Home Depot (HD, Financial) is often characterized as a defensive stock, but the company is working on changing itself and adding more dynamics to the mix through a growing digital ecosystem and shakeups in its business-to-business model. I believe these changes could pay off for the company in the long-term and lead to some growth characteristics.

Earnings growth fueled by e-commerce and B2B

Online sales at Home Depot jumped by 86% to $19.30 billion in fiscal 2020. Although the numbers have since stabilized, they constitute a massive piece of the overall revenue pie. To take advantage of this rapid sales growth, Home Depot is expanding its order pickup and delivery options and its in-store product assortment. These initiatives are helping to attract new customers and grow Home Depot's market share.

In addition, Home Depot is making strides in its efforts to become a one-stop shop for home improvement needs. In the second quarter of 2022, sales rose 6.5% year over year to $43.8 billion, and net earnings jumped 8.3% to $5.2 billion. While these are respectable numbers, e-commerce sales doubled during the same period, increasing by a whopping 12%. Earnings per share reached $5.05, a 5% increase from the prior-year quarter.

Home Depot's focus on building out its digital ecosystem is paying off in terms of traffic and sales, and this trend will likely continue in the future. Users downloaded its mobile app in record numbers during the second quarter. In addition, Home Depot's website is one of the most visited home improvement websites. Home Depot's success shows that even brick-and-mortar retailers can benefit from investing in a strong digital presence.

Much of Home Depot's digital growth is now coming from its B2B Pro channel, which sells to professional contractors. It is worth noting that Pro customers surpassed do-it-yourself ones in sales for the second quarter.

The company has been improving commerce and service capabilities in this area with ongoing updates that will allow them to serve these customers better. Home Depot's new capabilities on its B2B website allow associates to seamlessly modify orders if customers have questions or changes before placing an order.

Strong financials and dividends highlight Home Depot's defensive reputation

Home Depot has been around for decades, but the company saw explosive growth during the beginning of the pandemic. With people stuck at home and looking for ways to occupy their time, Home Depot saw a surge in sales as people undertook home improvement projects. Even as the pandemic begins to ease and people return to the office, Home Depot is still seeing strong sales growth thanks to the work-from-home trend and the stronger housing market.

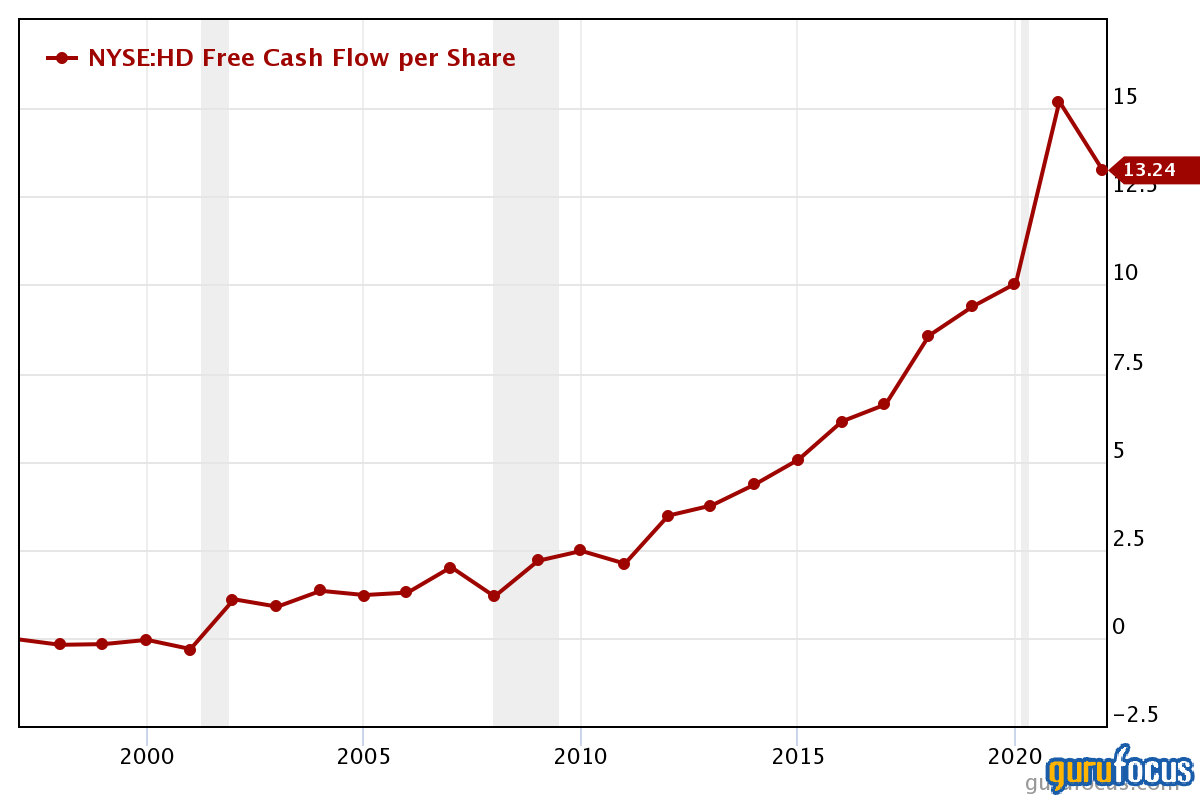

Home Depot has done extremely well financially over the last 10 years as it fully capitalized on a growing housing and construction industry, which has rewarded investors handsomely

Its dividend certainly looks safe because it has a payout ratio of 0.43. Plus, the company is producing free cash flow at a healthy rate and has the potential to further raise its payout in the future.

Outlook

The company faces increased operational costs, supply chain disruption and inflation. It has a positive track record of cutting costs to protect the margins, but it does not appear to be enough. With supply chain issues continuing to affect operations, it is natural for prices to rise, but this is unlikely to impact sales in the next few months in my view. Despite the challenges faced in the U.S. and elsewhere, the home improvement industry still thrives.

Home Depot is a juggernaut in the home improvement industry. The company has taken advantage of the housing and construction boom that followed the Great Recession in the past decade. Home Depot has consistently delivered strong earnings and dividend growth during this period. The share price has also benefited from the company's expansion into new markets.

To be clear, I still see Home Depot mainly as a defensive stock. However, with its growth initiatives, I think the stock has the potential to be something more going forward.