY rail traffic that we had a recession??

The answer is never….

Now, this isn’t to say the picture might not change by December, but I am hearing out there people claiming we “already are in a recession” but based on these numbers that is just patently false.