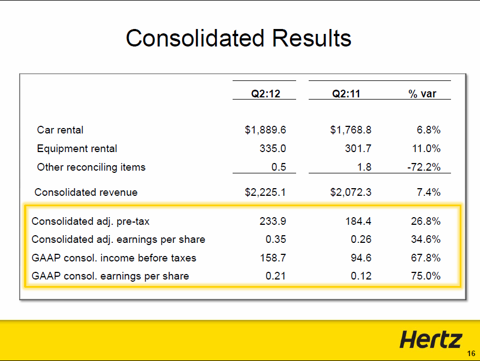

Hertz (HTZ, Financial) is the one of the largest rental car companies in the U.S. The company also operates an equipment rental business. Hertz reported strong results in second quarter 2012, with 6.8% car rental revenue growth and 11% equipment rental growth.

(click to enlarge)

* Q2 2012 slideshow here.

Hertz currently trades at $12.40 per share, having reached a low of $1.55 per share during the financial crisis of 2008.

HTZ data by YCharts.

Let's take a look at the recent financial results.

Revenue has been growing consistently since 2009 and free cash flow for the past two years has been roughly $2 billion dollars.

Owner Earnings

Owner Earnings is a better measure for valuation purposes than free cash flow. Warren Buffett defines Owner Earnings as follows:

Owner earnings smooth out capital expenditures and provide a clearer picture of the profitability of the company. Let's use the owner earnings figures to determine Hertz's cash return on invested capital, or CROIC. This is the cash return generated by the company on invested capital, and is simply the owner earnings divided by the total invested capital. This is a better measure than ROIC because ROIC relies on earnings, which is a poor measure of profitability.

Hertz has maintained a CROIC of around 14% over the past three years, which is quite high. This means than any reinvested capital will return 14%. Generally the company should grow at roughly the value of the CROIC. Let's take a look at the most recent balance sheet.

No matter how you slice it, Hertz has a large amount of debt. However, interest payments are only 28% of owner earnings, which is not high enough to be a real concern. Hertz's strong cash flow should allow the company to maintain these levels of debt.

Valuation

I use a discounted cash flow analysis to estimate the fair value of Hertz. I use a discount rate of 15%, which is my required rate of return. I will assume that Hertz's owner earnings will only grow at the rate of inflation, which I will assume to be 3%. This is a highly pessimistic calculation, but it shows just how undervalued Hertz truly is. Using the above parameters I arrive at a fair value estimate of $23.90 per share. Below is a list of buy targets for various margins of safety.

Conclusion

Hertz is a dramatically undervalued company, with extremely strong cash flow, and is trading at an enormous discount to a pessimistic estimate of the fair value. The amount of debt is a concern, but the cash flow covers the interest payments with plenty of room to spare. Hertz is a company that should be on any value investor's radar.

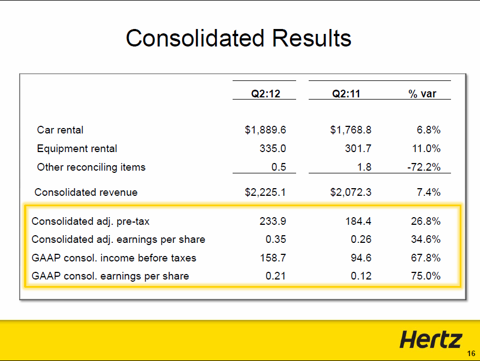

(click to enlarge)

* Q2 2012 slideshow here.

Hertz currently trades at $12.40 per share, having reached a low of $1.55 per share during the financial crisis of 2008.

HTZ data by YCharts.

Let's take a look at the recent financial results.

| (In Million $) | 2009 | 2010 | 2011 |

|---|---|---|---|

| Revenue | $7,101 | $7,562 | $8,298 |

| Operating Cash Flow | $1,693 | $2,208 | $2,233 |

| Capital Expenditure | $-101 | $-180 | $-282 |

| Free Cash Flow | $1,592 | $2,029 | $1,951 |

Revenue has been growing consistently since 2009 and free cash flow for the past two years has been roughly $2 billion dollars.

Owner Earnings

Owner Earnings is a better measure for valuation purposes than free cash flow. Warren Buffett defines Owner Earnings as follows:

These represent (1) reported earnings plus (2) depreciation, depletion, amortization, and certain other non-cash charges... less (3) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume... Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since (3) must be a guess - and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes.I'll calculate owner earnings by taking the net income and adding adding back various non-cash items, such as depreciation, and then a reasonable estimate for capital expenditures. I'll also add interest payments adjusted for taxes since interest is tax deductible.

| (In Million $) | 2009 | 2010 | 2011 |

|---|---|---|---|

| Net income | $-112 | $-32 | $195 |

| Depreciation & amortization | $2,075 | $2,008 | $2,037 |

| Amortization of debt discount/premium and issuance costs | $171 | $182 | $130 |

| Investment/asset impairment charges | $0 | $0 | $0 |

| Stock based compensation | $35 | $36 | $31 |

| Other non-cash items | $12 | $45 | $-27 |

| Interest Payments | $680 | $773 | $699 |

| Capital Expenditure | $-300 | $-300 | $-300 |

| Owner Earnings | $2,327 | $2,715 | $2,490 |

Owner earnings smooth out capital expenditures and provide a clearer picture of the profitability of the company. Let's use the owner earnings figures to determine Hertz's cash return on invested capital, or CROIC. This is the cash return generated by the company on invested capital, and is simply the owner earnings divided by the total invested capital. This is a better measure than ROIC because ROIC relies on earnings, which is a poor measure of profitability.

| 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|

| $3,104 | $2,327 | $2,715 | $2,490 |

| $16,451 | $16,002 | $17,344 | $17,673 |

| 18.87% | 14.54% | 15.65% | 14.09% |

Hertz has maintained a CROIC of around 14% over the past three years, which is quite high. This means than any reinvested capital will return 14%. Generally the company should grow at roughly the value of the CROIC. Let's take a look at the most recent balance sheet.

| Cash and Cash Equivalents | $594 |

|---|---|

| Investments | $0 |

| Debt | $11,425 |

| Pension Obligations | $0 |

| Minority Interest | $0 |

| Net Cash (Debt) | $-10,832 |

| Diluted Float | 440 |

| Cash/Share | $-24.57 |

No matter how you slice it, Hertz has a large amount of debt. However, interest payments are only 28% of owner earnings, which is not high enough to be a real concern. Hertz's strong cash flow should allow the company to maintain these levels of debt.

Valuation

I use a discounted cash flow analysis to estimate the fair value of Hertz. I use a discount rate of 15%, which is my required rate of return. I will assume that Hertz's owner earnings will only grow at the rate of inflation, which I will assume to be 3%. This is a highly pessimistic calculation, but it shows just how undervalued Hertz truly is. Using the above parameters I arrive at a fair value estimate of $23.90 per share. Below is a list of buy targets for various margins of safety.

| Margin of Safety | Buy Target |

|---|---|

| 10% | $21.52 |

| 15% | $20.33 |

| 20% | $19.13 |

| 25% | $17.94 |

Conclusion

Hertz is a dramatically undervalued company, with extremely strong cash flow, and is trading at an enormous discount to a pessimistic estimate of the fair value. The amount of debt is a concern, but the cash flow covers the interest payments with plenty of room to spare. Hertz is a company that should be on any value investor's radar.